Utilizing a standardized format for these records fosters transparency and facilitates prompt payment by eliminating ambiguity surrounding charges. This clarity strengthens client relationships and improves cash flow management. Organized financial records also simplify reconciliation processes and contribute to accurate financial reporting.

The following sections will delve deeper into the key components of effective account summaries, offer practical advice on creating and using them, and provide examples illustrating best practices for various business contexts.

1. Clarity

Clarity is paramount in a statement of account. Ambiguity can lead to misunderstandings, disputes, and delayed payments. A clear statement ensures all parties understand the financial obligations. This clarity stems from several factors: unambiguous language describing services rendered, accurate calculation of charges, and a logical presentation of information. For example, instead of a vague entry like “consulting services,” a clear statement would specify “Website consultation – 2 hours @ $150/hour.” This specificity prevents confusion about the nature and cost of services.

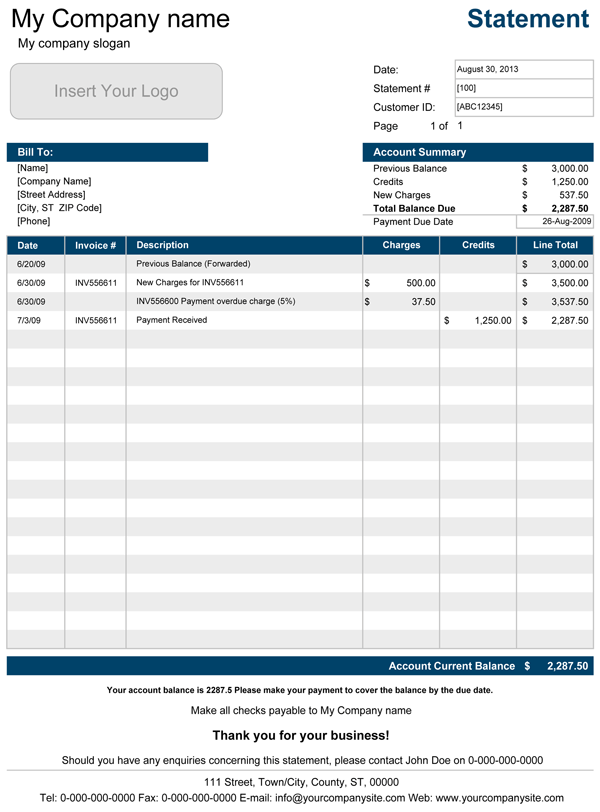

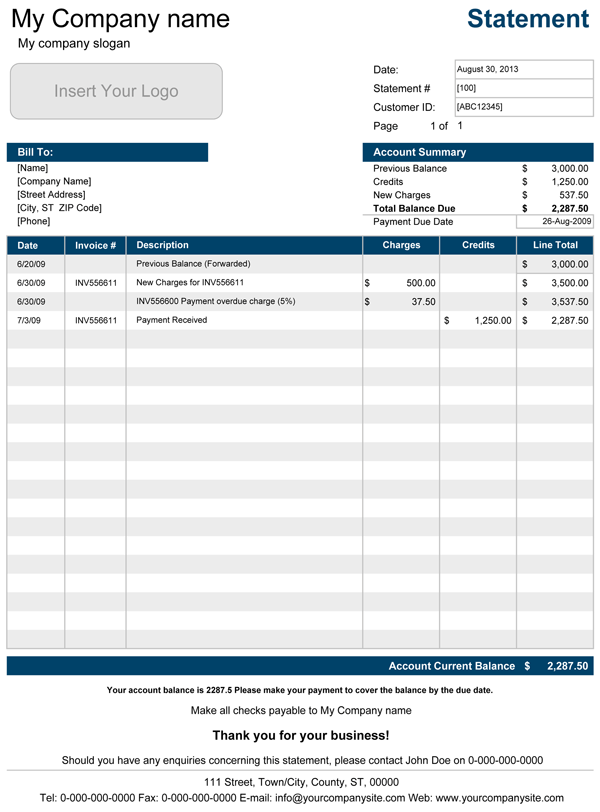

The structure of the document contributes significantly to clarity. Information should be organized logically, using clear headings and labels. Dates, invoice numbers, and descriptions should be easily identifiable. Consistent formatting, including the use of tables or columns, enhances readability. Consider a statement with a clear breakdown of charges, payments, and the remaining balance versus one where these figures are scattered and difficult to locate. The former promotes understanding and facilitates reconciliation; the latter breeds confusion and potential errors.

Ultimately, clarity in a statement of account strengthens the client-business relationship. It fosters trust by ensuring transparency and reducing the potential for disagreements. This clarity contributes to timely payments, improving cash flow and minimizing administrative overhead associated with resolving disputes. A well-structured, easy-to-understand statement reflects professionalism and reinforces a commitment to sound financial practices. In contrast, a confusing statement can damage credibility and strain client relationships, potentially leading to lost business.

2. Accuracy

Accuracy in a statement of account is not merely a desirable trait; it is fundamental to maintaining financial integrity and fostering trust between businesses and clients. Inaccurate statements can lead to disputes, damaged reputations, and potential legal ramifications. A simple, well-designed template contributes significantly to accuracy by minimizing the potential for human error and promoting consistent data entry.

- Precise CalculationsMathematical accuracy is crucial. Incorrect calculations, whether due to typos, formula errors, or misplaced decimals, can significantly impact the stated balance. A template with built-in formulas or automated calculations reduces the risk of such errors. For example, a template that automatically calculates discounts, taxes, and totals based on entered quantities and prices ensures consistent and reliable calculations.

- Correct Transaction DetailsAccurate recording of transaction details is paramount. This includes the correct invoice numbers, dates of service or sale, and precise descriptions of goods or services provided. A template with clearly labeled fields for each data point helps prevent omissions and ensures consistency in data entry. Consider a template with separate fields for “Invoice Date” and “Service Date” to distinguish between billing and service delivery dates.

- Up-to-Date InformationStatements must reflect the most current information. This requires diligent updating of payments received, credits issued, and any adjustments made to the account. A template that facilitates easy updating and tracking of changes ensures the statement reflects a true and accurate representation of the account balance. For example, a template with a dedicated section for recording payments and adjustments contributes to maintaining accurate records.

- Verification MechanismsImplementing verification mechanisms within the template itself can further enhance accuracy. This might include automated cross-checking of data entries, built-in validation rules, or prompts for confirmation before finalizing the statement. These features minimize the risk of discrepancies and ensure data integrity.

These facets of accuracy contribute to a reliable and trustworthy statement of account. A simple, well-designed template serves as a foundation for accuracy, reducing errors, and promoting consistent data entry. This, in turn, strengthens client relationships, simplifies reconciliation processes, and contributes to sound financial management. The consequences of inaccurate statements can range from minor inconveniences to serious legal and financial repercussions, underscoring the critical role accuracy plays in professional financial documentation.

3. Conciseness

Conciseness in a statement of account contributes directly to clarity and efficiency. Unnecessary information can obscure essential details, leading to confusion and wasted time. A concise statement focuses solely on pertinent information: transaction dates, descriptions, amounts, and the outstanding balance. Extraneous details, marketing materials, or lengthy explanations should be omitted. Consider a statement cluttered with promotional offers versus one that presents only essential financial data. The former distracts from the core purpose of the document, while the latter facilitates quick comprehension.

Achieving conciseness requires careful consideration of language and formatting. Descriptions of services or goods should be brief yet informative. Standard abbreviations can be used where appropriate, but clarity should not be sacrificed for brevity. For instance, “Website development – Phase 1 completion” is more concise and informative than “Completion of the first phase of the website development project as outlined in the initial proposal document.” Effective use of tables and columns can present data concisely, eliminating the need for lengthy paragraphs. Visual clarity enhances comprehension and reduces the time required to review the statement.

Conciseness, combined with accuracy and clarity, contributes to a professional and efficient statement of account. This streamlined approach benefits both the business and the client. Clients can quickly grasp their financial obligations, leading to prompt payments. Businesses benefit from reduced administrative overhead and improved cash flow. A concise statement demonstrates respect for the client’s time and reinforces a commitment to efficient financial management. Conversely, a lengthy, rambling statement can create confusion and frustration, potentially damaging client relationships. Therefore, conciseness serves as a crucial element in effective financial communication.

4. Professionalism

A professional statement of account reflects the credibility and competence of a business. It reinforces the perception of the business as organized, detail-oriented, and committed to clear financial communication. This perception fosters trust and strengthens client relationships. Conversely, a poorly designed or unprofessional statement can damage credibility and erode client confidence. Therefore, professionalism is not merely an aesthetic concern; it is a strategic element in effective financial management.

- Branding and Design ConsistencyIncorporating consistent branding elements, such as logos, color schemes, and fonts, reinforces brand identity and creates a cohesive professional image. A statement of account should align visually with other business communications. Imagine a statement with a mismatched logo or clashing fonts compared to one with a consistent, professional design. The former conveys a lack of attention to detail, while the latter projects a sense of competence and reliability.

- Clear Contact InformationProviding clear and accessible contact information facilitates communication and demonstrates accountability. This includes not only the business’s contact details but also clear instructions for clients regarding inquiries or disputes. A statement with readily available contact information encourages proactive communication, while one lacking such details can create frustration and hinder issue resolution.

- Formal Language and ToneMaintaining a formal and respectful tone throughout the statement conveys professionalism and respect for the client. Avoid using slang, jargon, or overly casual language. A professionally worded statement reflects a serious approach to financial matters, while an informal tone can undermine credibility.

- Error-Free PresentationA professional statement is free of typos, grammatical errors, and formatting inconsistencies. These errors detract from the credibility of the document and can create confusion. Thorough proofreading and quality control are essential. A meticulously crafted statement reflects attention to detail and professionalism, while a sloppy document suggests carelessness and undermines trust.

These facets of professionalism contribute to a statement of account that not only conveys essential financial information but also strengthens the client-business relationship. A professional presentation enhances credibility, fosters trust, and promotes efficient communication. This, in turn, contributes to timely payments, reduced disputes, and a positive overall client experience. Professionalism in financial documentation, therefore, is a key component of successful business operations.

5. Accessibility

Accessibility, in the context of a simple statement of account template, refers to the ease with which clients can receive, understand, and interact with the provided financial information. This encompasses both the format in which the statement is delivered and the clarity of the information presented. Improved accessibility translates directly into more efficient communication, reduced administrative overhead, and stronger client relationships. Consider the difference between a client struggling to decipher a complex, jargon-filled statement received via postal mail versus a client effortlessly reviewing a clear, concise statement accessible online. The former scenario breeds frustration and potential disputes, while the latter promotes transparency and timely payments.

Several factors contribute to the accessibility of a statement of account. Digital delivery methods, such as email or secure online portals, offer immediate access and eliminate the delays associated with traditional mail. Furthermore, digital formats allow for interactive features, such as searchable text, downloadable data, and integrated payment options. These features empower clients to manage their accounts efficiently and reduce the need for manual inquiries. Offering multiple delivery options caters to diverse client preferences and ensures no one is excluded due to technological limitations. Within the statement itself, clear language, logical organization, and consistent formatting enhance readability and comprehension. Consider a statement with clearly labeled sections, consistent use of terminology, and a visually appealing layout compared to one with dense text, inconsistent formatting, and ambiguous labels. The former promotes understanding, while the latter hinders it.

Prioritizing accessibility demonstrates a commitment to client service and contributes to a positive overall client experience. Easy access to clear and concise financial information empowers clients to manage their accounts effectively, leading to timely payments and reduced disputes. This, in turn, benefits businesses through improved cash flow and reduced administrative burdens. Furthermore, accessible statements contribute to greater transparency and trust between businesses and clients, fostering stronger, more sustainable relationships. Addressing accessibility challenges proactively, therefore, is a strategic investment in both client satisfaction and efficient financial management. Conversely, neglecting accessibility can lead to client frustration, increased disputes, and ultimately, damaged relationships and lost business.

6. Customizability

Customizability is a key feature of effective statement of account templates. A truly useful template accommodates the diverse needs of various businesses and client relationships. Adaptability ensures relevance and maximizes the template’s utility across different contexts. A rigid, one-size-fits-all approach often falls short of meeting specific requirements, potentially hindering clear communication and efficient financial management. Customizable templates, however, empower businesses to tailor statements to individual client needs, fostering clarity and strengthening relationships.

- Industry-Specific AdaptationsDifferent industries have unique billing practices and terminology. A customizable template allows for industry-specific adaptations, ensuring the statement of account reflects relevant terms and processes. A law firm, for instance, might require fields for billable hours and court fees, while a retailer might need fields for product codes and quantities. Adapting the template to industry conventions ensures clarity and avoids potential confusion.

- Client-Specific DetailsBuilding strong client relationships often requires personalized communication. Customizable templates allow for the inclusion of client-specific details, such as preferred payment methods, contract terms, or project milestones. This level of personalization demonstrates attention to individual client needs and fosters a sense of value. For example, a template could be adapted to display a client’s preferred currency or include project-specific details relevant to their ongoing work.

- Branding and Design FlexibilityMaintaining consistent branding across all communications reinforces a professional image. Customizable templates allow for adjustments to branding elements, such as logos, color schemes, and fonts, ensuring the statement of account aligns with overall brand identity. This consistency reinforces professionalism and strengthens brand recognition. A template that allows for easy integration of brand assets ensures a cohesive and professional presentation, regardless of the specific client or project.

- Variable Data InclusionBusinesses often need to include variable data in statements of account, such as discounts, late payment fees, or specific payment instructions. Customizable templates accommodate this need by allowing for the inclusion or exclusion of data fields as required. This flexibility ensures the statement contains only relevant information, avoiding clutter and promoting clarity. For example, a template could include a field for early payment discounts or allow for customized messages regarding upcoming payment deadlines.

These facets of customizability contribute to a more effective and versatile statement of account template. The ability to adapt the template to specific industry needs, client preferences, and branding requirements ensures clarity, promotes efficiency, and strengthens client relationships. A well-designed, customizable template becomes a valuable tool for managing finances and fostering positive communication, ultimately contributing to business success. Conversely, a rigid, inflexible template limits utility and can hinder effective communication, potentially leading to misunderstandings and strained client relationships. Investing in a customizable template, therefore, is a strategic decision that supports long-term growth and success.

Key Components of a Simple Statement of Account Template

Essential elements ensure clarity, accuracy, and professionalism in a statement of account. These components contribute to efficient financial communication and foster positive client relationships. Omitting key details can lead to confusion, disputes, and delayed payments, hindering smooth business operations.

1. Company Information: Clear identification of the issuing business is paramount. This typically includes the company’s legal name, address, contact information (phone number, email address), and logo. Accurate and readily available contact information facilitates communication and demonstrates accountability.

2. Client Information: Accurate client details ensure proper delivery and personalized communication. This section includes the client’s legal name, billing address, and account number. Consistency in client information across all documentation minimizes errors and confusion.

3. Statement Date: The statement date indicates the period covered by the document. This provides context for the listed transactions and clarifies the reporting timeframe.

4. Invoice Numbers and Dates: A clear link between the statement and individual invoices is essential for tracking and reconciliation. Listing invoice numbers and their corresponding dates allows clients to cross-reference transactions with their own records.

5. Description of Goods/Services: Concise yet informative descriptions of provided goods or services are crucial for clarity. Vague descriptions can lead to misunderstandings and disputes. Specific details ensure transparency and facilitate accurate record-keeping.

6. Transaction Amounts: Precise amounts for each transaction, including debits and credits, form the core of the statement. Accurate calculations are fundamental to maintaining financial integrity and avoiding discrepancies.

7. Payments Received: Clear documentation of payments received ensures an accurate reflection of the outstanding balance. This section should include payment dates and amounts, allowing clients to verify their payment history.

8. Outstanding Balance: The outstanding balance clearly indicates the total amount owed by the client. Prominent placement of this figure ensures immediate understanding of the current financial obligation.

These components work together to create a comprehensive and informative overview of a client’s account activity. Accurate, well-organized data presented in a professional format fosters transparency, strengthens client relationships, and contributes to efficient financial management. Each component plays a crucial role in ensuring clear communication and facilitating smooth business operations.

How to Create a Simple Statement of Account Template

Creating a clear and effective statement of account template requires careful consideration of essential components and design principles. A well-structured template ensures accurate financial reporting, facilitates efficient communication, and strengthens client relationships. The following steps outline the process of developing a professional and user-friendly template.

1. Define Template Objectives: Begin by clarifying the purpose of the template. Consider the specific needs of the business and its clients. Determine the level of detail required and the desired format for presenting information. A template designed for a small freelance business, for example, may differ significantly from one designed for a large corporation.

2. Select Software: Choose appropriate software for creating the template. Spreadsheet software, word processing software, or dedicated accounting software are all viable options. The choice depends on the complexity of the required calculations and the desired level of automation. Spreadsheet software offers robust calculation capabilities, while word processing software may be suitable for simpler templates. Dedicated accounting software often includes built-in statement of account templates.

3. Structure Essential Components: Organize the key components of the statement of account in a logical and clear manner. This includes sections for company information, client information, statement date, invoice details, descriptions of goods or services, transaction amounts, payments received, and the outstanding balance. A clear structure ensures easy navigation and comprehension. Consider using tables or columns to present data effectively.

4. Incorporate Branding Elements: Integrate consistent branding elements, such as logos, color schemes, and fonts. This reinforces brand identity and conveys professionalism. Maintaining a cohesive visual style across all business communications enhances credibility and reinforces brand recognition.

5. Ensure Calculation Accuracy: If using spreadsheet software, implement formulas for automated calculations. Verify the accuracy of these formulas to prevent errors. Accurate calculations are fundamental to maintaining financial integrity and avoiding disputes. Double-checking formulas and performing test calculations minimizes the risk of discrepancies.

6. Implement Clear Formatting: Use clear and consistent formatting throughout the template. Choose a legible font and appropriate font size. Use headings, subheadings, and labels to organize information effectively. Consistent formatting enhances readability and professionalism.

7. Test and Refine: Before deploying the template, thoroughly test its functionality. Review sample statements generated by the template to ensure accuracy and clarity. Gather feedback from colleagues or clients to identify potential areas for improvement. Testing and refinement ensure the template meets the intended objectives and functions effectively.

8. Document Usage Instructions: Create clear instructions for using the template. Explain how to input data, generate statements, and customize the template as needed. Clear documentation facilitates consistent usage and minimizes errors. Providing step-by-step instructions and examples ensures the template can be used effectively by anyone in the organization.

Developing a well-designed statement of account template requires careful planning, attention to detail, and thorough testing. A functional and user-friendly template promotes efficient communication, strengthens client relationships, and contributes to sound financial management practices.

Streamlined account summaries provide essential clarity in business-client financial interactions. Accurate, concise, and professionally presented documentation fosters transparency, promotes timely payments, and strengthens relationships. Customizable templates, adaptable to specific industry needs and client preferences, enhance communication efficiency and contribute to sound financial management. Accessibility, particularly through digital delivery and clear formatting, further empowers clients and reduces administrative overhead.

Effective financial communication underpins successful business operations. Investing in well-designed templates for account documentation represents a commitment to clarity, professionalism, and client satisfaction. This commitment contributes not only to immediate financial efficiency but also to the long-term health and sustainability of client relationships and overall business success. Prioritizing clear and accessible financial communication positions organizations for continued growth and positive client interactions.