Applying for a vehicle loan can sometimes feel like navigating a complicated maze, filled with endless paperwork and confusing jargon. For many, the dream of driving home in a new or pre-owned car is often dampened by the daunting process of getting approved. This is precisely why the idea of a straightforward, easy-to-understand loan application form is so appealing. It cuts through the complexity, making the initial step towards vehicle ownership much less intimidating and far more accessible for everyone involved.

Imagine a world where securing financing for your next car doesn’t involve a headache. A world where you can quickly provide the necessary information without feeling overwhelmed, speeding up the entire approval process. That’s the power of simplicity, especially when it comes to crucial documents like a loan application. It’s about creating a seamless experience, not just for the applicant, but also for the lender who needs to process the information efficiently.

What Makes a Vehicle Loan Application Truly Simple?

A truly simple vehicle loan application form template focuses on clarity, brevity, and essentialism. It strips away all the unnecessary questions and presents the required fields in an intuitive, logical order. The goal is to make it incredibly easy for an applicant to understand what information is needed and why, without feeling like they are filling out a government census. This approach not only reduces the time it takes to complete the form but also minimizes errors, leading to a smoother review process for lenders.

Think about the last time you had to fill out a form that felt overly long or confusing. Chances are, you felt frustrated, perhaps even abandoned the process altogether. A simple form avoids this by prioritizing the user experience above all else. It’s designed with the applicant in mind, ensuring that each step is clear and progression feels natural. This thoughtful design leads to higher completion rates and happier potential customers, setting a positive tone right from the start of their journey towards vehicle ownership.

Key Sections for a Streamlined Application

To achieve this simplicity, a form should typically be organized into logical, easy-to-digest sections. These sections gather all the necessary information without being intrusive or repetitive, ensuring a smooth flow for the applicant.

-

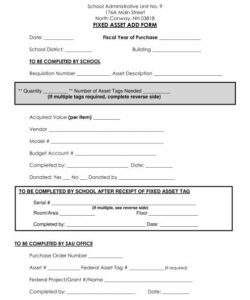

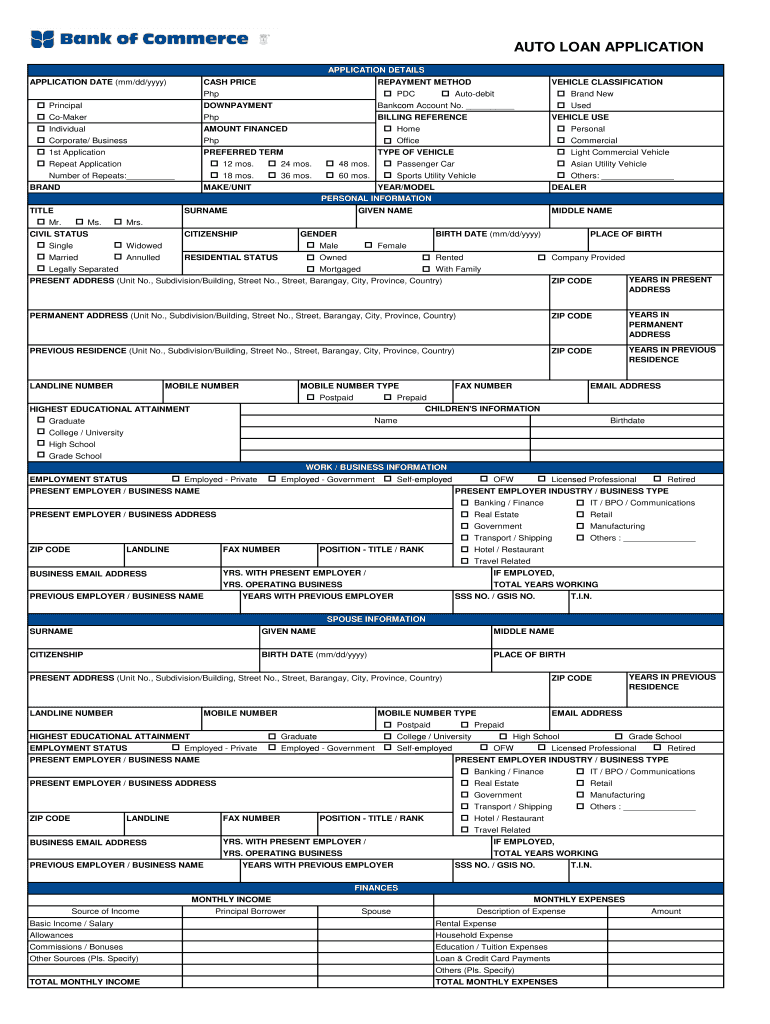

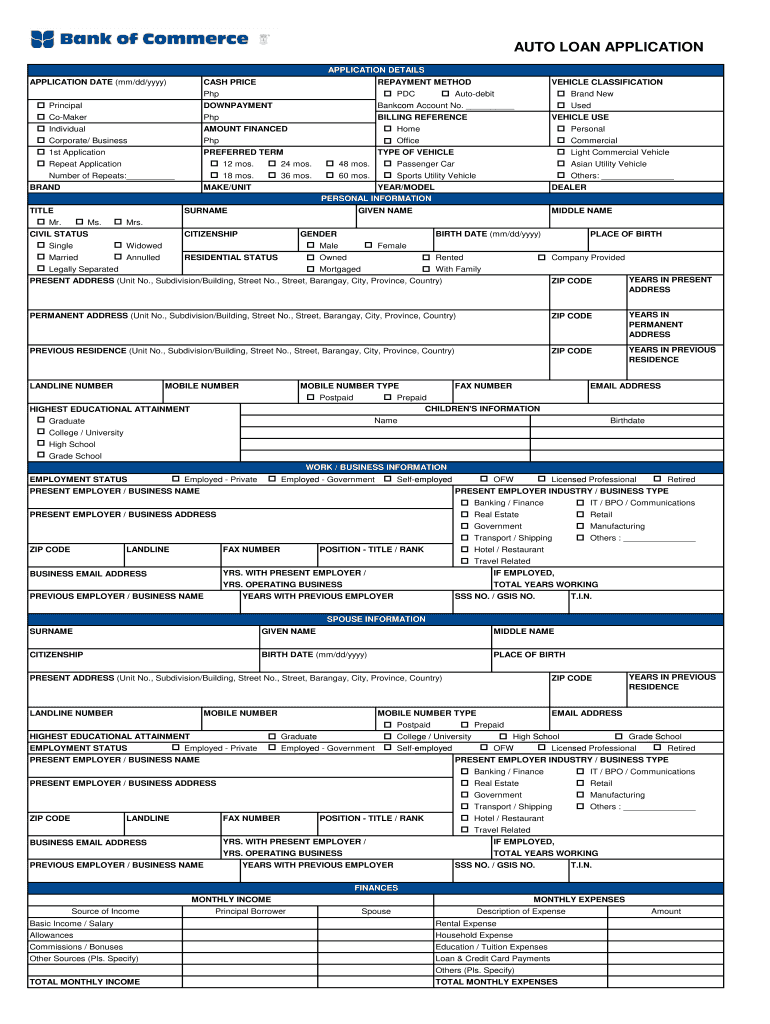

Personal Information: This is where the applicant provides their full name, contact details like phone number and email address, and their current address. It might also include their date of birth to verify age and identity. The key is to ask only for what is strictly necessary for identification and communication.

-

Employment and Income Details: Lenders need to assess an applicant’s ability to repay the loan. This section typically asks for current employment status, employer’s name, job title, and verifiable income. Clarity in these questions helps applicants provide accurate figures quickly.

-

Vehicle Information (if known): If the applicant has already chosen a vehicle, details such as make, model, year, and VIN (Vehicle Identification Number) might be requested. This helps the lender understand the asset against which the loan is being sought, though it’s often optional at the initial stage.

-

Loan Specifics: This section outlines the desired loan amount and preferred loan term. It helps the applicant specify their needs and gives the lender a clear target for the financing package. Keeping options clear and concise here is crucial.

By breaking down the application into these core categories, and ensuring each section is clearly labeled and easy to navigate, applicants can move through the process with confidence. It transforms a potentially daunting task into a manageable set of simple questions, truly embodying what a simple vehicle loan application form template aims to be.

Furthermore, a simple form understands the value of context. It might offer brief explanations or tooltips next to fields, clarifying why certain information is needed or how it should be formatted. This proactive guidance prevents common mistakes and reduces the need for back-and-forth communication between the applicant and the lender, ultimately saving time for everyone. It demonstrates that the form has been carefully thought out, with the user’s ease of use as the paramount consideration.

Designing for Efficiency and User Experience

When crafting or choosing a simple vehicle loan application form template, focusing on efficiency and the overall user experience is paramount. This isn’t just about reducing the number of fields; it’s about intelligent design that anticipates user needs and streamlines the data collection process. For instance, using dropdown menus for state selection or checkboxes for common yes or no questions can significantly cut down on typing and potential errors. Every design choice should contribute to making the application feel less like a chore and more like a straightforward exchange of information.

Another crucial aspect of an efficient application is its adaptability. A well-designed simple vehicle loan application form template should be usable across various devices, whether someone is applying from a desktop computer, a tablet, or a smartphone. Responsive design ensures that the form looks good and functions perfectly, regardless of screen size. This flexibility caters to the modern applicant who expects convenience and accessibility, allowing them to complete their application whenever and wherever it is most convenient for them, without any technical hiccups or formatting issues.

The transition from a paper-based form to a digital one offers immense opportunities for enhancing simplicity. Digital forms can employ smart logic, which means that certain questions only appear if they are relevant based on previous answers. For example, if an applicant indicates they are self-employed, specific fields related to business income might appear, while fields for traditional employment disappear. This dynamic tailoring prevents information overload and ensures applicants are only presented with questions that directly apply to their situation, making the process feel personalized and incredibly efficient.

Finally, a truly effective simple application form anticipates the next steps. It might include clear instructions on how to submit the form, what documents might be needed next, or what the expected timeline for a decision is. Setting clear expectations manages applicant anxiety and builds trust. Even after submission, a simple and clear communication strategy reinforces the positive experience. It’s about more than just the form itself; it’s about the entire pre-approval journey being as smooth and transparent as possible for anyone seeking vehicle financing.

Ultimately, a vehicle loan application doesn’t have to be a source of stress. By embracing the principles of clarity, conciseness, and user-centric design, it’s entirely possible to create a process that is not only quick and efficient but also genuinely pleasant for applicants. This focus on simplifying the initial steps can significantly impact customer satisfaction and foster stronger relationships between lenders and their future clients.

Streamlining this fundamental part of the vehicle purchasing journey benefits everyone. For individuals, it means less time spent on paperwork and more time looking forward to their new car. For financial institutions, it translates into higher completion rates, fewer processing errors, and a better reputation for being customer-friendly and efficient. Embracing a simpler approach to loan applications is a win-win, paving the way for more seamless and successful vehicle financing experiences.