Utilizing a pre-designed structure for this type of report offers numerous advantages. It promotes consistency in financial reporting, simplifies the process of data entry and analysis, and reduces the likelihood of errors. Furthermore, a standardized format allows for easy comparison of performance across different periods, facilitating trend identification and informed forecasting. This accessibility to clear, concise financial data empowers stakeholders to make timely, data-driven decisions that contribute to overall business success.

Understanding the core components and benefits of this crucial financial tool lays the foundation for exploring its practical application and the various ways it can be tailored to meet specific business needs. Let’s delve further into the key elements typically included in such a report and examine how these elements contribute to a comprehensive understanding of financial performance.

1. Revenue

Revenue forms the cornerstone of a year-to-date profit and loss statement. Accurate revenue reporting is crucial for understanding financial performance and making informed business decisions. This figure represents the total income generated from a company’s primary operations, reflecting the inflow of cash from sales of goods or services. A clear understanding of revenue trends, as presented in the statement, allows businesses to evaluate market demand, pricing strategies, and sales effectiveness. For instance, a software company might track software license sales, subscription fees, and professional service fees as distinct revenue streams within its statement. Variations in these streams can signal shifts in customer preferences or market saturation, prompting strategic adjustments.

Analyzing revenue within a year-to-date context offers valuable insights into growth trajectories and overall financial health. Comparing current year-to-date revenue with figures from the same period in the previous year can reveal areas of strength and weakness. Suppose a retail business observes a year-to-date revenue decline compared to the previous year. This information can trigger an investigation into potential causes, such as declining foot traffic, increased competition, or ineffective marketing campaigns. Furthermore, revenue data within the statement can be used to calculate key performance indicators (KPIs) like revenue growth rate and average revenue per user, providing further context for performance evaluation. Understanding these metrics enables businesses to identify areas for improvement, optimize resource allocation, and ultimately, drive profitability.

In conclusion, revenue serves as a fundamental component of a year-to-date profit and loss statement, providing a critical lens through which to assess business performance. Accurate and detailed revenue reporting enables organizations to identify trends, make informed decisions, and drive sustainable growth. A thorough understanding of this core element is essential for effective financial management and long-term success.

2. Expenses

A comprehensive understanding of expenses is crucial for interpreting a simple year-to-date profit and loss statement template. Expenses represent the outflow of money required to operate a business. Categorizing and tracking these outflows within the statement provides insights into cost management effectiveness and profitability drivers. Accurately recorded expenses, categorized within a structured template, facilitate analysis of spending patterns and inform strategic resource allocation decisions. For example, a manufacturing company might categorize expenses into direct costs, like raw materials, and indirect costs, like administrative overhead. This categorization allows for a granular understanding of how resources are consumed across different operational areas.

Examining expenses within a year-to-date context reveals cost trends and potential areas for optimization. Comparing current year-to-date expenses to those from the previous year can highlight increases or decreases in specific cost categories. Suppose a marketing agency observes a significant year-to-date increase in advertising expenses compared to the previous year. This finding could trigger a review of advertising campaign effectiveness and return on investment, leading to potential adjustments in marketing strategies. Furthermore, tracking expenses within a template facilitates the calculation of key profitability metrics, such as gross profit margin and operating profit margin. These metrics offer valuable insights into the relationship between revenue, expenses, and overall profitability, guiding data-driven decision-making. Monitoring these metrics allows businesses to identify areas for cost reduction, improve operational efficiency, and enhance profitability.

Effective expense management is essential for sustainable business growth. Utilizing a simple year-to-date profit and loss statement template provides the framework for detailed expense tracking and analysis. This understanding of expense trends and their impact on profitability empowers organizations to make informed decisions regarding resource allocation, cost control, and long-term financial health. Careful monitoring and analysis of expenses within this structured format contribute significantly to informed financial management and sustained business success.

3. Profit/Loss

The core purpose of a simple year-to-date profit and loss statement template is to determine the net financial outcome of operations within a specified timeframe. This outcome, represented as either profit (net income) or loss (net deficit), is a crucial indicator of financial performance and business health. Understanding the components contributing to profit or loss empowers stakeholders to make informed decisions regarding resource allocation, pricing strategies, and overall operational efficiency.

- Calculating Net Income/LossNet income or loss is derived by subtracting total expenses from total revenues. A positive result signifies profitability, while a negative result indicates a loss. For example, if a company generates $150,000 in revenue and incurs $120,000 in expenses during a given period, the net income is $30,000. Conversely, if expenses exceed revenue, a net loss results. Within the year-to-date context, this calculation provides a cumulative perspective on financial performance from the beginning of the fiscal year.

- Factors Influencing ProfitabilityNumerous factors influence profitability, including sales volume, pricing strategies, cost management, and market conditions. A company experiencing declining sales volume despite maintaining stable pricing might need to explore marketing strategies or product diversification to improve profitability. Similarly, effective cost control measures, such as negotiating favorable supplier contracts or optimizing operational processes, can positively impact the bottom line.

- Interpreting Profit/Loss TrendsAnalyzing profit/loss trends over time provides valuable insights into business performance and sustainability. Consistent profitability indicates financial health and effective management, while sustained losses may signal underlying operational challenges or market pressures. Evaluating year-to-date profit/loss against previous periods can reveal areas of strength and weakness, informing strategic adjustments and corrective actions.

- Impact on Decision-MakingProfit/loss data plays a critical role in informing strategic decision-making across various business functions. Consistently achieving profitability allows for reinvestment in research and development, expansion initiatives, or talent acquisition. Conversely, periods of loss may necessitate cost-cutting measures, operational restructuring, or revised pricing strategies. The insights gained from analyzing profit/loss data within the year-to-date context are essential for navigating market dynamics and ensuring long-term financial stability.

The profit/loss figure, representing the culmination of revenue and expense activity, provides a concise yet powerful indicator of financial performance within a simple year-to-date profit and loss statement template. Understanding the factors influencing this figure and analyzing its trends over time are critical for effective financial management, informed decision-making, and sustained business success.

4. Year-to-date

The “year-to-date” (YTD) component provides a cumulative perspective on financial performance within a specific fiscal year. A simple year-to-date profit and loss statement template aggregates financial data from the beginning of the fiscal year up to a specified date, offering a snapshot of performance over time rather than a single, isolated period. This cumulative view allows for the identification of trends, the assessment of progress towards annual goals, and informed decision-making based on a broader context. For instance, a YTD analysis might reveal consistent revenue growth throughout the year, indicating effective sales strategies, or it might highlight escalating expenses in a particular quarter, prompting a review of cost management practices. Without the YTD perspective, these insights might be obscured by the fluctuations of individual reporting periods.

The significance of the YTD aspect is further amplified when comparing current performance with previous years’ data. Analyzing YTD figures against historical data from the same period in prior years provides valuable benchmarks for assessing growth, identifying potential issues, and informing future projections. For example, a retail business might compare its YTD sales figures with those from the previous year to gauge market share growth or identify seasonal sales patterns. This comparative analysis enables businesses to understand their performance within a broader market context and make strategic adjustments based on historical trends. Furthermore, the YTD perspective allows for more accurate forecasting, as it considers the cumulative impact of financial activities throughout the year, rather than relying solely on isolated periods. This enhanced forecasting capability allows businesses to anticipate potential challenges and opportunities, optimizing resource allocation and improving strategic planning.

In conclusion, the YTD component is essential to a simple year-to-date profit and loss statement template. It provides a crucial temporal dimension, enabling businesses to analyze cumulative performance, identify trends, compare results with historical data, and make more informed forecasts. This comprehensive understanding of financial performance, facilitated by the YTD perspective, is fundamental to effective financial management and sustainable business growth. Without this crucial element, businesses risk operating with a limited view of their financial landscape, potentially overlooking critical trends and opportunities.

5. Template

Within the context of financial reporting, a template provides a pre-designed framework for organizing and presenting data consistently. Its relevance to a simple year-to-date profit and loss statement lies in its ability to streamline the reporting process, enhance data comparability, and reduce the risk of errors. A well-designed template ensures that essential financial information is captured and presented in a standardized format, facilitating analysis and interpretation.

- StandardizationTemplates enforce consistency in financial reporting. By providing predefined categories and formatting, they ensure uniformity across reporting periods, regardless of who prepares the statement. This standardization is crucial for accurate trend analysis and performance comparisons. For example, a template might mandate specific categories for operating expenses, such as salaries, rent, and utilities, ensuring consistent categorization across different periods and facilitating meaningful comparisons of expense trends over time.

- EfficiencyTemplates streamline the process of data entry and report generation. Predefined formulas and automated calculations reduce manual effort and minimize the potential for errors. This increased efficiency allows financial professionals to focus on analysis and interpretation rather than data compilation. Consider a template that automatically calculates gross profit by subtracting the cost of goods sold from revenue. This automation saves time and reduces the risk of manual calculation errors.

- ComparabilityUsing a consistent template facilitates comparisons of financial performance across different periods. By maintaining a standardized structure, templates allow for easy identification of trends and variances. This comparability is crucial for evaluating the effectiveness of business strategies and making informed decisions. For example, comparing year-to-date performance against the same period in the previous year using the same template allows for clear identification of growth or decline in key financial metrics.

- AccessibilityA well-designed template enhances the accessibility of financial information. Clear labeling, logical organization, and visual aids, such as charts and graphs, improve clarity and facilitate understanding for all stakeholders, regardless of their financial expertise. This enhanced accessibility empowers stakeholders to make informed decisions based on a shared understanding of financial performance. For example, a template that visually represents revenue and expense trends using charts can enhance understanding for non-financial stakeholders.

These facets of a template contribute significantly to the effectiveness of a simple year-to-date profit and loss statement. By ensuring standardization, efficiency, comparability, and accessibility, a well-designed template empowers businesses to effectively monitor financial performance, identify trends, and make informed decisions that drive sustainable growth. The template serves as the foundation for clear, concise, and insightful financial reporting, contributing significantly to effective financial management.

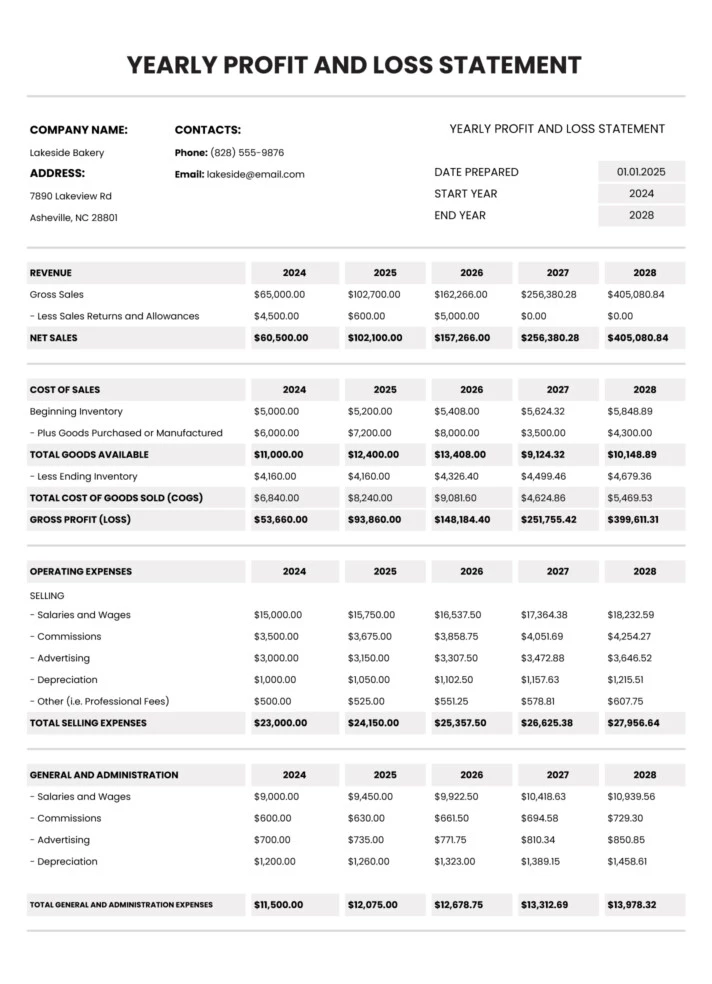

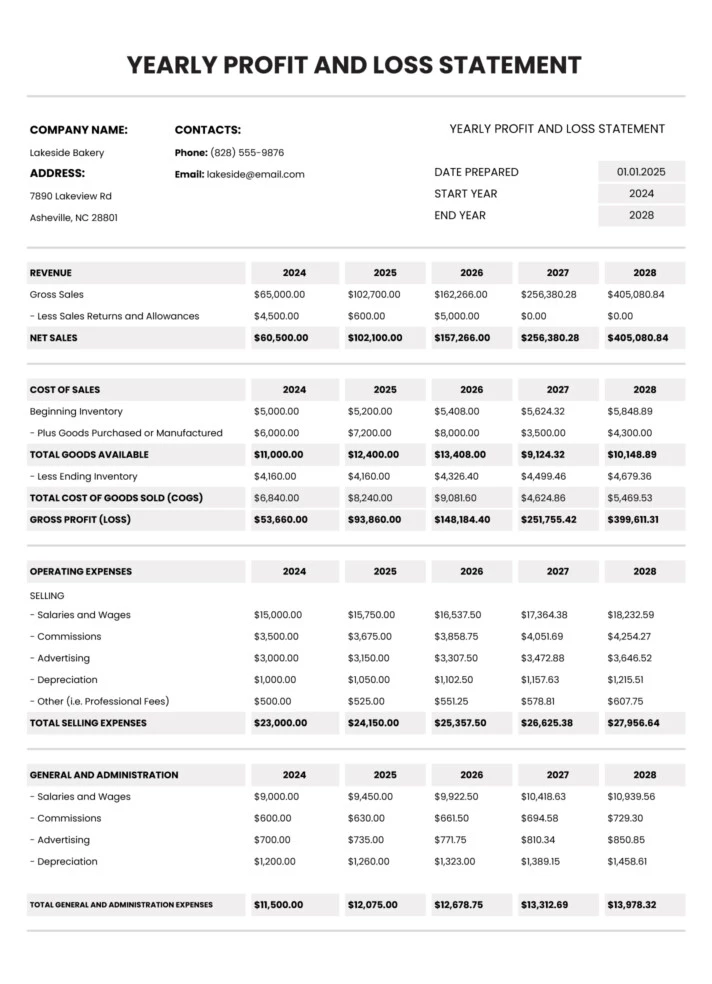

Key Components of a Simple Year-to-Date Profit and Loss Statement Template

A well-structured year-to-date profit and loss statement provides a concise overview of a company’s financial performance from the start of the fiscal year to a specific date. Understanding the key components is crucial for accurate interpretation and informed decision-making.

1. Revenue: This section details all income generated from the company’s primary business activities. It typically includes sales of goods or services, and may be further categorized into different revenue streams. Accurate revenue reporting is fundamental to understanding a company’s ability to generate income.

2. Cost of Goods Sold (COGS): For businesses selling physical products, COGS represents the direct costs associated with producing those goods. This includes raw materials, direct labor, and manufacturing overhead. COGS is subtracted from revenue to determine gross profit.

3. Gross Profit: Calculated as revenue minus COGS, gross profit represents the profit generated from core business operations before accounting for other operating expenses. Analyzing gross profit helps assess the efficiency of production and pricing strategies.

4. Operating Expenses: This section encompasses all costs incurred in running the business, excluding COGS. Typical operating expenses include salaries, rent, utilities, marketing, and administrative costs. Careful management of operating expenses is crucial for profitability.

5. Operating Income: Operating income, also known as Earnings Before Interest and Taxes (EBIT), is derived by subtracting operating expenses from gross profit. It reflects the profitability of the company’s core operations before considering financial obligations and taxes.

6. Interest and Taxes: This section accounts for interest expenses on debt and income tax obligations. Subtracting these from operating income yields net income.

7. Net Income: Often referred to as the “bottom line,” net income represents the company’s final profit or loss after all revenues and expenses have been considered. This figure provides a comprehensive overview of financial performance for the year-to-date.

8. Year-to-Date Figures: All figures within the statement represent cumulative totals from the beginning of the fiscal year up to the reporting date. This cumulative perspective is essential for identifying trends and evaluating performance over time.

Effective analysis of these components provides valuable insights into a company’s financial health, profitability, and operational efficiency. This understanding is crucial for informed decision-making and strategic planning.

How to Create a Simple Year-to-Date Profit and Loss Statement

Creating a clear and concise year-to-date profit and loss statement requires a structured approach. The following steps outline the process of developing a template for tracking and analyzing financial performance.

1. Define the Reporting Period: Specify the start and end dates for the year-to-date period. This ensures consistency and allows for accurate comparisons across different periods. Clarity in the reporting timeframe is crucial for meaningful analysis.

2. Establish Revenue Categories: Categorize revenue streams to provide a granular view of income generation. Distinct categories, such as product sales, service fees, or subscription revenue, facilitate analysis of specific income sources and their contribution to overall performance.

3. Outline Expense Categories: Develop a comprehensive list of expense categories relevant to the business. Common categories include cost of goods sold (COGS), salaries, rent, marketing, and administrative expenses. Detailed categorization enables precise tracking of spending patterns.

4. Design the Template Structure: Structure the template logically, separating revenue, expenses, and calculations of profit/loss. Clear visual organization enhances readability and facilitates interpretation. A well-structured template promotes efficient data entry and analysis.

5. Incorporate Formulas and Calculations: Implement formulas to automate calculations such as gross profit (revenue – COGS), operating income (gross profit – operating expenses), and net income (operating income – interest and taxes). Automated calculations ensure accuracy and efficiency.

6. Input Data: Populate the template with accurate financial data for the defined reporting period. Data accuracy is paramount for reliable insights and informed decision-making. Diligent data entry is crucial for meaningful analysis.

7. Review and Validate: Thoroughly review the completed statement for accuracy and completeness. Validation ensures data integrity and reinforces the reliability of the financial information presented. Regular review and validation minimize the risk of errors.

8. Analyze and Interpret: Analyze the statement to identify trends, evaluate performance against benchmarks, and inform strategic decisions. Meaningful interpretation of financial data is crucial for optimizing resource allocation and driving business growth.

A systematically developed template provides a robust framework for tracking, analyzing, and interpreting financial performance throughout the fiscal year. This structured approach facilitates informed decision-making and contributes to long-term financial health.

A streamlined year-to-date profit and loss statement template offers businesses a critical tool for monitoring financial performance. Its concise format, focusing on key metrics like revenue, expenses, and resulting profit or loss, provides a clear snapshot of financial health from the beginning of the fiscal year to the present date. Utilizing a template ensures consistency, simplifies reporting, and facilitates analysis, empowering stakeholders to make informed, data-driven decisions. Understanding the components within this template, from revenue streams and cost categorization to the calculation of net income, provides a solid foundation for interpreting financial data and identifying areas for improvement.

Effective financial management hinges on access to clear, concise, and accurate financial information. Regularly generating and analyzing these statements provides invaluable insights into operational efficiency, profitability trends, and overall financial health. This practice enables proactive adjustments, informed resource allocation, and ultimately, contributes significantly to sustainable business growth and long-term success. Leveraging the power of a well-structured template transforms financial data into a strategic asset, guiding organizations toward informed decision-making and sustained financial stability.