Using a pre-designed structure for this crucial financial report offers several advantages. It ensures consistency in reporting, simplifies the process of data entry and analysis, and reduces the risk of errors. Furthermore, a standardized format facilitates comparisons across different periods, enabling businesses to track progress and identify areas for improvement. This consistent tracking allows for informed decision-making, improved financial management, and ultimately, greater potential for sustained growth.

This article will further explore the key components of a typical profit and loss statement, provide practical guidance on its creation and interpretation, and discuss best practices for leveraging this tool to enhance financial health.

1. Revenue

Revenue, the lifeblood of any business, forms the cornerstone of the monthly income statement. Accurately capturing and analyzing revenue streams is crucial for understanding profitability and overall financial health. A well-structured income statement template provides the framework for this analysis, enabling businesses to track revenue trends and make informed decisions.

- Sales RevenueThis represents income generated from the core business operations, typically the sale of goods or services. For a retail store, this would be the total sales of products. For a consulting firm, it would be the fees earned from client projects. Accurately recording sales revenue is paramount for assessing business performance and forecasting future growth. Within a monthly income statement template, sales revenue is often broken down further, perhaps by product line or service category, providing a granular view of sales performance.

- Other RevenueThis category encompasses income derived from sources other than primary business operations. Examples include interest earned on investments, income from rental properties, or royalties from intellectual property. While often smaller than sales revenue, other revenue streams can contribute significantly to the bottom line and should be meticulously tracked within the income statement. This allows businesses to monitor the performance of these secondary income sources and identify potential areas for expansion.

- Returns and AllowancesThis represents a reduction in revenue due to returned goods or price adjustments offered to customers. Tracking returns and allowances is crucial for understanding true revenue and identifying potential issues with product quality or customer satisfaction. A comprehensive income statement template will clearly delineate this deduction from gross revenue to arrive at net revenue, providing a more accurate picture of financial performance.

- Revenue RecognitionThis refers to the specific accounting principles that dictate when revenue is recorded. Understanding and applying appropriate revenue recognition principles is essential for accurate financial reporting. For example, businesses offering subscription services might recognize revenue over the subscription period rather than upfront. A well-designed income statement template will facilitate adherence to these principles, ensuring financial statements reflect the true economic reality of the business.

By meticulously tracking and categorizing these different facets of revenue within a monthly income statement template, small businesses gain valuable insights into their financial performance. This granular view allows for data-driven decision-making, enabling businesses to identify growth opportunities, optimize pricing strategies, and improve overall profitability. Furthermore, a clear understanding of revenue trends provides a solid foundation for future planning and forecasting, contributing to long-term financial stability and success.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. Within a small business monthly income statement template, COGS plays a crucial role in determining gross profit and ultimately, net income. Accurately calculating and analyzing COGS is essential for informed decision-making regarding pricing, inventory management, and overall profitability. A clear understanding of COGS allows businesses to identify areas for cost optimization and improve financial performance.

For example, a bakery’s COGS includes the cost of ingredients like flour, sugar, and butter, as well as the direct labor costs associated with baking. A clothing retailer’s COGS comprises the cost of purchasing inventory from manufacturers or wholesalers. Accurately tracking these costs within a monthly income statement template enables businesses to monitor fluctuations in COGS and understand their impact on profitability. A sudden increase in ingredient costs for the bakery, for instance, could necessitate adjustments in pricing or sourcing strategies to maintain profit margins. Similarly, rising wholesale prices for the clothing retailer might require adjustments in retail pricing or a shift towards different suppliers.

Several factors can influence COGS, including raw material prices, manufacturing costs, and inventory management practices. Businesses must carefully track these factors and analyze their effect on COGS within the context of the monthly income statement. This analysis provides valuable insights into cost control opportunities and allows for proactive adjustments to business strategies. Ignoring COGS or calculating it inaccurately can lead to misinformed decisions, potentially impacting profitability and long-term financial health. A well-structured income statement template ensures accurate COGS calculation and facilitates informed financial management. By understanding and analyzing COGS, businesses can optimize pricing strategies, improve inventory control, and ultimately, enhance profitability.

3. Gross Profit

Gross profit, a key performance indicator, reveals the profitability of a business after accounting for the direct costs associated with producing goods or services. Within a small business monthly income statement template, gross profit occupies a central position, bridging the gap between revenue and operating expenses. Analyzing gross profit trends provides crucial insights into pricing strategies, cost management effectiveness, and overall financial health. A thorough understanding of this metric is essential for informed decision-making and sustainable growth.

- Calculating Gross ProfitGross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue. This straightforward calculation, readily apparent within a monthly income statement template, provides a clear picture of the profitability of core business operations. For instance, if a business generates $100,000 in revenue and incurs $60,000 in COGS, the gross profit is $40,000. Monitoring this figure month-to-month allows businesses to track the impact of changes in pricing, sales volume, or production costs.

- Analyzing Gross Profit MarginExpressing gross profit as a percentage of revenue yields the gross profit margin, a valuable metric for assessing profitability relative to sales. A higher gross profit margin generally indicates greater efficiency in managing production costs. Using the previous example, the gross profit margin would be 40% ($40,000/$100,000). Tracking this percentage within a monthly income statement template allows for easy comparison across different periods and against industry benchmarks, providing valuable insights into competitive positioning and potential areas for improvement.

- Impact of Pricing and CostsGross profit is directly influenced by both pricing strategies and cost management practices. Increasing prices while holding COGS constant will improve gross profit, while rising COGS with static pricing will erode it. A monthly income statement template facilitates the analysis of these interconnected factors. For example, if a business implements cost-saving measures in production, the impact on gross profit will be readily apparent within the following month’s statement, providing valuable feedback on the effectiveness of such initiatives.

- Relationship to Operating Expenses and Net IncomeGross profit serves as the foundation for covering operating expenses and ultimately, generating net income. A healthy gross profit is essential for absorbing overhead costs and achieving profitability. The monthly income statement template clearly depicts the flow from gross profit to net income, highlighting the importance of managing both COGS and operating expenses to maximize profitability. Analyzing this relationship allows businesses to make informed decisions regarding resource allocation and cost control measures.

By closely monitoring gross profit and its related metrics within the framework of a small business monthly income statement template, businesses gain valuable insights into their financial performance. This understanding empowers informed decision-making regarding pricing strategies, cost optimization initiatives, and overall financial management, contributing to sustainable growth and long-term success. Regularly analyzing gross profit trends within the context of the broader financial picture presented by the income statement is a cornerstone of effective financial management for small businesses.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business, excluding the direct costs of producing goods or services (COGS). Within a small business monthly income statement template, operating expenses are crucial for determining net income. Careful tracking and analysis of these expenses are essential for effective cost management, profitability assessment, and informed decision-making.

- Selling, General, and Administrative Expenses (SG&A)SG&A encompasses a wide range of expenses necessary for daily operations and sales activities. Examples include salaries for administrative staff, marketing and advertising costs, rent, utilities, and office supplies. Within the income statement, SG&A provides insights into the cost structure of supporting business functions. Monitoring SG&A trends can reveal areas for potential cost savings, such as negotiating better lease terms or optimizing marketing spend.

- Research and Development (R&D)R&D expenses represent investments in developing new products, services, or processes. For businesses focused on innovation, R&D is a crucial driver of future growth. Tracking R&D spending within the monthly income statement allows businesses to monitor investment levels and assess their impact on overall profitability. Analyzing R&D expenditure can inform strategic decisions regarding resource allocation and future innovation projects.

- Depreciation and AmortizationThese represent the allocation of the cost of long-term assets over their useful life. Depreciation applies to tangible assets like equipment and buildings, while amortization applies to intangible assets like patents and copyrights. Including these non-cash expenses in the income statement provides a more accurate reflection of the true cost of doing business. Tracking depreciation and amortization helps businesses understand the impact of asset utilization on profitability.

- Interest ExpenseInterest expense reflects the cost of borrowing money. This includes interest payments on loans and other forms of debt financing. Monitoring interest expense within the monthly income statement is crucial for managing debt levels and assessing their impact on profitability. Analyzing interest expense can inform decisions regarding financing strategies and debt reduction initiatives.

By meticulously tracking and categorizing operating expenses within a small business monthly income statement template, businesses gain a granular understanding of their cost structure. This detailed view enables effective cost management, informed decision-making regarding resource allocation, and ultimately, improved profitability. Analyzing operating expense trends within the broader context of the income statement provides crucial insights for achieving sustainable financial health and long-term success. Furthermore, comparing operating expenses to revenue and gross profit allows for a deeper understanding of operational efficiency and profitability drivers.

5. Net Income

Net income, often referred to as the “bottom line,” represents the ultimate measure of a business’s profitability after all revenues and expenses are considered. Within the context of a small business monthly income statement template, net income occupies a position of paramount importance. It provides a concise snapshot of financial performance over a specific period, enabling stakeholders to assess the effectiveness of operational strategies, pricing decisions, and cost management efforts. The consistent tracking and analysis of net income within a monthly framework allows for timely identification of trends, potential issues, and opportunities for improvement. This understanding forms the basis for informed decision-making, contributing significantly to long-term financial health and sustainability.

The calculation of net income within a monthly income statement template follows a logical progression. Beginning with total revenue, the cost of goods sold (COGS) is subtracted to arrive at gross profit. Subsequently, operating expenses, including selling, general, and administrative expenses (SG&A), research and development (R&D), depreciation, and amortization, are deducted from gross profit. Finally, interest expense and taxes are subtracted to arrive at net income. For example, a business with $100,000 in revenue, $60,000 in COGS, $30,000 in operating expenses, and $2,000 in interest expense, would report a net income of $8,000 before taxes. Analyzing the components contributing to this final figurerevenue, COGS, and operating expensesprovides valuable insights into the drivers of profitability. Consistently monitoring these elements within the monthly income statement template allows businesses to identify areas for improvement, such as reducing COGS through more efficient sourcing or optimizing operating expenses through streamlined processes. This ongoing analysis empowers businesses to proactively address challenges and capitalize on opportunities.

Understanding the relationship between net income and the various components within the small business monthly income statement template is essential for effective financial management. Analyzing trends in net income, coupled with a detailed examination of revenue streams, cost structures, and operating expenses, provides a comprehensive view of financial performance. This understanding empowers businesses to make informed decisions regarding pricing strategies, cost control measures, investment opportunities, and overall resource allocation. Furthermore, consistent tracking and analysis of net income within a monthly framework allows for proactive adjustments to business strategies, ultimately contributing to long-term financial stability and sustainable growth. The practical significance of this understanding lies in its ability to transform raw financial data into actionable insights, enabling businesses to navigate the complexities of the financial landscape and achieve their strategic objectives.

6. Regular Tracking

Regular tracking, specifically utilizing a monthly income statement template, provides crucial insights into the financial health of a small business. This consistent monitoring enables proactive management and informed decision-making by providing a clear view of financial performance over time. Cause and effect relationships between business activities and financial outcomes become more apparent through regular tracking. For instance, a marketing campaign’s impact on revenue generation can be directly observed by comparing pre-campaign revenue figures with post-campaign results reflected in the subsequent monthly income statements. Similarly, implementing cost-cutting measures can be evaluated by analyzing changes in operating expenses and their corresponding effect on net income across multiple monthly statements. Without regular tracking, these crucial connections might remain obscured, hindering effective management.

The importance of regular tracking as a component of a small business monthly income statement template lies in its ability to reveal trends and anomalies. A consistent decline in gross profit margin, for instance, signals potential issues with pricing strategies, production costs, or sales volume. Early identification of such trends, facilitated by monthly tracking, allows for timely intervention and corrective action. A sudden spike in operating expenses might indicate inefficiencies or unforeseen costs requiring immediate attention. Conversely, consistent growth in net income validates successful business strategies and reinforces positive momentum. These real-world examples highlight the practical significance of regular tracking in providing actionable insights.

In conclusion, regular tracking using a monthly income statement template offers a critical tool for small business management. It transforms raw financial data into a dynamic narrative of business performance, revealing cause-and-effect relationships, highlighting trends, and informing strategic decision-making. The insights gained from this consistent monitoring empower businesses to proactively address challenges, capitalize on opportunities, and navigate the complexities of the financial landscape. This practice contributes significantly to sustainable growth, financial stability, and long-term success by providing the necessary information for informed and timely action. Failing to implement regular tracking deprives businesses of a crucial management tool, increasing the risk of overlooking critical financial insights and hindering proactive decision-making.

Key Components of a Small Business Monthly Income Statement Template

A well-structured monthly income statement template provides a standardized framework for analyzing financial performance. Several key components contribute to this comprehensive overview, offering valuable insights into profitability, cost management, and overall financial health.

1. Revenue: This section details all income generated from business operations, typically categorized as sales revenue and other revenue. Accurate revenue reporting is fundamental to understanding financial performance and tracking growth.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services sold. This component is crucial for calculating gross profit and assessing the efficiency of production processes.

3. Gross Profit: Calculated as revenue less COGS, gross profit indicates the profitability of core business operations before accounting for operating expenses. Analyzing gross profit trends provides insights into pricing strategies and cost management effectiveness.

4. Operating Expenses: This section encompasses all costs incurred in running the business, excluding COGS. Examples include salaries, rent, marketing expenses, and administrative costs. Careful tracking of operating expenses is crucial for effective cost control.

5. Operating Income: This represents profit after deducting both COGS and operating expenses. It reflects the profitability of the core business operations before considering non-operating income and expenses.

6. Other Income and Expenses: This section includes income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time expenses. These items provide a more complete picture of the overall financial performance.

7. Net Income: Often referred to as the “bottom line,” net income represents the final profit or loss after all revenues and expenses are considered. This figure is a key indicator of overall financial health and the effectiveness of business strategies.

By utilizing a template that incorporates these key components, businesses gain a structured and consistent approach to financial analysis. This standardized framework allows for accurate tracking of financial performance over time, enabling informed decision-making and contributing to long-term stability and growth.

How to Create a Small Business Monthly Income Statement Template

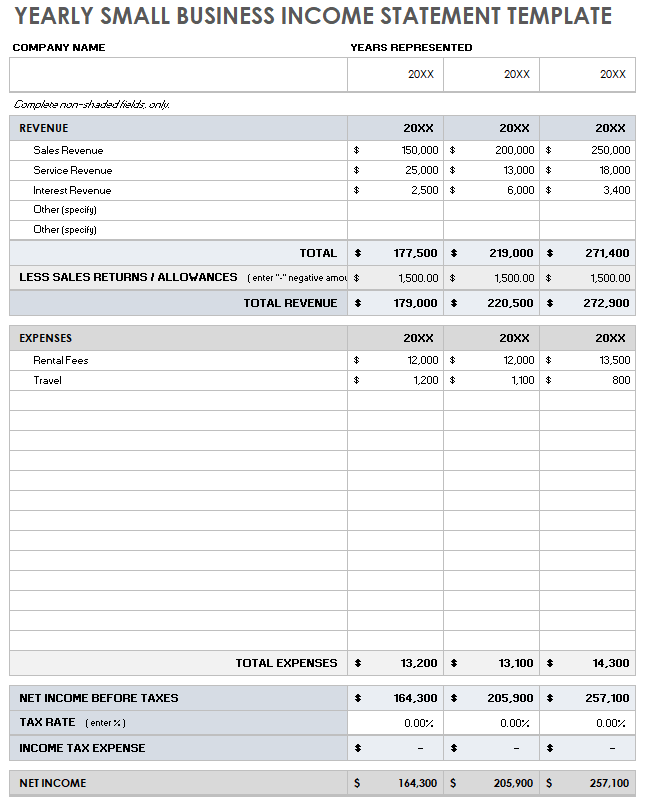

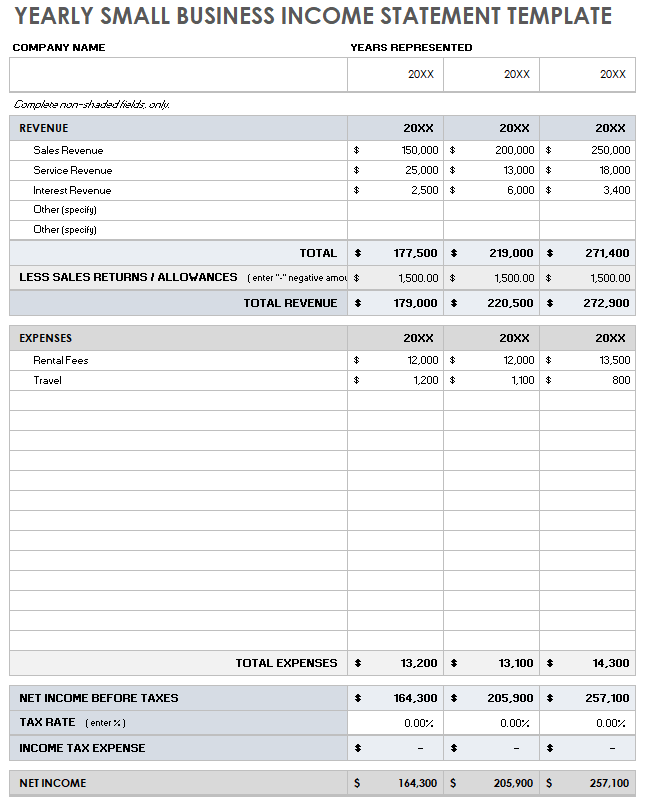

Creating a monthly income statement template involves structuring key financial data in a standardized format. This facilitates consistent tracking, analysis, and informed decision-making. The following steps outline the process.

1. Establish a Consistent Reporting Period: Select a specific time frame for the income statement, typically a calendar month. Consistent reporting periods enable accurate comparisons and trend analysis over time.

2. Categorize Revenue Streams: Clearly define and categorize different revenue sources. Common categories include sales revenue, service revenue, and other revenue. This granular approach provides insights into the performance of individual revenue streams.

3. Detail Cost of Goods Sold (COGS): Accurately track all direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

4. Calculate Gross Profit: Subtract COGS from total revenue to arrive at gross profit. This key metric reflects the profitability of core business operations before accounting for operating expenses.

5. Itemize Operating Expenses: Categorize and list all operating expenses, including salaries, rent, utilities, marketing costs, and administrative expenses. Detailed tracking of operating expenses facilitates cost management and efficiency analysis.

6. Include Other Income and Expenses: Account for any income or expenses not directly related to core business operations. This may include interest income, investment gains or losses, and extraordinary items.

7. Determine Net Income: Subtract total operating expenses and other expenses from gross profit to arrive at net income, or the “bottom line.” This crucial metric reflects the overall profitability of the business after all revenues and expenses are considered.

8. Format for Clarity and Readability: Organize the income statement template in a clear and logical manner using tables or spreadsheets. Ensure consistent formatting for easy interpretation and comparison across different periods.

A well-structured template provides a framework for consistent financial analysis. Regularly populating this template with accurate data enables businesses to monitor performance, identify trends, and make informed decisions. This process contributes significantly to effective financial management and long-term stability.

Regularly utilizing a structured financial report offers invaluable insights into operational performance. Tracking revenue, cost of goods sold, operating expenses, and ultimately, net income, provides a clear picture of financial health, enabling data-driven decision-making. Consistent use of such a template allows for trend analysis, identification of potential issues, and timely adjustments to business strategies. This structured approach to financial management empowers informed choices regarding pricing, cost control, and resource allocation, contributing significantly to long-term stability and sustainable growth.

Implementing a standardized monthly review process is not merely a bookkeeping exercise; it is a strategic imperative for small businesses seeking to thrive in a competitive landscape. This disciplined approach to financial management provides the necessary foundation for informed decision-making, enabling businesses to navigate challenges, capitalize on opportunities, and achieve long-term financial success. The insights derived from this consistent analysis empower businesses to not only understand their current financial position but also to project future performance and make proactive adjustments to ensure continued growth and stability.