Using a standardized framework for financial reporting offers numerous advantages. It facilitates informed decision-making by clearly presenting revenue streams, cost structures, and resulting profitability. This clarity enables businesses to identify areas for improvement, control expenses effectively, and strategize for growth. Furthermore, a consistent reporting format simplifies tax preparation and can be invaluable when seeking funding from investors or lenders.

This article will delve deeper into the key components of a structured profit and loss report, explore different available formats, and provide guidance on how to effectively utilize these tools for enhanced financial management.

1. Revenue Streams

A profit and loss statement provides a comprehensive overview of a company’s financial performance. Accurately representing revenue streams is foundational to this understanding. Clearly identifying and categorizing diverse income sources allows for insightful analysis and informed decision-making.

- Sales RevenueThis represents income generated from the core business operations, typically the sale of goods or services. For a retail store, this would be the revenue from product sales; for a consulting firm, it would be the fees earned from client projects. Accurate tracking of sales revenue is essential for assessing the overall health and growth trajectory of the business. Within a P&L statement, sales revenue is typically the primary and often largest revenue stream.

- Interest IncomeThis represents earnings generated from interest-bearing accounts or investments. While potentially a smaller revenue stream for some businesses, it should still be meticulously tracked within the P&L statement. This allows for a complete financial picture and facilitates informed decisions about cash management and investment strategies.

- Other IncomeThis category encompasses any revenue generated outside of core business operations and interest income. Examples include income from the sale of assets, lease agreements, or royalties. Proper categorization within the P&L statement ensures transparency and helps identify potential growth opportunities outside of the primary business focus.

- Cost of Goods Sold (COGS)While not strictly a revenue stream, COGS is a crucial component listed alongside revenue within a P&L statement. It represents the direct costs associated with producing goods sold by a business. Accurately calculating and presenting COGS is essential for determining gross profit and understanding the profitability of core business operations. This includes raw materials, direct labor, and manufacturing overhead.

By distinctly categorizing and analyzing these components within a profit and loss statement, businesses gain a granular understanding of their financial performance. This detailed view facilitates strategic decision-making regarding pricing, resource allocation, and future investments. It also enables accurate profit margin calculations, which are critical for assessing business health and potential for growth.

2. Expense Categorization

Expense categorization is crucial for a comprehensive and insightful profit and loss statement. A well-structured template facilitates this categorization, enabling businesses to understand cost structures, identify areas for potential savings, and make informed financial decisions. Without meticulous expense categorization, a profit and loss statement offers limited value for strategic planning and performance analysis.

Categorizing expenses involves grouping similar costs under specific headings. Common categories include operating expenses (rent, utilities, salaries), marketing and advertising costs, research and development expenditures, and interest expenses. For example, a restaurant might categorize expenses under food costs, labor costs, rent, and utilities. A software company might categorize expenses under development costs, marketing costs, and administrative expenses. Accurate categorization provides a clear view of where funds are being allocated, enabling comparisons across periods and identification of trends.

A structured template ensures consistent expense tracking and reporting. This consistency allows for meaningful analysis of spending patterns and identification of potential cost-saving opportunities. Furthermore, accurate expense categorization is essential for tax reporting and compliance. By leveraging a template and adhering to consistent categorization practices, businesses can simplify tax preparation and ensure accurate reporting. Ultimately, effective expense categorization within a structured profit and loss statement empowers informed financial management and contributes to long-term business sustainability.

3. Calculating Profitability

A core function of a profit and loss statement template is to facilitate the calculation of profitability. This involves determining key metrics that reflect the financial health and performance of a business. These metrics are essential for internal performance evaluation, strategic decision-making, and securing external funding.

- Gross ProfitGross profit represents the revenue remaining after deducting the direct costs associated with producing goods or services (Cost of Goods Sold). This metric reveals the efficiency of production and pricing strategies. A higher gross profit margin indicates greater profitability on each sale. For example, a furniture maker calculates gross profit by subtracting the cost of lumber, hardware, and direct labor from the revenue generated by selling furniture. This metric is a fundamental building block in assessing overall profitability.

- Operating ProfitOperating profit, also known as earnings before interest and taxes (EBIT), measures profitability after accounting for both direct and indirect operating expenses. This metric provides insight into the efficiency of day-to-day business operations. A consistently growing operating profit suggests a healthy and sustainable business model. For a retail store, this would include subtracting rent, utilities, and salaries from gross profit. This metric helps evaluate the core business operations’ effectiveness independent of financing and tax structures.

- Net ProfitNet profit, often referred to as the “bottom line,” represents the ultimate profitability after all expenses, including interest and taxes, have been deducted. This metric indicates the overall financial success of the business. Consistent net profit is crucial for long-term sustainability and growth. For any business, this is the final profit figure after all deductions, representing the actual earnings available for reinvestment, distribution to owners, or debt reduction. This is the key indicator of overall financial success.

- Profit MarginsProfit margins, expressed as percentages, provide a standardized way to compare profitability across different periods or against industry benchmarks. These metrics are calculated by dividing a specific profit figure (gross, operating, or net) by revenue. Analyzing profit margins over time reveals trends and identifies areas for improvement. Comparing a business’s profit margins against industry averages offers valuable competitive insights. For example, consistent declines in gross profit margin might indicate rising production costs or ineffective pricing strategies, necessitating further investigation and corrective actions.

These calculated profitability metrics derived from a profit and loss statement template offer essential insights into business performance. By tracking these metrics over time, businesses can identify trends, evaluate the effectiveness of strategies, and make informed decisions to improve financial health and drive sustainable growth.

4. Time Period Comparisons

Analyzing financial performance across different time periods is crucial for understanding trends, evaluating the effectiveness of strategies, and making informed projections. A small business P&L statement template facilitates these comparisons by providing a consistent structure for organizing financial data. This structured approach allows for meaningful analysis of performance changes and identification of potential areas for improvement or growth.

- Year-over-Year AnalysisComparing performance metrics from one year to the next reveals long-term trends and the overall trajectory of the business. For example, consistent year-over-year revenue growth indicates a healthy business trajectory, while declining profits might signal underlying issues requiring attention. This analysis provides a high-level view of progress and helps assess the long-term sustainability of the business model.

- Quarter-over-Quarter AnalysisComparing performance metrics across fiscal quarters allows for a more granular view of recent performance trends. This frequency of analysis helps identify seasonal fluctuations, the impact of short-term strategies, and emerging challenges or opportunities. For example, a retail business might experience higher sales in the fourth quarter due to holiday shopping. This analysis facilitates timely adjustments to strategies and operational plans.

- Month-over-Month AnalysisAnalyzing performance on a monthly basis provides the most immediate feedback on business operations. This frequency is particularly useful for tracking progress towards short-term goals, identifying emerging trends, and quickly addressing performance fluctuations. For example, a subscription-based service can track monthly recurring revenue to assess the effectiveness of customer acquisition and retention strategies. This granular view allows for rapid adjustments and proactive management.

- Custom Time Period ComparisonsThe flexibility of a P&L template allows for comparisons across custom time periods, tailored to specific business needs. This can include comparing performance before and after implementing a new strategy, assessing the impact of a specific marketing campaign, or analyzing performance during a particular economic cycle. This customized approach provides targeted insights relevant to specific business decisions.

By leveraging the consistent structure of a P&L template, businesses can conduct meaningful time period comparisons, gaining valuable insights into performance trends, identifying areas for improvement, and making informed decisions to drive future growth and success. The ability to analyze performance across various timeframes provides a comprehensive understanding of the business’s financial trajectory and empowers proactive management.

5. Financial Health Insights

A small business profit and loss statement template provides the foundation for deriving crucial financial health insights. The structured format facilitates the calculation of key performance indicators (KPIs) such as gross profit margin, operating profit margin, and net profit margin. These KPIs offer a quantifiable view of profitability, efficiency, and overall financial performance. Trends in these KPIs, observed over time, reveal deeper insights into the financial health of the business. For instance, a consistently declining gross profit margin could indicate escalating production costs or ineffective pricing strategies, prompting further investigation and corrective action. Conversely, consistent growth in operating profit suggests efficient management of operating expenses and sustainable business practices.

Real-world applications of these insights are numerous. A restaurant owner, for example, might observe declining profit margins despite consistent revenue growth. Analysis of the P&L statement might reveal escalating food costs or increasing labor expenses. This insight allows the owner to take corrective actions, such as renegotiating supplier contracts, adjusting menu pricing, or optimizing staffing levels. Similarly, a retail business might use P&L data to assess the effectiveness of marketing campaigns. By comparing sales revenue and marketing expenses before and after a campaign, the business can determine its return on investment and make informed decisions about future marketing strategies. These practical applications demonstrate the crucial link between a well-structured P&L statement and informed decision-making.

In conclusion, a small business P&L statement template is not merely a record-keeping tool; it is a powerful instrument for gaining crucial financial health insights. Consistent use of a template ensures standardized data collection and facilitates meaningful analysis of performance trends. These insights empower businesses to identify strengths, address weaknesses, and make data-driven decisions that contribute to long-term sustainability and growth. Challenges in accurately capturing and categorizing data can hinder the effectiveness of P&L analysis. Addressing these challenges through robust accounting practices and consistent use of a standardized template is essential for maximizing the value of financial reporting and gaining a comprehensive understanding of business performance.

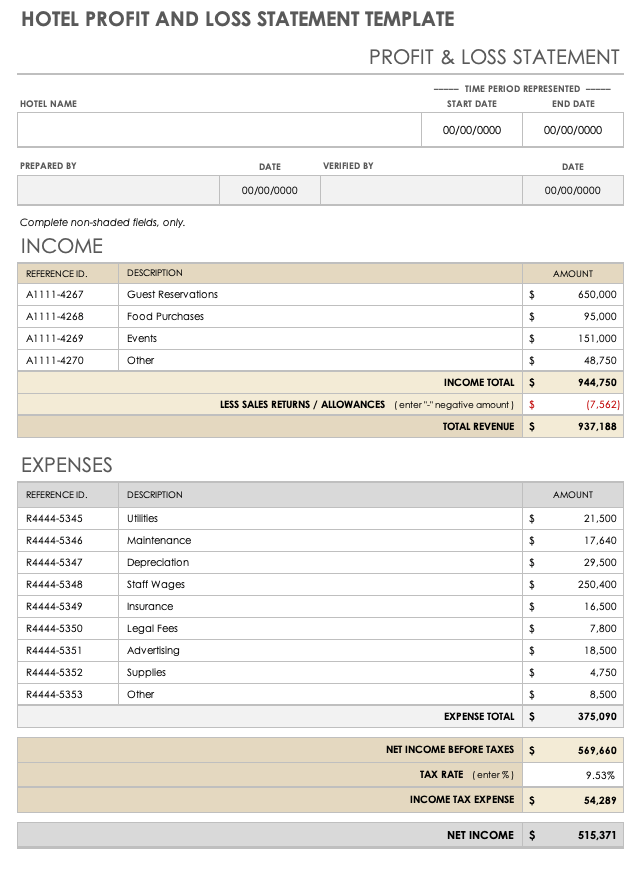

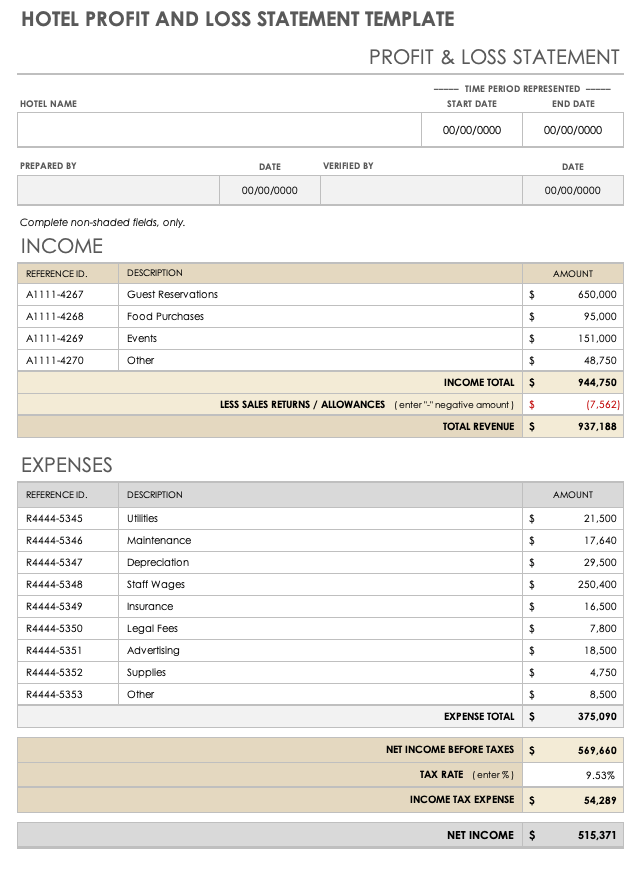

Key Components of a Profit and Loss Statement

A well-structured profit and loss statement provides a comprehensive overview of a company’s financial performance. Several key components contribute to this overview, each offering specific insights into different aspects of the business’s financial health.

1. Revenue: This section details all income generated from business operations. It typically includes sales revenue, interest income, and any other income streams. Accurate revenue reporting is fundamental to understanding a company’s financial position.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold by a business. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated by subtracting COGS from revenue, gross profit represents the profit generated from core business operations before accounting for operating expenses. This metric offers insights into production efficiency and pricing strategies.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. Common operating expenses include rent, utilities, salaries, marketing, and administrative costs. Careful tracking and categorization of operating expenses are crucial for cost control and profitability analysis.

5. Operating Profit: Calculated by subtracting operating expenses from gross profit, operating profit reflects the profitability of the core business operations. This metric, also known as Earnings Before Interest and Taxes (EBIT), offers a clear view of operational efficiency.

6. Interest Expense: This component represents the cost of borrowing money. Accurate reporting of interest expense is essential for a complete understanding of a company’s financial obligations.

7. Income Before Taxes: This represents the profit generated before accounting for income tax expenses. It provides a clear picture of earnings generated from core business operations and investments, less all operating expenses and interest costs.

8. Income Tax Expense: This section accounts for the expense associated with income taxes. Accurate calculation of income tax expense ensures compliance and accurate profit reporting.

9. Net Profit: This is the “bottom line” the final profit calculation after all expenses, including taxes, have been deducted from revenue. Net profit represents the overall profitability of the business and is a key indicator of financial health.

These components work together to provide a comprehensive picture of a company’s financial performance. Analysis of these elements allows for informed decision-making, effective resource allocation, and the development of strategies for sustainable growth.

How to Create a Small Business P&L Statement

Creating a profit and loss statement involves organizing financial data into a structured format. This process facilitates analysis and provides insights into business performance. The following steps outline the creation of a P&L statement.

1. Choose a Reporting Period: Define the timeframe for the P&L statement. This could be a month, quarter, or year, depending on the specific needs of the business. Consistent reporting periods allow for meaningful comparisons over time.

2. Calculate Revenue: Compile all revenue generated during the chosen period. This includes sales revenue, interest income, and other income streams. Accuracy in revenue reporting is paramount.

3. Determine Cost of Goods Sold (COGS): Calculate the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

4. Calculate Gross Profit: Subtract COGS from total revenue to arrive at gross profit. This figure represents profit generated before operating expenses are considered.

5. Itemize Operating Expenses: List all operating expenses incurred during the reporting period. This includes rent, utilities, salaries, marketing expenses, and administrative costs. Categorization of expenses facilitates analysis and cost control.

6. Calculate Operating Profit: Subtract total operating expenses from gross profit to determine operating profit. This metric, also known as EBIT (Earnings Before Interest and Taxes), provides insight into operational efficiency.

7. Account for Interest and Taxes: Deduct interest expenses and income tax expenses to arrive at net profit. These deductions provide a comprehensive view of a company’s financial obligations and profitability after all expenses are considered.

8. Calculate Net Profit: Subtract interest and tax expenses from operating profit to determine net profit, also known as the “bottom line.” This represents the overall profitability after all expenses are deducted.

Accurate data input and consistent categorization are crucial for generating a meaningful P&L statement. This structured approach provides a clear and concise overview of financial performance, enabling informed decision-making and effective financial management.

Profit and loss statement templates offer small businesses a crucial tool for financial management. Standardized reporting enables clear tracking of revenue and expenses, facilitating calculation of key profitability metrics such as gross profit, operating profit, and net profit. Analysis of these metrics over different time periods provides invaluable insights into performance trends and overall financial health, enabling informed decision-making and strategic planning. Understanding the structure and components of these templates, along with accurate data input and consistent categorization, is essential for maximizing their value.

Effective utilization of profit and loss statement templates empowers small businesses to gain a comprehensive understanding of their financial performance. This understanding is fundamental for identifying areas for improvement, optimizing resource allocation, and making data-driven decisions that contribute to long-term sustainability and growth. Regular review and analysis of these statements are essential for proactive financial management and navigating the complexities of the business landscape.