Utilizing a standardized structure offers numerous advantages. It facilitates efficient tracking of financial health, simplifies tax preparation, and enables clear communication with stakeholders such as investors and lenders. A well-organized report provides valuable insights into operational efficiency, allowing businesses to identify trends, pinpoint areas of overspending, and strategically allocate resources for growth. This understanding empowers owners to make data-driven decisions, optimize pricing strategies, and enhance overall profitability.

This article will delve further into the specific components of these reports, exploring best practices for their creation and utilization, and highlighting the diverse resources available for businesses seeking to improve financial management.

1. Revenue Streams

Revenue streams represent the various inflows of cash a business generates from its operations. Within the context of a profit and loss statement, these streams are meticulously categorized and documented to provide a comprehensive view of income generation. This detailed breakdown is crucial for understanding the financial health of a business and identifying areas for potential growth or concern. The categorization allows for analysis of each stream’s contribution to overall profitability. For example, a software company might categorize revenue by product subscriptions, licensing fees, and professional services. This granular approach allows businesses to assess the performance of each revenue channel and make informed decisions regarding resource allocation and future strategy.

Accurately representing revenue streams within the statement requires diligent tracking and precise categorization. This precision is paramount for stakeholders, including investors and lenders, who rely on this information to assess financial performance and make investment decisions. Furthermore, a clear understanding of revenue streams enables businesses to identify seasonal trends, anticipate potential fluctuations, and adapt their strategies accordingly. For instance, a seasonal business like a landscaping company can anticipate lower revenue during winter months and adjust expenses or explore supplemental revenue streams to mitigate the impact.

In conclusion, meticulous documentation of revenue streams within a profit and loss statement is essential for sound financial management. This granular analysis provides insights into business performance, informs strategic decision-making, and facilitates communication with stakeholders. Challenges may include accurate attribution of revenue to specific streams and managing complex revenue recognition principles. However, overcoming these challenges yields a clear picture of financial health and facilitates sustainable growth.

2. Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. Accurate COGS calculation is crucial for determining gross profit and net income within a profit and loss statement. Understanding this figure allows businesses to assess pricing strategies, inventory management, and overall profitability.

- Direct MaterialsDirect materials encompass all raw materials and components directly used in production. For a furniture maker, this includes wood, fabric, and hardware. Accurate tracking of direct material costs is essential for calculating COGS and managing inventory levels effectively. Overestimating or underestimating these costs can significantly impact profitability calculations.

- Direct LaborDirect labor represents the wages and benefits paid to employees directly involved in production. For a bakery, this includes bakers and pastry chefs. Accurately allocating direct labor costs is crucial for understanding the true cost of production and setting appropriate prices. This includes accounting for overtime and other labor-related expenses.

- Manufacturing OverheadManufacturing overhead includes all other costs directly associated with production but not categorized as direct materials or labor. Examples include factory rent, utilities, and depreciation of manufacturing equipment. Proper allocation of these overhead costs is essential for accurate COGS calculation and informed decision-making regarding production efficiency.

- Inventory Valuation MethodsDifferent inventory valuation methods, such as FIFO (First-In, First-Out) and LIFO (Last-In, First-Out), can impact COGS and profitability. Choosing the appropriate method depends on the nature of the business and industry standards. Understanding the implications of each method is crucial for accurate financial reporting and analysis. Consistent application of the chosen method is key for comparability across reporting periods.

Accurate COGS calculation, encompassing these facets, is fundamental for a comprehensive profit and loss statement. A clear understanding of COGS allows businesses to make informed decisions regarding pricing, production, and resource allocation, ultimately driving profitability and sustainable growth. Mismanagement of COGS can lead to inaccurate financial reporting and potentially hinder long-term success. Regular review and analysis of COGS are therefore vital for effective financial management.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business’s day-to-day operations, excluding the direct costs of producing goods or services (COGS). Within a small business profit and loss statement template, these expenses are categorized and meticulously tracked to provide a clear picture of resource allocation and profitability. Accurately representing operating expenses is crucial for understanding a business’s financial performance and identifying areas for potential cost optimization. This understanding is fundamental for informed decision-making, strategic planning, and sustainable growth. Examples of operating expenses include rent, utilities, marketing and advertising costs, salaries for administrative staff, and office supplies.

A detailed breakdown of operating expenses within the profit and loss statement allows for analysis of spending patterns and identification of potential inefficiencies. For example, a rising trend in marketing expenses without a corresponding increase in sales might indicate a need to reassess marketing strategies. Similarly, comparing administrative expenses to industry benchmarks can reveal areas for potential cost reduction. A restaurant, for example, might track operating expenses such as rent, utilities, marketing costs, and staff salaries separately to understand their impact on profitability and identify areas for improvement. They might discover that high utility costs warrant investment in energy-efficient equipment or that renegotiating their lease could significantly reduce rent expenses.

Effective management of operating expenses is directly linked to a business’s profitability and long-term sustainability. Careful monitoring and analysis of these expenses within the profit and loss statement framework are essential for informed financial decision-making. Challenges may include accurately categorizing expenses and separating operating expenses from capital expenditures. However, overcoming these challenges through diligent record-keeping and consistent application of accounting principles yields valuable insights into a business’s financial health and supports strategic growth initiatives.

4. Profitability Metrics

Profitability metrics, derived from the data within a small business profit and loss statement template, are key indicators of a company’s financial health and operational efficiency. These metrics provide insights into a company’s ability to generate revenue, manage costs, and ultimately achieve profitability. The statement serves as the foundation for calculating these crucial metrics, providing a structured overview of revenues, costs, and expenses over a specific period. Understanding these metrics is essential for making informed business decisions, attracting investors, and ensuring long-term sustainability. For example, a consistently declining gross profit margin might signal pricing issues or increasing production costs, prompting management to investigate and implement corrective measures.

Key profitability metrics include gross profit margin, operating profit margin, and net profit margin. Gross profit margin reveals the profitability of core business operations after accounting for the direct costs of producing goods or services. Operating profit margin reflects profitability after considering both direct and indirect costs, providing a broader perspective on operational efficiency. Net profit margin, the ultimate measure of profitability, indicates the percentage of revenue remaining after deducting all expenses, including taxes and interest. Analyzing trends in these metrics over time offers invaluable insights into a company’s performance and potential areas for improvement. A retail business, for example, might analyze its gross profit margin to understand the impact of pricing changes on profitability and adjust its pricing strategy accordingly.

Effective financial management requires a thorough understanding and consistent monitoring of profitability metrics. The small business profit and loss statement template provides the raw data necessary to calculate these metrics, enabling business owners to assess performance, identify trends, and make data-driven decisions. Challenges may include accurate data collection and consistent application of accounting principles. However, overcoming these challenges allows businesses to leverage the power of profitability metrics for strategic planning, performance evaluation, and long-term growth. Consistently analyzing these metrics can help businesses identify emerging issues, adapt to changing market conditions, and maintain a healthy financial trajectory.

5. Time Period Coverage

Defining the reporting period is crucial for a small business profit and loss statement template. The chosen timeframe significantly impacts the insights derived from the statement and influences strategic decision-making. Whether monthly, quarterly, or annually, the selected period provides the context for evaluating financial performance and identifying trends. This temporal dimension allows for meaningful comparisons and informed assessments of business growth and stability. Selecting the appropriate reporting period is therefore essential for effective financial management and strategic planning.

- Monthly ReportingMonthly reports offer a granular view of financial performance, enabling businesses to quickly identify and address emerging trends or issues. This frequency is particularly beneficial for businesses with fluctuating sales or seasonal variations, allowing for prompt adjustments to operational strategies. For example, a retail store experiencing a sales slump in a particular month can quickly investigate the cause and implement corrective measures. However, the short-term nature of monthly data may not always reflect long-term trends.

- Quarterly ReportingQuarterly reports provide a broader perspective on financial performance, smoothing out short-term fluctuations and offering a more stable view of progress. This timeframe is often preferred for evaluating performance against established targets and making strategic adjustments. A manufacturing company, for instance, can use quarterly reports to assess production efficiency and inventory management. However, critical issues arising mid-quarter might not be immediately apparent.

- Annual ReportingAnnual reports provide a comprehensive overview of financial performance for the entire year, facilitating long-term strategic planning and evaluation of overall business health. This timeframe is essential for tax purposes and communicating financial performance to external stakeholders such as investors and lenders. A service-based business, for example, can utilize annual reports to assess overall profitability and plan for future investments. However, annual reports lack the granularity needed for timely adjustments to operational strategies.

- Comparative AnalysisRegardless of the chosen reporting period, comparative analysis across multiple periods is essential for identifying trends and understanding performance changes. Comparing current performance to previous periods or industry benchmarks provides valuable context and insights. For instance, a software company comparing its quarterly revenue growth over several years can identify growth patterns and adjust its sales strategies accordingly. Consistent time period coverage allows for meaningful comparisons and informed decision-making.

Selecting the appropriate time period coverage is fundamental for effectively utilizing a small business profit and loss statement template. The chosen timeframe directly influences the insights derived from the statement and shapes strategic decision-making. By understanding the implications of different reporting periods and employing comparative analysis, businesses can leverage the statement to gain a comprehensive understanding of their financial performance, identify areas for improvement, and drive sustainable growth. The choice of time period should align with the specific needs and objectives of the business, ensuring the statement provides the most relevant and actionable insights.

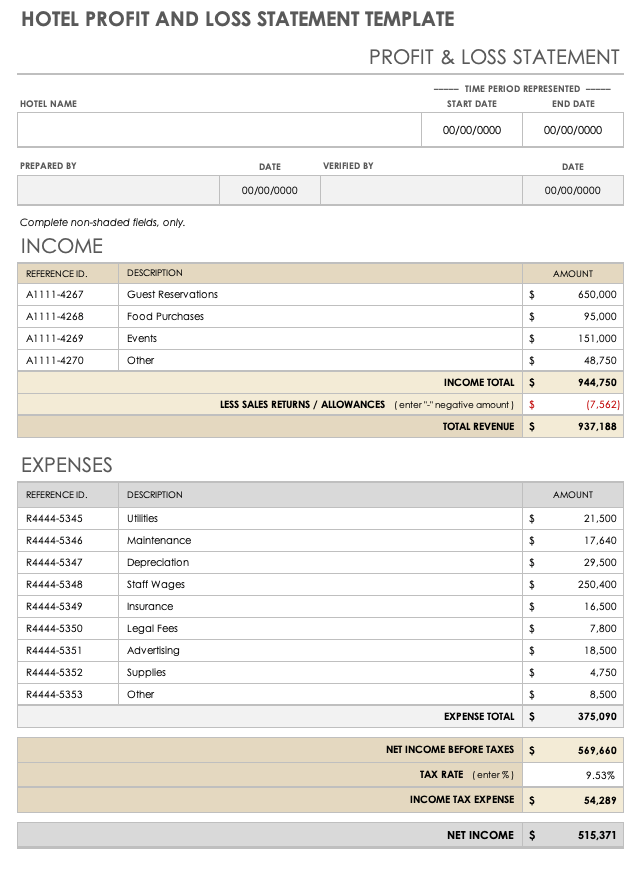

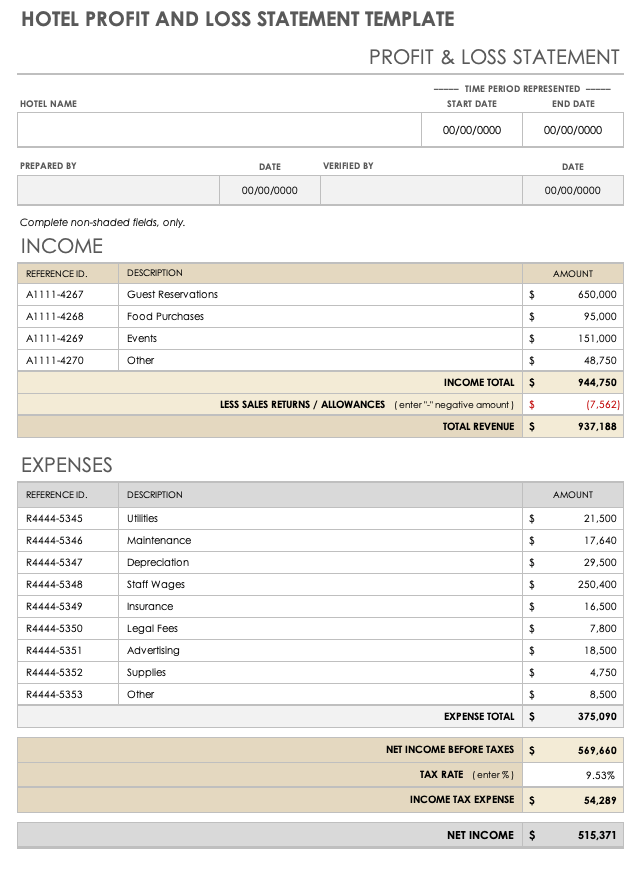

Key Components of a Small Business Profit & Loss Statement

A well-structured profit and loss statement provides a clear and concise overview of a company’s financial performance. Several key components contribute to this comprehensive view, each offering valuable insights into distinct aspects of the business’s operations.

1. Revenue: This section details all income generated from sales of goods or services. It may be further categorized by product line, service type, or other relevant distinctions, offering granular insights into revenue streams.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead. This figure is crucial for calculating gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profit generated from core business operations before accounting for operating expenses.

4. Operating Expenses: This section details all expenses incurred in running the business’s day-to-day operations, including rent, utilities, salaries, marketing, and administrative costs.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects the profitability of the business’s core operations after accounting for all operating expenses.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time expenses.

7. Net Income: This bottom-line figure represents the company’s overall profit after accounting for all revenues, expenses, and other income/expenses. It represents the ultimate measure of profitability.

8. Reporting Period: The profit and loss statement covers a specific period, such as a month, quarter, or year. This timeframe provides context for evaluating financial performance and facilitates comparisons across different periods.

Accurate and detailed representation of these components is essential for understanding a company’s financial health, making informed decisions, and driving sustainable growth. Each element contributes to a comprehensive picture of financial performance, enabling stakeholders to assess profitability, identify trends, and develop effective strategies.

How to Create a Small Business Profit & Loss Statement

Creating a profit & loss statement involves organizing financial data into a structured format. This process facilitates analysis of revenue, costs, and expenses, leading to a clear understanding of profitability.

1. Choose a Reporting Period: Establish a specific timeframe for the statement, such as a month, quarter, or year. This timeframe provides context for the financial data.

2. Calculate Revenue: Document all income generated from sales of goods or services during the reporting period. Categorize revenue by product line or service type for more detailed analysis.

3. Determine Cost of Goods Sold (COGS): Calculate the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead.

4. Calculate Gross Profit: Subtract COGS from Revenue to determine Gross Profit. This metric represents profit from core operations before operating expenses.

5. Itemize Operating Expenses: List all expenses incurred in running daily business operations, such as rent, utilities, salaries, marketing, and administrative costs.

6. Calculate Operating Income: Subtract Operating Expenses from Gross Profit to arrive at Operating Income. This metric reflects profitability after operating expenses.

7. Account for Other Income/Expenses: Include any income or expenses not directly tied to core business operations, such as interest income or investment gains/losses.

8. Calculate Net Income: Subtract other expenses from other income and combine with Operating Income to arrive at Net Income, the final measure of profitability.

Following these steps provides a structured overview of financial performance. This structured approach allows for informed decision-making and strategic planning.

Profit and loss statement templates offer invaluable tools for small businesses to understand their financial health. By providing a structured framework for tracking revenue, costs, and expenses, these templates empower businesses to monitor profitability, identify trends, and make informed decisions. From calculating key metrics like gross profit and net income to analyzing operating expenses and revenue streams, these statements offer crucial insights into a business’s performance. Understanding the components, creation process, and analysis of these reports is fundamental for effective financial management and sustainable growth.

Regularly generating and analyzing these financial statements provides a crucial foundation for long-term success. This practice allows businesses to adapt to changing market conditions, optimize resource allocation, and strategically plan for future growth. Leveraging the insights gained from these reports empowers small businesses to not only navigate present challenges but also proactively shape their future financial trajectory.