Navigating legal documents can sometimes feel like trying to solve a complex puzzle, especially when it involves property and specific state laws. If you’re looking to transfer ownership of property as a gift in Louisiana, you’re likely dealing with what’s known as an Act of Donation. This document is a crucial legal instrument, distinct from a sale or a will, that allows someone to gratuitously give property to another person. Understanding its nuances, particularly within the specific context of St. Tammany Parish, is key to a smooth and legally sound transfer.

Whether you’re donating a piece of land, a vehicle, or other valuable assets, a correctly executed Act of Donation ensures that the transfer is legally recognized and binding. Louisiana’s unique civil law system means that the requirements for such documents can differ significantly from common law states. This guide aims to demystify the process, offering insights into what you need to know about preparing and executing an Act of Donation, with a special focus on considerations relevant to St. Tammany Parish.

Understanding the Act of Donation in Louisiana

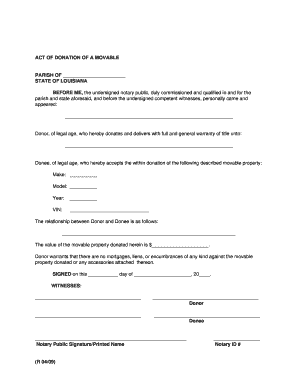

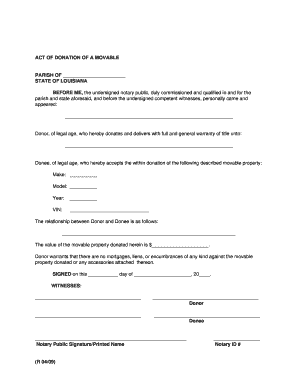

An Act of Donation in Louisiana is a formal legal agreement where a "donor" voluntarily transfers ownership of property to a "donee" without receiving anything in return. Unlike a sale, which involves a reciprocal exchange of value, a donation is purely gratuitous. This makes it a popular tool for estate planning, gifting to family members, or contributing to charitable organizations. The Civil Code of Louisiana governs these transactions, outlining very specific requirements to ensure the validity and enforceability of the donation.

The property being donated can be either movable, like a car or a boat, or immovable, such as land or a building. The type of property often dictates some of the specific formalities involved. For instance, donations of immovable property typically require more stringent formalities, including a notarized act and often a formal acceptance by the donee. Without adherence to these formalities, the donation might be deemed invalid, leading to potential disputes and legal headaches down the line.

Key Elements of a Valid Donation

For any Act of Donation to be legally recognized in Louisiana, several critical elements must be present. Missing even one of these can render the entire transaction void, meaning the property would never officially transfer ownership. This is why it’s so important to be meticulous in the preparation and execution of the document.

Here are some fundamental requirements for a valid Act of Donation:

- Intent to Donate: The donor must clearly and unequivocally express their intention to give the property without expecting anything in return. This is the core principle of a donation.

- Acceptance by Donee: The person receiving the donation must expressly accept it. This acceptance can be made in the Act of Donation itself or in a separate authentic act. Without acceptance, the donation is not complete.

- Proper Description of Property: The donated property must be described with sufficient detail to identify it clearly. For immovable property, this usually involves a legal description that can be found in a prior deed.

- Authentic Act: Most donations in Louisiana, especially those involving immovable property, must be executed by an "authentic act." This means the document must be signed by the donor and donee in the presence of a notary public and two witnesses.

- Capacity of Parties: Both the donor and donee must have the legal capacity to enter into such an agreement. This generally means they must be of sound mind and legal age.

Understanding these foundational aspects is crucial before considering a specific st tammany parish louisiana act of donation form template. While templates can be helpful starting points, they must always be adapted to the specific circumstances and legal requirements of Louisiana law to ensure their validity.

Navigating the Process in St. Tammany Parish

When it comes to executing an Act of Donation, local procedures and specific parish requirements can play a significant role. For those dealing with property located in St. Tammany Parish, it’s important to understand the steps involved in ensuring the document is properly recorded and recognized by the local authorities. The Clerk of Court’s office in Covington is the primary point for recording these vital documents, and their specific processes must be followed.

While a general Act of Donation template might provide a basic framework, tailoring it to St. Tammany Parish’s recording standards and any specific local nuances is highly advisable. This often means ensuring the property description meets the parish assessor’s requirements, and that the document is prepared in a format acceptable for recording with the Clerk of Court. Incorrect formatting or missing information can lead to delays or even rejection of the document for recording.

Another critical consideration in St. Tammany Parish, as with other parishes, is the potential for specific tax implications. While the Act of Donation itself is a transfer without consideration, there may be state or local taxes related to the transfer or future property taxes for the donee. Consulting with a local attorney or tax professional in St. Tammany can help clarify any financial obligations associated with the gift.

Here are some general steps to consider when executing an Act of Donation in St. Tammany Parish:

- Draft the Document: Prepare the Act of Donation, ensuring all required elements are present and the property is correctly described.

- Notarization: Have the document signed by the donor and donee in the presence of a Louisiana notary public and two competent witnesses.

- Recordation: File the original, properly executed Act of Donation with the St. Tammany Parish Clerk of Court’s office. This step is crucial for public notice and to protect the donee’s ownership rights against third parties.

- Update Records: The donee should ensure that relevant records, such as property tax records with the St. Tammany Parish Assessor’s office, are updated to reflect the new ownership.

Given the complexities and the legal weight of property transfers, seeking professional legal assistance is always a wise decision. A qualified attorney familiar with Louisiana civil law and St. Tammany Parish procedures can help draft the Act of Donation, ensure all legal requirements are met, and guide you through the recording process, helping to avoid common pitfalls and ensuring your generous gift is legally sound.

Properly executing an Act of Donation, particularly for immovable property within St. Tammany Parish, is a multi-step process that demands attention to detail. From the initial drafting to the final recording, each stage is vital for the legal transfer of ownership. By understanding the specific requirements of Louisiana law and St. Tammany Parish, individuals can ensure their generous acts are legally recognized and bring peace of mind to all parties involved. A well-prepared and properly filed document offers clarity and security, making the transfer of property a smooth and trouble-free experience for everyone.