Utilizing a consistent format offers several advantages. It facilitates the identification of trends in cash movement, enabling informed decision-making regarding resource allocation and future investments. Furthermore, a clear presentation of cash flow data enhances transparency and strengthens stakeholder trust. This clarity is essential for securing financing, attracting investors, and demonstrating financial stability.

Understanding the structure and benefits of organized cash flow reporting is fundamental to a comprehensive financial analysis. The following sections will delve deeper into the specific components of each activity category and illustrate how they contribute to a holistic understanding of an organization’s financial performance.

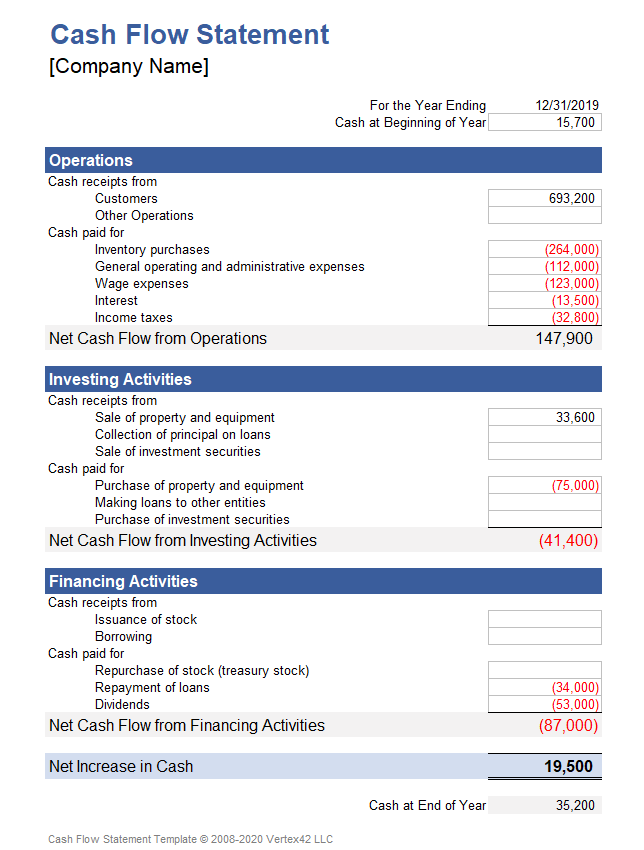

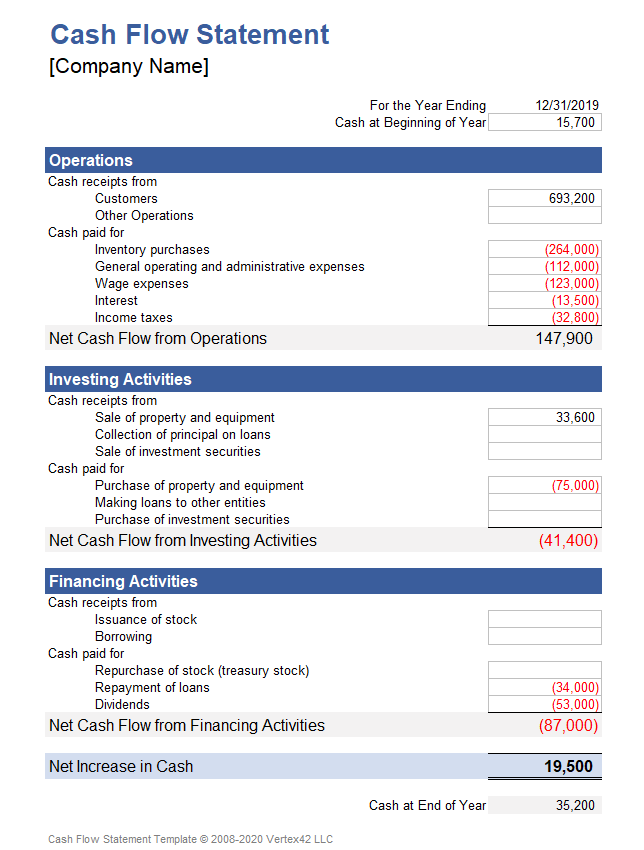

1. Operating Activities

Operating activities form the core of a standard cash flow statement template, representing the cash generated from a company’s day-to-day business functions. This section provides crucial insights into the sustainability and profitability of core operations. The standard template requires reporting cash flows from activities such as sales, collections from customers, payments to suppliers, and salary disbursements. Accurately presenting these cash flows is essential for understanding a company’s ability to generate sufficient cash to cover operating expenses, service debt, and reinvest in the business. For example, a consistent positive cash flow from operations often signals a healthy and sustainable business model, while negative cash flow might indicate underlying operational challenges.

The importance of operating activities within the standard template stems from their direct link to a company’s core business functions. Analyzing trends in operating cash flow can reveal shifts in profitability, efficiency, and overall financial health. Consider a retail company experiencing declining sales. While net income might still appear positive due to accounting practices like accruals, the operating activities section might reveal declining cash collections, signaling a potential problem earlier than traditional income statements would. This early warning allows stakeholders to address underlying issues proactively. Furthermore, consistent growth in operating cash flow relative to net income can indicate high-quality earnings, suggesting that reported profits are translating into tangible cash inflows.

A robust understanding of operating activities within the context of the standard cash flow statement is fundamental for any financial analysis. Challenges in accurately classifying and reporting these activities can arise from complex accounting rules and industry-specific practices. However, overcoming these challenges is crucial for gaining a comprehensive view of a company’s financial performance and its ability to generate sustainable cash flow for future growth and stability. This understanding provides valuable context for evaluating overall financial health and making informed investment decisions.

2. Investing Activities

Investing activities within a standard cash flow statement template detail the acquisition and disposal of long-term assets. These activities provide crucial insights into a company’s capital allocation strategies and growth prospects. The template typically includes cash flows related to property, plant, and equipment (PP&E), investments in other companies, and the purchase or sale of intangible assets. This structured presentation allows analysts to assess management’s effectiveness in allocating capital for future growth and generating returns on investments. For example, significant investments in research and development might signal a focus on innovation and long-term growth, while divestitures of assets could indicate a strategic shift or a need to raise capital.

The importance of accurately reporting investing activities stems from their impact on a company’s long-term financial health. Consistent investment in new technologies or expanding production capacity often signals confidence in future growth. Conversely, a pattern of divestitures without corresponding reinvestment might raise concerns about a company’s long-term viability. Consider a manufacturing company investing heavily in automation. While this might initially result in negative cash flow from investing activities, it could lead to increased efficiency and lower operating costs in the future, ultimately enhancing profitability. Understanding the nature and timing of these investments is crucial for assessing the company’s long-term prospects. Furthermore, analyzing the relationship between investing activities and operating cash flow can provide insights into the effectiveness of capital expenditures. Strong operating cash flow combined with strategic investments suggests a sustainable growth trajectory.

Accurate reporting of investing activities poses several challenges. Determining the appropriate categorization of certain transactions and accurately valuing assets can be complex, requiring careful consideration of accounting standards and industry-specific practices. However, a clear understanding of these activities is essential for assessing a company’s strategic direction, its commitment to growth, and its potential for generating future returns. This analysis, in conjunction with the examination of operating and financing activities, provides a comprehensive view of the company’s overall financial position and its ability to create long-term value.

3. Financing Activities

Financing activities within a standard cash flow statement template illuminate how a company obtains and manages its capital. This section provides critical insights into the company’s capital structure, debt levels, and equity financing. Understanding these activities is crucial for assessing financial risk, long-term solvency, and the overall financial health of an organization.

- Debt FinancingDebt financing involves borrowing money through loans or issuing bonds. The cash flow statement captures proceeds from debt issuance as inflows and principal repayments as outflows. For example, a company securing a new loan will show an inflow, while regular loan payments appear as outflows. Analyzing these flows reveals the company’s reliance on debt and its ability to service its obligations. High levels of debt coupled with insufficient operating cash flow can signal increased financial risk.

- Equity FinancingEquity financing involves raising capital through the issuance of stock. The cash flow statement reflects proceeds from stock sales as inflows and repurchases of company stock as outflows, as well as dividend payments. For instance, an initial public offering (IPO) generates a significant cash inflow. Stock repurchases, aimed at increasing shareholder value, represent outflows. Analyzing these activities helps assess the company’s equity strategy and its impact on ownership structure.

- Dividend PaymentsDistributions of profits to shareholders are classified as financing activities. These outflows represent a return on investment for shareholders. Consistent and growing dividend payments can signal financial stability and confidence in future earnings. However, excessively high dividend payouts relative to operating cash flow could indicate unsustainable practices and limit reinvestment opportunities.

- Capital Structure ManagementFinancing activities offer a comprehensive view of how a company balances debt and equity financing. This balance, known as capital structure, significantly impacts financial risk and cost of capital. Analyzing changes in long-term debt, equity, and dividend policies over time reveals management’s approach to capital structure optimization and its implications for the company’s financial stability.

Careful analysis of financing activities within the standard cash flow statement template provides crucial context for evaluating a company’s financial health and risk profile. By understanding how a company raises and utilizes capital, stakeholders gain valuable insights into its long-term sustainability and potential for future growth. This information, combined with an analysis of operating and investing activities, forms a comprehensive foundation for informed financial decision-making.

4. Standardized Format

A standardized format is fundamental to the utility of a standard cash flow statement template. Consistency in presentation allows for meaningful comparisons across reporting periods and between different entities. This comparability is crucial for identifying trends, benchmarking performance, and making informed financial decisions. Without a standardized structure, analyzing cash flow data would be significantly more complex and less reliable.

- Uniformity Across Reporting PeriodsConsistent presentation of cash flow information across different reporting periods, whether quarterly or annually, is essential for tracking changes in a company’s financial position. This uniformity facilitates trend analysis, allowing stakeholders to identify patterns in operating, investing, and financing activities. For example, consistent growth in cash flow from operations over several years indicates a healthy and sustainable business model, while a declining trend might signal underlying operational challenges.

- Inter-Company ComparisonA standardized format enables meaningful comparisons of cash flow performance between different companies within the same industry. This benchmarking allows investors and analysts to assess a company’s relative financial strength and efficiency. For instance, comparing the cash flow from investing activities of two competing companies can reveal differences in their growth strategies and capital allocation priorities.

- Enhanced Transparency and UnderstandingA standardized presentation enhances transparency by ensuring that all stakeholders interpret cash flow information consistently. This clarity fosters trust and improves communication between management, investors, and creditors. Clear and consistent reporting reduces the risk of misinterpretation and promotes informed decision-making.

- Simplified Analysis and InterpretationA standardized template simplifies the analysis and interpretation of complex financial data. By presenting information in a predictable and organized manner, it allows users to quickly identify key trends and draw meaningful conclusions. This efficiency is particularly important for analysts and investors who need to assess a large volume of financial information quickly and accurately.

The standardized format of a cash flow statement template is essential for effective financial analysis. By ensuring consistency, comparability, and transparency, it empowers stakeholders to gain valuable insights into a company’s financial performance, its strategic direction, and its ability to generate sustainable cash flow for future growth and stability. This structured approach ultimately contributes to more informed decision-making and a deeper understanding of a company’s financial health.

5. Comparative Analysis

Comparative analysis derives significant value from the standardized format of a cash flow statement template. The consistent structure enables meaningful comparisons across different reporting periods and between distinct entities. This analytical capacity is essential for identifying trends, evaluating performance, and making informed investment and management decisions. Without a standardized template, such comparisons would be significantly more challenging and less reliable. Consider a company evaluating its performance over several quarters. Using a standard template, year-over-year or quarter-over-quarter changes in cash flow from operations can reveal improving or deteriorating trends in core business profitability. This allows management to identify potential issues and take corrective action.

Analyzing trends within a single entity, facilitated by the standardized format, provides insights into operational efficiency, investment effectiveness, and financing strategies. For example, consistent growth in operating cash flow coupled with strategic investments in research and development might indicate a successful growth trajectory. Conversely, declining operating cash flow alongside increased borrowing could signal financial distress. Furthermore, comparing a company’s cash flow performance to industry benchmarks, enabled by the standardized structure, allows for relative performance assessment. This benchmarking can highlight competitive advantages, areas for improvement, and potential investment opportunities.

Comparative analysis, empowered by the standardized cash flow statement template, forms a cornerstone of robust financial evaluation. While challenges may arise in ensuring data accuracy and consistency across different sources, the insights derived from this analysis are crucial for understanding a companys financial health, its strategic direction, and its potential for future growth. This understanding, in turn, supports informed decision-making by investors, creditors, and management, contributing to greater financial transparency and stability.

Key Components of a Standard Cash Flow Statement Template

A standard cash flow statement template provides a structured framework for analyzing an organization’s financial health by categorizing cash inflows and outflows into key activities. Understanding these components is crucial for assessing financial performance and making informed decisions.

1. Operating Activities: This section details the cash generated from a company’s core business operations, such as sales, collections from customers, and payments to suppliers. It provides insights into the profitability and sustainability of day-to-day business functions.

2. Investing Activities: This section tracks cash flows related to the acquisition and disposal of long-term assets, including property, plant, and equipment (PP&E), investments in other companies, and intangible assets. It reveals a company’s capital allocation strategies and growth prospects.

3. Financing Activities: This section illustrates how a company obtains and manages its capital, including debt financing, equity financing, and dividend payments. It provides crucial insights into capital structure, debt levels, and overall financial risk.

4. Standardized Format: A consistent format ensures comparability across different reporting periods and between different entities. This standardization facilitates trend analysis, benchmarking, and informed decision-making.

5. Beginning Cash Balance: The starting point for the statement, representing the cash available at the beginning of the reporting period. This balance is crucial for understanding the net change in cash over time.

6. Net Increase/Decrease in Cash: This figure represents the overall change in cash during the reporting period, calculated by summing the net cash flows from operating, investing, and financing activities. It provides a concise view of cash flow performance.

7. Ending Cash Balance: The closing cash position, calculated by adding the net increase/decrease in cash to the beginning cash balance. This balance is a key indicator of a company’s liquidity and its ability to meet short-term obligations.

Careful examination of these components within the standardized template provides a comprehensive understanding of a company’s financial performance, its strategic direction, and its ability to generate sustainable cash flow. This structured approach is essential for robust financial analysis and informed decision-making.

How to Create a Standard Cash Flow Statement

Creating a standard cash flow statement requires a systematic approach to organizing cash inflows and outflows. The following steps outline the process of developing this crucial financial statement.

1. Determine the Reporting Period: Specify the timeframe for the statement, whether it covers a quarter, a year, or another designated period. This establishes the boundaries for the cash flow analysis.

2. Calculate Cash Flow from Operating Activities: Begin with net income and adjust for non-cash items such as depreciation and amortization. Then, analyze changes in working capital accounts like accounts receivable, inventory, and accounts payable. Increases in assets represent cash outflows, while decreases signify inflows. Conversely, increases in liabilities indicate inflows, while decreases represent outflows.

3. Calculate Cash Flow from Investing Activities: Document all cash flows related to the purchase and sale of long-term assets. Purchases represent cash outflows, while sales generate inflows. Include investments in other companies and changes in long-term investment portfolios.

4. Calculate Cash Flow from Financing Activities: Record all cash flows related to debt, equity, and dividends. Proceeds from debt or equity issuance represent inflows, while principal repayments, stock repurchases, and dividend payments are outflows.

5. Determine the Beginning Cash Balance: Identify the cash balance at the start of the reporting period. This balance serves as the foundation for calculating the net change in cash.

6. Calculate the Net Increase or Decrease in Cash: Sum the net cash flows from operating, investing, and financing activities. This figure represents the overall change in the company’s cash position during the reporting period.

7. Calculate the Ending Cash Balance: Add the net increase or decrease in cash to the beginning cash balance. This final figure represents the cash available at the end of the reporting period.

8. Present the Statement in a Standardized Format: Organize the statement into the three main activity categories: operating, investing, and financing. Clearly label each section and ensure consistent presentation for comparability across periods and with other entities.

A properly constructed cash flow statement provides a comprehensive overview of a company’s cash inflows and outflows, offering crucial insights into financial performance, liquidity, and long-term sustainability. This structured approach is an essential element of sound financial analysis and informed decision-making.

A standardized structure for reporting cash flows provides a crucial framework for understanding an organization’s financial health. Categorizing inflows and outflows into operating, investing, and financing activities allows for consistent analysis across reporting periods and between different entities. This structured approach facilitates the identification of trends, the evaluation of capital allocation strategies, and the assessment of financial risks and opportunities. A clear understanding of each activity category and their interrelationships is essential for a comprehensive financial evaluation.

Effective financial analysis requires diligent application and interpretation of information presented within the standardized framework. Leveraging this structure empowers stakeholders to make informed decisions regarding resource allocation, investment strategies, and overall financial management. The insights gained from a thorough cash flow analysis contribute significantly to long-term financial stability and sustainable growth.