Utilizing such resources offers several advantages. It saves time and effort by eliminating the need to create these documents from scratch. Standardized formatting ensures professionalism and clarity, minimizing misunderstandings and disputes. Furthermore, readily available formats promote consistent record-keeping, facilitating efficient financial management and analysis.

This foundation of understanding is crucial for exploring related topics such as customizing these resources, integrating them into accounting software, and leveraging them for enhanced client communication and financial transparency.

1. Accessibility

Accessibility, in the context of statement of account free templates, refers to the ease with which businesses can obtain and utilize these resources. This factor significantly impacts a business’s ability to manage finances efficiently and maintain transparent client communication. Easy access to suitable templates is crucial for streamlining accounting processes.

- Format AvailabilityTemplates should be available in commonly used formats like Microsoft Word, Excel, or Google Sheets. This ensures compatibility with most business software, avoiding the need for complex conversions or specialized applications. A readily accessible format contributes directly to efficient workflow integration.

- Platform AccessibilityIdeally, templates should be readily downloadable from reputable online platforms. Clear navigation and readily available download links contribute to a seamless acquisition process. Businesses can then quickly implement these resources without technical barriers.

- Device CompatibilityTemplates should function correctly across various devices, including desktops, laptops, tablets, and smartphones. This allows access to financial information and management tools regardless of location or preferred device. Such flexibility is crucial for modern business operations.

- User-FriendlinessEven with accessible formats and platforms, the template itself must be easy to understand and use. Clear instructions, intuitive layouts, and straightforward input fields are essential for effective utilization, particularly for individuals with limited technical expertise. This ensures that the template serves its intended purpose of simplifying accounting processes.

These facets of accessibility directly impact the effectiveness of a statement of account free template. A readily available, easily customizable, and user-friendly template ultimately empowers businesses to maintain organized financial records and foster clear communication with clients, contributing to stronger financial health and positive client relationships.

2. Customizability

Customizability is a critical aspect of a statement of account free template. It directly impacts the template’s practical utility, allowing businesses to tailor the document to specific needs and branding requirements. A customizable template facilitates accurate and comprehensive reflection of individual business transactions and fosters a professional image.

Consider a small business offering specialized consulting services. A generic template might not adequately capture the nuances of these services. Customizability allows the business to modify descriptions, itemize specific tasks performed, and accurately reflect the value provided. This level of detail strengthens client communication, minimizing potential misunderstandings and reinforcing professionalism. Similarly, incorporating company logos and branding elements creates a cohesive brand identity, further enhancing client perception.

However, customizability must be balanced with ease of use. Overly complex customization options can negate the time-saving benefits of using a template. A well-designed template provides a framework of essential fields while allowing flexibility for modifications without requiring advanced technical skills. This balance ensures that the template remains a practical tool for efficient and accurate financial reporting. Furthermore, well-structured customizability options mitigate the risk of introducing errors during modification, ensuring the integrity of financial data.

3. Professional Format

A professional format is a cornerstone of any effective statement of account. It contributes significantly to credibility, clarity, and the overall impression conveyed to clients. A well-formatted document reflects meticulous attention to detail and reinforces the professionalism of the business issuing the statement. Conversely, a poorly formatted statement can undermine client trust and create confusion.

- Clear LayoutA clear, organized layout is paramount. Information should be presented logically, using distinct sections for different data categories. For example, clear delineation between the billing period, client details, itemized transactions, and payment information ensures easy readability and comprehension. A cluttered or disorganized layout can lead to misinterpretations and hinder efficient processing.

- Consistent Font and StylingConsistent use of font, size, and styling contributes to a professional and cohesive appearance. Employing a standard, easily readable font throughout the document, along with consistent spacing and headings, enhances readability and reinforces a sense of order. Inconsistent styling can detract from the document’s credibility and create a sense of unprofessionalism.

- Accurate Data PresentationAccurate and unambiguous presentation of financial data is crucial. Figures should be presented with appropriate decimal places and currency symbols, and any calculations should be clearly displayed and verifiable. Errors in data presentation can lead to disputes and damage client trust.

- Branding ElementsIncorporating appropriate branding elements, such as a company logo and color scheme, further enhances the professional image projected by the statement. Consistent branding across all financial documentation reinforces brand identity and contributes to a cohesive and professional client experience. However, branding should be implemented tastefully and should not detract from the clarity of the information presented.

These facets of professional formatting contribute significantly to the effectiveness of a statement of account. A well-formatted document not only conveys financial information clearly and accurately but also reinforces the professionalism and credibility of the business, ultimately fostering stronger client relationships and contributing to smoother financial operations.

4. Clarity

Clarity within a statement of account free template is paramount for effective communication and financial transparency. A clear, unambiguous presentation of information ensures that both the business issuing the statement and the client receiving it have a shared understanding of the financial transactions documented. This shared understanding minimizes the potential for disputes, facilitates timely payments, and contributes to a positive client relationship. Lack of clarity, conversely, can lead to confusion, delayed payments, and potentially strained business-client interactions. A clearly structured template, utilizing precise language and logical organization, provides a solid foundation for accurate and efficient financial record-keeping.

Consider a scenario where a statement of account includes ambiguous descriptions of services rendered. This ambiguity can lead to client inquiries, requiring further clarification and potentially delaying payment. Alternatively, a statement with clearly itemized services, precise quantities, and unambiguous pricing avoids such confusion, facilitating prompt payment and reinforcing client trust. Clear presentation of payment terms, due dates, and accepted payment methods further contributes to this efficiency. The practical implication of such clarity is a streamlined payment process, improved cash flow, and reduced administrative overhead associated with resolving payment discrepancies.

In conclusion, clarity in a statement of account free template is not merely a desirable quality; it is a fundamental requirement for effective financial management and positive client relationships. Templates promoting clear, concise, and unambiguous communication contribute directly to efficient payment processing, minimized disputes, and enhanced trust between businesses and clients. Addressing potential ambiguity proactively through well-structured templates and precise language is a key strategy for achieving these positive outcomes. This understanding underscores the importance of selecting and utilizing templates that prioritize clarity in their design and functionality.

5. Accuracy

Accuracy in a statement of account free template is non-negotiable. It forms the bedrock of trust between businesses and clients, ensuring financial transparency and facilitating smooth transactions. Inaccurate information can lead to disputes, erode client confidence, and create significant accounting challenges. Ensuring accuracy requires meticulous attention to detail and a robust system of checks and balances throughout the process, from data entry to final review.

- Data IntegrityMaintaining data integrity is fundamental. Every transaction detail, including dates, descriptions, quantities, and amounts, must be recorded accurately. Errors in data entry can have cascading effects, leading to incorrect balances and discrepancies that are difficult to reconcile. Regular data validation and verification processes are essential to prevent and rectify such errors. For example, automated cross-referencing with sales records or inventory management systems can help identify and correct discrepancies early on.

- Calculation PrecisionCalculations within the statement, such as discounts, taxes, and total amounts due, must be precise. Even minor calculation errors can undermine client trust and lead to disputes. Employing automated calculation formulas within the template can minimize the risk of human error. Furthermore, implementing a review process where a second individual verifies calculations adds an additional layer of assurance, ensuring accuracy and reducing the likelihood of discrepancies.

- Currency and Unit ConsistencyConsistency in currency and units of measurement is crucial, particularly in international transactions or when dealing with multiple product types. Clearly specifying the currency used and the units of measurement for each item prevents ambiguity and ensures accurate interpretation of financial data. For instance, a statement involving both US dollars and Euros must clearly indicate the respective currencies for each transaction to avoid confusion and potential financial discrepancies.

- Timely UpdatesStatements of account must reflect the most current information. Regular updates are essential to ensure that the information presented accurately reflects the current financial status of the client’s account. This includes promptly recording payments received, applying credits, and adjusting balances accordingly. Delays in updates can lead to inaccurate balances and potentially impact client credit assessments.

These facets of accuracy are integral to a reliable and trustworthy statement of account. Employing a free template aids in maintaining consistency and structure but does not guarantee accuracy on its own. Diligent data entry, rigorous verification processes, and a commitment to precision are essential to ensuring the accuracy and integrity of financial information presented, ultimately fostering trust and promoting positive client relationships. Overlooking these elements can undermine the value of even the most well-designed template, highlighting the importance of accuracy as a crucial component of sound financial practice.

6. Time-saving

Time-saving is a significant advantage offered by statement of account free templates. Manual creation of these documents involves considerable time and effort, particularly for businesses handling numerous transactions. Templates streamline this process by providing pre-formatted layouts, standardized sections, and, in some cases, automated calculation fields. This reduces the time spent on formatting, data entry, and calculations, allowing resources to be allocated to other essential business operations. Consider a small business owner spending several hours each month creating statements of account from scratch. Utilizing a free template could reduce this time commitment significantly, freeing up time for client communication, business development, or other revenue-generating activities.

The practical implications of this time-saving aspect are substantial. Reduced administrative overhead translates to cost savings, improved efficiency, and increased productivity. Furthermore, the time saved allows for more focused attention on client relationships and core business functions. For example, a freelance consultant can leverage the time saved to acquire new clients or enhance services offered to existing clients. This contributes directly to business growth and enhanced profitability. Moreover, utilizing templates ensures consistency in statement presentation, further enhancing professionalism and efficiency.

In conclusion, the time-saving benefit of statement of account free templates offers tangible advantages for businesses of all sizes. By streamlining administrative tasks and freeing up valuable time, these resources contribute directly to improved efficiency, reduced costs, and increased opportunities for business growth. Recognizing and leveraging this advantage is crucial for businesses seeking to optimize operations and maximize their potential. The readily available nature of these templates, coupled with their inherent time-saving properties, positions them as valuable tools for any business seeking to enhance financial management practices and improve overall operational efficiency.

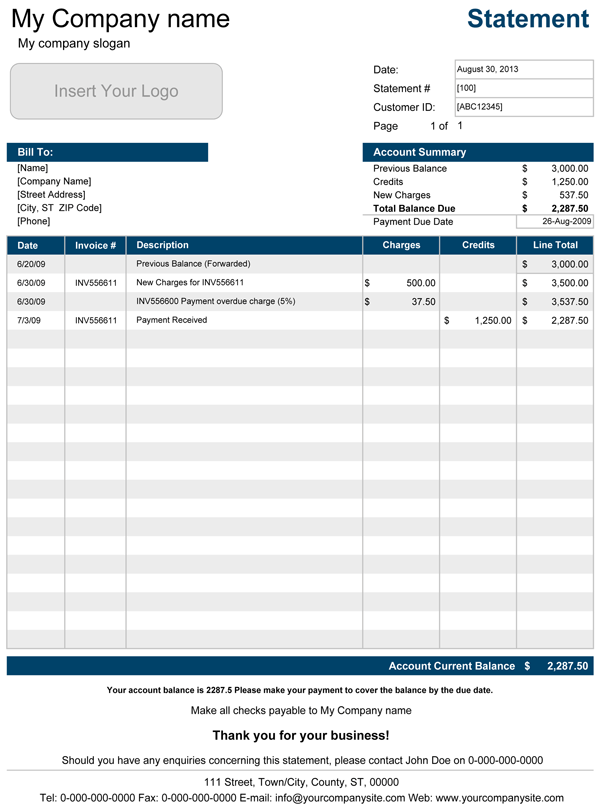

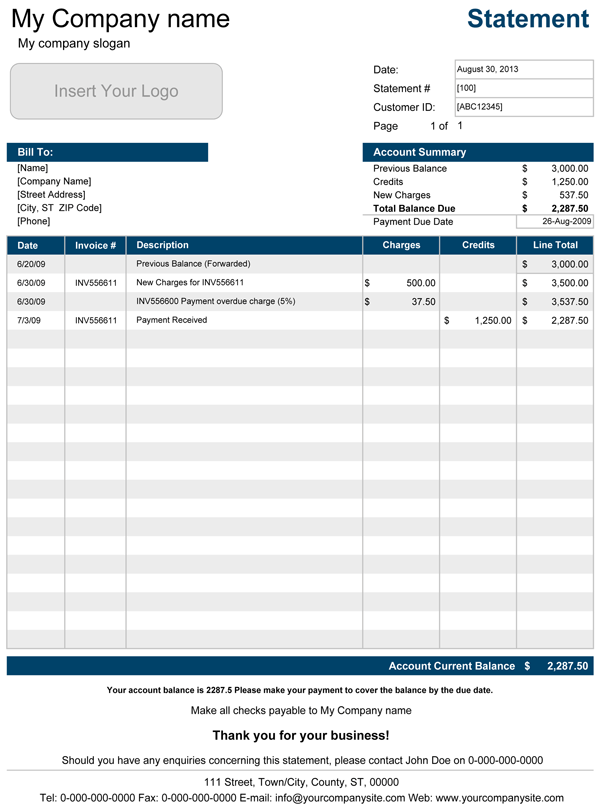

Key Components of a Statement of Account Free Template

Essential elements comprise a well-structured statement of account template. Understanding these components is crucial for leveraging the full potential of these resources and ensuring accurate, professional financial documentation.

1. Business Information: Clear identification of the issuing business, including name, address, and contact details, is essential for establishing credibility and facilitating communication.

2. Client Information: Accurate client details, including name, billing address, and account number, ensure proper identification and facilitate efficient record-keeping.

3. Statement Period: A clearly defined statement period, specifying the start and end dates, provides context for the transactions listed and facilitates reconciliation.

4. Transaction Details: Itemized transaction details, including date, description, quantity, unit price, and total amount, provide a comprehensive overview of financial activity during the statement period. Clarity and accuracy in these details are crucial for transparency.

5. Payment Information: Clear instructions regarding accepted payment methods, payment due dates, and any applicable late payment fees promote timely payments and minimize potential disputes. Inclusion of details for online payment platforms or bank transfer instructions streamlines the payment process.

6. Balance Summary: A summary of the opening balance, total debits and credits, and closing balance provides a concise overview of the account’s financial status. Accurate calculation and clear presentation of this summary are critical for client comprehension.

7. Terms and Conditions: Inclusion of relevant terms and conditions, such as dispute resolution procedures or specific service agreements, clarifies expectations and provides a framework for resolving potential issues. This contributes to a more transparent and professional client relationship.

These components work together to create a comprehensive and informative document. Accurate and clearly presented data within this structured format ensures transparency, promotes timely payments, and fosters trust between businesses and their clients. This understanding is fundamental for effective financial management and the maintenance of positive client relationships.

How to Create a Statement of Account Free Template

Creating a professional and effective statement of account template requires careful consideration of key components and formatting. A well-structured template ensures clarity, accuracy, and promotes efficient financial communication. The following steps outline the process:

1: Define the Purpose: Clarify the specific purpose of the template. Determine whether it will serve general billing purposes or address specific client needs or project types. A clear objective guides template design choices.

2: Choose Software: Select appropriate software for template creation. Spreadsheet applications like Microsoft Excel or Google Sheets offer flexibility and built-in calculation functionalities, well-suited for financial documents. Word processing software may suffice for simpler formats.

3: Structure Layout: Establish a clear and logical layout. Organize sections for business information, client details, statement period, transaction details, payment information, balance summary, and terms and conditions. This structured approach promotes readability and comprehension.

4: Incorporate Branding: Integrate branding elements, such as company logos and color schemes. Consistent branding reinforces professional identity and enhances client perception. However, ensure branding elements do not compromise clarity.

5: Input Formulas: Utilize formulas for automated calculations within the spreadsheet. This minimizes manual calculations, reduces the risk of errors, and ensures accurate totals and balances. Thoroughly test formulas to ensure proper functionality.

6: Test and Refine: Conduct thorough testing to ensure accuracy and functionality. Input sample data and verify calculations, formatting, and overall usability. Refine the template based on testing results to optimize its effectiveness.

7: Save and Distribute: Save the template in a readily accessible format, such as a spreadsheet or document file. Ensure compatibility with common software applications. Distribute the template to relevant personnel, providing clear instructions on its use and customization options.

A well-designed template, incorporating these components, serves as a valuable tool for maintaining organized financial records, promoting transparency, and facilitating effective communication between businesses and clients. This structured approach to template creation contributes to improved financial management practices and strengthens client relationships.

Careful consideration of available resources, such as a statement of account free template, empowers businesses to streamline financial processes, enhance communication, and maintain professionalism. Understanding key components, ensuring accuracy, and prioritizing clarity contribute significantly to effective financial management. Leveraging these readily available tools allows businesses to allocate more time to core operations and strategic initiatives, fostering growth and enhancing client relationships.

Ultimately, the strategic implementation of clear, accurate, and professional financial documentation serves as a cornerstone of sustained business success. Regular review and refinement of these processes, informed by best practices and evolving business needs, remain crucial for navigating the complexities of the financial landscape and maintaining a competitive edge. This proactive approach to financial management positions businesses for long-term stability and growth.