Utilizing such a framework offers numerous advantages. It streamlines the billing process, reduces the likelihood of errors, and saves time and resources. Clear, consistent documentation strengthens professional relationships by providing clients with easy-to-understand records, which in turn minimizes disputes and improves communication. These structured records also simplify internal accounting processes and aid in financial analysis.

Understanding the structure and benefits of this type of financial documentation is crucial for effective financial management. The following sections will explore best practices for creating and utilizing these documents, along with examples demonstrating their application in various business contexts.

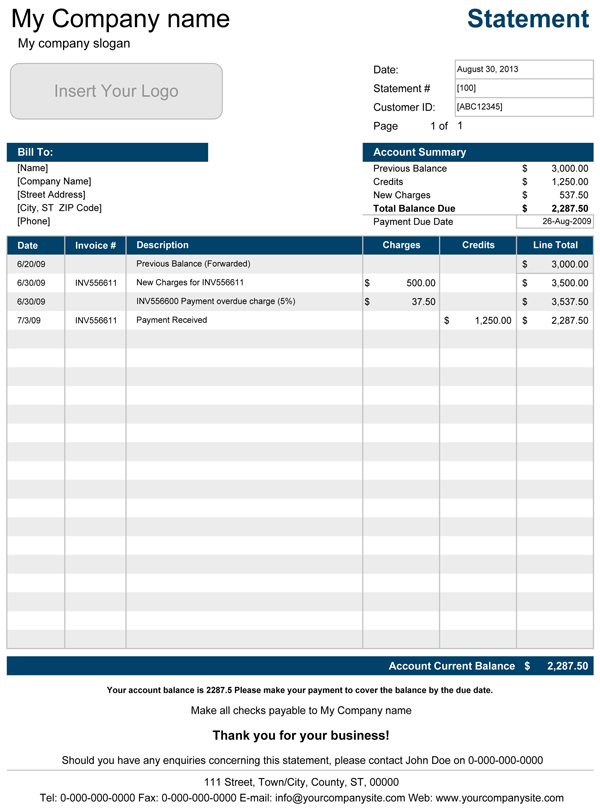

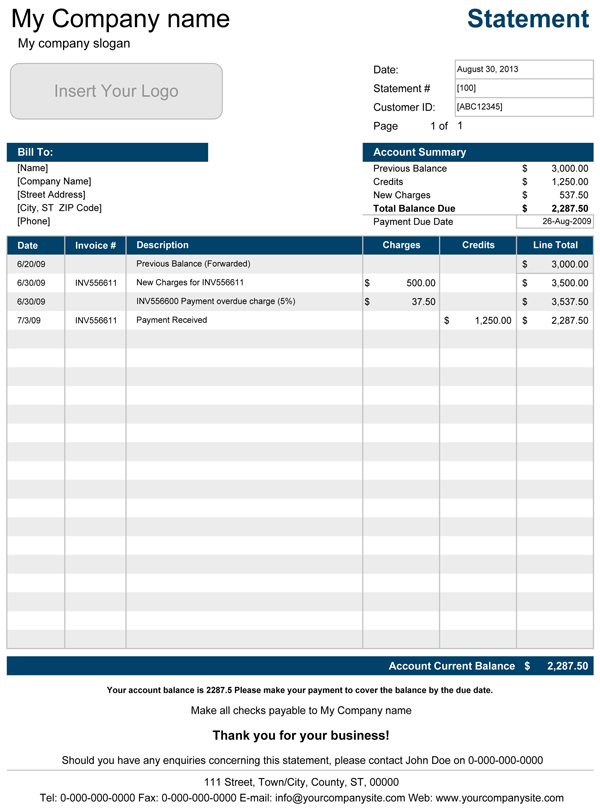

1. Standardized Format

A standardized format is fundamental to a well-designed statement of account sample template. Consistency ensures clarity, facilitates processing, and projects professionalism. A structured approach allows for easy comparison across multiple statements and simplifies data analysis.

- Consistent LayoutA consistent layout ensures all essential information appears in the same location on every statement. This predictable structure allows clients to quickly locate specific details, such as the billing period, total due, and payment methods. For example, consistently placing the company logo in the top left corner and the client’s address in the top right ensures immediate recognition and clarity.

- Uniform TerminologyUsing uniform terminology avoids confusion and ensures accurate interpretation of the financial information presented. Consistent use of terms like “Invoice Number,” “Service Description,” and “Payment Due Date” eliminates ambiguity and promotes efficient processing. This standardized vocabulary streamlines communication and reduces the potential for misunderstandings.

- Defined Calculation MethodsClearly defined calculation methods are crucial for transparency and accuracy. A standardized approach to calculating discounts, taxes, and other charges ensures consistency and allows clients to easily verify the amounts due. For example, consistently applying sales tax based on the client’s location ensures accurate and legally compliant billing.

- Branding ElementsIncorporating branding elements, such as logos and color schemes, reinforces brand identity and adds a professional touch. Consistent branding across all financial documents creates a cohesive and recognizable image, further enhancing credibility and professionalism. This consistent visual presentation strengthens brand recognition and reinforces the company’s image.

These facets of a standardized format contribute significantly to the effectiveness of a statement of account sample template. A well-structured document promotes efficient processing, strengthens client relationships, and facilitates accurate financial management. By adhering to a standardized format, businesses can improve communication, minimize errors, and project a professional image.

2. Clear Itemization

Clear itemization is a cornerstone of effective financial documentation, particularly within a statement of account sample template. It provides clients with a transparent and detailed breakdown of charges, fostering understanding and facilitating prompt payment. Without clear itemization, a statement of account risks becoming a confusing jumble of numbers, potentially leading to disputes, delayed payments, and strained client relationships. Itemization transforms a generic balance due into a comprehensible record of financial activity.

Consider a scenario where a client receives a statement of account simply listing a total amount due. Lacking details, the client may be unable to reconcile the charges against their own records, leading to inquiries and delays. However, a clearly itemized statement listing individual services rendered, associated costs, applicable taxes, and dates of service empowers clients to readily verify the accuracy of the charges. This transparency builds trust and reduces the likelihood of discrepancies. For example, instead of a single line item for “Consulting Services,” an itemized statement would break down the charges by project, date, and hours worked, providing a comprehensive overview of the services provided.

Effective itemization requires attention to detail and a structured approach. Each charge should be accompanied by a clear description, relevant dates, and accurate amounts. Grouping similar charges together and utilizing subtotals can further enhance clarity, particularly in statements covering extended periods or multiple transactions. This level of detail not only benefits the client but also aids internal accounting processes, simplifies reconciliation, and provides valuable data for financial analysis. The benefits of clear itemization extend beyond client satisfaction, contributing to streamlined operations and improved financial management.

3. Accurate Calculations

Accuracy in calculations forms the bedrock of a reliable statement of account sample template. Errors, regardless of size, erode trust, create confusion, and can lead to financial disputes. A template, while providing a structured framework, does not guarantee accuracy; meticulous data entry and verification remain essential. Consider a scenario where an incorrect discount rate is applied within the template. This seemingly small error can lead to an inaccurate final balance, potentially damaging client relationships and necessitating time-consuming corrections.

The importance of accurate calculations extends beyond individual client interactions. Inaccurate data within statements of account can skew financial reporting, leading to flawed business decisions based on misleading information. For instance, overstated revenue figures due to calculation errors can lead to unrealistic projections and unsustainable budgeting. Therefore, robust validation processes, including automated checks and manual reviews, should be integral to any system employing a statement of account template. Employing formulas within the template itself can minimize manual data entry and reduce the risk of human error, particularly with repetitive calculations like sales tax or discounts. Regularly reviewing and updating these formulas ensures they remain aligned with current regulations and business practices.

Accurate calculations are not merely a desirable feature of a statement of account; they are a non-negotiable requirement. They ensure financial integrity, build client trust, and support informed decision-making. While a well-designed template provides a structure for accuracy, consistent diligence in data entry and verification is crucial. Integrating validation mechanisms and utilizing automated calculations within the template further strengthens accuracy and minimizes the potential for errors, ultimately contributing to the financial health and credibility of the business.

4. Professional Presentation

Professional presentation within a statement of account sample template significantly impacts client perception and reinforces brand identity. A polished and well-organized document communicates competence, instills confidence, and strengthens client relationships. Conversely, a poorly presented statement can create a negative impression, irrespective of the accuracy of the data it contains. Consider the impact of receiving a crumpled, handwritten invoice versus a professionally formatted electronic statement. The former suggests a lack of attention to detail, while the latter projects an image of professionalism and efficiency.

- Clear Typography and LayoutLegible fonts, appropriate spacing, and a logical flow of information contribute significantly to a professional appearance. A cluttered or visually jarring layout can make it difficult for clients to extract key information. Using a clear, professional font like Arial or Calibri and ensuring adequate white space between sections enhances readability and promotes a positive impression. For example, using different font sizes for headings, subheadings, and body text creates a visual hierarchy that guides the reader through the document.

- Branding ElementsConsistent use of company logos, colors, and fonts strengthens brand recognition and reinforces a professional image. Integrating these elements seamlessly into the statement of account template ensures a cohesive brand experience across all client interactions. A consistent brand presence builds familiarity and trust. For instance, incorporating a company watermark subtly in the background can enhance the professional appearance without being intrusive.

- High-Quality Paper and Printing (if applicable)If using physical statements, high-quality paper and professional printing demonstrate attention to detail and respect for the client. Faded ink, low-grade paper, or smudges detract from the professionalism of the document and can create a negative impression. Choosing a heavier weight paper and ensuring sharp, clear printing enhances the perceived value and professionalism of the statement.

- Electronic Delivery ConsiderationsFor electronically delivered statements, ensuring compatibility across different devices and email clients is crucial for maintaining a professional presentation. A distorted or unreadable statement due to formatting issues can frustrate clients and undermine the intended message. Using a widely compatible file format like PDF and optimizing the document for different screen sizes ensures a consistent and professional appearance regardless of how the client accesses the statement.

These elements of professional presentation, while seemingly superficial, play a vital role in how a statement of account is perceived. A well-presented document enhances credibility, strengthens client relationships, and reinforces a positive brand image. By prioritizing professional presentation within a statement of account sample template, businesses demonstrate attention to detail and commitment to client satisfaction, ultimately contributing to a more positive and productive business relationship. A professionally presented statement communicates not only financial information but also a commitment to quality and professionalism in all aspects of business operations.

5. Payment Instructions

Clear and comprehensive payment instructions are a critical component of a statement of account sample template. Their inclusion directly impacts the efficiency of the payment process and, consequently, the timeliness of revenue collection. Without explicit instructions, clients may experience confusion or delays in remitting payment, negatively impacting cash flow. Payment instructions transform a statement of account from a mere record of transactions into a call to action. For instance, a statement lacking payment details necessitates further communication from the client, adding an unnecessary step and potentially delaying payment. Conversely, a statement with clear instructions empowers clients to remit payment promptly and efficiently.

Several key elements contribute to effective payment instructions. Accepted payment methods should be clearly listed, including details such as bank account information for wire transfers, online payment portal links, or accepted credit card types. Providing multiple payment options caters to diverse client preferences and increases the likelihood of prompt payment. Additionally, specifying payment deadlines and outlining any applicable late payment penalties further encourages timely remittance. Consider a scenario where a client prefers to pay via online transfer but the statement only provides details for a check payment. This mismatch creates friction in the payment process and can lead to delays. However, offering a range of payment options, from online portals to traditional mail-in checks, streamlines the process and accommodates individual client needs. Further clarity can be achieved by including contact information for inquiries regarding payment or billing discrepancies. This proactive approach minimizes potential delays and fosters a positive client experience.

Effective payment instructions within a statement of account template are essential for optimizing revenue collection and maintaining positive client relationships. They facilitate a smooth and efficient payment process, minimizing potential confusion and delays. Clear instructions, coupled with a range of payment options and readily available contact information, contribute to a positive client experience and ensure timely payment. This, in turn, positively impacts cash flow and contributes to the overall financial health of the organization. Neglecting this crucial aspect of a statement of account can lead to inefficiencies, payment delays, and strained client relationships, highlighting the practical significance of incorporating clear and comprehensive payment instructions within any statement of account template.

6. Contact Information

Inclusion of accurate and accessible contact information within a statement of account sample template is crucial for effective communication and efficient dispute resolution. This seemingly minor detail plays a significant role in facilitating timely query resolution and maintaining positive client relationships. Absence of readily available contact information can lead to frustration, delays, and potentially escalate minor issues into significant disputes. Contact details transform a static document into a dynamic communication tool.

- Business Contact DetailsProviding complete business contact information, including the company name, address, phone number, email address, and website URL, enables clients to easily reach out with inquiries or report discrepancies. For example, a client noticing a discrepancy in a charge can quickly contact the billing department using the provided information, facilitating prompt resolution. This readily available access fosters transparency and builds trust.

- Client Contact DetailsAccurate client contact details ensure the statement reaches the intended recipient and enable efficient two-way communication. This includes the client’s full name, company name (if applicable), billing address, phone number, and email address. Accurate client details prevent misdirected statements and ensure efficient communication regarding payment or discrepancies.

- Designated Contact PersonSpecifying a designated contact person within the business, along with their direct contact information, provides clients with a clear point of contact for inquiries. This personalized approach can expedite issue resolution and foster a stronger client relationship. For instance, a client with a complex billing question can directly contact the designated individual, avoiding the potential delays and frustrations of navigating a general customer service line.

- Payment Remittance Address (if different)If the payment remittance address differs from the business’s primary address, it should be clearly stated within the statement of account. This prevents misdirected payments and ensures timely processing. Clear remittance instructions minimize the potential for payment delays due to incorrect addressing, optimizing cash flow and reducing administrative overhead.

Accurate and readily accessible contact information within a statement of account template is essential for facilitating efficient communication and maintaining positive client relationships. It empowers clients to quickly resolve queries, report discrepancies, and make timely payments. This proactive approach to communication minimizes potential disputes, enhances transparency, and contributes to a smoother, more efficient billing process. By prioritizing clear and comprehensive contact information, businesses demonstrate a commitment to client service and contribute to the overall effectiveness of their financial communications.

Key Components of a Statement of Account Template

Essential elements ensure a statement of account template effectively communicates financial information, facilitates transparent transactions, and fosters positive client relationships. These components contribute to accurate record-keeping, efficient payment processing, and clear communication.

1. Company Information: Clear identification of the issuing business, including legal name, address, contact numbers, and email address, establishes credibility and provides necessary contact information for inquiries.

2. Client Information: Accurate client details, including name, billing address, and account number, ensure proper delivery and facilitate personalized communication. This information also aids in efficient record-keeping and tracking.

3. Statement Period: A clearly defined date range specifies the period covered by the statement, enabling clients to reconcile transactions against their own records. This clarity prevents confusion and facilitates accurate reconciliation.

4. Transaction Details: Itemized transaction records, including dates, descriptions, amounts, and applicable taxes or discounts, provide transparency and facilitate verification. Detailed descriptions prevent ambiguity and ensure clear understanding of charges.

5. Payment Information: Clear instructions regarding accepted payment methods, payment deadlines, and remittance details streamline the payment process and encourage timely payment. This clarity reduces potential delays and improves cash flow.

6. Outstanding Balance: A prominent display of the outstanding balance clearly communicates the total amount due, facilitating prompt payment and accurate financial management. This clarity eliminates ambiguity and promotes timely settlement.

7. Contact Information for Inquiries: Providing dedicated contact information for billing inquiries enables clients to quickly resolve questions or report discrepancies. This accessible support channel enhances client satisfaction and fosters open communication.

A well-designed template incorporating these elements promotes transparency, efficiency, and positive client interactions. Comprehensive and accurate financial documentation strengthens financial management practices and builds trust with clients.

How to Create a Statement of Account Sample Template

Creating a professional and effective statement of account sample template requires careful consideration of key elements and best practices. A well-structured template ensures clarity, accuracy, and efficiency in financial communication.

1. Define the Purpose: Determine the specific objectives of the template. Consider the types of transactions it will document, the target audience, and the desired level of detail. A clear purpose guides the design process.

2. Choose a Format: Select a suitable format, whether digital (spreadsheet, word processing document) or physical. Consider compatibility with existing accounting software and accessibility for clients. The chosen format should facilitate efficient data entry and retrieval.

3. Incorporate Essential Elements: Include crucial information such as company details, client details, statement period, itemized transactions, payment instructions, outstanding balance, and contact information. Completeness ensures clarity and minimizes potential confusion.

4. Ensure Accurate Calculations: Implement formulas and automated checks within the template to minimize calculation errors. Regularly review and update these formulas to maintain accuracy and compliance with current regulations. Accuracy builds trust and prevents disputes.

5. Prioritize Clarity and Readability: Use clear typography, a logical layout, and concise language. Avoid jargon and technical terms that may confuse clients. Clarity promotes understanding and facilitates efficient processing.

6. Maintain Professional Presentation: Incorporate branding elements and ensure a consistent visual identity. Pay attention to formatting, font choices, and overall presentation. Professionalism enhances credibility and reinforces a positive brand image.

7. Test and Refine: Before widespread implementation, thoroughly test the template with various scenarios and user groups. Gather feedback and make necessary adjustments to optimize functionality and usability. Testing ensures effectiveness and identifies potential areas for improvement.

8. Regularly Review and Update: Periodically review and update the template to ensure it remains aligned with evolving business needs, regulatory requirements, and best practices. Regular review maintains relevance and ensures compliance.

A well-designed statement of account template, incorporating these elements, provides a structured framework for clear and efficient financial communication. It streamlines processes, reduces errors, and fosters positive client relationships, contributing to effective financial management.

Effective financial management necessitates clear and accurate communication. A well-designed statement of account sample template provides the framework for conveying essential financial information to clients, facilitating timely payments, and minimizing disputes. Standardized formatting, accurate calculations, clear itemization, professional presentation, comprehensive payment instructions, and readily accessible contact information are crucial elements of such a template. These components contribute to transparency, efficiency, and the development of strong client relationships.

Leveraging a robust and well-maintained statement of account template contributes significantly to sound financial practices. Regular review and adaptation of these templates to evolving business needs and industry best practices ensure ongoing effectiveness in managing financial interactions and promoting positive client relationships. This proactive approach to financial documentation strengthens operational efficiency and supports long-term financial health.