Utilizing a pre-designed structure for these personalized recommendations offers several advantages. It ensures compliance with regulatory requirements, promotes clarity and transparency in communication, and streamlines the financial planning process. This structured approach facilitates informed decision-making by clients and fosters a strong advisor-client relationship built on trust and understanding.

The following sections will delve deeper into the key components of a well-structured financial plan, exploring best practices for its development and implementation. These components will provide a comprehensive understanding of how personalized financial strategies are crafted and the value they bring to achieving long-term financial security.

1. Client Profiling

Client profiling forms the cornerstone of a robust statement of advice financial planning template. It involves gathering comprehensive information about a client’s financial situation, goals, risk tolerance, and personal circumstances. This data-driven approach ensures that the subsequent financial recommendations are relevant, appropriate, and aligned with the client’s specific needs. Cause and effect are directly linked: detailed profiling leads to a tailored and effective financial plan. Without accurate profiling, the plan risks becoming generic and failing to address the client’s unique circumstances. For instance, a young professional with a high-risk tolerance may have different investment goals compared to a retiree seeking stable income. Profiling distinguishes these needs.

As a critical component of the statement of advice, client profiling facilitates the development of personalized strategies. Consider a client aiming to purchase a property within five years. Profiling reveals their current savings, income, and spending patterns, allowing the advisor to recommend specific savings strategies, investment options, and loan structures tailored to their goal. Without this information, the advice would lack the necessary precision and relevance. Accurate profiling also aids in risk management. Understanding a client’s risk tolerance ensures that the proposed investment portfolio aligns with their comfort level, minimizing potential emotional distress during market fluctuations.

In conclusion, effective client profiling is indispensable for a successful financial planning process. It enables advisors to develop tailored strategies, manage risk effectively, and build stronger client relationships based on trust and understanding. While challenges may arise in gathering complete and accurate information, the practical significance of this process cannot be overstated. Thorough profiling ultimately empowers clients to make informed decisions and achieve their financial aspirations.

2. Goal Setting

Goal setting forms the crucial bridge between a client’s current financial situation and their desired future. Within a statement of advice financial planning template, clearly defined goals provide direction and purpose, shaping investment strategies, risk assessments, and overall financial recommendations. Without concrete objectives, financial planning becomes an aimless exercise, lacking the focus necessary to achieve desired outcomes.

- Specificity and MeasurabilityVague aspirations, such as “financial security,” offer little practical guidance. Effective goals within a financial plan must be specific and measurable. For example, “accumulating a $500,000 retirement nest egg by age 65” provides a quantifiable target, enabling advisors to develop a tailored plan with measurable milestones. This precision allows for ongoing monitoring and adjustments as needed. The specificity also facilitates clear communication between the advisor and client, ensuring a shared understanding of the intended outcome.

- Time-Bound ObjectivesEstablishing a timeframe for achieving financial goals adds a critical dimension of accountability and urgency. A goal without a deadline risks indefinite postponement. For instance, specifying a timeframe for debt reduction”paying off a $20,000 loan within three years”creates a structured repayment plan, motivating consistent progress. Within a financial plan, time-bound objectives allow advisors to calculate required savings rates, investment returns, and other critical factors necessary for achieving the goal within the specified period.

- Alignment with Risk ToleranceGoals must align with a client’s risk tolerance. Aggressive growth objectives may require higher-risk investments, potentially unsuitable for risk-averse individuals. Conversely, conservative goals might not necessitate high-risk strategies. For example, a client aiming for rapid portfolio growth might be comfortable with volatile investments, while someone prioritizing capital preservation would likely prefer lower-risk options. The financial plan must reconcile these factors to ensure the chosen investment strategy aligns with both the client’s goals and their comfort level with risk.

- Regular Review and AdjustmentLife circumstances and financial markets are dynamic. Regularly reviewing and adjusting goals within a financial plan ensures its continued relevance. For instance, marriage, childbirth, or career changes can significantly impact financial priorities. The statement of advice should incorporate a framework for periodic reviews, allowing adjustments to goals, investment strategies, and other elements to reflect evolving needs and circumstances. This adaptability ensures the plan remains a dynamic tool for achieving long-term financial well-being.

In conclusion, well-defined goals are the bedrock of a successful financial plan. By providing clarity, direction, and measurability, they empower advisors to create personalized strategies aligned with client needs and aspirations. Within a statement of advice financial planning template, effectively established goals serve as the compass, guiding clients towards their desired financial destination.

3. Strategy Recommendations

Strategy recommendations form the core of a statement of advice financial planning template. These recommendations translate client goals and risk profiles into actionable steps, bridging the gap between aspiration and achievement. A direct causal link exists: clearly defined goals and a thorough understanding of risk tolerance inform the development of tailored strategies. Without specific recommendations, the financial plan remains a theoretical framework, lacking the practical guidance necessary for effective implementation. For example, a client aiming for early retirement requires a more aggressive investment strategy compared to someone focused on preserving capital. The recommendations section provides this crucial direction.

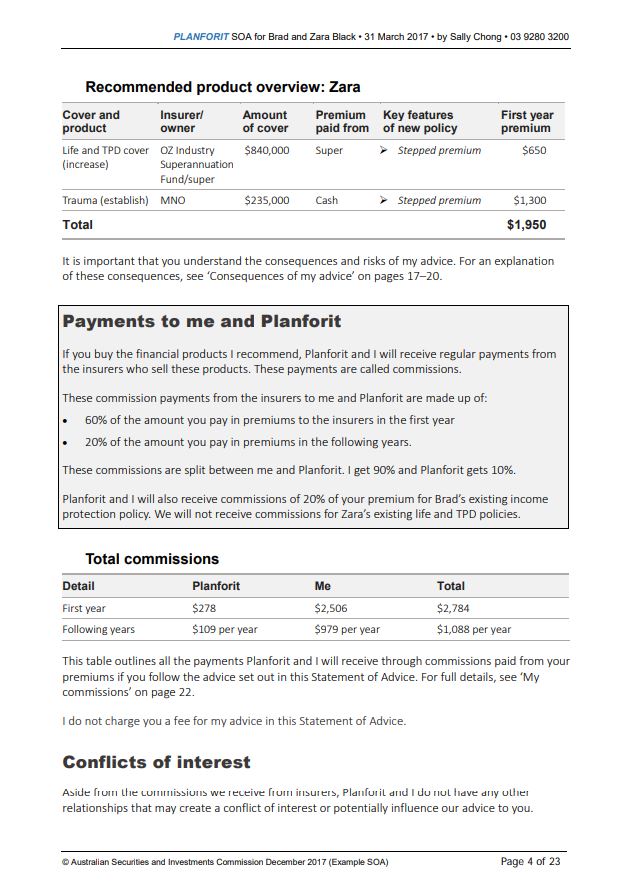

As a critical component of the statement of advice, strategy recommendations encompass various financial domains. Investment strategies might include asset allocation guidance, specific investment product selections, and diversification strategies. Retirement planning recommendations could involve contribution levels to retirement accounts, withdrawal strategies, and estate planning considerations. Insurance recommendations might address appropriate coverage levels for life, health, and disability insurance, mitigating potential financial risks. For instance, a client with young children might require a higher life insurance coverage compared to a single individual. The recommendations section tailors these considerations to individual circumstances.

Effective strategy recommendations also consider the practical implications of implementation. They should outline specific actions required by the client, associated costs, and anticipated timelines. For example, a recommendation to consolidate multiple debts might detail the process, fees involved, and projected impact on the client’s credit score. This practical approach empowers clients to understand and execute the recommended actions effectively. Furthermore, the recommendations section should address potential challenges and alternative strategies, providing a contingency plan in case unforeseen circumstances arise. This proactive approach enhances the robustness and resilience of the financial plan.

In conclusion, well-crafted strategy recommendations are essential for translating a financial plan into tangible results. Within a statement of advice financial planning template, these recommendations provide the roadmap, guiding clients towards their financial goals. The practical significance of this component lies in its ability to empower informed decision-making, facilitate effective implementation, and ultimately enhance the likelihood of achieving long-term financial well-being. While market volatility and unforeseen life events can present challenges, a robust strategy framework, adaptable to changing circumstances, remains crucial for navigating the complexities of personal finance.

4. Risk Assessment

Risk assessment forms an integral part of a comprehensive statement of advice financial planning template. It provides a structured framework for evaluating a client’s capacity and willingness to tolerate financial risk. This assessment directly influences investment strategy recommendations, ensuring alignment between portfolio composition and the client’s risk profile. A causal relationship exists: a thorough risk assessment informs appropriate investment choices. Without understanding a client’s risk tolerance, investment advice risks misalignment, potentially leading to unsuitable portfolio construction and client dissatisfaction. For example, recommending volatile growth stocks to a risk-averse client contradicts their risk profile and could result in undue stress during market downturns. Conversely, a client with a high-risk tolerance might find a conservative portfolio too limiting, hindering potential returns.

As a critical component of the statement of advice, risk assessment considers multiple factors. These include time horizon, financial goals, investment knowledge, and personal circumstances. A longer time horizon generally allows for greater risk-taking, while short-term goals necessitate more conservative approaches. Similarly, a client with extensive investment knowledge might be comfortable with complex, higher-risk strategies, whereas someone with limited experience might prefer simpler, lower-risk options. Consider a young professional saving for retirement decades away. Their long time horizon allows for a higher allocation to growth-oriented investments, accepting greater short-term volatility for potential long-term gains. Conversely, a client nearing retirement requires a more conservative approach, prioritizing capital preservation over aggressive growth. The risk assessment informs these crucial decisions.

In conclusion, a thorough risk assessment is essential for developing a suitable and effective financial plan. Within a statement of advice financial planning template, it serves as a critical guide, ensuring that investment recommendations align with the client’s individual risk profile. The practical significance of this assessment lies in its ability to mitigate potential losses, manage client expectations, and foster a stronger advisor-client relationship built on trust and understanding. While accurately gauging risk tolerance can be challenging due to subjective factors and potential changes in circumstances, its importance in shaping a successful financial plan remains paramount.

5. Regular Review Framework

A regular review framework is essential to the efficacy of a statement of advice financial planning template. Market fluctuations, life events, and evolving financial goals necessitate periodic adjustments to maintain alignment between the plan and client circumstances. This framework operates on the principle of dynamic adaptation: a static financial plan risks obsolescence in the face of change. Without regular reviews, the carefully crafted initial strategy can drift off course, failing to achieve its intended purpose. For example, a significant market downturn might necessitate portfolio rebalancing to maintain the desired risk level. Similarly, a change in family circumstances, such as the birth of a child or a job loss, could require adjustments to financial goals and savings strategies.

As a critical component of the statement of advice, the regular review framework establishes a systematic process for monitoring progress and making necessary adjustments. This process typically involves periodic meetings between the advisor and client, during which portfolio performance is analyzed, financial goals are reassessed, and investment strategies are adjusted as needed. The frequency of these reviews depends on client needs and market conditions, ranging from quarterly check-ins to annual reviews. For instance, a client approaching retirement might require more frequent reviews to fine-tune withdrawal strategies and manage portfolio risk. Conversely, a younger investor with a long-term horizon might benefit from less frequent, but still consistent, reviews.

The practical significance of a regular review framework lies in its ability to ensure the ongoing relevance and effectiveness of the financial plan. It allows for proactive adjustments, mitigating potential risks and capitalizing on new opportunities. While adhering to a consistent review schedule can be challenging due to time constraints and changing priorities, the long-term benefits of this disciplined approach are substantial. By incorporating a robust review framework, the statement of advice financial planning template becomes a dynamic tool, adaptable to life’s inevitable changes and capable of guiding clients towards long-term financial well-being.

Key Components of a Statement of Advice Financial Planning Template

A robust template ensures clarity, compliance, and client understanding. Essential components work together to provide a comprehensive and effective financial roadmap.

1. Executive Summary: Provides a concise overview of the client’s financial situation, goals, and recommended strategies. This high-level summary allows for quick comprehension of the plan’s key elements.

2. Client Profile: Details the client’s current financial standing, including assets, liabilities, income, and expenses. Demographic information, financial goals, and risk tolerance are also documented to personalize recommendations.

3. Goal Setting: Outlines specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These objectives provide direction for the entire plan and serve as benchmarks for measuring progress.

4. Risk Assessment: Evaluates the client’s risk tolerance and capacity, considering factors like time horizon, investment knowledge, and financial stability. This assessment informs appropriate investment strategies.

5. Strategy Recommendations: Presents tailored strategies designed to achieve the client’s stated goals, encompassing investment management, retirement planning, estate planning, and risk management. Recommendations are aligned with the client’s risk profile and time horizon.

6. Implementation Plan: Details the specific steps required to execute the recommended strategies, including timelines, responsibilities, and associated costs. This actionable plan facilitates efficient implementation and progress tracking.

7. Review Framework: Establishes a schedule for regular reviews and adjustments to the plan. This dynamic approach ensures ongoing alignment with evolving market conditions and client circumstances.

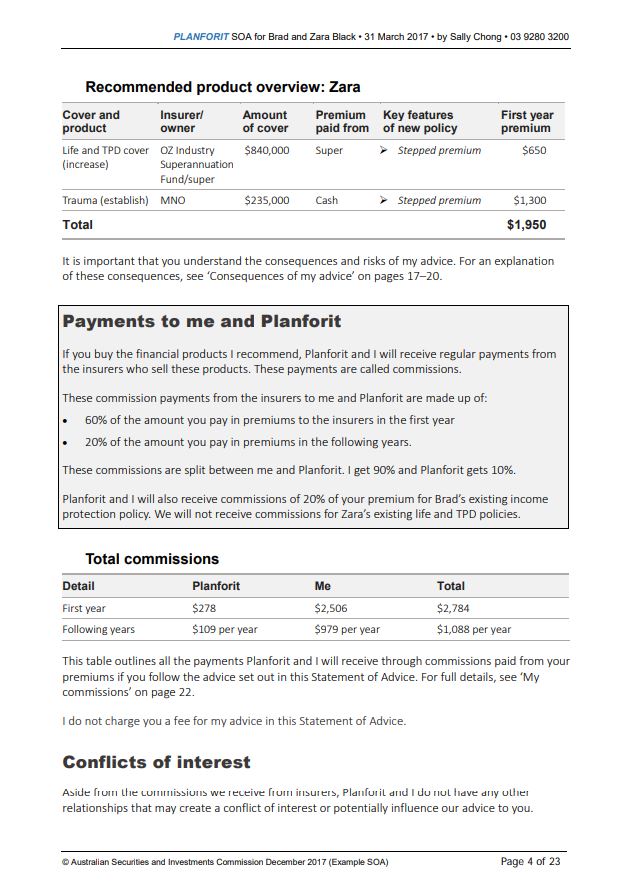

8. Disclosures: Includes necessary legal and regulatory disclosures, ensuring transparency and compliance. Fee structures, potential conflicts of interest, and other relevant information are clearly presented.

These interconnected components form a cohesive framework, guiding clients toward their financial aspirations. Regular review and adaptation ensure the plan remains relevant and effective over time, navigating market fluctuations and life’s inevitable changes.

How to Create a Statement of Advice Financial Planning Template

Developing a robust template requires a structured approach, incorporating essential components to ensure clarity, compliance, and client understanding. The following steps outline the process:

1. Define Scope and Purpose: Clearly articulate the template’s intended use and target audience. Specificity in scope ensures relevance and practicality. A template designed for retirees will differ significantly from one designed for young professionals.

2. Structure Client Information Gathering: Develop a standardized format for collecting client data, including financial details, goals, risk tolerance, and personal circumstances. A consistent structure facilitates efficient data analysis and personalized recommendations.

3. Establish Goal-Setting Framework: Incorporate a structured process for defining specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. This framework provides direction and benchmarks for progress measurement.

4. Develop Risk Assessment Methodology: Implement a standardized risk assessment tool to evaluate client risk tolerance and capacity. Consistent methodology ensures objectivity and informs suitable investment strategies.

5. Create Strategy Recommendation Templates: Design standardized templates for presenting investment, retirement, estate planning, and risk management strategies. Templates ensure consistency and clarity in communication.

6. Design Implementation Plan Outline: Develop a structured outline for detailing action steps, timelines, responsibilities, and associated costs. A clear implementation plan facilitates effective execution and progress tracking.

7. Establish Review Framework: Define a systematic process for regular reviews and adjustments to the plan, including frequency, scope, and documentation requirements. A structured review process ensures ongoing relevance and adaptability.

8. Integrate Compliance and Disclosures: Incorporate necessary legal and regulatory disclosures, ensuring transparency and adherence to industry standards. This includes fee structures, potential conflicts of interest, and other relevant information.

A well-designed template streamlines the financial planning process, promoting consistency, clarity, and client engagement. Regular review and refinement of the template ensure its continued effectiveness in meeting evolving client needs and market conditions.

A statement of advice financial planning template provides a structured and comprehensive approach to financial planning. Its key componentsclient profiling, goal setting, risk assessment, strategy recommendations, and a regular review frameworkwork synergistically to create a personalized roadmap for achieving financial objectives. A well-designed template ensures clarity, consistency, and compliance, fostering informed decision-making and a strong advisor-client relationship. The structured approach facilitates effective communication, enabling clients to understand complex financial concepts and actively participate in their financial journey.

Effective financial planning requires more than just a template; it demands ongoing commitment, adaptability, and a proactive approach to managing financial well-being. Utilizing a structured template empowers both advisors and clients to navigate the complexities of personal finance, fostering financial security and achieving long-term goals. Regular review and adaptation to changing circumstances remain crucial for ensuring the plan’s continued relevance and effectiveness in the face of evolving market conditions and life events.