Using such a framework offers numerous advantages. It allows organizations to identify potential financial challenges early on and develop strategies to mitigate them. A well-crafted document also builds credibility and instills confidence in stakeholders by demonstrating a clear understanding of financial realities. Furthermore, it serves as a valuable management tool for monitoring progress and making informed decisions throughout a project’s lifecycle or a business’s operational period.

This understanding of the purpose and advantages of a structured financial projection framework provides a foundation for exploring specific components and best practices in its development. The following sections will delve into the key elements, offering practical guidance for creating a robust and persuasive document.

1. Projected Revenue

Projected revenue forms the cornerstone of any credible statement of financial viability. It represents the anticipated income streams over a specific period, providing the basis for assessing long-term sustainability. Accurately forecasting revenue is crucial because it directly impacts the overall financial projections and influences key decisions regarding resource allocation and future investments. Overestimating revenue can lead to unrealistic expectations and unsustainable financial planning, while underestimating it can hinder growth opportunities and deter potential investors.

Consider a startup seeking funding for a new product. Their statement of financial viability must include realistic revenue projections based on market analysis, competitive landscape, and pricing strategies. For example, if the startup projects overly optimistic sales figures without sufficient market justification, investors may view the entire financial plan with skepticism. Conversely, if the projections are too conservative, the startup might miss out on securing the necessary capital to scale its operations effectively. A well-researched and justifiable revenue projection, demonstrating a clear understanding of market dynamics, is essential for building investor confidence.

A clear understanding of projected revenue and its impact on overall financial health is essential for developing a robust and persuasive statement. Challenges in accurately forecasting revenue can arise from unpredictable market fluctuations, changing consumer behavior, and unforeseen economic events. However, utilizing robust forecasting models, incorporating historical data where available, and conducting thorough market research can significantly improve the accuracy of revenue projections, leading to a more reliable and impactful assessment of long-term financial viability.

2. Expense Forecasting

Expense forecasting plays a critical role in developing a comprehensive statement of financial viability. Accurate expense projections are essential for determining profitability, assessing funding requirements, and demonstrating responsible financial management. A thorough understanding of anticipated costs allows organizations to develop realistic budgets, make informed decisions about resource allocation, and ultimately, present a credible picture of long-term sustainability to stakeholders.

- Operating ExpensesOperating expenses encompass the day-to-day costs of running a business or project. These include salaries, rent, utilities, marketing, and administrative expenses. Accurately forecasting these costs is crucial for determining operating profitability and overall financial health. For example, a manufacturing company must accurately project raw material costs, labor costs, and utility expenses to determine the cost of goods sold and establish appropriate pricing strategies. Underestimating these expenses can lead to unexpected financial shortfalls and jeopardize long-term viability.

- Capital ExpendituresCapital expenditures represent investments in long-term assets such as equipment, property, and infrastructure. These expenses are typically significant and have a long-term impact on an organization’s financial position. Accurately forecasting capital expenditures is essential for planning future investments, securing necessary funding, and demonstrating responsible financial management. For instance, a technology company planning to expand its data center infrastructure must accurately project the costs of new servers, networking equipment, and software licenses. Failure to accurately forecast these expenses can lead to delays in expansion plans and hinder growth opportunities.

- Contingency PlanningContingency planning involves setting aside funds to cover unexpected costs or unforeseen events. This is a crucial aspect of responsible financial management, as it allows organizations to navigate unexpected challenges without jeopardizing their long-term viability. Incorporating a contingency buffer into expense forecasts demonstrates prudence and foresight, enhancing credibility with stakeholders. For example, a construction company might allocate a contingency for potential cost overruns due to material price fluctuations or unforeseen site conditions. This demonstrates proactive risk management and strengthens the overall financial plan.

- Cost Optimization StrategiesWhile forecasting expenses is essential, exploring cost optimization strategies is equally crucial for maximizing financial viability. Identifying areas where costs can be reduced without compromising quality or efficiency can significantly improve profitability and long-term sustainability. This might involve negotiating better rates with suppliers, implementing energy-efficient technologies, or streamlining operational processes. For instance, a retail business might explore strategies to optimize inventory management and reduce storage costs, contributing to improved profitability and a stronger financial position. Demonstrating a commitment to cost optimization enhances the credibility of the financial plan and instills confidence in stakeholders.

By meticulously forecasting each category of expenses and incorporating strategies for cost optimization, organizations can develop a realistic and robust statement of financial viability. This detailed approach not only strengthens the financial plan but also demonstrates a commitment to responsible financial management, enhancing credibility with investors and other stakeholders. Accurate expense forecasting, coupled with well-defined revenue projections, provides a solid foundation for assessing long-term sustainability and making informed strategic decisions.

3. Cash Flow Projections

Cash flow projections serve as a vital component within a statement of financial viability template. They provide a dynamic view of an organization’s financial health by illustrating the anticipated movement of money into and out of the business over a specific period. This forward-looking analysis is crucial for assessing short-term liquidity and long-term solvency, directly impacting the perceived viability of a project or venture. A robust cash flow projection allows stakeholders to understand whether an organization can meet its financial obligations, fund its operations, and reinvest for future growth. Without a clear understanding of cash flow dynamics, even profitable businesses can face financial distress due to insufficient liquidity.

Consider a retail business experiencing strong sales growth during the holiday season. While revenue might be high, the business could still face a cash flow crunch if customers are using extended payment terms or if the business has invested heavily in inventory. A comprehensive cash flow projection would reveal this potential issue, allowing management to implement strategies such as negotiating shorter payment terms with suppliers or securing a line of credit to bridge the gap. Conversely, a business with declining sales but favorable payment terms might maintain positive cash flow for a certain period, providing a window of opportunity to address underlying operational issues. The ability to anticipate and manage these cash flow fluctuations is essential for long-term financial health and is directly reflected in a well-constructed statement of financial viability.

Understanding the intricacies of cash flow projections is essential for interpreting a statement of financial viability effectively. Challenges can arise from unpredictable market conditions, inaccurate sales forecasts, or unexpected delays in payments. However, incorporating sensitivity analysis and scenario planning into the cash flow projections can mitigate these risks and provide a more realistic assessment of financial viability. By analyzing various potential outcomes, organizations can demonstrate a proactive approach to risk management and build greater confidence in their ability to navigate financial challenges. This careful analysis of cash flow strengthens the overall statement of financial viability, offering stakeholders a more comprehensive and reliable picture of long-term sustainability.

4. Key Assumptions

A statement of financial viability relies on a set of underlying assumptions that drive the financial projections. Clearly articulating these key assumptions is crucial for transparency and allows stakeholders to understand the basis upon which the financial projections are built. This transparency enhances the credibility of the statement and allows for informed assessment of potential risks and opportunities. Without clearly stated assumptions, the financial projections lack context and may be misinterpreted, leading to flawed decision-making.

- Market Growth RateAn assumption regarding the future growth rate of the target market significantly influences revenue projections. For example, a software company projecting its future revenue might assume a 10% annual growth in the cloud computing market. If the actual market growth deviates significantly from this assumption, the revenue projections, and consequently the entire financial viability assessment, will be affected. Clearly stating and justifying this assumption allows stakeholders to understand the underlying market dynamics considered.

- Pricing StrategyAssumptions about pricing strategies directly impact revenue projections and profitability. A company launching a premium product might assume a higher price point than its competitors. This assumption must be justified by factors such as unique product features, brand positioning, or target customer demographics. If the assumed pricing strategy proves unsustainable in the face of market competition, the financial projections will need to be revised. Transparency regarding pricing assumptions allows stakeholders to assess the feasibility and potential risks associated with the chosen pricing strategy.

- Cost of Goods Sold (COGS)Assumptions related to the cost of producing goods or delivering services directly impact profitability calculations. A manufacturing company might assume a certain cost for raw materials based on existing supplier contracts. However, fluctuations in commodity prices or changes in supplier relationships could impact these costs. Clearly stating the assumed COGS and the factors influencing it allows stakeholders to understand the potential variability in profitability projections.

- Operating ExpensesAssumptions about operating expenses, such as rent, salaries, and marketing costs, are crucial for projecting overall profitability and cash flow. A rapidly expanding company might assume a significant increase in operating expenses to support its growth. These assumptions must be justified by factors such as hiring plans, office space expansion, and marketing campaigns. Transparent articulation of operating expense assumptions allows stakeholders to assess the scalability and efficiency of the business model.

By clearly articulating and justifying these key assumptions, a statement of financial viability gains credibility and provides stakeholders with a comprehensive understanding of the underlying factors driving the financial projections. This transparency facilitates informed decision-making and allows for a more robust assessment of potential risks and opportunities, ultimately strengthening the overall viability assessment.

5. Sensitivity Analysis

Sensitivity analysis is a crucial component of a robust statement of financial viability template. It explores the impact of variations in key assumptions on the overall financial projections. By systematically changing these assumptions and observing the resulting effects on key financial metrics, such as profitability and cash flow, sensitivity analysis provides valuable insights into the potential risks and opportunities associated with a particular project or venture. This process enhances the understanding of the robustness and reliability of the financial projections, ultimately leading to better informed decision-making.

- Impact of Revenue FluctuationsSensitivity analysis can assess the impact of changes in projected revenue on overall profitability and cash flow. For example, a business might analyze the effect of a 10% decrease in sales on its net income and cash reserves. This analysis could reveal the business’s vulnerability to market downturns and inform strategies for mitigating potential losses. A restaurant, for instance, might discover that a small decrease in customer traffic could significantly impact its profitability, highlighting the need for strategies to maintain consistent customer flow.

- Effect of Cost VariationsAnalyzing the sensitivity of financial projections to changes in costs, such as raw materials, labor, or operating expenses, provides valuable insights into cost management strategies. For example, a manufacturing company could analyze how a 15% increase in raw material prices would affect its gross profit margin. This analysis might lead to exploring alternative suppliers, negotiating better contracts, or implementing cost-saving measures in the production process. A construction company, similarly, might analyze the impact of fluctuating lumber prices on project profitability.

- Influence of Discount RatesSensitivity analysis can be used to assess the impact of changes in discount rates on the net present value (NPV) of a project. The discount rate reflects the time value of money and the risk associated with future cash flows. A higher discount rate indicates higher risk and reduces the present value of future cash flows. Analyzing the sensitivity of NPV to different discount rates helps assess the project’s viability under various risk scenarios. This is particularly important for long-term projects where the time value of money has a significant impact.

- Impact of Market Share ChangesFor businesses operating in competitive markets, analyzing the sensitivity of financial projections to changes in market share can be crucial. A small change in market share can significantly impact revenue and profitability. Sensitivity analysis can help businesses understand the potential impact of competitive pressures and inform strategies for maintaining or gaining market share. A telecommunications company, for example, might analyze how a 2% loss in market share would affect its overall revenue and profitability.

By incorporating sensitivity analysis into a statement of financial viability template, organizations demonstrate a thorough understanding of potential risks and opportunities. This analysis provides a more nuanced view of the financial projections, allowing stakeholders to make more informed decisions and enhancing the overall credibility of the viability assessment. It moves beyond presenting static projections and provides a dynamic understanding of the interplay between key assumptions and financial outcomes, ultimately leading to a more robust and reliable assessment of long-term sustainability.

6. Funding Requirements

A crucial aspect of a statement of financial viability template lies in its ability to clearly articulate funding requirements. This section bridges the gap between projected financial performance and the resources needed to achieve those projections. A well-defined articulation of funding requirements demonstrates a clear understanding of financial needs, enhances transparency, and increases the likelihood of securing necessary capital. It provides potential investors and lenders with a concrete understanding of how much funding is required, when it is needed, and how it will be utilized to achieve the projected financial outcomes.

- Startup CostsStartup costs represent the initial capital required to launch a new business or project. These costs can include expenses related to product development, marketing, initial inventory, equipment purchases, and recruitment. Clearly outlining these startup costs in the statement of financial viability is essential for attracting seed funding or securing early-stage investment. For example, a new software company might require funding for software development, marketing campaigns, and hiring initial staff. A detailed breakdown of these startup costs demonstrates preparedness and provides investors with a clear picture of the initial investment required.

- Working Capital NeedsWorking capital refers to the funds required to cover day-to-day operational expenses and maintain sufficient liquidity. A statement of financial viability must accurately project working capital needs, considering factors such as inventory management, accounts receivable and payable cycles, and seasonal fluctuations in sales. For instance, a retail business might require higher working capital during peak seasons to manage increased inventory levels and extended payment terms offered to customers. Clearly articulating these working capital needs demonstrates an understanding of cash flow dynamics and allows for informed financial planning.

- Growth Capital RequirementsGrowth capital is required to finance expansion plans, such as increasing production capacity, entering new markets, or acquiring other businesses. A statement of financial viability should clearly outline these growth capital requirements, linking them to specific strategic initiatives and demonstrating how these investments will contribute to future revenue growth and profitability. For example, a manufacturing company might require growth capital to invest in new equipment and expand its production facility to meet increasing demand. Clearly articulating these growth capital requirements and their projected return on investment strengthens the case for securing funding.

- Debt Servicing RequirementsIf the financial plan involves debt financing, the statement of financial viability must clearly outline the projected debt servicing requirements, including principal and interest payments. This demonstrates an understanding of debt obligations and reassures lenders about the organization’s ability to repay its debts. For instance, a real estate development project financed through a bank loan must demonstrate its ability to generate sufficient cash flow to cover the loan repayments. Transparent articulation of debt servicing requirements builds confidence and strengthens the credibility of the financial plan.

By clearly articulating these various funding requirements, a statement of financial viability provides a comprehensive overview of the resources needed to achieve projected financial outcomes. This transparency enhances the credibility of the financial plan and increases the likelihood of securing funding from investors or lenders. A well-defined explanation of how these funds will be utilized, coupled with realistic financial projections, demonstrates a clear understanding of financial needs and instills confidence in stakeholders regarding the long-term sustainability of the venture.

Key Components of a Statement of Financial Viability Template

A comprehensive statement of financial viability requires careful consideration of several key components. These elements work together to provide a holistic view of an organization’s financial health and long-term sustainability.

1. Executive Summary: A concise overview of the organization, its mission, and the purpose of the financial viability statement provides context and sets the stage for the detailed financial information that follows. This summary should highlight key financial projections and funding requirements.

2. Market Analysis: A thorough analysis of the target market, including market size, growth potential, competitive landscape, and key market trends, provides a foundation for realistic revenue projections and informs strategic decision-making. This analysis demonstrates an understanding of the market dynamics and the organization’s position within it.

3. Products and Services: A clear description of the products or services offered, including pricing strategies, target customer segments, and competitive advantages, clarifies the revenue-generating activities and demonstrates the value proposition offered to customers. This section should highlight key differentiators and demonstrate a clear understanding of the target audience.

4. Revenue Projections: Realistic and well-justified revenue projections, based on market analysis, pricing strategies, and sales forecasts, form the basis for assessing long-term financial sustainability. This section should demonstrate a clear understanding of revenue drivers and provide a detailed breakdown of projected income streams.

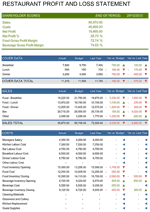

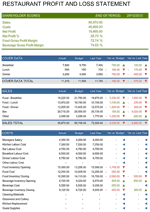

5. Expense Forecasting: A detailed breakdown of anticipated expenses, including operating expenses, capital expenditures, and contingency planning, demonstrates responsible financial management and allows for accurate profitability calculations. This section should provide a comprehensive view of all anticipated costs.

6. Cash Flow Projections: Projecting the movement of cash into and out of the organization over a specific period provides insights into short-term liquidity and long-term solvency. This analysis is crucial for assessing the ability to meet financial obligations and fund future growth.

7. Funding Requirements: A clear articulation of funding requirements, including startup costs, working capital needs, and growth capital requirements, demonstrates a clear understanding of financial needs and enhances transparency for potential investors or lenders. This section should specify the amount of funding required, the purpose of the funding, and the proposed use of funds.

8. Key Assumptions: Explicitly stating and justifying the key assumptions underlying the financial projections enhances transparency and allows stakeholders to understand the basis for the financial analysis. This includes assumptions about market growth rates, pricing strategies, and cost of goods sold.

9. Sensitivity Analysis: Exploring the impact of variations in key assumptions on the overall financial projections demonstrates an understanding of potential risks and opportunities, enhancing the credibility of the viability assessment.

These components, when presented cohesively and supported by thorough analysis, provide a comprehensive view of an organization’s financial outlook, enabling stakeholders to make informed decisions regarding its long-term viability and potential for success. A robust and well-structured statement instills confidence and serves as a valuable tool for strategic planning and resource allocation.

How to Create a Statement of Financial Viability Template

Developing a robust statement of financial viability requires a structured approach and careful consideration of key financial elements. The following steps outline the process for creating a comprehensive and persuasive document.

1. Define the Scope and Purpose: Clearly define the scope of the statement, including the timeframe it covers (e.g., three years, five years) and the specific purpose it serves (e.g., securing funding, attracting investors, internal planning). A well-defined scope ensures focus and relevance.

2. Conduct Thorough Market Research: Analyze the target market, including market size, growth potential, competitive landscape, and key trends. This research provides a foundation for realistic revenue projections and informs strategic decision-making. Robust market analysis demonstrates an understanding of market dynamics.

3. Develop Realistic Revenue Projections: Based on market research, pricing strategies, and sales forecasts, project anticipated revenue streams. Clearly articulate the underlying assumptions and methodologies used in developing these projections. Justifiable revenue projections build credibility.

4. Forecast Expenses Meticulously: Project all anticipated expenses, including operating expenses, capital expenditures, and contingency planning. A detailed breakdown of expenses demonstrates responsible financial management. Consider cost optimization strategies to maximize profitability.

5. Project Cash Flow Dynamics: Develop cash flow projections to illustrate the anticipated movement of money into and out of the organization over the specified timeframe. This analysis is essential for assessing short-term liquidity and long-term solvency.

6. Articulate Funding Requirements: Clearly specify the amount of funding required, the purpose of the funding, and the proposed use of funds. This transparency enhances credibility and facilitates informed decision-making by potential investors or lenders.

7. Document Key Assumptions: Explicitly state and justify all key assumptions underlying the financial projections. This transparency allows stakeholders to understand the basis of the financial analysis and assess potential risks and opportunities.

8. Conduct Sensitivity Analysis: Explore the impact of variations in key assumptions on the overall financial projections. Sensitivity analysis provides valuable insights into the robustness and reliability of the financial plan.

9. Review and Refine: Thoroughly review and refine the statement to ensure accuracy, consistency, and clarity. A well-presented and error-free document enhances professionalism and credibility.

By following these steps, organizations can create a comprehensive and persuasive statement of financial viability that serves as a valuable tool for strategic planning, resource allocation, and securing necessary capital. The meticulous consideration of each element contributes to a robust and reliable assessment of long-term sustainability.

A well-crafted framework for assessing long-term financial health provides a crucial foundation for decision-making, resource allocation, and stakeholder engagement. Its components, ranging from market analysis and revenue projections to expense forecasting and cash flow analysis, offer a comprehensive view of an organization’s financial outlook. Sensitivity analysis and clearly articulated assumptions further enhance the robustness and transparency of the process, enabling informed assessments of potential risks and opportunities. A meticulous approach to developing such a framework empowers organizations to demonstrate financial viability, secure necessary capital, and navigate the complexities of the financial landscape.

Ultimately, a robust framework for financial viability serves as a roadmap for sustainable growth and long-term success. It equips organizations with the insights needed to make informed decisions, adapt to changing market conditions, and achieve their strategic objectives. The ability to articulate a clear and compelling financial narrative is essential for attracting investors, securing funding, and building long-term stakeholder confidence. It represents a commitment to responsible financial management and provides a solid foundation for navigating the challenges and opportunities that lie ahead.