Utilizing a pre-designed structure for this combined report offers several advantages. It ensures consistency in reporting, simplifies the process of compiling financial data, and reduces the risk of errors. This standardized format facilitates comparisons across different periods and allows stakeholders to quickly grasp key financial metrics. Moreover, it aids in informed decision-making regarding investments, budgeting, and overall financial strategy.

The following sections will delve into the specific components of this essential financial report, providing a detailed explanation of its structure, calculations, and interpretation. This comprehensive guide will equip readers with the knowledge necessary to understand and effectively utilize this powerful tool for financial analysis.

1. Standardized Format

A standardized format is fundamental to the utility of a statement of income and retained earnings template. Consistency in presentation allows for efficient analysis and comparison of financial data across different reporting periods. This standardization ensures that key figures, such as revenue, expenses, net income, and retained earnings, are presented in a predictable and readily understandable manner. Without a standardized structure, extracting meaningful insights and tracking trends becomes significantly more challenging. For instance, comparing year-over-year performance requires consistent categorization and presentation of financial data, which a standardized template provides.

Adhering to a standardized format also enhances the comparability of financial performance between different companies within the same industry. Investors and analysts rely on standardized reports to assess relative profitability and financial health. A consistent structure facilitates benchmarking and enables informed investment decisions. Imagine trying to compare the performance of two companies using vastly different reporting formats; the process would be cumbersome and prone to misinterpretation. Standardization mitigates this issue and promotes transparency in financial reporting.

Furthermore, a standardized format simplifies the auditing process. Auditors can more efficiently verify the accuracy and completeness of financial information when presented in a consistent and predictable manner. This reduces the risk of errors and strengthens the reliability of the reported financial data. In conclusion, a standardized format is not merely a convenient feature but a critical component ensuring the effectiveness and reliability of the statement of income and retained earnings template. It empowers stakeholders to make informed decisions based on clear, comparable, and auditable financial information.

2. Financial Performance Overview

A financial performance overview, derived from a statement of income and retained earnings template, provides a concise yet comprehensive summary of a company’s profitability and earnings distribution over a specific period. This overview acts as a crucial lens through which stakeholders can assess the financial health and sustainability of an organization. The statement serves as the foundation, offering the raw data revenues, expenses, net income while the overview distills these figures into actionable insights. This connection is essential for understanding the overall financial trajectory of a company. For example, a consistent increase in net income, reflected in the overview, indicates successful business operations and potentially strong future growth.

The importance of a financial performance overview as a component of the combined statement lies in its ability to translate complex financial data into a readily digestible format. Instead of sifting through detailed figures, stakeholders can quickly grasp key performance indicators, such as profit margins, revenue growth, and return on equity. This overview facilitates informed decision-making by highlighting trends and potential areas of concern. For instance, declining profit margins, readily apparent in the overview, might signal increased competition or escalating operational costs, prompting management to investigate and implement corrective strategies.

Understanding the relationship between a financial performance overview and its underlying statement empowers stakeholders to evaluate a company’s financial health effectively. While the statement provides the granular details, the overview offers a synthesized perspective, enabling efficient analysis and informed decision-making. Challenges may arise in interpreting the overview without a thorough understanding of the underlying accounting principles. However, by combining the overview with detailed analysis of the statement, stakeholders gain a comprehensive understanding of a company’s current financial position and its potential for future growth, contributing significantly to strategic planning and investment decisions.

3. Income Statement Data

Income statement data forms the foundation of a statement of income and retained earnings template. This data, detailing revenues, costs of goods sold, operating expenses, and other income and expenses, culminates in the net income or loss figure. This figure is not merely an endpoint but a crucial link to the retained earnings portion of the combined statement. Net income increases retained earnings, while a net loss decreases them. This direct relationship underscores the importance of accurate and comprehensive income statement data. For instance, misrepresenting revenue would inflate net income, leading to an overstatement of retained earnings and a distorted view of a company’s financial health.

The flow of income statement data into the retained earnings calculation demonstrates the integrated nature of the combined statement. Changes in revenue or expenses directly impact retained earnings, illustrating the dynamic relationship between profitability and shareholder equity. Consider a scenario where a company experiences a significant increase in operating expenses. This would reduce net income, consequently lowering the amount added to retained earnings. Analyzing this interconnectedness allows stakeholders to understand how operational decisions impact a company’s overall financial position and its ability to reinvest profits or distribute dividends.

Accurately interpreting a statement of income and retained earnings requires a thorough understanding of the underlying income statement data. This data provides the context for evaluating retained earnings and understanding the factors driving its changes. Challenges may arise when income statement data is incomplete or inaccurate. However, by critically analyzing this data, stakeholders gain valuable insights into a company’s operational efficiency, profitability, and its ability to generate sustainable earnings, essential for informed investment decisions and strategic planning.

4. Retained Earnings Calculation

The retained earnings calculation is a pivotal component of the statement of income and retained earnings template, bridging the gap between a company’s profitability and its accumulated shareholder equity. This calculation reveals how much of a company’s profits are reinvested back into the business rather than distributed as dividends. Understanding this dynamic is crucial for assessing long-term growth potential and financial stability. A robust retained earnings balance often signals a company’s commitment to reinvestment and future expansion.

- Beginning Retained EarningsThe starting point for the retained earnings calculation is the balance from the end of the previous accounting period. This figure represents the accumulated profits not yet distributed to shareholders. For example, if a company had retained earnings of $100,000 at the end of the previous year, that amount becomes the beginning retained earnings for the current year. This provides context for evaluating the current period’s performance and the overall trend in retained earnings growth.

- Net Income or LossThe net income or loss from the income statement directly impacts retained earnings. Net income increases retained earnings, while a net loss decreases them. Suppose a company generates a net income of $50,000 during the current period. This amount is added to the beginning retained earnings. Conversely, a net loss of $20,000 would be subtracted. This direct link highlights the importance of accurate income reporting for a meaningful retained earnings calculation.

- DividendsDividends paid to shareholders reduce retained earnings. These distributions represent a return of profits to investors, reducing the amount reinvested in the business. If a company distributes $10,000 in dividends, this amount is subtracted from the retained earnings. Analyzing the proportion of earnings paid out as dividends versus the amount retained provides insight into a company’s dividend policy and its implications for future growth.

- Ending Retained EarningsThe ending retained earnings represent the cumulative profits retained in the business after accounting for net income/loss and dividend distributions. This figure becomes the beginning retained earnings for the next accounting period, creating a continuous chain of retained earnings calculations. For example, if beginning retained earnings were $100,000, net income was $50,000, and dividends were $10,000, the ending retained earnings would be $140,000. This figure represents the company’s accumulated reinvestment potential and its overall financial strength.

Within the statement of income and retained earnings template, the retained earnings calculation offers a critical view of a company’s financial strategy. By analyzing the changes in retained earnings over time, stakeholders can assess the company’s ability to reinvest profits, fund future growth, and provide returns to shareholders. This dynamic interplay between profitability, reinvestment, and distributions forms a cornerstone of long-term financial health and sustainability, making the retained earnings calculation a vital element of financial statement analysis.

5. Shareholder Equity Impact

Shareholder equity, representing the owners’ stake in a company, is significantly influenced by the information presented within a statement of income and retained earnings template. This statement provides a dynamic view of how profits and their allocation directly impact the value of ownership. Understanding this connection is crucial for investors assessing a company’s financial health and long-term growth potential. The template serves as a crucial tool for tracking these changes and understanding their implications for shareholder value.

- Retained Earnings ContributionRetained earnings, a key component of shareholder equity, represent the accumulated profits reinvested in the business. The statement of income and retained earnings template details how net income, after accounting for dividends, flows into retained earnings, increasing or decreasing shareholder equity. For example, consistent profitability, reflected in increasing retained earnings within the statement, strengthens shareholder equity, signifying a growing ownership stake. Conversely, sustained losses deplete retained earnings, diminishing shareholder equity.

- Dividend DistributionsDividends, distributions of profits to shareholders, represent a return on investment and directly reduce retained earnings, impacting shareholder equity. The statement clearly outlines dividend payments, allowing investors to understand the proportion of profits returned versus the amount reinvested for growth. A high dividend payout ratio, evident in the statement, may be attractive to income-seeking investors but could limit a company’s ability to reinvest and grow, potentially affecting long-term shareholder value.

- Stock Issuances and RepurchasesWhile not directly reflected in the income statement, stock issuances and repurchases, which significantly impact shareholder equity, can be considered in conjunction with the statement to gain a comprehensive understanding of equity changes. Issuing new shares dilutes existing ownership, while repurchasing shares increases the ownership stake of remaining shareholders. Analyzing these actions alongside retained earnings provides a more complete picture of shareholder equity dynamics.

- Comprehensive Income ImpactComprehensive income, encompassing net income and other comprehensive income items like unrealized gains or losses on available-for-sale securities, affects shareholder equity. While the standard template primarily focuses on net income, understanding the broader impact of comprehensive income provides a more nuanced view of how overall financial performance influences shareholder value. Significant fluctuations in other comprehensive income, even if not affecting net income, can still impact the overall value of shareholder equity.

The statement of income and retained earnings template offers valuable insights into the factors influencing shareholder equity. By analyzing the interplay of retained earnings, dividends, and net income, stakeholders gain a deeper understanding of a company’s financial performance and its implications for ownership value. Evaluating this information within the broader context of stock issuances, repurchases, and comprehensive income provides a comprehensive assessment of shareholder equity dynamics and its role in long-term investment decisions.

6. Comparative Analysis

Comparative analysis is essential for extracting meaningful insights from a statement of income and retained earnings template. Examining financial data across multiple reporting periods reveals trends, identifies potential issues, and facilitates informed decision-making. This comparative approach allows stakeholders to assess a company’s progress, stability, and overall financial trajectory. Without comparative analysis, the template provides a snapshot of a single period, limiting the ability to understand performance changes and predict future outcomes. For instance, a single period of high net income may appear positive in isolation, but comparing it to previous periods reveals whether this performance is sustainable or an anomaly. Similarly, analyzing changes in retained earnings over time provides insights into a company’s reinvestment strategy and its long-term growth potential.

The practical application of comparative analysis extends beyond simple trend identification. Comparing current performance to industry benchmarks allows stakeholders to assess a company’s competitive position and identify areas for improvement. Suppose a company’s profit margin consistently lags behind its competitors. Comparative analysis reveals this weakness, prompting management to investigate the underlying causes, such as high operating costs or inefficient pricing strategies. Furthermore, comparing key financial ratios, such as return on equity or debt-to-equity ratio, across different periods provides a comprehensive view of financial health and risk. A consistently increasing debt-to-equity ratio, identified through comparative analysis, may indicate growing financial risk and warrant further investigation.

In conclusion, comparative analysis is not merely a supplementary tool but an integral component of utilizing a statement of income and retained earnings template effectively. It transforms static financial data into dynamic insights, enabling stakeholders to understand past performance, assess current financial health, and make informed predictions about the future. While the template provides the raw data, comparative analysis unlocks its true value. Challenges in conducting comparative analysis can arise from inconsistencies in accounting practices or changes in reporting standards across periods. Addressing these challenges requires careful data normalization and a thorough understanding of the underlying accounting principles. By incorporating rigorous comparative analysis, stakeholders gain a comprehensive understanding of a company’s financial performance and its position within the broader economic landscape, enhancing the value of the statement as a tool for strategic decision-making.

Key Components of a Statement of Income and Retained Earnings Template

A comprehensive understanding of a combined statement of income and retained earnings requires a detailed examination of its key components. These elements work together to provide a holistic view of a company’s financial performance and the allocation of its earnings.

1. Heading: The heading clearly identifies the company name, the statement type (Statement of Income and Retained Earnings), and the reporting period. Accurate identification ensures clarity and facilitates proper filing and retrieval.

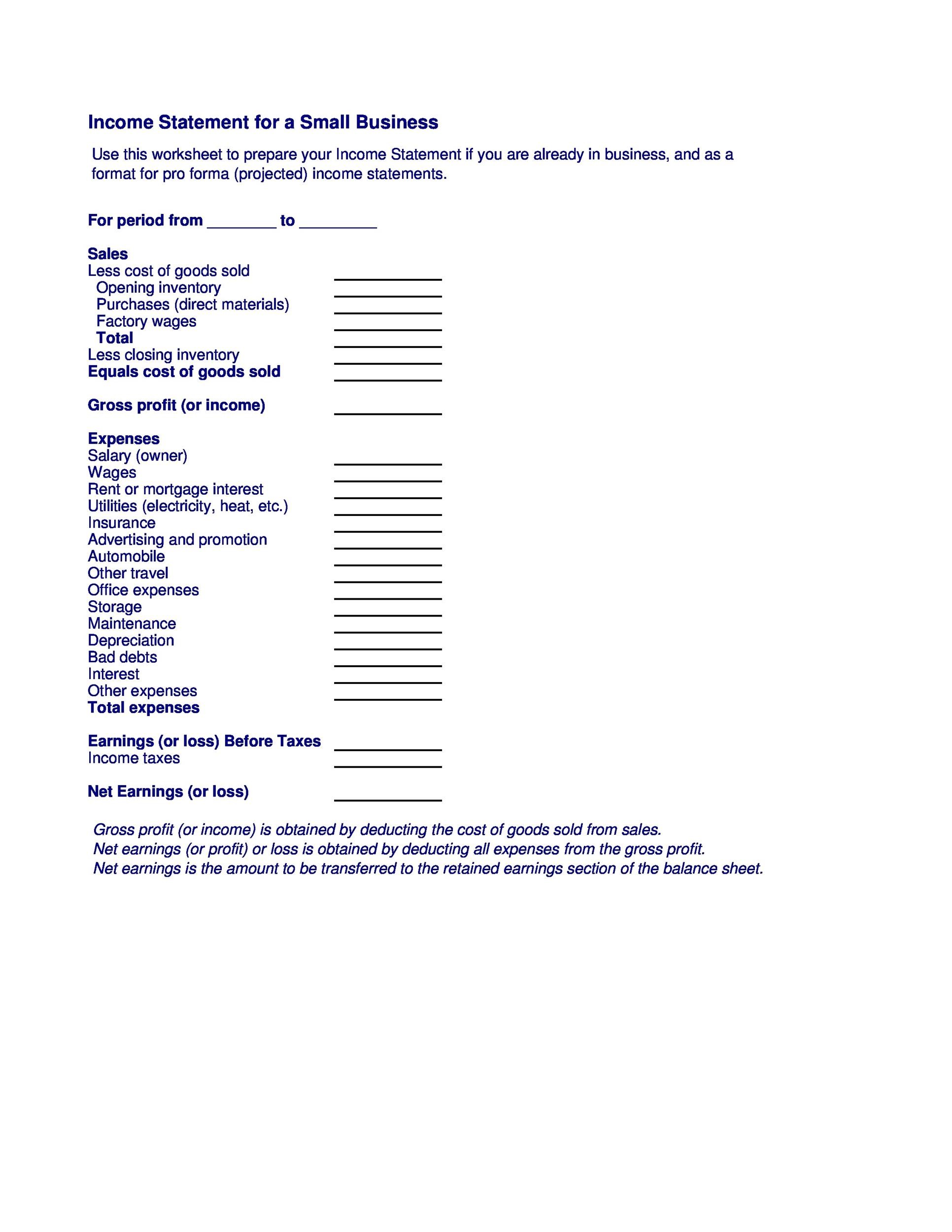

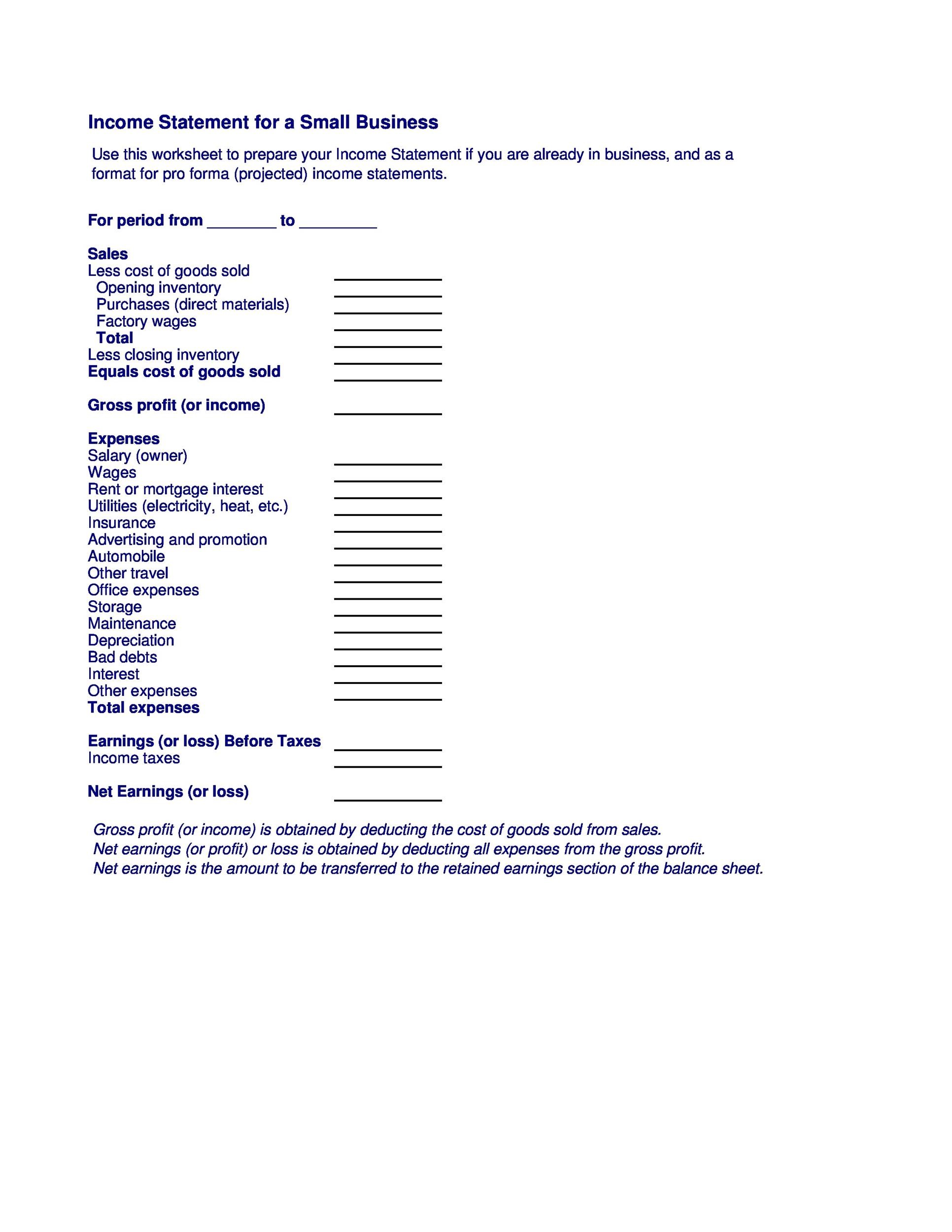

2. Income Statement Section: This section presents revenues earned, costs of goods sold (if applicable), operating expenses, and other income and expenses. The resulting net income or loss is a crucial figure that feeds directly into the retained earnings calculation.

3. Retained Earnings Section: This section details the beginning retained earnings balance, net income or loss from the income statement, dividends declared, and the resulting ending retained earnings balance. It demonstrates how profits are either reinvested in the business or distributed to shareholders.

4. Comprehensive Income (Optional): While not always included, a section for comprehensive income may be present. This section reports other comprehensive income items, such as unrealized gains or losses on certain investments, which impact shareholder equity but are not included in net income.

5. Notes (Footnotes): Accompanying notes provide detailed explanations of accounting policies, significant transactions, and other relevant information that enhance understanding of the financial data presented in the statement.

6. Comparative Figures: Often, prior period figures are presented alongside the current period data. This facilitates comparative analysis, enabling trend identification and assessment of financial performance over time.

These interconnected components provide a robust framework for analyzing a company’s financial performance, profitability, and the allocation of its earnings. The statement offers crucial insights for both internal management and external stakeholders, enabling informed decision-making regarding investment, resource allocation, and overall financial strategy.

How to Create a Statement of Income and Retained Earnings Template

Creating a statement of income and retained earnings template involves structuring key financial data elements in a standardized format. This structured approach ensures clarity, consistency, and facilitates comparative analysis across reporting periods. The following steps outline the process of creating a robust and informative template.

1: Define the Reporting Period: Specify the precise start and end dates for the financial period covered by the statement. Accurate date definition ensures data relevance and comparability.

2: Structure the Income Statement Section: Begin with revenue, followed by cost of goods sold (if applicable), then delineate operating expenses. Calculate the gross profit (revenue less cost of goods sold) and operating income (gross profit less operating expenses). Account for other income and expenses, such as interest income or expense, to arrive at net income or loss.

3: Develop the Retained Earnings Section: Begin with the beginning retained earnings balance from the end of the previous period. Add net income (or subtract net loss) calculated in the income statement section. Subtract any dividends declared during the period. The resulting figure represents the ending retained earnings balance.

4: Incorporate Comprehensive Income (Optional): If applicable, include a section for comprehensive income. This section reports items that impact shareholder equity but are not included in net income, such as unrealized gains or losses on available-for-sale securities. This provides a more holistic view of changes in equity.

5: Include Notes (Footnotes): Allocate space for explanatory notes. These notes provide crucial details about accounting policies, significant transactions, or any unusual items affecting the reported figures. Comprehensive notes enhance transparency and understanding.

6: Add Comparative Figures: Incorporate columns for prior period data. Presenting comparative figures facilitates trend analysis and provides valuable context for evaluating current performance. Consistent formatting ensures comparability.

7: Format for Clarity: Use clear headings and subheadings. Maintain consistent formatting for numerical values, including currency symbols and decimal places. Ensure proper alignment and spacing to enhance readability and professional presentation.

8: Review and Refine: Thoroughly review the template for accuracy and completeness. Ensure all formulas and calculations are correct. Refine the formatting as needed to optimize clarity and usability.

A well-structured statement of income and retained earnings template provides a clear and concise overview of a company’s financial performance and the allocation of its earnings. This template becomes a valuable tool for internal management, investors, and other stakeholders seeking to understand a company’s financial health and potential for future growth. Regular review and refinement ensure ongoing accuracy and relevance.

Careful analysis of a standardized financial document combining income and retained earnings data provides crucial insights into a company’s profitability, earnings distribution, and overall financial health. Understanding the interconnectedness of revenue, expenses, net income, and retained earnings, as presented within this structured format, allows stakeholders to assess a company’s ability to generate sustainable earnings, reinvest profits for future growth, and provide returns to investors. The standardized format facilitates comparisons across different periods and against industry benchmarks, enabling informed decision-making regarding investment, resource allocation, and strategic planning.

Effective utilization of this combined statement requires not only a thorough understanding of its individual components but also a commitment to rigorous comparative analysis and interpretation. This document serves as a cornerstone of financial transparency and accountability, empowering stakeholders to make informed decisions that contribute to long-term financial success. Continued emphasis on accurate data collection, consistent reporting practices, and insightful analysis will further enhance the value and utility of this essential financial tool.