Utilizing such a framework offers several advantages. It streamlines the process of creating financial reports, reducing the time and effort required. The standardized structure enhances clarity and understanding for both internal and external users, including investors, lenders, and management. Furthermore, it promotes accuracy by ensuring all essential financial elements are consistently captured. Regularly generated reports using this consistent framework allow for trend analysis and informed decision-making based on a clear picture of profitability and expense management.

This overview provides a foundation for a deeper exploration of key financial concepts. Further discussion will cover creating, interpreting, and using these reports for effective financial management, analysis, and strategic planning. Topics will include best practices, common challenges, and how these reports integrate with broader financial statements.

1. Standardized Format

Standardized formatting is fundamental to the efficacy of profit and loss reporting. Consistency in presentation ensures clear communication of financial performance to stakeholders and facilitates meaningful comparisons across periods and against industry benchmarks. A structured approach allows for efficient analysis and reduces the risk of misinterpretation.

- Uniformity of PresentationUniformity ensures that all elementsrevenues, expenses, and calculationsare presented consistently across reporting periods. This consistency allows for accurate trend analysis and performance evaluation over time. For example, consistently classifying operating expenses enables accurate tracking of changes in these costs.

- ComparabilityA standardized format allows for comparisons between different companies within the same industry. This benchmarking provides insights into relative performance and identifies areas for potential improvement. Investors and analysts rely on comparable data for informed decision-making.

- Regulatory ComplianceAdhering to established accounting principles and reporting standards ensures legal compliance and builds trust with stakeholders. These standards dictate specific formatting and disclosure requirements, ensuring transparency and accountability.

- Efficiency of AnalysisA predictable structure simplifies the analysis process for both internal and external users. Analysts can quickly locate key figures and assess financial health without needing to decipher variations in presentation. This efficiency supports timely decision-making.

These facets of standardized formatting contribute to the overall value and reliability of profit and loss statements. By ensuring consistency, comparability, compliance, and efficiency, a standardized template enhances transparency and provides a solid foundation for informed financial analysis and strategic planning. This, in turn, strengthens stakeholder confidence and supports effective resource allocation.

2. Financial Performance Overview

A financial performance overview provides a concise summary of an organization’s profitability over a specified period. The statement of profit or loss template serves as the foundation for this overview, structuring the presentation of revenues, expenses, and the resulting net income or loss. This structured presentation facilitates a rapid understanding of financial health, enabling stakeholders to assess operational efficiency and profitability trends.

The template’s standardized format ensures consistent reporting, allowing for meaningful comparisons across different periods. For example, comparing the net income of consecutive quarters reveals potential growth or decline. Furthermore, analyzing individual line items within the template, such as cost of goods sold or operating expenses, provides insights into specific areas impacting profitability. A rising cost of goods sold, for instance, might signal inefficiencies in the supply chain or increasing raw material prices. This granular analysis enables management to identify areas requiring attention and implement corrective measures.

A comprehensive understanding of the relationship between a financial performance overview and the underlying statement of profit or loss template is crucial for effective financial management. This understanding allows stakeholders to interpret financial results accurately, identify trends, and make informed decisions based on data-driven insights. Challenges may include data accuracy and interpretation, requiring robust internal controls and financial expertise. Ultimately, the template’s consistent structure empowers stakeholders to assess financial performance effectively, contributing to strategic planning and long-term financial sustainability.

3. Revenue and Expense Tracking

Accurate revenue and expense tracking forms the bedrock of a reliable statement of profit or loss. Meticulous recording of all financial transactions provides the raw data necessary for calculating key profitability metrics and understanding the financial health of an organization. Without comprehensive and precise tracking, the resulting financial statement may misrepresent the true financial position, leading to flawed decision-making.

- Comprehensive Data CaptureComprehensive data capture ensures all revenue streams and expense categories are recorded. This includes sales revenue, investment income, cost of goods sold, operating expenses, and other relevant financial activities. For example, a retail business must track sales from various channels (online, in-store) and expenses such as rent, salaries, and inventory costs. Omitting any of these elements would distort the overall financial picture presented in the profit and loss statement.

- Accurate CategorizationAccurate categorization ensures that each transaction is assigned to the correct account. Proper classification is essential for meaningful analysis and reporting. Misclassifying expenses, such as assigning marketing costs to administrative overhead, can lead to inaccurate assessments of departmental performance and overall profitability. Consistent application of accounting standards ensures uniformity and comparability.

- Timely RecordingTimely recording of transactions prevents data loss and ensures that the financial statement accurately reflects the organization’s financial position at a given point in time. Delayed recording can lead to discrepancies and inaccuracies in the reported figures. For instance, delaying the recording of invoices can misrepresent the current accounts receivable balance, impacting the assessment of short-term liquidity.

- Verification and ReconciliationVerification and reconciliation processes ensure the accuracy and integrity of the recorded data. Regular reconciliation of bank statements and internal records identifies and rectifies discrepancies, preventing errors from propagating to the final financial statement. This process also helps detect potential fraud and strengthens internal controls.

These facets of revenue and expense tracking directly impact the reliability and usefulness of the statement of profit or loss. By ensuring comprehensive data capture, accurate categorization, timely recording, and robust verification procedures, organizations can generate accurate and meaningful financial statements that support informed decision-making and contribute to long-term financial stability. Furthermore, consistent and reliable tracking simplifies audits and enhances stakeholder confidence in the reported financial performance.

4. Profitability Analysis

Profitability analysis relies heavily on the data presented within a statement of profit or loss template. The template provides a structured framework for organizing revenue and expense information, enabling the calculation of key profitability metrics such as gross profit margin, operating profit margin, and net profit margin. These metrics offer insights into an organization’s ability to generate profit from its core operations, manage operating expenses, and achieve overall profitability. Cause and effect relationships become clearer through this analysis. For example, a decrease in gross profit margin might stem from increased raw material costs or reduced selling prices, prompting further investigation into supply chain dynamics or pricing strategies. Examining operating expenses as a percentage of revenue can reveal areas of inefficiency or potential cost savings. For example, a rising sales, general, and administrative expense ratio could signal excessive overhead costs, prompting management to review staffing levels or operational processes.

The importance of profitability analysis as a component of understanding a statement of profit or loss cannot be overstated. Consider a manufacturing company analyzing its performance. The statement of profit or loss template provides the raw datarevenue from product sales, cost of goods sold (including raw materials, labor, and manufacturing overhead), and operating expenses. Profitability analysis then transforms this data into actionable insights. Calculating gross profit margin reveals the profitability of production, while operating profit margin assesses the efficiency of managing operating expenses. Net profit margin reflects the overall profitability after all expenses are considered. These insights are essential for evaluating the company’s financial health and identifying areas for improvement. For instance, a declining net profit margin despite increasing sales might point to rising operating expenses, prompting a review of cost control measures.

A deep understanding of the link between profitability analysis and the statement of profit or loss template is crucial for informed financial decision-making. This understanding equips stakeholders to identify trends, diagnose underlying issues affecting profitability, and develop strategies for improvement. Challenges in conducting profitability analysis can include data accuracy, consistency in applying accounting principles, and interpreting the results in the context of specific industry dynamics. However, overcoming these challenges yields significant benefits, including improved cost management, optimized pricing strategies, and enhanced overall financial performance, ultimately contributing to the long-term sustainability and success of the organization.

5. Key Performance Indicators (KPIs)

Key performance indicators (KPIs) provide quantifiable measures of performance across various aspects of an organization’s financial health. Derived from the data presented in the statement of profit or loss template, these KPIs offer valuable insights into profitability, operational efficiency, and overall financial performance. Understanding the relationship between KPIs and the statement of profit or loss is essential for effective financial analysis and informed decision-making.

- Gross Profit MarginGross profit margin, calculated as (Revenue – Cost of Goods Sold) / Revenue, reflects the profitability of core business operations after accounting for direct production costs. A declining gross profit margin might indicate rising raw material costs, inefficiencies in production processes, or pricing pressures. For example, a manufacturer experiencing a decrease in gross profit margin could investigate supply chain disruptions or explore cost-saving measures in the production process. Monitoring this KPI provides insights into the efficiency of production and pricing strategies.

- Operating Profit MarginOperating profit margin, calculated as Operating Income / Revenue, measures profitability after accounting for both direct production costs and operating expenses, such as sales, general, and administrative expenses. A decreasing operating profit margin might signal rising operating costs, prompting a review of overhead expenses or operational efficiencies. For instance, a retail company with a declining operating profit margin could analyze staffing levels, marketing expenditures, or rent costs to identify potential areas for cost reduction. This KPI helps assess the organization’s ability to manage operating expenses effectively.

- Net Profit MarginNet profit margin, calculated as Net Income / Revenue, represents the overall profitability after all expenses, including taxes and interest, are deducted. This KPI provides a comprehensive view of the organization’s bottom line. A declining net profit margin, even with growing revenue, could indicate increasing expenses or financial burdens. For example, a software company experiencing a shrinking net profit margin might analyze rising research and development costs or explore options for debt refinancing. Tracking net profit margin is crucial for assessing overall financial health and long-term sustainability.

- Return on Sales (ROS)Return on sales (ROS), similar to net profit margin, measures the net income generated for each dollar of sales revenue. This KPI provides a concise measure of profitability relative to sales volume. A declining ROS suggests reduced efficiency in converting sales into profit. For example, an e-commerce business experiencing a falling ROS could investigate increasing marketing costs, higher customer acquisition costs, or changing product mix. Monitoring ROS helps assess sales efficiency and profitability.

These KPIs, derived from the statement of profit or loss, provide critical insights into an organization’s financial performance. Analyzing these metrics over time and comparing them to industry benchmarks enables stakeholders to identify trends, diagnose potential problems, and make informed decisions to improve profitability, operational efficiency, and overall financial health. Understanding the interrelationship between these KPIs and the statement of profit or loss provides a comprehensive perspective on financial performance, contributing to effective financial management and long-term success.

6. Decision-Making Support

The statement of profit or loss template provides crucial data that supports informed decision-making across various business functions. By offering a structured view of revenues, expenses, and resulting profit or loss, the template facilitates analysis and informs strategic choices related to pricing, cost management, investment allocation, and overall business strategy. Its standardized format ensures consistency and comparability, enabling effective trend analysis and performance evaluation.

- Pricing StrategiesAnalysis of gross profit margins, derived from the statement of profit or loss, informs pricing decisions. Low margins may necessitate price adjustments or cost reduction strategies. For example, if a clothing retailer observes declining gross profit margins, analysis of the statement may reveal increasing raw material costs. This insight could lead to decisions to increase prices, source alternative suppliers, or adjust product designs to reduce material usage. The template provides the data foundation for these strategic pricing choices.

- Cost ManagementExamining operating expenses within the template allows for targeted cost control measures. Identifying areas of high expenditure relative to revenue can prompt initiatives to streamline operations, negotiate better supplier contracts, or optimize resource allocation. For instance, a restaurant analyzing its statement of profit or loss might identify escalating food costs. This could lead to decisions to renegotiate with suppliers, adjust menu offerings to feature more cost-effective ingredients, or implement stricter inventory control measures to minimize waste. The template facilitates this cost analysis and informs cost optimization strategies.

- Investment AllocationProfitability analysis derived from the template guides investment decisions. High-performing product lines or departments may warrant further investment for expansion or development, while underperforming areas might necessitate restructuring or divestment. Consider a technology company evaluating investment opportunities. Analysis of the statement of profit or loss may reveal that its cloud computing division exhibits strong profitability and growth potential. This insight could lead to decisions to allocate more resources towards expanding the cloud computing infrastructure, developing new cloud-based services, or acquiring complementary businesses. The template provides the financial justification for these investment choices.

- Performance EvaluationThe template serves as a benchmark for evaluating overall business performance. Comparing actual results against projected figures or prior periods allows for assessment of strategic initiatives and identification of areas needing corrective action. For example, if a manufacturing company’s actual net profit falls short of the projected figures outlined in its budget, analysis of the statement of profit or loss can pinpoint the source of the discrepancy. This might reveal lower-than-expected sales volumes, higher-than-anticipated production costs, or increased operating expenses. This analysis, facilitated by the template, enables management to implement corrective actions, such as adjusting sales strategies, streamlining production processes, or controlling overhead costs. The template provides the framework for this performance evaluation and subsequent adjustments.

The statement of profit or loss template plays a pivotal role in supporting effective decision-making. By providing a structured and comprehensive view of financial performance, the template empowers stakeholders to analyze key metrics, identify trends, and make informed decisions across various aspects of the business. From pricing strategies and cost management to investment allocation and performance evaluation, the template serves as a crucial tool for driving strategic planning, enhancing operational efficiency, and achieving financial objectives.

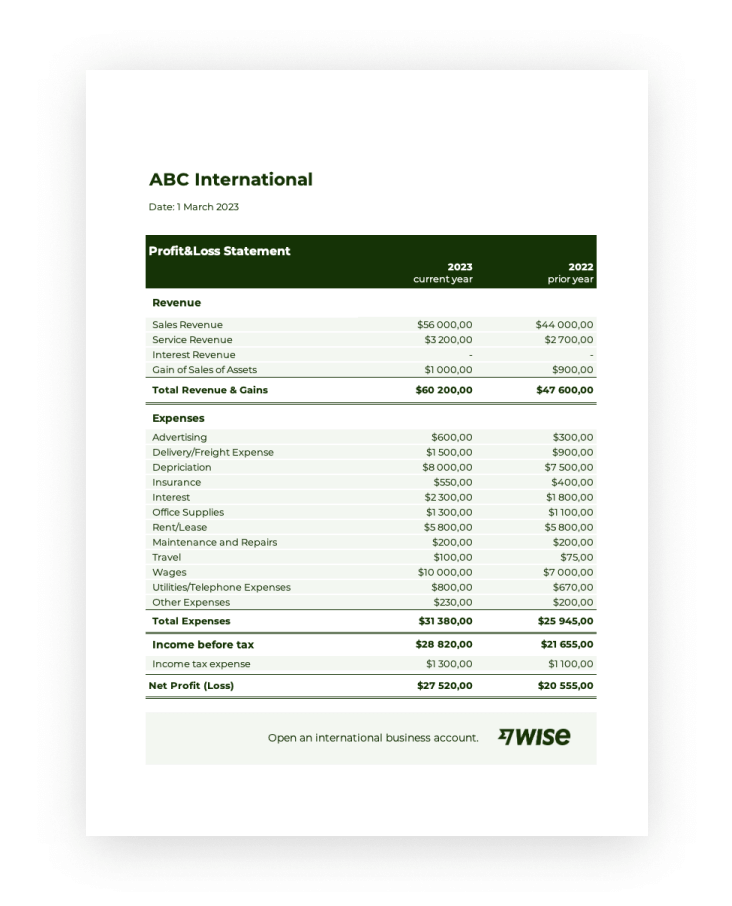

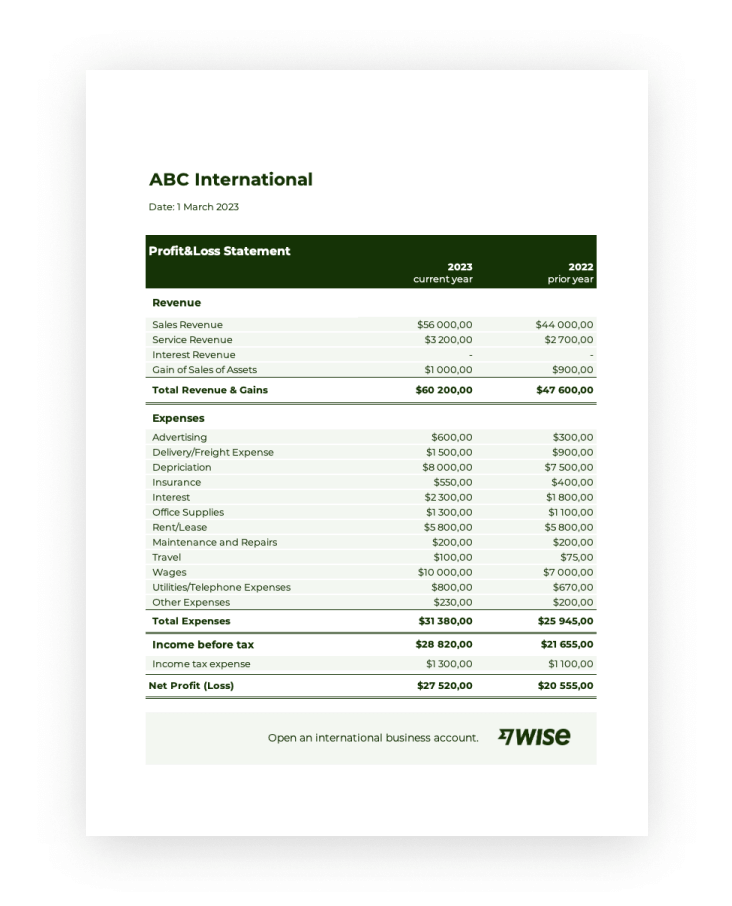

Key Components of a Statement of Profit or Loss Template

A comprehensive understanding of the key components within a statement of profit or loss template is essential for accurate financial reporting and analysis. These components provide a structured framework for presenting financial performance.

1. Revenue: This section details all income generated from the core business operations, including sales of goods or services. Various revenue streams should be clearly delineated to provide a transparent view of income sources.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit reflects the profitability of core operations before accounting for operating expenses. This metric provides insights into production efficiency and pricing strategies.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. Examples include salaries, rent, marketing, and administrative costs. Categorizing operating expenses provides insights into cost drivers.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income represents profitability from core business operations after accounting for all operating costs. This metric reflects the efficiency of managing operating expenses.

6. Other Income/Expenses: This section captures income or expenses not directly related to core operations, such as interest income, investment gains or losses, and one-time charges. These items provide a comprehensive view of financial performance beyond core activities.

7. Income Tax Expense: This represents the expense associated with income taxes. Accurate calculation ensures compliance with tax regulations and reflects the true net profit.

8. Net Income/Loss: Representing the bottom line, net income or loss is calculated as all revenues less all expenses. This key figure indicates the overall profitability of the organization during the reporting period.

These components, when presented within a standardized template, provide a clear and concise overview of an organization’s financial performance, enabling stakeholders to analyze profitability, assess operational efficiency, and make data-driven decisions.

How to Create a Statement of Profit or Loss Template

Creating a statement of profit or loss template involves structuring key financial components to present a clear and accurate overview of an organization’s performance over a specific period. This structured approach ensures consistency and facilitates analysis.

1. Define the Reporting Period: Clearly specify the timeframe covered by the statement, such as a month, quarter, or year. This provides context for the financial data presented.

2. Structure Revenue Categories: Establish distinct categories for different revenue streams. This allows for detailed tracking and analysis of income sources. For example, a software company might categorize revenue by product licenses, subscriptions, and professional services. This detailed breakdown provides granular insights into revenue generation.

3. Outline Cost of Goods Sold (COGS): If applicable, create a section for COGS, including subcategories for direct materials, direct labor, and manufacturing overhead. Accurate COGS categorization is crucial for manufacturing and retail businesses to determine gross profit and analyze production efficiency.

4. Categorize Operating Expenses: Establish clear categories for operating expenses, such as salaries, rent, marketing, and administrative costs. This structured approach allows for analysis of cost drivers and identification of potential cost-saving opportunities.

5. Incorporate Other Income and Expenses: Include sections for other income and expenses not directly related to core operations, such as interest income, investment gains/losses, and extraordinary items. This provides a comprehensive view of financial performance beyond core business activities.

6. Calculate Key Metrics: Include formulas for calculating key profitability metrics, such as gross profit (Revenue – COGS), operating income (Gross Profit – Operating Expenses), and net income (Operating Income + Other Income – Other Expenses – Income Tax Expense). These calculations provide insights into profitability at different levels of operation.

7. Ensure Formatting Consistency: Use a consistent format for headings, subheadings, numerical values, and currency symbols. This enhances readability and facilitates comparison across different reporting periods.

8. Implement Version Control: Track template versions to maintain a record of changes and ensure consistency in reporting over time. Version control is essential for maintaining accuracy and facilitating audits.

A well-designed template provides a clear, concise, and consistent view of financial performance. This structure facilitates analysis, informs strategic decision-making, and supports effective communication with stakeholders.

Financial reporting hinges on clear, concise, and consistent presentation of financial data. A standardized framework for organizing revenue and expenses, culminating in a net income or loss figure, provides crucial insights into an organization’s financial health. Understanding the components within this frameworkrevenue streams, cost of goods sold, operating expenses, and other income and expensesis fundamental for accurate reporting and analysis. This structured approach enables calculation of key performance indicators, including gross profit margin, operating profit margin, and net profit margin, which are essential for evaluating profitability and operational efficiency. Furthermore, this structured approach allows for informed decision-making related to pricing strategies, cost management, investment allocation, and overall business strategy. Effective utilization of such a framework contributes significantly to informed financial management, strategic planning, and long-term financial sustainability.

Accurate and insightful financial reporting is not merely a compliance requirement but a strategic imperative. Regularly generating and analyzing these statements, coupled with a thorough understanding of underlying trends and influencing factors, empowers organizations to proactively address challenges, capitalize on opportunities, and navigate the complexities of the business landscape. The ability to extract actionable insights from financial data is paramount for sustained growth and long-term success in any competitive market. Continual refinement of financial analysis techniques and a commitment to data-driven decision-making are essential for achieving financial objectives and ensuring long-term prosperity.