Navigating the financial landscape of construction projects can feel like a complex puzzle, especially when you’re a subcontractor eager to get paid for your hard work. Getting paid on time isn’t just a convenience; it’s the lifeblood of your business, ensuring you can cover your costs, pay your team, and take on new projects. One of the most crucial tools in your arsenal for achieving this financial clarity and efficiency is a well-structured payment application.

Think of the application for payment as your formal invoice, a detailed request outlining the work completed and the amount due for a specific period. It’s more than just a bill; it’s a professional document that communicates your progress and justifies your payment request to the general contractor or client. A clear, comprehensive application ensures there are no ambiguities, speeding up the approval process and minimizing potential disputes.

Why a Solid Payment Application is Your Best Friend

In the fast-paced world of construction, communication is key, and that extends especially to financial matters. A robust payment application isn’t just a formality; it’s a strategic tool that streamlines your financial operations and fosters trust with the general contractor. When your payment application is clear, concise, and complete, you make it easy for the general contractor to verify your progress, approve your request, and release funds promptly. This proactive approach helps avoid those frustrating back-and-forths that can delay payments and strain working relationships.

Imagine the general contractor’s perspective: they’re managing multiple subcontractors and numerous payment applications. A well-organized document from you saves them time and effort, making you a preferred partner. It reduces the chances of errors, omissions, or misunderstandings that often lead to payment delays or even disputes down the line. It truly is about making the process as smooth as possible for everyone involved.

Beyond just getting paid, a solid payment application serves as an invaluable record-keeping tool. It provides a clear audit trail of work completed, payments requested, and payments received, which is crucial for internal accounting, tax purposes, and resolving any future discrepancies. It also helps you stay compliant with project-specific payment terms and general construction industry standards.

Ultimately, a professional payment application template helps you present your requests with confidence and clarity, demonstrating your professionalism and commitment to proper financial management. It’s the foundation for healthy cash flow and sustained business growth. That’s why having a go-to subcontractor application for payment form template is so incredibly valuable.

Key Components to Look For in a Subcontractor Application For Payment Form Template

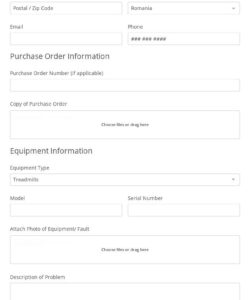

- Project Information: This includes the project name, number, address, and any specific identification codes.

- Subcontractor Details: Your company name, address, contact person, and tax identification number.

- General Contractor Information: The GC’s company name and contact details.

- Application Period/Draw Number: Clearly state the period this application covers (e.g., “Payment Application #3 for the period of October 1-31, 2023”).

- Detailed Schedule of Values: A breakdown of your scope of work into line items with corresponding values. This shows the original contract amount, completed work to date, current requested amount, and remaining balance.

- Change Orders: Any approved changes to the original contract that impact the scope or cost should be clearly listed and accounted for.

- Lien Waivers and Certifications: Often, you’ll need to submit conditional or unconditional lien waivers for the current and previous payment periods, certifying that you’ve paid your suppliers and sub-tier contractors.

- Payment Summary: A clear summary showing the total amount requested for the current period, previous payments received, and the total amount due to date.

- Signatures: Spaces for authorized signatures from both the subcontractor and the general contractor, confirming approval.

- Supporting Documentation Checklist: A list of any required attachments, such as daily logs, invoices from suppliers, or photographs of completed work.

Crafting Your Own or Using a Pre-Made Template: What to Consider

When it comes to your payment application process, you generally have two main paths: creating a form entirely from scratch or leveraging a pre-existing subcontractor application for payment form template. Each approach has its merits, and the best choice often depends on your specific needs, the complexity of your projects, and your available resources. Building one from the ground up gives you ultimate control and allows for hyper-customization to perfectly match your unique services and typical client requirements. However, it can be time-consuming and requires a thorough understanding of all the necessary components to ensure nothing critical is missed.

On the other hand, using a pre-made subcontractor application for payment form template can be a fantastic time-saver. Many reputable sources offer templates designed with industry best practices in mind, often covering all the standard legal and financial considerations. This reduces the risk of overlooking essential details and provides a professional baseline from which to operate. You can usually find these templates online, often in formats that are easy to fill in and adapt slightly to your specific project needs.

The key to effectively using any template, whether custom or pre-made, lies in accuracy and consistency. Always double-check every figure, every date, and every line item before submission. Any discrepancies can lead to delays or, worse, questions about your professionalism. Remember, the goal is to make it as easy as possible for the general contractor to approve your payment.

Once you have your preferred template, ensure you integrate it seamlessly into your financial workflow. This means understanding the general contractor’s payment schedule, submitting your applications well in advance of deadlines, and keeping diligent records of every submission. Proactive communication about your progress and payment expectations, backed by a clear and comprehensive application, will always put you in the best position for timely compensation.

Having a consistent, professional method for requesting payment is more than just good business practice; it’s a cornerstone of financial stability for any subcontractor. A well-designed payment application template ensures that your hard work is accurately documented and that your requests for payment are clear, concise, and complete. This level of professionalism not only accelerates your cash flow but also strengthens your reputation as a reliable and organized partner in the construction ecosystem.

By investing time in setting up your payment application process—whether by customizing a pre-made template or refining your own—you’re investing in the future health of your business. It allows you to focus less on chasing payments and more on delivering exceptional work, ultimately contributing to smoother project execution and fostering long-term, successful relationships with general contractors and clients.