Utilizing a standardized structure minimizes disputes arising from unclear billing practices. It helps prevent cost overruns by providing a clear overview of expenses, enabling both parties to track spending effectively. This documentation also simplifies accounting processes and provides essential records for tax purposes, contributing to sound financial management for all stakeholders.

Further exploration of this topic will cover key components of such a document, best practices for its completion, and common challenges in its implementation. This information will be beneficial to both contractors and subcontractors in ensuring smooth financial transactions and successful project completion.

1. Project Title

Accurate project identification is paramount for effective financial management. Within the context of a subcontractor’s final account statement, the project title provides essential context, linking financial transactions to a specific project. This clarity is crucial for all parties involved, ensuring accurate record-keeping and facilitating efficient payment processing.

- Contextualization of CostsThe project title connects the listed costs and payments within the statement to the specific project. This prevents confusion when multiple projects are running concurrently, especially with the same contractor or subcontractor. For example, differentiating between “Residential Renovation – 123 Main Street” and “Commercial Build – 456 Oak Avenue” clarifies the financial transactions associated with each distinct project.

- Simplified Record-KeepingA clearly stated project title simplifies record-keeping for both the contractor and subcontractor. When referencing past projects, the title enables quick identification and retrieval of the associated final account statement. This is vital for audits, tax purposes, and future project estimations. Consider a scenario where a dispute arises months after project completion; the project title allows efficient access to the relevant documentation.

- Efficient Payment ProcessingThe project title streamlines payment processing by clearly identifying the project for which payment is requested. This reduces processing errors and delays, ensuring timely payment for the subcontractor. For instance, a banking institution processing the payment can easily match the transaction to the correct project based on the provided title.

- Dispute ResolutionIn case of discrepancies or disputes, the project title provides a crucial reference point for all parties involved. It allows for focused discussion and quick resolution of any financial discrepancies. For example, if a discrepancy arises concerning material costs, referencing the project title immediately clarifies the specific project under scrutiny.

In conclusion, the project title, seemingly a minor detail, plays a significant role in ensuring accurate and efficient financial management within the context of a subcontractor’s final account statement. Its presence provides clarity, simplifies processes, and contributes to successful project completion and positive business relationships.

2. Subcontractor Information

Accurate and complete subcontractor information is fundamental to a valid final account statement. This information ensures proper payment routing and facilitates clear communication regarding project financials. Omitting or incorrectly recording this information can lead to payment delays, disputes, and project completion issues. A comprehensive understanding of the required information ensures accurate and efficient processing of the final account statement.

- Legal Business Name and AddressThe legal business name should match the registered entity responsible for the subcontracted work. This ensures legal validity for contractual agreements and financial transactions. The address should be the official business address where invoices and legal notices can be sent. Providing a P.O. Box without a physical address can sometimes be insufficient. For example, “ABC Plumbing Services Ltd., 123 Main Street, Anytown, CA 91234” provides clear identification and contact information. This information is crucial for tax documentation and legal compliance.

- Contact Person and DetailsA designated contact person facilitates efficient communication regarding the final account statement. Including a direct phone number and email address ensures prompt resolution of any queries or discrepancies. This avoids delays caused by miscommunication or difficulty reaching the appropriate individual. For instance, listing “John Smith, Project Manager, [email protected], (555) 123-4567” allows direct communication. This direct line of communication is essential for efficient query resolution.

- Tax Identification Number/VAT NumberThe tax identification number (e.g., EIN in the United States) or VAT number (for VAT-registered businesses) is essential for tax compliance and accurate financial reporting. This information is required for both the contractor and subcontractor to fulfill their tax obligations. Providing this information ensures legal compliance and avoids potential financial penalties. For international projects, VAT compliance is crucial.

- License Number (If Applicable)In industries requiring specific licenses or certifications, providing the relevant license number validates the subcontractor’s qualifications and legitimacy. This provides assurance to the contractor that the work performed meets regulatory requirements. For example, a licensed electrician should include their license number on the final account statement. This is particularly relevant in regulated industries like construction or electrical work.

Accurate subcontractor information is not merely a formality; it is a critical component of a valid and effective final account statement. Complete and accurate details ensure timely payments, facilitate clear communication, and contribute to a smooth and successful project conclusion. Furthermore, this information plays a vital role in maintaining accurate financial records for both the contractor and the subcontractor, contributing to sound financial management practices and regulatory compliance.

3. Contractor Information

Accurate contractor information is essential within a subcontractor’s final account statement. This information ensures proper invoice delivery and facilitates clear communication regarding project financials. Complete and correct contractor details are crucial for timely payments and effective record-keeping for both parties.

- Legal Business Name and AddressThe contractor’s legal business name and registered address are crucial for legal and financial purposes. This information ensures that invoices are addressed correctly and payments are routed to the appropriate entity. Discrepancies can lead to processing delays and potential legal complications. For example, using “Acme Construction Inc.” instead of “Acme Construction Co.” could cause payment issues. The address should be where official correspondence should be sent.

- Contact Person and DetailsA designated contact person at the contracting company streamlines communication regarding the final account statement. Providing a direct phone number and email address facilitates efficient query resolution and prompt payment processing. This minimizes delays and ensures effective communication between parties. For instance, including “Jane Doe, Project Manager, [email protected], (555) 555-1212” enables direct contact and efficient communication.

- Payment InformationClear payment instructions are vital for timely and accurate payment processing. This typically includes bank account details, preferred payment methods, and any specific invoicing requirements. Providing this information upfront prevents delays and ensures the subcontractor receives payment promptly. This might include specifying electronic transfer details or preferred invoice formats.

- Project Reference Number (If Applicable)A project reference number, if used by the contractor, assists in internal tracking and reconciliation of project costs. Including this number on the final account statement facilitates efficient processing and matching of invoices to the correct project. This is especially beneficial for large contractors managing multiple projects simultaneously, and ensures proper allocation of payments. For instance, including “Project # ABC-123” helps the contractor quickly identify and process the payment.

Accurate contractor information is integral to a complete and effective final account statement. This data ensures accurate payment processing, facilitates clear communication, and contributes to efficient project closeout. Maintaining accurate records benefits both the contractor and subcontractor, promoting a professional and transparent business relationship.

4. Itemized Costs

Itemized costs constitute a critical component of a comprehensive subcontractor final account statement template. A detailed breakdown of expenses ensures transparency and facilitates accurate financial reconciliation between contractors and subcontractors. This specificity minimizes disputes arising from ambiguous billing practices, fostering trust and promoting stronger business relationships. Without itemization, the final account statement lacks the necessary detail to justify the total cost, potentially leading to disagreements and delays in final payment. Consider a scenario where a final account statement simply lists “$10,000 for labor.” An itemized breakdown, conversely, would specify hours worked per individual, hourly rates, and dates of work, providing a clear and verifiable account of labor costs.

Practical significance lies in the ability to track project spending effectively. Itemized costs allow both contractors and subcontractors to monitor expenditures against the agreed-upon budget, identifying potential overruns early. This granular view enables proactive cost management, minimizing financial risks and ensuring project profitability. For instance, if a specific material cost significantly exceeds the initial estimate, both parties can address the discrepancy promptly, exploring alternative materials or adjusting the project scope accordingly. This proactive approach prevents unexpected financial burdens at the project’s conclusion. Furthermore, detailed cost breakdowns simplify accounting processes and provide essential records for tax purposes, contributing to sound financial management for all stakeholders.

In conclusion, the inclusion of itemized costs within a subcontractor final account statement template is not merely a best practice; it is a fundamental requirement for accurate financial reporting and effective project management. This level of detail ensures transparency, facilitates dispute resolution, enables effective cost control, and supports regulatory compliance. Challenges can arise when documentation practices are inconsistent or inadequate. Therefore, implementing standardized procedures and utilizing comprehensive templates are essential for successful project completion and strong contractor-subcontractor relationships.

5. Payment Schedule

A clearly defined payment schedule, integrated within the subcontractor’s final account statement template, is crucial for managing project cash flow and maintaining a positive working relationship between contractors and subcontractors. This schedule outlines agreed-upon payment milestones and their corresponding due dates, providing predictability and transparency regarding payment expectations. Its absence can lead to payment delays, disputes, and strained professional relationships. A well-defined payment schedule, linked to verifiable project milestones, minimizes the risk of late payments and ensures the subcontractor receives compensation for completed work. For example, a schedule might stipulate a 20% payment upon completion of foundation work, 30% upon framing completion, and the remaining 50% upon final inspection and project sign-off. This structured approach allows subcontractors to forecast income and manage their own financial obligations effectively.

The practical significance of a well-defined payment schedule extends beyond simply ensuring timely payments. It serves as a tool for project management, incentivizing timely completion of project phases. By linking payments to milestones, both parties are motivated to adhere to the agreed-upon timeline. Furthermore, a transparent payment schedule reduces the likelihood of financial disputes. When expectations are clearly documented and agreed upon upfront, the potential for misunderstandings and disagreements is minimized. Consider a scenario where unforeseen delays impact the project timeline. A predefined payment schedule, coupled with a change order process, allows for adjustments to payment milestones, maintaining financial fairness and preventing disputes. This proactive approach fosters trust and strengthens the contractor-subcontractor relationship.

In conclusion, incorporating a detailed payment schedule within the subcontractor’s final account statement template is essential for effective project financial management. It provides clarity, promotes timely payments, incentivizes progress, and minimizes the risk of disputes. Challenges may arise when projects deviate significantly from the initial plan. Therefore, mechanisms for adjusting the payment schedule in response to unforeseen circumstances should be included within the initial agreement. This flexibility ensures that the payment schedule remains a relevant and effective tool throughout the project lifecycle, contributing to a successful outcome for all parties involved.

6. Signatures

Signatures on a subcontractor’s final account statement template signify formal agreement regarding the documented financial transactions. This seemingly simple act holds significant legal and practical implications, transforming a record of expenses into a binding agreement. The presence and validity of signatures are crucial for dispute resolution and legal enforceability, underscoring their critical role in project completion and financial reconciliation.

- Binding AgreementSignatures transform the final account statement from a record of costs into a legally binding agreement. Both the subcontractor and an authorized representative of the contracting company must sign the document. This mutual agreement signifies acceptance of the listed expenses and the obligation of payment. Without signatures, the document lacks the legal weight necessary to enforce payment or resolve disputes effectively.

- Proof of AcceptanceSignatures serve as evidence that both parties have reviewed and accepted the details within the final account statement. This includes the itemized costs, payment terms, and any other agreed-upon conditions. In case of future discrepancies, the signed document provides a crucial point of reference, demonstrating mutual agreement on the documented figures. This can be particularly important in legal proceedings or during mediation.

- Dispute ResolutionA signed final account statement serves as a foundational document for resolving potential disputes. It clearly outlines the agreed-upon costs and payment terms, minimizing the potential for disagreements. In cases where disputes arise, the signed document provides a clear framework for discussion and resolution. This documented agreement helps prevent misunderstandings and facilitates a more efficient resolution process.

- Financial Audit TrailsSigned final account statements are crucial components of financial audit trails for both the contractor and subcontractor. They provide verifiable documentation of project expenses and payments, essential for tax purposes and internal financial reviews. These records demonstrate compliance with financial regulations and contribute to sound financial management practices. Complete and accurate records, including signatures, are essential for demonstrating financial transparency.

In conclusion, signatures on a subcontractor’s final account statement template are not merely a formality; they are a crucial element that transforms a record of costs into a legally binding agreement. They provide proof of acceptance, facilitate dispute resolution, and contribute to robust financial record-keeping. Ensuring proper signatures on these documents is paramount for successful project completion and maintaining strong, transparent business relationships. Neglecting this seemingly simple step can have significant legal and financial repercussions for all parties involved.

Key Components of a Subcontractor Final Account Statement Template

A comprehensive final account statement ensures clarity and facilitates accurate financial reconciliation. The following components are essential for a complete and effective document:

1. Project Title: Clear project identification is paramount. The project title provides essential context, linking all financial transactions within the statement to a specific project. This clarity is crucial for accurate record-keeping, efficient payment processing, and effective communication between all parties. Ambiguity in project identification can lead to confusion and potential disputes, especially when multiple projects run concurrently.

2. Subcontractor Information: Complete and accurate subcontractor details are essential for proper payment routing and clear communication. This includes the legal business name, address, contact person details, tax identification number, and any relevant license numbers. Accurate information ensures timely payments, facilitates efficient query resolution, and contributes to legal and tax compliance. Incomplete or inaccurate information can lead to payment delays and potential legal complications.

3. Contractor Information: Corresponding contractor information is equally crucial. This includes the legal business name, address, contact person, payment details, and any project-specific reference numbers. Accurate contractor information ensures that invoices are delivered correctly and payments are processed efficiently. Clear communication channels and accurate payment instructions prevent delays and foster a smooth financial process.

4. Itemized Costs: A detailed breakdown of all project-related costs is fundamental. This includes labor, materials, equipment rentals, and any other agreed-upon expenses. Itemized costs provide transparency, enable accurate cost tracking, and facilitate effective budget management. This detailed breakdown minimizes the potential for disputes arising from ambiguous billing practices.

5. Payment Schedule: A well-defined payment schedule outlines agreed-upon payment milestones and their corresponding due dates. This provides predictability and transparency regarding payment expectations, promoting timely payments and minimizing financial disputes. Linking payments to project milestones incentivizes timely completion and facilitates effective project management.

6. Signatures: Signatures of authorized representatives from both the subcontractor and the contracting company are essential for legal validity. Signatures signify formal agreement on the documented financial transactions, transforming the statement into a binding agreement. This is crucial for dispute resolution and legal enforceability. Unsigned documents lack legal weight and may not be admissible in legal proceedings.

These key components ensure a comprehensive and legally sound final account statement, facilitating transparency, promoting timely payments, and minimizing the potential for disputes. Accurate and detailed documentation benefits both contractors and subcontractors, contributing to successful project completion and strong professional relationships.

How to Create a Subcontractor Final Account Statement Template

Creating a standardized template ensures clarity and consistency in final account statements, facilitating smooth financial reconciliation between contractors and subcontractors. A well-structured template minimizes disputes and promotes efficient payment processing.

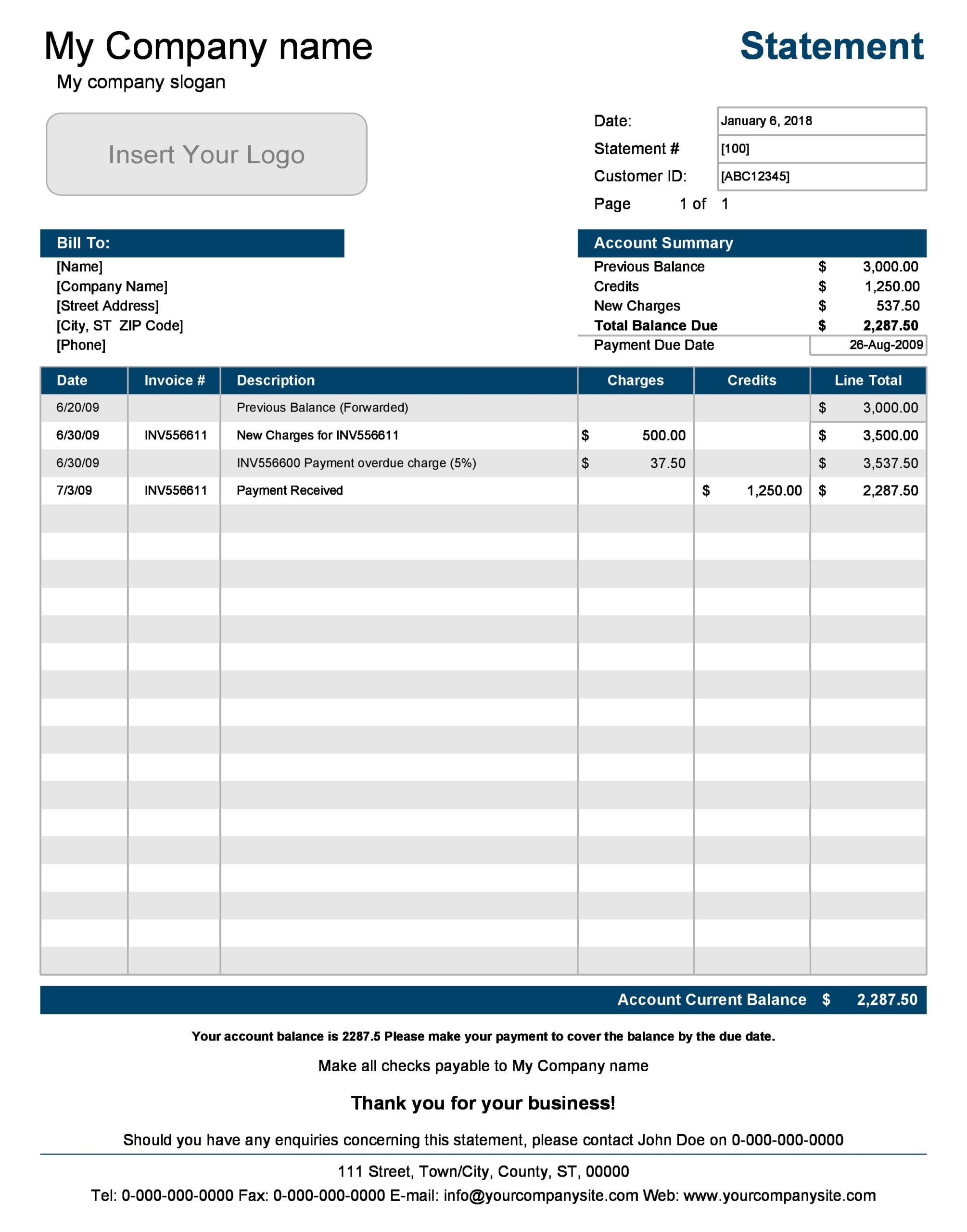

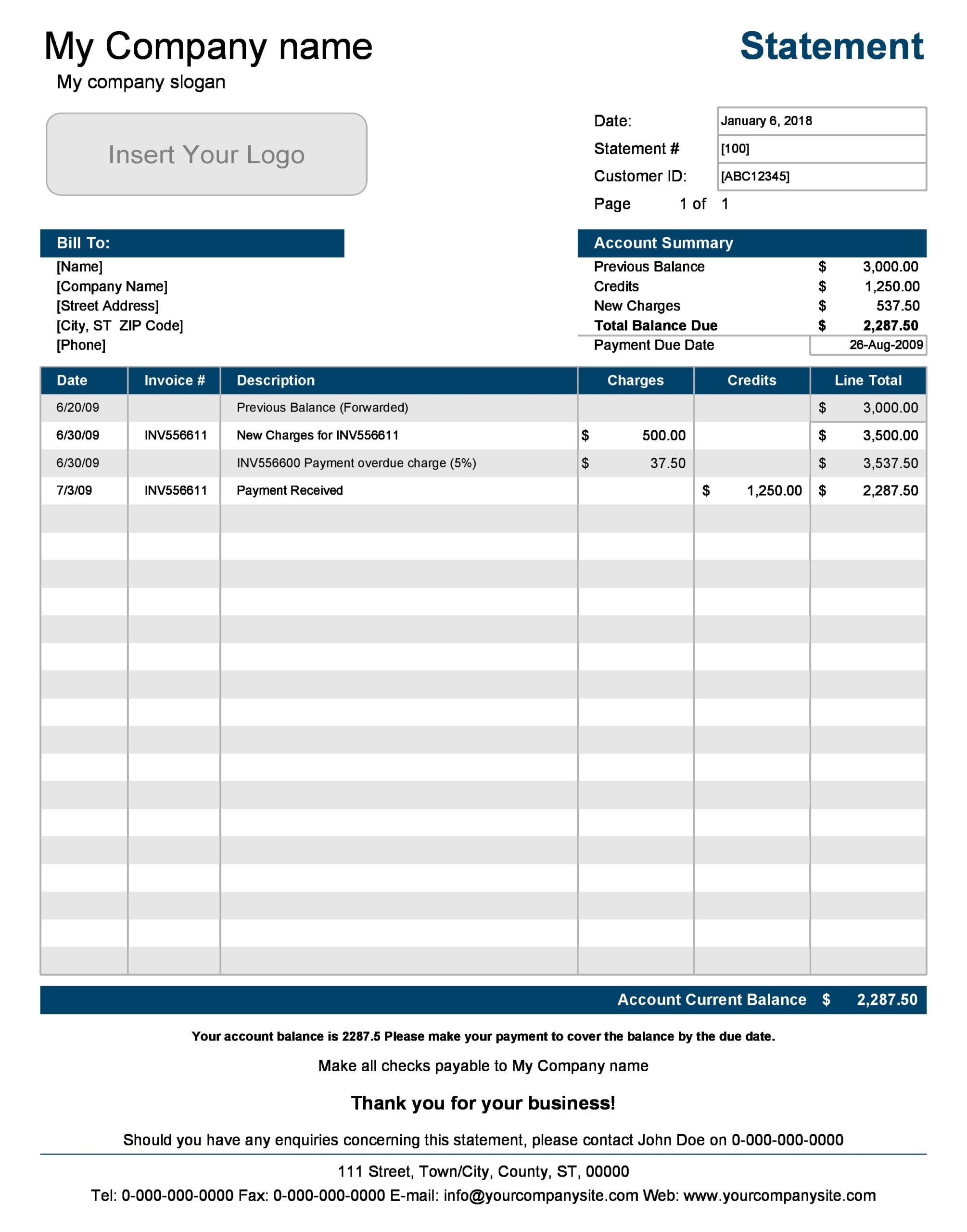

1. Define Header Information: Begin by clearly identifying the document as a “Subcontractor Final Account Statement.” Include fields for the project title, date, and unique identifying numbers, such as a project reference number or invoice number. This header information provides essential context and facilitates efficient record-keeping.

2. Capture Contractor and Subcontractor Details: Dedicate sections for complete contractor and subcontractor information. This includes legal business names, addresses, contact person details, and tax identification numbers. Accurate contact information is crucial for communication and ensures proper payment routing.

3. Establish an Itemized Cost Section: Create a structured table or list format to capture itemized costs. Include columns for description, quantity, unit cost, and total cost for each item. This detailed breakdown provides transparency and facilitates accurate cost reconciliation. Consider adding columns for dates and supporting documentation references.

4. Incorporate a Payment Schedule Section: Define a section outlining the agreed-upon payment schedule. This should detail payment milestones, corresponding amounts, and due dates. A clear payment schedule fosters predictability and minimizes potential payment disputes.

5. Include a Summary and Total Cost Calculation: Provide a section to calculate the total cost of all itemized expenses. Clearly display the total amount due to the subcontractor. This summary provides a concise overview of the financial transactions.

6. Designate Signature Lines: Include designated spaces for signatures from authorized representatives of both the subcontractor and the contractor. Signatures signify formal agreement on the documented financial transactions, transforming the statement into a legally binding document.

7. Add Terms and Conditions (Optional): Consider including a section for relevant terms and conditions, such as payment terms, dispute resolution procedures, or any other project-specific agreements. This adds further clarity and helps prevent misunderstandings.

8. Choose a Format and Accessibility: Opt for a format that is easily accessible and editable, such as a spreadsheet or a word processing document. Ensure the template is compatible with common software used by both contractors and subcontractors. This facilitates efficient completion and distribution of the final account statement.

A well-designed template, incorporating these elements, ensures clear communication, facilitates accurate financial tracking, and contributes to successful project completion. Standardizing this process strengthens professional relationships and minimizes the potential for financial disputes.

Accurate and comprehensive final account statements are crucial for successful project completion and positive contractor-subcontractor relationships. Standardized templates ensure clarity, facilitate efficient payment processing, and minimize financial disputes. Key components include clear project identification, detailed contractor and subcontractor information, itemized cost breakdowns, a defined payment schedule, and legally binding signatures. These elements contribute to transparent financial management and promote accountability throughout the project lifecycle.

Effective implementation of these templates requires meticulous record-keeping, clear communication, and adherence to agreed-upon terms. Investing time in developing and utilizing comprehensive templates strengthens professional relationships, reduces financial risks, and contributes to a more efficient and successful construction process. The proper utilization of these tools represents a commitment to best practices in financial management and fosters a collaborative environment for all project stakeholders.