Utilizing a standardized structure offers several advantages. It streamlines the claims process, facilitating a more efficient review by insurance adjusters. This structured approach reduces ambiguity and ensures consistency in the information provided, minimizing potential delays. Furthermore, it helps claimants organize their claim details methodically, aiding in accurate valuation and supporting a thorough presentation of their case. A well-prepared declaration contributes significantly to a smoother, more transparent, and potentially faster claims settlement.

The following sections will delve deeper into the specific components of this type of declaration, offering guidance on its preparation and highlighting key considerations for ensuring a complete and accurate submission. Topics covered will include the necessary documentation, common pitfalls to avoid, and best practices for maximizing the effectiveness of the claim.

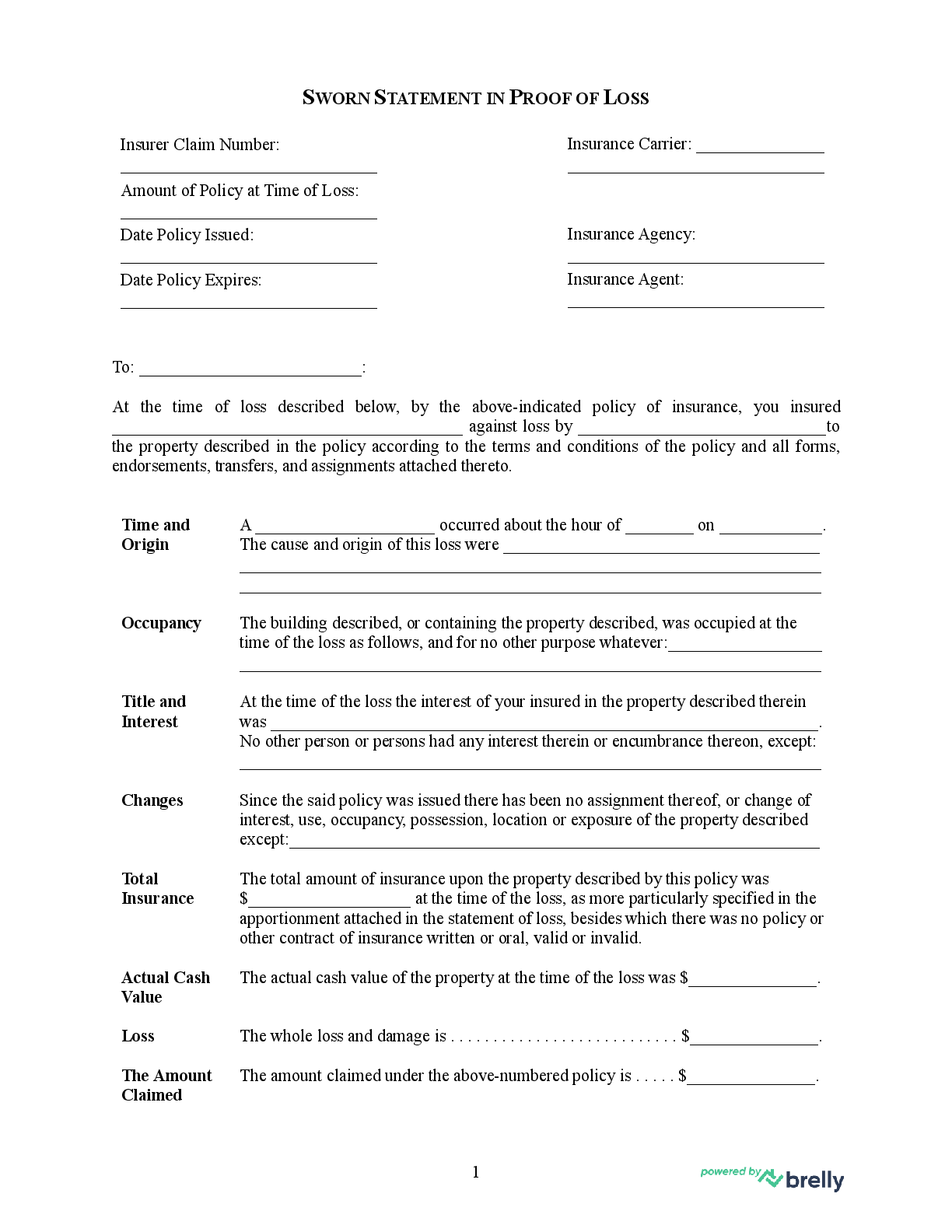

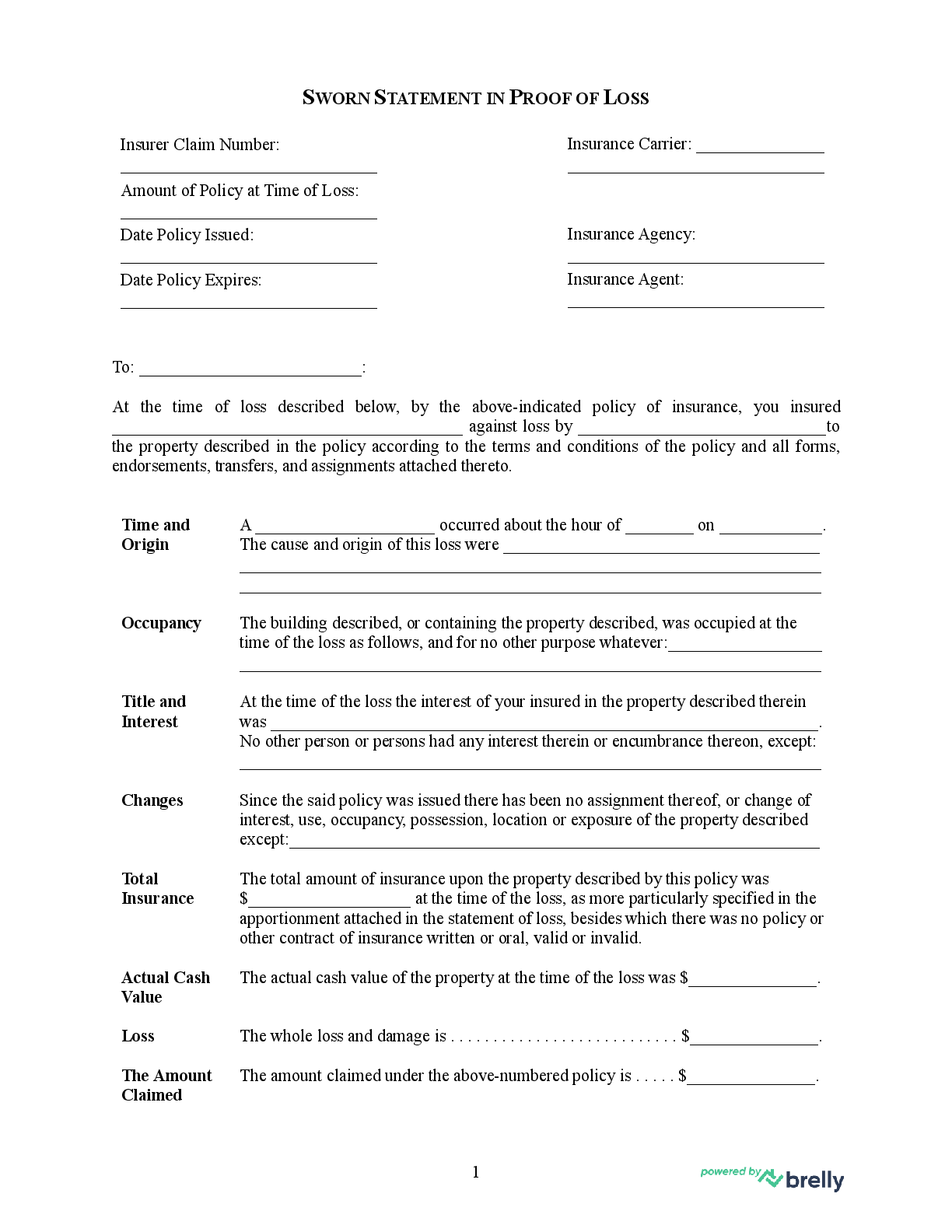

1. Formal Document

The formal nature of a sworn statement in proof of loss template underscores its legal significance within the insurance claims process. This formality ensures the document’s validity and admissibility as evidence, contributing to a transparent and legally sound claim procedure. Understanding the facets of this formality is crucial for accurate completion and effective claim submission.

- Structure and OrganizationFormal documents adhere to specific structural conventions. A sworn statement typically includes sections for personal information, policy details, incident description, loss itemization, and a notarized signature. This structured approach ensures clarity and completeness, facilitating efficient review by insurance adjusters. For example, a standardized format ensures consistent reporting of damaged property following a fire, simplifying the valuation process.

- Language and ToneFormal language and an objective tone are paramount. The document should avoid colloquialisms, slang, and emotional language. Precise and factual descriptions are essential for conveying information accurately and maintaining credibility. For instance, when describing a stolen item, objective details like brand, model, and serial number are more effective than subjective descriptions of sentimental value.

- Legal RequirementsSpecific legal requirements, such as notarization, often apply to formal documents. Notarization validates the signer’s identity and affirms the statement’s authenticity under oath, reinforcing its legal weight. This process underscores the document’s seriousness and its role in a potentially legal proceeding.

- Supporting DocumentationFormal documents often require supporting evidence. This could include photographs, receipts, police reports, or appraisals. These documents substantiate the claimed losses and provide verifiable proof, strengthening the claim’s validity and aiding in accurate assessment. For example, photographs of damaged property after a flood can corroborate the described damage and support the claimed value.

Adherence to these formal elements ensures the sworn statement in proof of loss template functions as a credible and legally sound document. This formality contributes to a more efficient claims process, facilitates clear communication between the claimant and the insurer, and ultimately strengthens the claim’s validity.

2. Legal Declaration

A sworn statement in proof of loss functions as a legal declaration, attesting to the veracity of the information provided regarding sustained losses. This legal standing transforms the document from a simple account of events into a sworn testimony, subject to legal scrutiny and carrying significant weight in the insurance claims process. Understanding the legal implications inherent within this declaration is crucial for accurate completion and effective claim submission.

- Affidavit Under OathThe sworn nature of the statement signifies its status as an affidavit made under oath. This oath affirms the truthfulness and accuracy of the information provided, holding the affiant legally accountable for any misrepresentations. This legal commitment reinforces the seriousness of the document and its role in a potentially legal proceeding. For example, falsely claiming an item as stolen when it was not constitutes perjury.

- Legal Consequences of MisrepresentationSubmitting false or misleading information in a sworn statement can have severe legal consequences. These consequences can range from claim denial and policy cancellation to criminal charges of fraud or perjury. The legal weight of the document necessitates meticulous accuracy and honesty in all disclosed information. For instance, inflating the value of damaged goods can lead to legal action by the insurer.

- Evidentiary Value in Legal DisputesIn the event of a dispute regarding the insurance claim, the sworn statement serves as crucial evidence. Its legal standing allows it to be admissible in court, providing a documented account of the claimed losses from the perspective of the insured. This evidentiary value underscores the importance of a clear, concise, and accurate statement. Should a claim go to court, the sworn statement becomes a key piece of evidence in determining the validity of the claim.

- Notarization as ValidationThe notarization process plays a vital role in validating the legal declaration. A notary public, an authorized official, witnesses the signing of the document and verifies the signer’s identity. This act of notarization affirms the statement’s authenticity and reinforces its legal admissibility, strengthening its weight as a legal document. Notarization ensures the statement is recognized as a legally binding document, further emphasizing its importance.

The legal implications associated with a sworn statement in proof of loss template highlight its significant role in the insurance claims process. Understanding these legal facets ensures accurate completion, strengthens the claim’s validity, and contributes to a transparent and legally sound procedure. The formal, legally binding nature of the statement protects both the insured and the insurer, facilitating a fair and just resolution of claims.

3. Verifies Losses

Verification of losses lies at the heart of a sworn statement in proof of loss template. This process substantiates the claimed damages, providing credible evidence of the loss event and its impact. It bridges the gap between the alleged loss and tangible proof, forming the cornerstone of a valid insurance claim. Without verification, claims lack the necessary support for proper evaluation and risk rejection. A comprehensive verification process serves to protect both the claimant, ensuring a fair settlement, and the insurer, guarding against fraudulent claims.

The verification process necessitates detailed documentation of the losses incurred. This documentation may include photographs, videos, receipts, repair estimates, police reports, and other relevant evidence. For instance, in a house fire, photographs of the damaged property, along with repair estimates, serve to verify the extent of the loss. Similarly, in a theft, a police report coupled with receipts for the stolen items provides verifiable proof of the loss. The specificity and accuracy of this documentation directly impact the claim’s validity and the subsequent settlement process.

The sworn statement itself plays a critical role in this verification process. By signing the statement under oath, the claimant attests to the accuracy and truthfulness of the information provided, including the documented losses. This sworn testimony adds a layer of legal weight to the verification process, reinforcing the claim’s credibility. The notarization of the statement further validates its authenticity, providing additional assurance to the insurer. This combination of documented evidence and sworn testimony establishes a robust verification process, essential for a successful claim outcome. Challenges may arise when documentation is lacking or incomplete. In such cases, obtaining professional appraisals or expert opinions can provide additional support for the claimed losses, further strengthening the verification process.

4. Supports Claims

A sworn statement in proof of loss template serves as a critical supporting document for insurance claims. It provides a structured framework for claimants to articulate their losses and substantiate them with verifiable evidence. This structured approach strengthens the claim’s validity and facilitates a more efficient review process for insurance adjusters. The supporting role of this documented declaration hinges on several key facets.

- Evidence SubstantiationThe sworn statement provides a platform to present evidence substantiating the claimed losses. This evidence may include photographs of damaged property, receipts for lost items, repair estimates, police reports, and other relevant documentation. For example, in a claim for a stolen vehicle, the statement would accompany the police report and vehicle registration, providing a cohesive narrative of the loss event and supporting the claim for reimbursement. This substantiation transforms the claim from a mere assertion into a verifiable account of the loss, significantly increasing its credibility.

- Detailed Account of EventsThe template’s structured format guides claimants to provide a detailed account of the events leading to the loss. This chronological narrative clarifies the circumstances of the loss, eliminating ambiguity and potential misunderstandings. For instance, in a claim for water damage, the statement would detail the source of the water, the date of the incident, and the extent of the damage. This detailed account provides context for the claimed losses, aiding the insurer in accurately assessing the claim’s validity.

- Quantifiable Loss ValuationThe template facilitates quantifiable loss valuation, crucial for determining the appropriate compensation. By itemizing lost or damaged items and assigning monetary values, the statement provides a concrete basis for calculating the financial impact of the loss. For example, in a fire damage claim, the statement would list each damaged item, its original value, and the cost of repair or replacement. This itemized valuation provides a clear and transparent basis for settlement negotiations, streamlining the claims process.

- Formalized Claim PresentationThe formal nature of a sworn statement, particularly the notarized signature, lends weight and credibility to the claim. This formal presentation signifies the seriousness of the claim and the claimant’s commitment to the veracity of the information provided. The sworn oath reinforces the legal implications of providing false information, further strengthening the document’s value as a supporting element in the claims process. This formality adds a layer of assurance for the insurer, contributing to a more transparent and trustworthy claims interaction.

Through these facets, the sworn statement in proof of loss template transitions from a simple form to a powerful tool supporting insurance claims. It provides the necessary structure, evidence, and legal weight to substantiate the claim, facilitating a smoother, more efficient, and transparent claims process for both the claimant and the insurer. This structured approach minimizes potential disputes and contributes to a more equitable and timely claim resolution.

5. Required by Insurers

Insurance policies often mandate a sworn statement in proof of loss as a prerequisite for claim consideration. This requirement stems from the need for verifiable, legally substantiated evidence of the claimed loss. Understanding the implications of this requirement is crucial for policyholders navigating the claims process. Non-compliance can lead to claim delays or even denial, highlighting the importance of adhering to this stipulation.

- Contractual ObligationThe requirement for a sworn statement often constitutes a contractual obligation within the insurance policy. Policyholders agree to this stipulation upon policy inception. Failing to fulfill this obligation can breach the contract, potentially jeopardizing the entire claim. For example, an auto insurance policy may explicitly state the requirement of a sworn statement in the event of a theft, making its submission a contractual necessity for claim processing.

- Fraud Prevention and MitigationThe sworn statement serves as a deterrent against fraudulent claims. The legal implications of submitting false information under oath discourage misrepresentation and exaggeration of losses. This safeguard protects the insurer from fraudulent activities and helps maintain reasonable premiums for all policyholders. The sworn nature of the statement adds a layer of accountability, reducing the likelihood of fabricated or inflated claims.

- Standardized Claim EvaluationRequiring a standardized sworn statement facilitates consistent and efficient claim evaluation. The structured format ensures all necessary information is readily available to the adjuster, streamlining the review process. This standardization allows for objective comparison across claims and promotes fair and equitable claim settlements. Consistent information gathering aids in accurate loss assessment and reduces processing time.

- Legal Admissibility in DisputesThe sworn and notarized nature of the statement ensures its admissibility as evidence in legal disputes. Should a disagreement arise regarding the claim, the sworn statement provides a legally sound record of the claimed losses, protecting both the insurer and the insured. This admissibility reinforces the importance of accurate and truthful completion of the statement, as it could become a key piece of evidence in legal proceedings.

The requirement for a sworn statement in proof of loss by insurers underscores its importance within the claims process. It functions as a crucial element for verifying losses, deterring fraud, and ensuring efficient claim processing. Adherence to this requirement safeguards the interests of both the policyholder and the insurer, contributing to a fair and legally sound resolution of claims. Understanding the reasons behind this requirement emphasizes its significance in upholding the integrity of the insurance system.

6. Standardized Format

Standardized formats play a crucial role in the efficacy of sworn statements in proof of loss. These formats provide a structured framework ensuring consistency, completeness, and clarity, which are essential for efficient processing and validation of insurance claims. A standardized approach benefits both claimants, by guiding them through the necessary information, and insurers, by streamlining review and assessment procedures. This structure minimizes ambiguity and facilitates a more transparent and legally sound claims process.

- Consistency and ComparabilityStandardized formats ensure uniformity across all submitted statements. This consistency allows insurers to directly compare claims, facilitating a more objective and equitable assessment process. For instance, standardized fields for property description and valuation enable consistent data collection, simplifying analysis and reducing the potential for discrepancies. This consistency is particularly valuable when dealing with large volumes of claims, as it streamlines the review process and promotes fair claim handling.

- Completeness and AccuracyStandardized templates guide claimants through all necessary information, reducing the risk of omissions or incomplete submissions. Pre-defined fields for personal information, policy details, incident description, and loss itemization prompt claimants to provide comprehensive details, minimizing the need for follow-up inquiries and potential delays. This structured approach ensures all essential information is captured, reducing the likelihood of claim rejection due to incomplete documentation. For example, a standardized field for the date and time of an incident ensures this crucial detail is consistently recorded.

- Clarity and EfficiencyStandardized formats enhance clarity for both the claimant and the insurer. Clear headings, concise instructions, and logically organized sections improve readability and comprehension, facilitating a smoother claims process. This clarity reduces the likelihood of misinterpretations or errors, expediting claim processing and minimizing potential disputes. A clear format also allows for easier integration with automated claims processing systems, further enhancing efficiency.

- Legal Validity and AdmissibilityStandardized formats often incorporate legally required elements, such as designated spaces for notarization. This ensures the document’s compliance with legal standards, reinforcing its validity and admissibility as evidence in potential legal proceedings. This structured approach strengthens the document’s legal standing and protects the rights of both the claimant and the insurer. For example, a designated space for the claimant’s signature, witnessed and stamped by a notary public, affirms the statement’s legal authenticity.

The standardized format of a sworn statement in proof of loss template serves as a cornerstone of efficient and effective claims processing. By ensuring consistency, completeness, clarity, and legal validity, these formats contribute significantly to a more transparent, equitable, and legally sound insurance claims environment. This structured approach ultimately benefits both claimants and insurers, facilitating a smoother and more efficient resolution of claims.

Key Components of a Sworn Statement in Proof of Loss

Specific components ensure a complete and legally sound sworn statement, maximizing its effectiveness in the insurance claim process. Understanding these elements is crucial for accurate completion and efficient claim submission. Omitting crucial details can lead to delays or claim denial.

1. Identifying Information: Accurate and complete identifying information for both the insured and the insurer is paramount. This includes full names, addresses, policy numbers, and contact information. Precise identification ensures efficient communication and proper routing of the claim.

2. Date and Time of Loss: Precisely documenting the date and time of the loss event is essential. This establishes a clear timeline for the incident, a crucial element for investigation and assessment. Accuracy in this detail can be vital in corroborating other evidence and establishing the validity of the claim.

3. Description of Loss: A clear, concise, and factual description of the loss event is critical. This narrative should detail the circumstances surrounding the loss, avoiding speculation or emotional language. Objective details like the cause of a fire or the method of entry in a burglary are essential for a comprehensive understanding of the event.

4. Itemized List of Damaged/Lost Items: A detailed inventory of all damaged or lost items forms the core of the statement. This list should include specific descriptions, including brand names, model numbers, serial numbers, and quantities, along with supporting documentation like receipts or appraisals. Accurate itemization is essential for accurate valuation and claim settlement.

5. Valuation of Losses: Assigning accurate monetary values to each damaged or lost item is crucial for determining the appropriate compensation. This valuation should reflect the actual cash value or replacement cost of the items, supported by relevant documentation. Providing a realistic valuation strengthens the claim’s credibility and facilitates a smoother settlement process.

6. Supporting Documentation: Attaching supporting documentation substantiates the claimed losses and provides verifiable proof. This documentation may include photographs, videos, receipts, repair estimates, police reports, and other relevant evidence. Comprehensive documentation reinforces the claim’s validity and aids in accurate assessment by the insurer.

7. Signature and Notarization: The claimant’s signature, witnessed and affirmed by a notary public, attests to the truthfulness and accuracy of the information provided under oath. This legally binding signature transforms the statement into a sworn affidavit, carrying significant legal weight. Notarization validates the document’s authenticity and strengthens its admissibility as evidence.

These components form the foundation of a comprehensive and legally sound sworn statement in proof of loss. Accurate completion of each section ensures a clear, verifiable account of the loss, supporting a more efficient and equitable claims process. This meticulous approach facilitates a smoother interaction between the claimant and the insurer, promoting a timely and fair resolution.

How to Create a Sworn Statement in Proof of Loss

Creating a comprehensive and legally sound sworn statement requires careful attention to detail and accurate information. Following a structured approach ensures all necessary elements are included, facilitating efficient processing by the insurance provider and strengthening the claim’s validity. A well-crafted statement supports a smoother claims process and contributes to a more equitable and timely resolution.

1. Obtain a Template: One can often obtain a template from the insurance provider directly. Utilizing a provided template ensures adherence to specific requirements and streamlines the submission process. Alternatively, generic templates can be found online, but one must verify their suitability for the specific insurance policy.

2. Accurate Identifying Information: Complete and accurate identifying information for both the insured and the insurer is essential. This includes full legal names, addresses, policy numbers, contact information, and any other relevant identifiers requested by the insurer. Accuracy in this section ensures proper routing and efficient communication.

3. Precise Loss Details: Documenting the precise date, time, and location of the loss event is crucial. A clear, concise, and factual description of the circumstances surrounding the loss should follow. Objective details and avoidance of speculation or emotional language are paramount.

4. Itemized Loss Inventory: Create a detailed inventory of all damaged or lost items. Include specific descriptions, such as brand names, model numbers, serial numbers, quantities, dates of purchase, and original purchase prices. Supporting documentation, such as receipts, photographs, or appraisals, should be referenced and attached.

5. Loss Valuation: Assign a monetary value to each damaged or lost item. This valuation should reflect the actual cash value or replacement cost, supported by documentation. Consulting with professionals, such as appraisers or contractors, can be beneficial for complex or high-value items. Accurate valuation supports a fair and equitable settlement.

6. Gather Supporting Documentation: Compile all supporting documentation substantiating the claim. This documentation might include photographs, videos, receipts, repair estimates, police reports, or other relevant evidence. Organize these documents logically and label them clearly for easy reference by the insurance adjuster.

7. Review and Notarization: Thoroughly review the completed statement for accuracy and completeness before signing. Errors or omissions can lead to delays or claim denial. Once reviewed, sign the statement in the presence of a notary public. Notarization validates the document’s legal standing and affirms the truthfulness of the information provided under oath.

8. Submitting the Statement: Submit the completed sworn statement and all supporting documentation to the insurance provider according to their specified procedures. Retain copies of all submitted materials for personal records. Following submission, maintain communication with the insurer to track the claim’s progress and address any inquiries.

Meticulous preparation of a sworn statement in proof of loss strengthens the claim and contributes to a more efficient resolution process. Accurate information, detailed documentation, and proper notarization are critical components of a legally sound and effective statement. This structured approach facilitates a smoother interaction with the insurance provider and supports a fair and timely settlement of the claim.

Accurate completion of this crucial document requires meticulous attention to detail, thorough documentation, and a clear understanding of its legal implications. From providing precise identifying information and a detailed account of the loss event to compiling a comprehensive inventory of damaged or lost items with supporting evidence, each component contributes to the statement’s validity and effectiveness. Proper valuation of losses, adherence to standardized formats, and notarized affirmation under oath reinforce the document’s legal standing and support a more efficient claims process. Understanding the specific requirements of individual insurance policies is paramount for ensuring compliance and maximizing the potential for a successful claim outcome.

This formal declaration serves as a cornerstone of the insurance claims process, playing a vital role in verifying losses, supporting claims, and facilitating equitable settlements. Its importance extends beyond mere documentation, acting as a critical link between the insured and the insurer in navigating the complexities of loss recovery. Diligent preparation of this document empowers claimants to effectively articulate their losses, while providing insurers with the necessary information for accurate assessment and timely resolution. This structured approach contributes to a more transparent and legally sound claims environment, ultimately fostering greater trust and efficiency within the insurance industry.