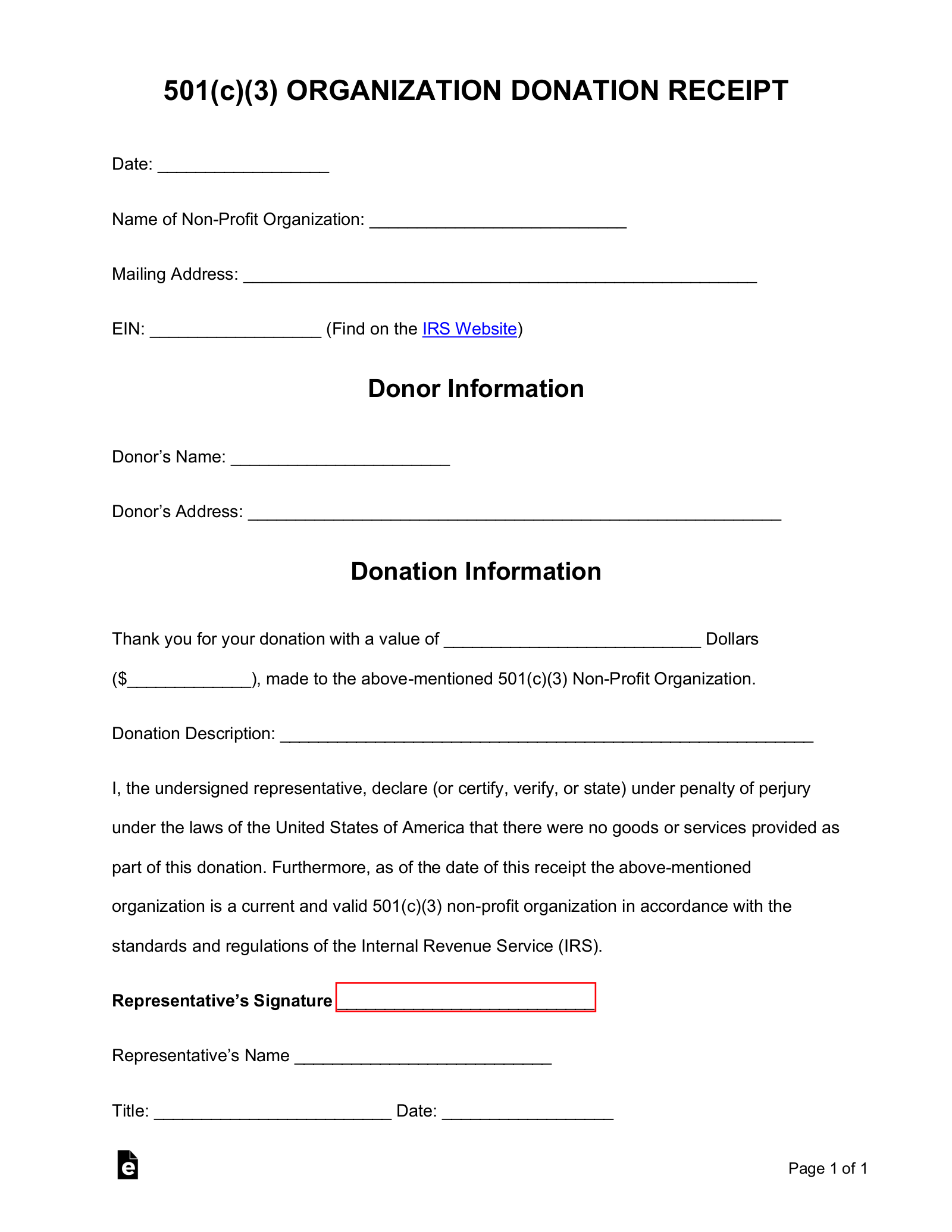

If you’re involved with a non-profit organization, charitable group, or any entity accepting financial contributions, you know how crucial it is to manage donations properly. Not only does it help you keep accurate records, but it also provides donors with the documentation they need, especially when it comes to claiming tax deductions. That’s where a robust tax exempt donation form template becomes an absolute game-changer.

Imagine the ease of having a standardized, clear, and comprehensive form ready to go for every gift received. It streamlines your administrative tasks, ensures compliance with tax regulations, and most importantly, offers transparency and reassurance to your generous supporters. Getting this right isn’t just about paperwork; it’s about building trust and efficiency.

Understanding the Importance of a Proper Donation Form

For any organization relying on public generosity, a well-structured donation form is much more than just a receipt. It serves as an official record of the transaction, providing critical data for your accounting and donor management systems. Beyond that, it’s a professional face for your organization, demonstrating your commitment to transparency and proper governance. Think about it from a donor’s perspective: a clear, easy-to-understand form instills confidence in where their money is going and how it’s being handled.

One of the primary reasons these forms are indispensable is their role in tax deductions. Donors who contribute to qualified tax-exempt organizations often wish to claim these contributions on their annual tax returns. Without proper documentation from your end, this can become a confusing and frustrating process for them. A clear acknowledgment of their donation, specifically stating your organization’s tax-exempt status, simplifies their filing and encourages future giving.

Moreover, these forms help you capture essential donor information. This isn’t just about the amount they’ve given; it’s about their contact details, preferences, and even how they heard about your cause. This data is invaluable for building long-term relationships, thanking donors effectively, and informing them about your ongoing work and future needs. It helps you move beyond a transactional relationship to a truly collaborative one.

Having a standardized form also minimizes errors and reduces the potential for misunderstandings. It ensures that every necessary piece of information is collected consistently, preventing headaches down the line when it comes to audits or reporting. It’s a proactive step towards smooth operations and strong financial integrity.

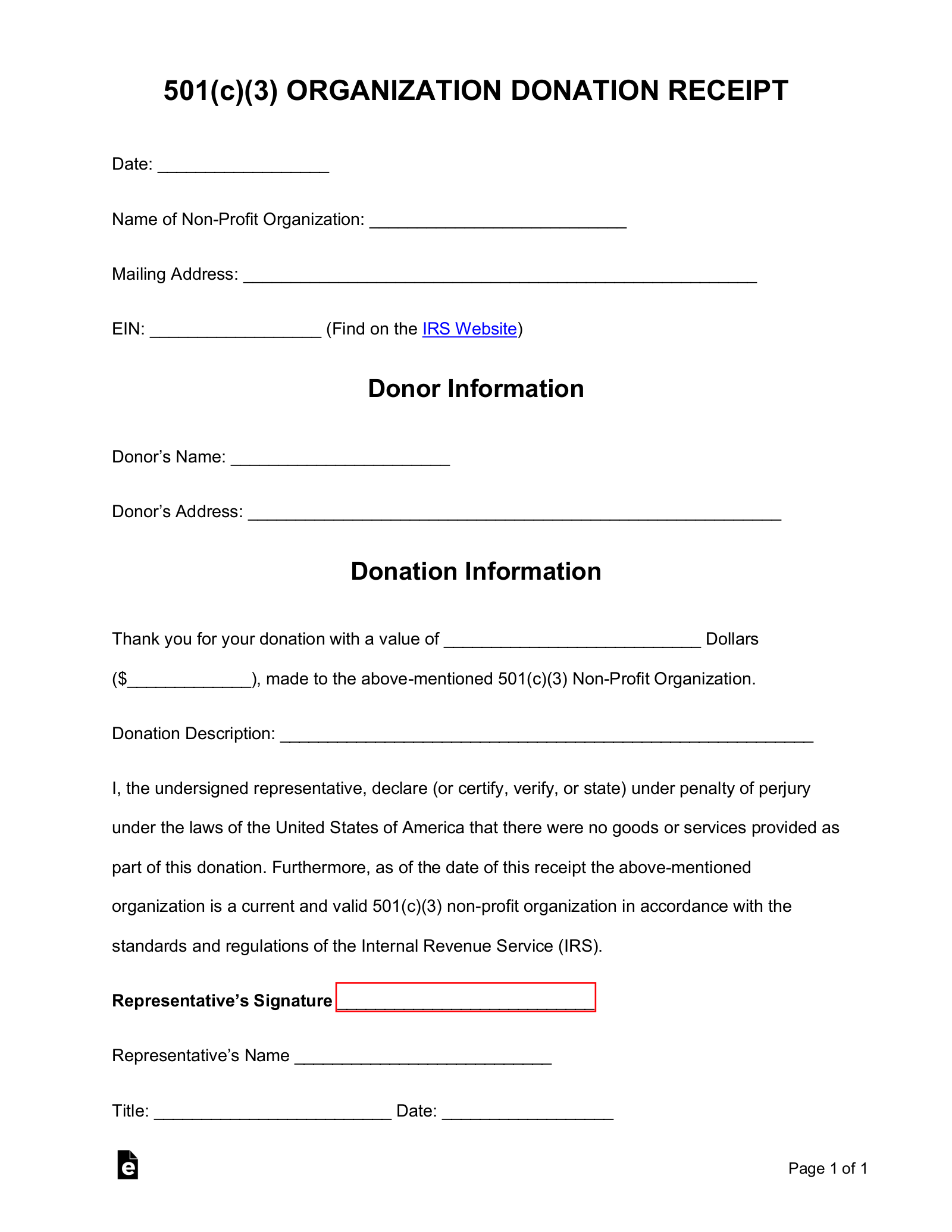

Key Elements Your Form Must Include

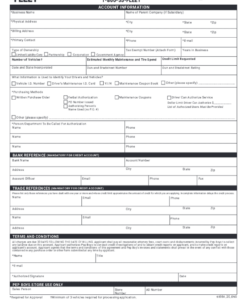

- Organization Name and Contact Information: Clearly state who is receiving the donation, including address and EIN (Employer Identification Number).

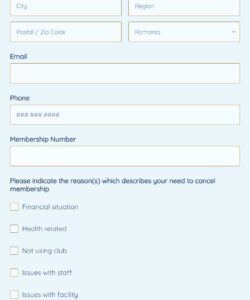

- Donor Information: Full name, address, email, and phone number of the donor.

- Date of Donation: The exact date the contribution was made.

- Donation Amount: The precise monetary value of the contribution.

- Type of Donation: Specify if it’s cash, check, credit card, in-kind (with description and fair market value), or securities.

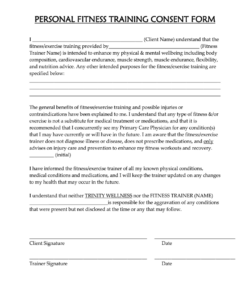

- Statement of Tax-Exempt Status: A clear declaration that your organization is a qualified tax-exempt entity under relevant IRS codes (e.g., 501(c)(3)).

- Quid Pro Quo Statement (if applicable): If the donor received goods or services in exchange for their donation, the form must state the fair market value of those goods/services.

- Signature Lines: For both the organization representative and the donor, if a physical form is used.

- Privacy Policy Statement: A brief note on how donor information will be used.

Designing and Implementing Your Tax Exempt Donation Form Template

Once you understand the ‘why,’ the next step is the ‘how.’ Creating an effective tax exempt donation form template doesn’t have to be daunting. You have several options, ranging from simple printable PDFs to sophisticated online forms integrated with your website. The best approach often depends on your organization’s size, technical capabilities, and how your donors prefer to give. Regardless of the format, clarity and ease of use should be your guiding principles.

For digital forms, consider using reputable online donation platforms or website plugins. Many of these tools are designed specifically for non-profits and automatically include fields for all the necessary tax-related information. They can also process payments, send automated receipts, and even track donor history, making your administrative life much easier. For physical forms, ensure the layout is clean, legible, and provides ample space for donors to fill in their details without feeling cramped.

User experience is paramount. A donor should be able to complete your form quickly and without confusion. This means using straightforward language, logical flow, and clear instructions. Test your form internally before making it public. Have someone unfamiliar with your organization try to fill it out and provide feedback. This simple step can highlight areas that need improvement and ensure a smooth process for every potential contributor.

Finally, don’t overlook the importance of security and data privacy, especially with online forms. Ensure that any platform or system you use is PCI DSS compliant for handling credit card information and that it has robust security measures in place to protect sensitive donor data. Clearly communicate your privacy policy to build trust and reassure donors that their personal and financial information is safe with you. A secure process reinforces your organization’s credibility.

Creating and maintaining a precise and comprehensive tax exempt donation form is an invaluable asset for any charitable organization. It not only simplifies the administrative burden but also reinforces trust with your donors by providing them with the necessary documentation for their records and tax purposes. By investing time into developing a clear, user-friendly form, you’re building a stronger foundation for sustained support and ensuring compliance every step of the way.

Ultimately, a well-designed donation form reflects positively on your organization’s professionalism and dedication. It helps you manage contributions effectively, nurture donor relationships, and continue your vital work without unnecessary hurdles. Make sure this essential tool is working as hard as you are to further your mission.