Utilizing such a structure offers several advantages. It provides a clear and organized overview of financial activity, simplifying analysis and reconciliation efforts. This can be particularly useful for budgeting, expense tracking, and financial reporting. Furthermore, a standardized format aids in quickly identifying discrepancies or unusual transactions.

This foundation of understanding regarding structured financial documentation allows for a deeper exploration of related topics, such as personal finance management, business accounting practices, and the role of technology in modern banking. It also facilitates discussions about security measures, fraud prevention, and the legal implications of financial record keeping.

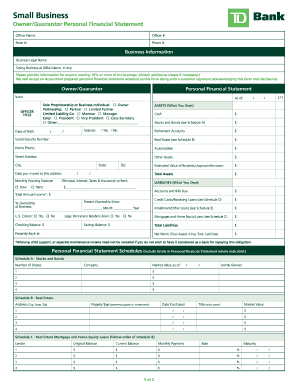

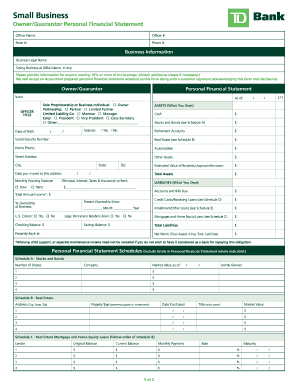

1. Structure and Format

The structure and format of a TD Bank bank statement template are fundamental to its usability and purpose. A standardized structure ensures consistent presentation of information, facilitating efficient review and analysis. This typically involves distinct sections for account details, transaction history, and balance summaries. Consistent formatting, such as date formats, transaction codes, and descriptive terminology, further enhances clarity and comprehension. Without a defined structure and format, extracting meaningful information becomes significantly more challenging, potentially hindering accurate financial management.

Consider the impact of an inconsistent date format. Variances could lead to confusion when reconciling transactions against other financial records. Similarly, unclear or inconsistently applied transaction codes can obscure the nature of individual transactions, making it difficult to categorize spending or identify potential errors. A well-defined structure, coupled with standardized formatting, streamlines these processes. For example, a dedicated section for pending transactions separated from posted transactions provides a clear overview of current financial status, allowing for proactive management of funds.

In conclusion, a standardized structure and format are integral to the effectiveness of a TD Bank bank statement template. These elements enable efficient data extraction, analysis, and reconciliation. Consistent presentation of information minimizes ambiguity, supports accurate financial tracking, and facilitates informed decision-making. Challenges arise when these principles are not adhered to, potentially leading to errors, inefficiencies, and ultimately, compromised financial management.

2. Transaction Details

Comprehensive transaction details within a TD Bank bank statement template are crucial for accurate financial record-keeping and analysis. These details provide a granular view of all account activities, enabling users to understand cash flow, identify potential discrepancies, and manage finances effectively. Without detailed transaction records, reconstructing financial history and identifying specific transactions becomes significantly more challenging.

- Transaction DateThe transaction date indicates when a specific transaction occurred. This allows for chronological tracking of financial activity and is essential for reconciling statements against other records. For example, knowing the precise date of a purchase helps match it with receipts or invoices. Accurate dating is crucial for dispute resolution and identifying unauthorized transactions.

- Transaction DescriptionThe transaction description provides a brief explanation of the transaction’s nature. This could include merchant names, transaction types (e.g., deposit, withdrawal, online transfer), or check numbers. Clear descriptions facilitate categorization and analysis of spending patterns. For instance, differentiating between “Grocery Store Purchase” and “ATM Withdrawal” provides valuable insights into spending habits.

- Transaction AmountThe transaction amount specifies the value of the transaction, indicating credits (deposits) and debits (withdrawals). Precise amounts are critical for calculating account balances and tracking overall financial health. Discrepancies in transaction amounts can signal errors or fraudulent activity. Understanding the distinction between positive and negative values is essential for accurate reconciliation.

- Running BalanceThe running balance displays the account balance after each transaction. This provides a dynamic view of how funds fluctuate over time, facilitating real-time monitoring of account status. Tracking the running balance helps identify low-balance situations, preventing overdrafts and facilitating proactive financial management.

These interconnected details form a comprehensive record of each transaction within a TD Bank bank statement template. This level of detail enables users to gain a thorough understanding of their financial activities, supporting effective budgeting, spending analysis, and account reconciliation. The absence of any of these details would significantly diminish the value and utility of the statement for financial management purposes.

3. Account balance summary

The account balance summary within a TD Bank bank statement template provides a consolidated overview of key financial figures. This typically includes the beginning balance, ending balance, and any applicable interest earned or fees charged during the statement period. This summary offers a concise snapshot of account performance, enabling efficient tracking of financial progress and identification of potential issues. Without a clear account balance summary, users would need to manually calculate these figures, increasing the risk of errors and hindering efficient financial review. For example, a significant difference between the expected and actual ending balance could indicate an unrecorded transaction or an error requiring investigation. A consistently low ending balance might signal the need for budgetary adjustments.

The relationship between the account balance summary and the detailed transaction history is crucial. The summary provides a high-level view, while the transaction details offer supporting evidence. Reconciling these two components ensures accuracy and completeness of financial records. Consider a scenario where the ending balance is lower than expected. Reviewing the transaction history allows for identification of the specific transactions contributing to this discrepancy, such as unexpected fees or larger-than-anticipated expenditures. This granular analysis facilitates informed financial decision-making and proactive account management. An accurate account balance summary, coupled with a detailed transaction history, empowers informed financial decisions.

In conclusion, the account balance summary within a TD Bank bank statement template serves as a critical component for efficient financial management. It provides a concise overview of account performance, enabling users to track financial progress, identify potential issues, and reconcile information against detailed transaction records. Challenges in interpreting or reconciling the account balance summary can hinder effective financial management. Therefore, understanding the components and significance of the account balance summary is fundamental to sound financial practices.

4. Key identification information

Key identification information within a TD Bank bank statement template serves a critical role in verifying authenticity and ensuring accurate record association. This information connects the statement to a specific account holder and financial institution, establishing its validity for official purposes. Without accurate identification information, the statement’s reliability is compromised, potentially leading to difficulties in dispute resolution, financial audits, or legal proceedings. Understanding the various components of this information is crucial for proper utilization and interpretation of the statement.

- Account NumberThe account number uniquely identifies the specific financial account associated with the statement. This number is essential for linking transactions and balances to the correct account, preventing confusion or misattribution of funds. For instance, individuals often hold multiple accounts, and the account number ensures that each statement reflects the activity of the intended account. Errors in the account number can lead to incorrect record-keeping and potential financial discrepancies.

- Customer Name and AddressThe customer name and address identify the account holder as registered with the financial institution. This information confirms ownership and responsibility for the account activity detailed within the statement. For example, during a financial audit, the customer name and address on the statement must match official records to validate the information. Discrepancies in this information can raise concerns about authenticity and ownership.

- Statement Date and PeriodThe statement date indicates when the statement was generated, while the statement period specifies the timeframe covered by the included transactions. This information contextualizes the financial activity within a defined timeframe. For instance, comparing statements from different periods allows for analysis of spending trends and financial progress. Incorrect statement dates or periods can lead to confusion when reconciling records or tracking financial performance.

- Bank InformationThe inclusion of bank information, such as the bank’s name, address, and contact details, identifies the issuing financial institution. This confirms the statement’s origin and provides a point of contact for inquiries or discrepancies. In cases of suspected fraud or errors, this information allows for direct communication with the responsible financial institution. The absence of this information can hinder resolution processes and raise concerns about the statement’s legitimacy.

These elements of key identification information work together to establish the validity and relevance of a TD Bank bank statement template. Accurate and complete identification details are crucial for proper record-keeping, financial analysis, and legal compliance. Omitting or misrepresenting any of these components compromises the integrity of the statement and can create challenges in various financial processes. Therefore, understanding the significance and function of each element is fundamental for effectively utilizing and interpreting financial statements.

5. Potential Uses and Benefits

Understanding the potential uses and benefits of a TD Bank bank statement template provides valuable context for its importance in personal and business finance. A structured overview of these applications demonstrates how the template can be leveraged for effective financial management, informed decision-making, and various administrative processes. Examining these applications highlights the template’s practical utility beyond a simple record of transactions.

- Personal Budgeting and Financial PlanningUtilizing a TD Bank bank statement template as a foundation for personal budgeting allows for detailed tracking of income and expenses. By categorizing transactions from the statement, individuals can gain insights into spending patterns and identify areas for potential savings. For example, reviewing recurring monthly expenses from the statement can reveal opportunities to reduce discretionary spending or negotiate better rates on services. This informed approach to budgeting facilitates better financial control and supports long-term financial goals.

- Business Expense Tracking and ReportingBusinesses can leverage the template to track expenses, supporting accurate accounting practices and generating financial reports. The detailed transaction information within the statement facilitates the categorization and allocation of expenses, simplifying tax preparation and financial analysis. For instance, businesses can easily extract expense data related to specific projects or departments, enabling better cost management and informed resource allocation. This organized approach to expense tracking enhances financial transparency and supports strategic business decisions.

- Loan Applications and Financial AuditsTD Bank bank statement templates often serve as supporting documentation for loan applications and financial audits. They provide verifiable evidence of financial history, demonstrating creditworthiness and financial stability. For example, when applying for a mortgage, individuals typically submit bank statements to demonstrate consistent income and responsible financial management. Similarly, during a financial audit, the detailed transaction information within the statement supports verification of financial records and compliance with regulations. The template ensures consistent and comprehensive data presentation, streamlining these processes.

- Dispute Resolution and Fraud DetectionThe detailed transaction records within the statement can be invaluable for resolving disputes with merchants or identifying potentially fraudulent activity. For instance, if a customer disputes a charge, the bank statement provides a clear record of the transaction, including date, amount, and merchant details. This information facilitates investigation and resolution of the dispute. Similarly, reviewing the statement regularly can help identify unauthorized transactions or suspicious activity, allowing for prompt action to mitigate potential financial losses. The organized format of the template simplifies this review process, aiding in timely detection and resolution of financial discrepancies.

In conclusion, the potential uses and benefits of a TD Bank bank statement template extend beyond basic record-keeping. It serves as a valuable tool for personal budgeting, business accounting, loan applications, financial audits, dispute resolution, and fraud detection. By understanding these diverse applications, individuals and businesses can effectively leverage the information within the statement to enhance financial management, support informed decision-making, and maintain accurate financial records. This contributes to improved financial health and informed financial strategies.

Key Components of a TD Bank Bank Statement Template

A thorough understanding of the key components within a TD Bank bank statement template is essential for accurate interpretation and effective utilization. These components provide a structured framework for organizing and presenting critical financial information.

1. Account Identification: This section provides unique identifiers linking the statement to a specific account and account holder. It typically includes the account number, customer name, and address. Accurate account identification ensures proper attribution of financial activity and facilitates efficient record-keeping.

2. Statement Period: The statement period specifies the timeframe covered by the included transactions and balances. This defined timeframe contextualizes the financial activity, enabling analysis of trends and performance over specific periods. Clarity regarding the statement period is crucial for accurate reconciliation and comparison with other financial records.

3. Opening and Closing Balances: These figures represent the account balance at the beginning and end of the statement period, respectively. They provide a snapshot of the overall change in account value during the specified period. Analysis of these balances can reveal patterns of spending, saving, and overall financial health.

4. Transaction History: This section comprises a detailed record of all transactions occurring within the statement period. Each transaction typically includes the date, description, amount, and running balance. This granular view of financial activity is crucial for tracking expenses, identifying discrepancies, and understanding cash flow.

5. Interest and Fees: This component details any interest earned or fees charged to the account during the statement period. Accurate reporting of interest and fees is essential for calculating net gains or losses and understanding the true cost of account maintenance. This information informs financial decisions and facilitates cost optimization strategies.

6. Bank Information: This section identifies the issuing financial institution, typically including the bank’s name, address, and contact information. This information validates the statement’s authenticity and provides a point of contact for inquiries or discrepancies.

These interconnected components provide a comprehensive overview of account activity, enabling informed financial management and decision-making. Accurate interpretation and utilization of these components are fundamental to maintaining organized financial records and facilitating sound financial practices. A lack of clarity or completeness in any of these areas can hinder effective financial analysis and potentially lead to misinterpretations of financial status.

How to Create a TD Bank Bank Statement Template

Creating a document that accurately reflects the structure and content of a TD Bank bank statement requires careful attention to detail and a thorough understanding of the key components. The following steps outline the process of developing such a template.

1. Software Selection: Select appropriate software. Spreadsheet applications offer robust functionality for creating structured documents with formulas for automatic calculations. Word processing software can also be utilized, though it may require manual calculations.

2. Header Information: Establish a header section containing essential identification information. This includes the bank’s name and logo, the customer’s name and address, the account number, and the statement period. Accurate and consistent placement of this information is crucial for clarity and authenticity.

3. Balance Summary: Incorporate a section for the account balance summary. This should clearly display the beginning balance, ending balance, and any interest earned or fees charged during the statement period. Accurate calculation and presentation of these figures are essential for financial reconciliation.

4. Transaction Details: Create a table or structured format for listing transaction details. Columns should include the transaction date, description, amount (clearly differentiating credits and debits), and the running balance after each transaction. Accurate recording of transaction details is crucial for comprehensive financial analysis.

5. Totals and Subtotals: Calculate and display totals and subtotals where relevant. This might include total deposits, total withdrawals, and net change in balance. These calculations provide a summarized view of financial activity within the statement period.

6. Formatting and Layout: Ensure consistent formatting throughout the template. Use clear fonts, appropriate spacing, and a logical layout to enhance readability and comprehension. Consistent formatting facilitates efficient review and analysis of financial information.

7. Review and Refinement: Thoroughly review the completed template for accuracy and completeness. Verify all calculations and ensure consistent formatting. Regular review and refinement of the template are crucial for maintaining its accuracy and relevance to current financial practices.

Careful attention to these steps ensures the creation of a template that reflects the structure and content of an official bank statement. This structured approach facilitates accurate record-keeping, efficient financial analysis, and informed financial decision-making.

Careful examination of the structure, components, and potential applications of documents mirroring official TD Bank bank statements reveals their significance in financial management. Understanding the format, including transaction details, balance summaries, and key identifying information, allows for accurate interpretation and utilization of these records. The potential applications, ranging from personal budgeting to business accounting and loan applications, underscore the practical utility of these structured financial documents. Proper utilization of these templates enables informed financial decisions, efficient record-keeping, and effective financial planning.

Accurate financial record-keeping forms the cornerstone of sound financial practices. Leveraging structured templates provides a framework for organized financial management, enabling individuals and businesses to gain valuable insights into their financial activities and make informed decisions. Continued emphasis on accurate record-keeping and analysis will undoubtedly play a critical role in navigating the complexities of personal and business finance in the evolving financial landscape.