Utilizing such structured documentation offers several advantages. For property owners and managers, it streamlines accounting processes, simplifies dispute resolution, and supports efficient rent collection. For renters, it offers a clear overview of their financial obligations, aids in budgeting, and provides a valuable record for personal financial management. This reciprocal transparency fosters a positive landlord-tenant relationship built on trust and mutual understanding.

The following sections will delve deeper into the key components of these financial summaries, explore best practices for their creation and utilization, and provide practical guidance for both landlords and tenants. Understanding the details of this documentation is essential for fostering a successful and harmonious tenancy.

1. Itemized Transactions

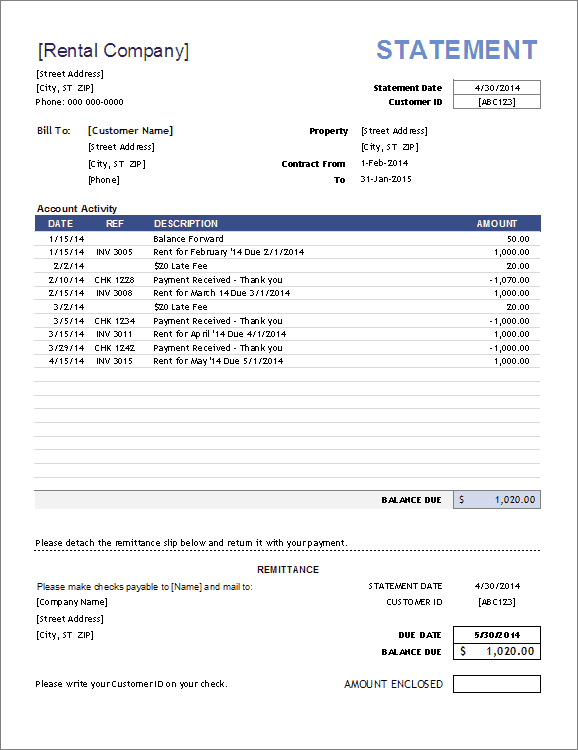

Itemized transactions form the core of a comprehensive tenant statement of account. A detailed breakdown of charges and payments provides transparency and allows both landlords and tenants to reconcile financial records easily. This granularity is essential for preventing misunderstandings and resolving potential disputes efficiently. Without itemization, a simple balance due offers little insight into the specific charges, potentially leading to confusion and distrust. For example, a statement showing only a total balance due does not explain whether it includes rent, late fees, utility charges, or other applicable costs. Itemization clarifies these individual components, enabling both parties to understand the basis of the balance.

Consider a scenario where a tenant believes they paid their rent on time, but the statement shows an outstanding balance. With itemized transactions, the discrepancy can be quickly identified. Perhaps a late fee was applied due to a processing delay or a utility charge was added. This level of detail enables prompt resolution and prevents escalation of the issue. Conversely, without itemization, determining the cause of the discrepancy becomes a complex, potentially contentious process. This clarity fostered by itemized transactions strengthens the landlord-tenant relationship, promoting open communication and mutual understanding.

In summary, itemized transactions within a statement of account are not merely a best practice but a fundamental requirement for effective financial management in a rental agreement. This practice ensures clarity, facilitates reconciliation, minimizes disputes, and ultimately contributes to a more positive and productive landlord-tenant relationship. Failing to provide this level of detail can lead to confusion, erode trust, and complicate the management of the tenancy. Therefore, incorporating itemized transactions into every statement of account is crucial for maintaining transparency and fostering a healthy financial relationship between landlords and tenants.

2. Accurate Balance Calculation

Accurate balance calculation is paramount within a tenant statement of account. A precise reflection of the financial standing between landlord and tenant is crucial for transparency and trust. Discrepancies, even minor ones, can erode confidence and lead to disputes. A statement’s value diminishes significantly if the balance due is incorrect. Consider a scenario where a tenant overpays rent due to a calculation error on the statement. While seemingly beneficial to the landlord in the short term, this error can complicate future reconciliations and damage the landlord-tenant relationship. Conversely, undercharging a tenant due to miscalculation leads to revenue loss for the property owner and potential disagreements when the error is eventually discovered.

Several factors contribute to accurate balance calculation. These include correctly recording all transactions, applying payments to the appropriate charges, and accurately factoring in any applicable fees or credits. Automated systems can minimize human error, but regular review and verification remain essential. For instance, a software glitch or a manual input error could lead to an incorrect balance, even with automation. Therefore, implementing robust quality control measures is essential to maintain accuracy. Regularly reconciling statements with bank records and other financial documents can help identify and rectify discrepancies promptly. Furthermore, providing tenants with clear instructions on how payments are applied to their accounts can further enhance transparency and reduce the likelihood of misunderstandings.

In conclusion, accurate balance calculation is not simply a desirable feature of a tenant statement of account; it is a fundamental requirement. It forms the basis of trust and transparency in the landlord-tenant relationship. Errors in balance calculation, regardless of size or cause, can have significant consequences, impacting both financial stability and interpersonal dynamics. Prioritizing accuracy through meticulous record-keeping, robust systems, and regular verification processes is essential for maintaining a healthy financial relationship and fostering a positive tenancy experience.

3. Clear Payment Schedule

A clear payment schedule is an integral component of an effective tenant statement of account template. It provides transparency and predictability regarding rent and other associated charges, fostering a positive landlord-tenant relationship. This clarity reduces the likelihood of missed or late payments, contributing to consistent cash flow for property owners and avoiding unnecessary financial penalties for tenants. A well-defined payment schedule outlines due dates, accepted payment methods, and any applicable grace periods. This information empowers tenants to manage their finances effectively and ensures timely rent collection for landlords. For example, a statement might specify that rent is due on the first of each month, payable via online transfer, check, or money order, with a grace period of five days before late fees are applied.

The absence of a clear payment schedule can lead to confusion and potential disputes. Without specified due dates or accepted payment methods, tenants may inadvertently miss payments or utilize methods that are not accepted, resulting in late fees or processing delays. For instance, a tenant might assume rent is due mid-month, resulting in a late payment if the due date is actually the first. Similarly, a tenant might attempt to pay via a method not accepted by the landlord, causing further complications. These scenarios underscore the practical significance of a clear payment schedule within the statement of account. It provides a framework for timely and consistent payments, mitigating potential misunderstandings and promoting financial stability for both parties.

In conclusion, incorporating a clear payment schedule within the tenant statement of account template is essential for efficient financial management in rental agreements. This clarity benefits both landlords and tenants by promoting timely payments, minimizing disputes, and fostering a positive, transparent financial relationship. The lack of a well-defined payment schedule can lead to confusion, missed payments, and strained landlord-tenant relations. Therefore, prioritizing clarity and detail in outlining payment expectations within the statement of account contributes significantly to a successful tenancy.

4. Contact Information

Inclusion of accurate and accessible contact information is a crucial element of a comprehensive tenant statement of account template. This information facilitates clear communication channels between landlords and tenants regarding financial matters, enabling prompt resolution of inquiries, discrepancies, or disputes. Contact details typically include the landlord or property manager’s name, phone number, email address, and physical mailing address. This readily available information empowers tenants to seek clarification or address concerns efficiently. For instance, if a tenant identifies a potential error in their statement, readily available contact information enables them to communicate the issue promptly, preventing escalation and fostering collaborative problem-solving. Conversely, the absence of contact information can create frustration and hinder timely resolution, potentially straining the landlord-tenant relationship.

The practical significance of including contact information extends beyond addressing immediate concerns. It also serves as a vital resource for tenants regarding general inquiries or routine communication about financial matters. For example, a tenant might need to inquire about acceptable payment methods, request a payment extension due to unforeseen circumstances, or seek clarification regarding specific charges on their statement. Accessible contact information facilitates these interactions, promoting transparency and open communication. Furthermore, providing multiple contact options, such as phone, email, and physical mail, caters to different communication preferences and ensures accessibility for all tenants. This consideration demonstrates professionalism and commitment to effective communication.

In summary, incorporating accurate and accessible contact information within the tenant statement of account template is essential for effective communication and positive landlord-tenant relations. This seemingly simple detail plays a significant role in facilitating transparency, enabling prompt issue resolution, and fostering a collaborative approach to managing financial aspects of the tenancy. Failing to provide adequate contact information can hinder communication, escalate minor issues into disputes, and ultimately undermine the landlord-tenant relationship. Therefore, prioritizing clear and accessible contact details within the statement of account is a crucial step toward fostering a positive and productive tenancy experience.

5. Date and Period Covered

Specification of the date and period covered is a fundamental aspect of a tenant statement of account template. This seemingly simple detail provides crucial context for the financial information presented, enabling both landlords and tenants to reconcile records accurately and track financial activity over time. A statement without a clearly defined period essentially becomes a snapshot of an unknown timeframe, lacking the necessary context for meaningful interpretation. The date and period provide a framework for understanding the transactions listed, enabling users to place the information within a specific timeframe and correlate it with other financial records. For instance, a statement dated March 1st, 2024, covering the period of February 1st, 2024, to February 29th, 2024, clearly indicates that the transactions listed pertain specifically to February’s rental activity. This clarity is essential for both record-keeping and financial planning.

Consider a scenario where a tenant receives multiple statements without clearly defined periods. Reconciling these statements with personal banking records becomes a complex and potentially error-prone process. Without knowing the specific period each statement covers, matching payments to charges and tracking outstanding balances becomes challenging. This lack of clarity can lead to confusion, disputes, and difficulties in managing finances effectively. Conversely, clearly stating the date and period covered allows for straightforward reconciliation, simplifying financial management for both landlords and tenants. Furthermore, this information becomes invaluable for tax purposes, providing documented proof of rental payments and expenses within specific timeframes. This detailed record-keeping facilitates accurate reporting and simplifies financial audits.

In conclusion, the inclusion of the date and period covered within a tenant statement of account template is not merely a formality but a critical component for accurate record-keeping, financial transparency, and efficient reconciliation. This seemingly minor detail provides essential context, enabling both landlords and tenants to understand the financial activity within a specific timeframe, facilitating effective financial management and minimizing potential disputes. The absence of this information undermines the statement’s utility and can complicate financial planning and record-keeping processes. Therefore, prioritizing the clear specification of the date and period covered contributes significantly to a transparent and well-organized financial relationship between landlords and tenants.

Key Components of a Tenant Statement of Account

A comprehensive statement of account requires specific components to ensure clarity and functionality. These components provide a detailed overview of the financial relationship between landlord and tenant, facilitating transparency and minimizing potential disputes.

1. Tenant Information: Complete tenant details, including full name and current rental unit address, ensure the statement is correctly attributed and easily identifiable.

2. Landlord/Property Manager Information: Corresponding landlord or property manager information allows tenants direct access for inquiries or clarifications.

3. Statement Period: A defined timeframe, including start and end dates, provides context for all listed transactions and facilitates accurate reconciliation.

4. Itemized Charges: Detailed breakdowns of individual charges, such as rent, late fees, utilities, and maintenance costs, ensure transparency and allow for easy verification.

5. Itemized Payments: A record of all payments received, including dates and amounts, provides a clear picture of the tenant’s payment history.

6. Running Balance: A continuously updated balance reflecting charges and payments provides a real-time overview of the tenant’s account status.

7. Payment Due Date: Clear indication of the due date for upcoming rent and other charges promotes timely payments and prevents late fees.

8. Accepted Payment Methods: Listing acceptable payment methods simplifies the payment process and ensures efficiency.

These components work in concert to provide a transparent and accurate representation of a tenant’s financial activity, facilitating clear communication and a positive landlord-tenant relationship. Accurate and detailed information ensures both parties maintain a clear understanding of financial obligations and transactions.

How to Create a Tenant Statement of Account Template

Creating a standardized template ensures consistency, clarity, and efficiency in managing tenant accounts. A well-structured template benefits both landlords and tenants by providing a clear overview of financial transactions.

1. Software Selection: Utilize spreadsheet software or dedicated property management software. Spreadsheet software offers basic functionality, while property management software often includes automated features like rent tracking and late fee calculation.

2. Header Information: Include sections for tenant and landlord/property manager contact details. This ensures clear identification and facilitates direct communication. Include the statement date and the period it covers for accurate record-keeping.

3. Transaction Details: Designate columns for itemized charges and payments. Specify the date, description, and amount for each transaction. This level of detail promotes transparency and enables easy reconciliation.

4. Balance Calculation: Incorporate a formula to calculate the running balance after each transaction. This provides a real-time overview of the account status and helps prevent discrepancies.

5. Payment Information: Clearly state the payment due date and accepted payment methods. This promotes timely payments and reduces the likelihood of confusion.

6. Late Fee Policy: If applicable, outline the late fee policy, including the amount and when it applies. Transparency regarding late fees helps prevent misunderstandings.

7. Additional Information: Include any other relevant information, such as lease terms or contact information for emergency maintenance. This provides a comprehensive resource for tenants.

8. Regular Review: Periodically review and update the template to ensure accuracy and compliance with legal requirements. This helps maintain clarity and prevents potential disputes.

A well-designed template streamlines accounting processes, promotes transparency, and facilitates effective communication. Utilizing a consistent format simplifies record-keeping and fosters a positive landlord-tenant relationship.

Accurate and comprehensive financial documentation is paramount for successful landlord-tenant relationships. Standardized, detailed records of transactions provide clarity, facilitate communication, and minimize potential for disputes. Understanding the components, creation, and utilization of these crucial documents benefits both property owners and renters. Properly implemented, these records contribute significantly to efficient property management and positive tenant experiences. They serve as a cornerstone of transparency and accountability, fostering trust and mutual understanding.

Effective management of rental properties requires a commitment to clear and consistent financial practices. Adoption of best practices in documentation is an investment in long-term stability and positive landlord-tenant relationships. Regular review and refinement of processes ensure continued efficacy and adaptability to evolving circumstances. Prioritizing these practices contributes to a more professional and harmonious rental environment for all parties involved.