Managing rental properties comes with its fair share of responsibilities, and one of the most crucial aspects is handling rent and deposit payments efficiently and securely. Gone are the days when paper checks were the only option. Today, electronic payment methods, particularly Automated Clearing House (ACH) transactions, offer a streamlined solution that benefits both landlords and tenants. Embracing this technology can significantly simplify your financial processes, making rent collection less of a chore and more of a seamless operation.

ACH payments allow for direct money transfers between bank accounts, which is incredibly convenient for recurring payments like rent. It eliminates the need for physical checks, reduces the risk of lost mail, and provides a clear digital trail for every transaction. For landlords, this means more consistent on-time payments and less time spent depositing checks. For tenants, it offers an easy, automated way to ensure rent is paid without the hassle of writing and mailing checks every month. It’s a win-win situation, but to make it work smoothly and legally, you need the right framework, starting with a robust tenants ACH deposit form template.

Understanding the Importance of a Tenants ACH Deposit Form Template

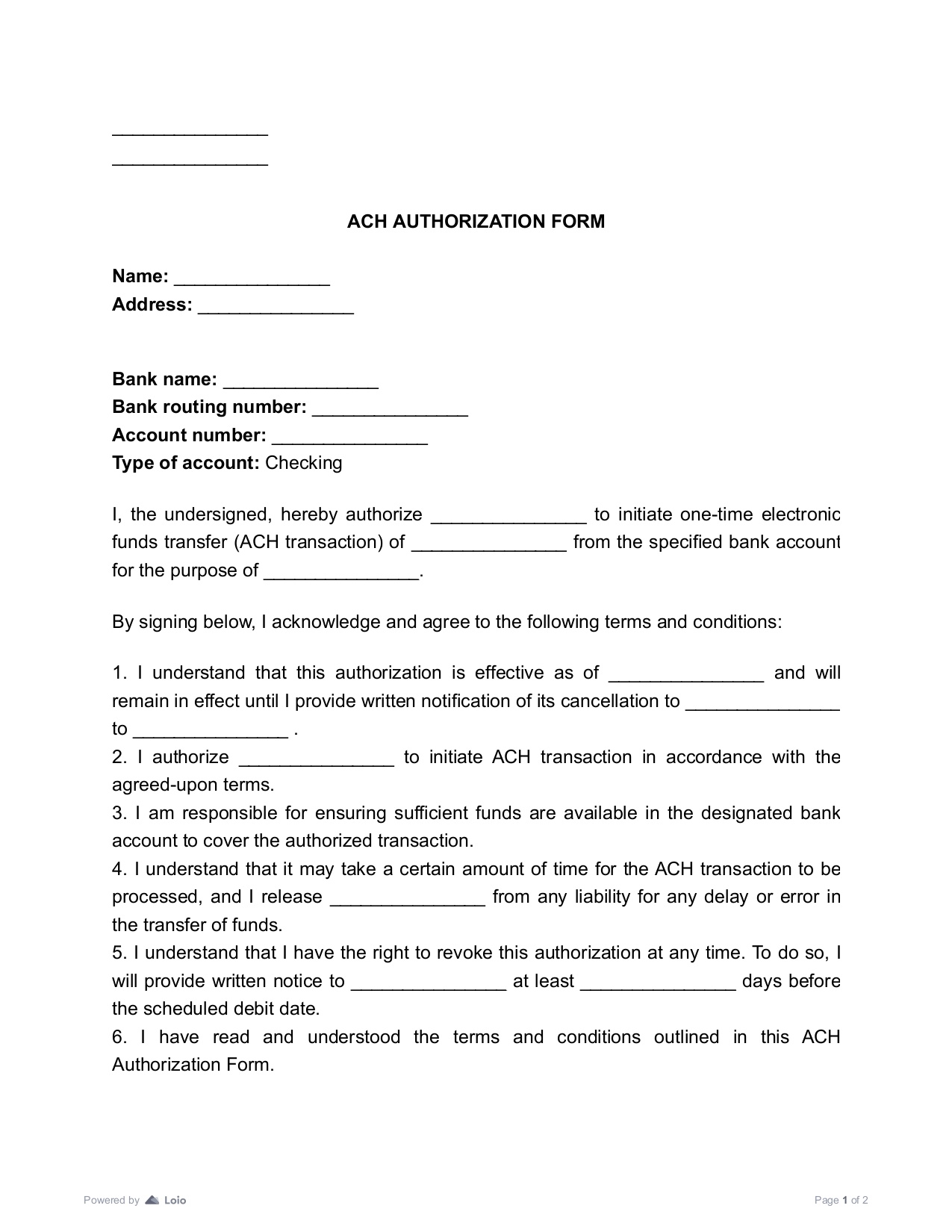

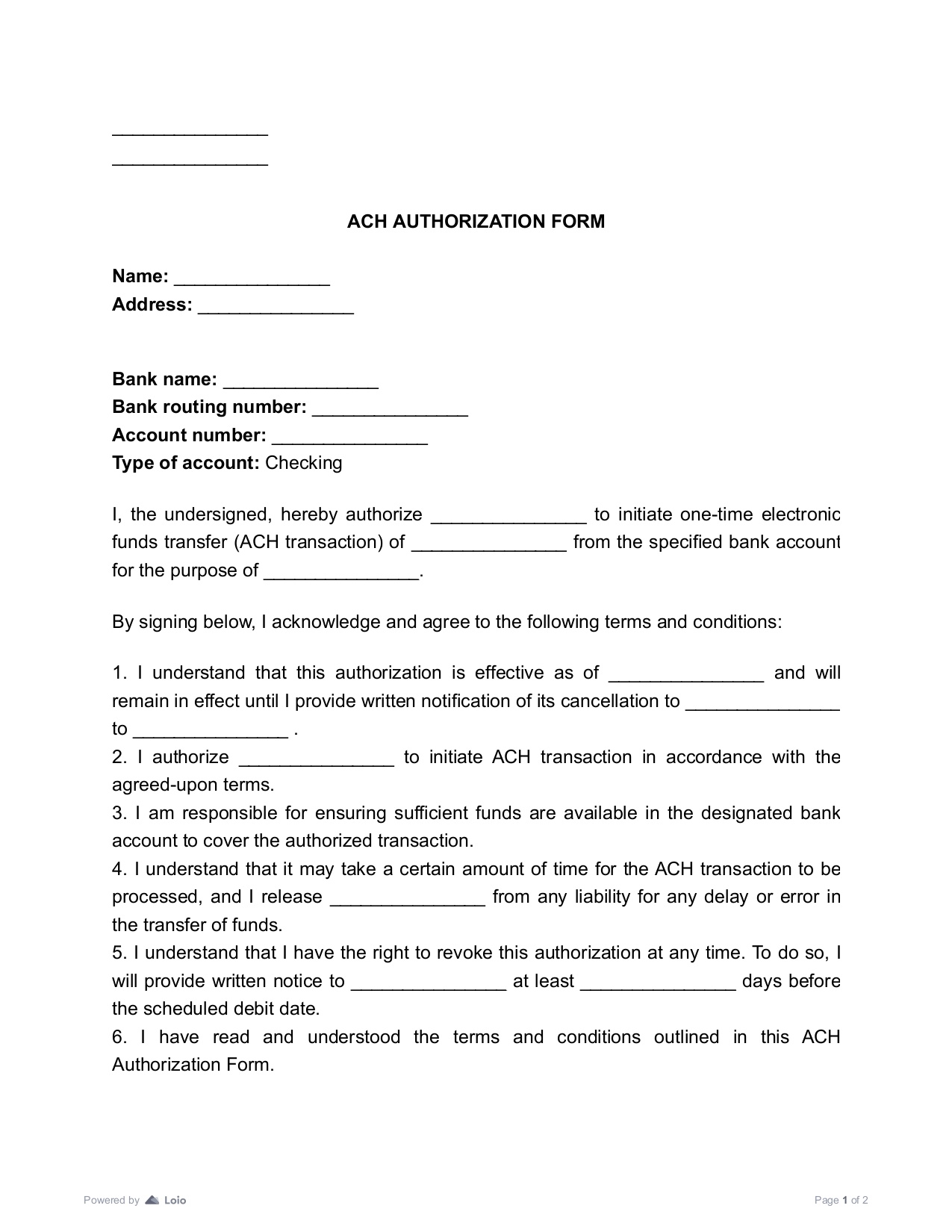

An ACH deposit form template isn’t just a piece of paper; it’s a critical legal document that authorizes a landlord to directly debit a tenant’s bank account for rent or other agreed-upon payments. This form serves as the official agreement, detailing the terms of the electronic transactions and protecting both parties by clearly outlining responsibilities and authorizations. Without a properly completed and signed form, initiating ACH payments would be impossible and unauthorized. It acts as the bridge between convenience and compliance, ensuring that all electronic transfers are conducted with explicit consent.

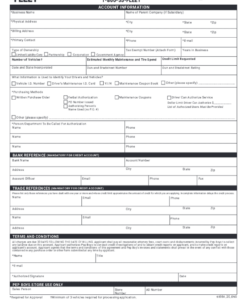

Beyond basic authorization, a well-designed tenants ACH deposit form template mitigates potential disputes by documenting the agreement. It provides a clear record of the banking information, the amount to be debited, the frequency of payments, and the effective start date. This transparency is crucial for maintaining trust and avoiding misunderstandings. Imagine trying to reconcile payments without clear documentation; it could lead to financial headaches and strained landlord-tenant relationships. The form removes ambiguity, making the entire process straightforward and auditable.

Furthermore, leveraging a template ensures consistency across all your properties and tenants. Instead of creating a new form from scratch for each new tenant, a template allows you to quickly populate the necessary details, saving time and reducing the chance of errors. This standardization is vital for efficient property management, especially if you handle multiple units. It streamlines the onboarding process for new tenants, making their transition into your property as smooth as possible, right down to setting up their rent payments.

Finally, the security aspect cannot be overstated. A professional tenants ACH deposit form template will include language about data privacy and the secure handling of sensitive banking information. It shows tenants that you take their financial security seriously, which is a major factor in building trust. While the digital transfer itself is secure, the initial collection of banking details must also be handled with care and respect for privacy, and the form serves as your commitment to that.

Key Components of an Effective Form

A comprehensive tenants ACH deposit form template should include specific sections to ensure all necessary information is captured and legal requirements are met. These typically include:

Streamlining Payments: Implementing Your ACH Deposit System

Once you have your perfected tenants ACH deposit form template, the next step is integrating it into your payment collection process. This transition can significantly reduce the administrative burden associated with rent collection. Begin by clearly communicating the benefits of ACH payments to your tenants, emphasizing convenience, security, and the elimination of manual checks. Offering ACH as the preferred payment method, perhaps with a small incentive, can encourage widespread adoption. Many tenants appreciate the automation that takes one more item off their monthly to-do list.

For landlords, the advantages extend beyond just convenience. Implementing an ACH system means more predictable cash flow, as payments are debited directly from tenant accounts on a set schedule. This reduces late payments and the need for time-consuming follow-ups. Automated reconciliation with your accounting software becomes much simpler, as transactions are clearly marked and consistent. Imagine the time saved not having to manually process dozens of checks, make trips to the bank, or deal with bounced checks.

Tenants, too, experience substantial benefits. They no longer need to remember to write and mail checks, potentially avoiding late fees due to postal delays or forgotten due dates. ACH payments provide a clear digital record, which can be easily tracked through their bank statements. This transparency offers peace of mind and simplifies budgeting, as they know exactly when the rent will be debited each month. It’s a modern solution for a modern renter, aligning with the digital financial habits many people already embrace.

To ensure a smooth transition, provide clear instructions for filling out the form and explain the process of how and when funds will be debited. Address common concerns about security and provide a point of contact for any questions. Regularly review your ACH processes to ensure compliance with banking regulations and to identify any areas for improvement. A well-implemented ACH system, supported by a robust tenants ACH deposit form template, is a cornerstone of efficient and tenant-friendly property management.

Embracing modern payment solutions like ACH transactions can truly transform how you manage your rental properties. By utilizing a clear and comprehensive form, you create a foundation of trust and efficiency that benefits everyone involved. It simplifies financial operations, reduces common payment hurdles, and ultimately contributes to a more professional and harmonious landlord-tenant relationship.

Moving towards electronic payments not only saves time and reduces stress but also positions your property management as forward-thinking and tenant-focused. It’s an investment in a smoother, more reliable process that ensures timely income and provides tenants with the convenience they expect in today’s digital world.