Analyzing financial data across multiple reporting periods offers several key advantages. It allows for the identification of significant trends in revenue generation, cost management, and profitability. This historical perspective enables more accurate forecasting, informed strategic planning, and better-informed decision-making. Furthermore, it provides valuable insights for potential investors, lenders, and other stakeholders interested in evaluating the long-term viability and stability of the organization.

The following sections will delve deeper into the specific components, construction, and practical applications of comparative financial reporting for enhanced business analysis and strategic planning.

1. Revenue Trends

Revenue trends, a crucial component of multi-year income statement analysis, provide insights into an organization’s sales performance over an extended period. Examining revenue figures across three years reveals patterns such as consistent growth, stagnation, or decline. This information is essential for understanding the financial trajectory of a business. A consistent upward trend often signals strong market demand and effective sales strategies. Conversely, declining or stagnant revenue may indicate market saturation, increased competition, or ineffective pricing strategies. For example, a software company experiencing year-over-year revenue growth might attribute this trend to successful product launches or increasing market share. Conversely, a retailer showing declining revenue might investigate factors like changing consumer preferences or the impact of e-commerce competitors.

Analyzing revenue trends within a multi-year income statement allows stakeholders to assess the sustainability and predictability of an organization’s income streams. This analysis can also inform strategic decision-making. For instance, consistent revenue growth might justify investments in expansion or research and development, while declining revenue might necessitate cost-cutting measures or strategic pivots. Comparing revenue trends with industry benchmarks provides context and helps assess an organization’s performance relative to its competitors. This comparative analysis can highlight areas of strength and weakness, informing strategic adjustments to improve market positioning.

Understanding revenue trends is fundamental for evaluating the financial health and future prospects of any organization. This analysis, facilitated by a multi-year income statement, allows for proactive identification of potential challenges and opportunities, enabling informed decision-making and enhanced strategic planning.

2. Expense Analysis

Expense analysis within a three-year income statement template provides crucial insights into an organization’s cost structure and its evolution over time. Understanding expense trends is essential for effective cost management, profitability assessment, and informed decision-making. Examining expenses across multiple reporting periods allows for the identification of areas of potential cost savings, operational inefficiencies, and the impact of external factors on an organization’s financial performance.

- Cost of Goods Sold (COGS)COGS represents the direct costs associated with producing goods sold by a company. Analyzing COGS trends helps assess production efficiency and pricing strategies. Increasing COGS alongside stagnant or declining revenue can signal production inefficiencies or rising raw material costs. For example, a manufacturer experiencing rising COGS might investigate supply chain disruptions or explore alternative sourcing options.

- Operating ExpensesOperating expenses encompass costs incurred in running the day-to-day business, including salaries, rent, and marketing expenses. Analyzing operating expenses across three years reveals trends in administrative efficiency and resource allocation. Rapidly increasing operating expenses can indicate overstaffing, inefficient processes, or escalating overhead costs. A service-based company, for example, might analyze rising salary expenses to assess employee productivity and optimize staffing levels.

- Research and Development (R&D)R&D expenses reflect investments in innovation and future growth. Analyzing R&D spending trends helps assess an organization’s commitment to innovation and its potential for long-term growth. Consistent R&D investment often signifies a focus on developing new products or improving existing ones, which can enhance competitiveness. A technology company, for instance, might analyze R&D spending to evaluate the effectiveness of its innovation initiatives and their potential contribution to future revenue streams.

- Interest ExpenseInterest expense represents the cost of borrowing money. Analyzing interest expense trends reveals the impact of debt financing on an organization’s profitability. Increasing interest expenses alongside rising debt levels can signal potential financial strain. A real estate developer, for example, might analyze interest expense trends to assess the impact of financing costs on project profitability and evaluate its debt management strategies.

By analyzing these expense categories within a three-year income statement template, stakeholders gain a comprehensive understanding of an organization’s cost structure, efficiency, and financial health. This analysis facilitates informed decision-making related to cost control, pricing strategies, resource allocation, and long-term financial planning. Comparing expense trends with industry benchmarks provides further context for evaluating an organization’s performance and identifying areas for potential improvement.

3. Profitability Measurement

Profitability measurement, a critical aspect of financial analysis, gains significant depth when viewed through the lens of a three-year income statement template. This multi-period perspective allows stakeholders to assess not just the current profitability of an organization, but also its trajectory and sustainability. Analyzing key profitability metricsgross profit margin, operating profit margin, and net profit marginacross three years reveals trends that offer valuable insights into an organization’s financial health and operational efficiency.

Gross profit margin, calculated as revenue less the cost of goods sold divided by revenue, reflects the profitability of core business operations. A consistent increase in gross profit margin over three years might indicate improved production efficiencies, effective pricing strategies, or a favorable shift in input costs. Conversely, a declining trend might signal rising production costs, increased competition, or pricing pressures. For instance, a manufacturing company implementing lean manufacturing principles might observe an increasing gross profit margin over time due to reduced production costs.

Operating profit margin, calculated as operating income divided by revenue, measures profitability after accounting for operating expenses. Analyzing operating profit margin across three years reveals how effectively an organization manages its operating costs. A stable or increasing operating profit margin suggests efficient cost control and effective resource allocation. A declining trend, however, might indicate rising administrative expenses, inefficient processes, or escalating overhead costs. A retail company expanding into new markets, for example, might experience a temporary dip in operating profit margin due to increased marketing and expansion costs. However, successful market penetration should lead to improved operating margins in subsequent years.

Net profit margin, calculated as net income divided by revenue, represents the overall profitability of an organization after accounting for all expenses, including interest and taxes. Analyzing net profit margin over three years provides a comprehensive view of an organization’s financial performance. A healthy and growing net profit margin indicates sustainable profitability and efficient financial management. A declining trend might signal challenges related to debt burden, increased competition, or declining market share. A technology company investing heavily in research and development, for instance, might experience a short-term decrease in net profit margin due to increased R&D expenses. However, successful innovation should eventually lead to higher revenue and improved profitability in the long run.

Understanding the trends in these profitability metrics, facilitated by a three-year income statement template, allows stakeholders to assess the financial health, operational efficiency, and long-term sustainability of an organization. This analysis provides a basis for informed decision-making related to pricing strategies, cost management, investment decisions, and overall strategic planning. Furthermore, comparing these trends with industry benchmarks provides valuable context and helps assess an organization’s performance relative to its competitors.

4. Comparative Analysis

Comparative analysis, facilitated by a three-year income statement template, provides a powerful tool for understanding trends, identifying strengths and weaknesses, and evaluating financial performance over an extended period. This approach moves beyond static, single-year snapshots to offer a dynamic view of an organization’s financial trajectory. By examining key financial metrics across multiple reporting periods, stakeholders gain deeper insights into the drivers of financial performance and can make more informed decisions.

- Trend IdentificationReviewing financial data across three years reveals underlying trends in revenue, expenses, and profitability. For example, consistently increasing revenue alongside controlled expenses suggests sustainable growth. Conversely, declining profitability despite rising revenue warrants further investigation into cost management practices. These trends offer valuable insights for strategic planning and resource allocation.

- Performance BenchmarkingComparative analysis enables benchmarking against competitors or industry averages. This comparison provides context for evaluating an organization’s performance relative to its peers. For instance, a company’s consistently higher profit margins compared to industry averages might indicate a competitive advantage in pricing strategies or cost control. Conversely, lagging performance might signal areas for improvement.

- Risk AssessmentAnalyzing financial data over multiple years facilitates the identification of potential risks and vulnerabilities. For example, consistently increasing debt levels coupled with declining profitability might signal financial strain and increased risk of default. Early identification of such trends allows for proactive risk mitigation strategies.

- Strategic Decision-MakingComparative analysis informs strategic decision-making by providing a historical perspective on financial performance. This information supports data-driven decisions related to pricing, product development, market expansion, and resource allocation. For instance, consistently strong performance in a particular product segment might justify further investment in that area, while declining performance in another segment might necessitate a strategic shift or exit strategy.

Comparative analysis, leveraging the insights provided by a three-year income statement template, is essential for effective financial management and strategic planning. This approach allows stakeholders to move beyond static analysis and gain a dynamic understanding of an organization’s financial trajectory, enabling data-driven decisions and proactive responses to emerging trends and challenges.

5. Financial Forecasting

Financial forecasting relies heavily on historical financial data, making the three-year income statement template a crucial tool. This historical perspective provides a foundation for projecting future financial performance, enabling organizations to anticipate potential challenges and opportunities. Accurate forecasting is essential for informed decision-making, resource allocation, and strategic planning.

- Trend AnalysisAnalyzing revenue and expense trends within the three-year statement reveals patterns that inform future projections. For example, consistent revenue growth might suggest a similar trajectory in the coming year, while fluctuating expenses require careful consideration of contributing factors and potential future variability. A software company experiencing consistent subscription revenue growth might project similar growth in the next year, adjusting for anticipated market changes or new product launches.

- Seasonality ConsiderationsThe three-year timeframe allows for the identification of seasonal patterns in revenue and expenses. This understanding is crucial for accurate forecasting, ensuring that projections account for predictable fluctuations. A retail business, for example, can anticipate increased sales during the holiday season and adjust inventory and staffing levels accordingly based on historical data.

- External Factor IntegrationForecasting must consider external factors like market conditions, economic outlook, and industry trends. The three-year income statement, while providing a historical perspective, serves as a baseline for incorporating these external influences into future projections. A construction company, for instance, might adjust its revenue projections based on anticipated changes in interest rates or the availability of construction materials.

- Scenario PlanningThe three-year income statement facilitates scenario planning by providing historical data for various what-if scenarios. Organizations can model different potential outcomes based on varying assumptions about future market conditions or internal performance. A manufacturing company, for example, might model different scenarios based on varying raw material prices or changes in customer demand.

By integrating these facets of financial forecasting with the historical data provided by the three-year income statement template, organizations develop a more robust and informed outlook on future financial performance. This, in turn, supports more effective strategic planning, resource allocation, and risk management, ultimately contributing to long-term financial stability and growth.

6. Performance Evaluation

Performance evaluation, a critical aspect of organizational management, gains significant depth and context through the utilization of a three-year income statement template. This multi-period perspective allows for a comprehensive assessment of financial performance beyond a single reporting period, revealing trends, identifying strengths and weaknesses, and informing strategic decision-making.

- Trend IdentificationAnalyzing key performance indicators (KPIs) such as revenue growth, profitability margins, and expense ratios across three years reveals underlying trends. These trends offer insights into the effectiveness of operational strategies, pricing decisions, and cost management initiatives. For example, consistent revenue growth coupled with stable or improving profit margins indicates sustainable financial performance. Conversely, declining profitability despite revenue growth warrants further investigation into cost structures and operational efficiencies.

- Benchmarking and Competitive AnalysisThe three-year income statement facilitates benchmarking against competitors or industry averages. Comparing KPIs across multiple periods provides a more robust assessment of competitive positioning and relative performance. A company consistently outperforming its competitors in terms of revenue growth and profitability may possess a sustainable competitive advantage. Conversely, lagging performance highlights areas requiring strategic attention and improvement.

- Progress Measurement Against ObjectivesOrganizations establish financial objectives to guide their operations and strategic direction. The three-year income statement provides a framework for measuring progress towards these objectives over time. Consistent achievement or exceeding of targets indicates effective strategy execution and operational efficiency. Failure to meet objectives, however, necessitates a review of underlying strategies, resource allocation, and operational processes.

- Stakeholder CommunicationThe three-year income statement serves as a valuable communication tool for conveying financial performance to stakeholders, including investors, lenders, and internal management. The multi-period perspective provides a clear and concise summary of financial trends, enabling stakeholders to assess the organization’s financial health, stability, and potential for future growth. This transparency fosters trust and informed decision-making.

The insights gained from performance evaluation based on the three-year income statement template are instrumental in driving strategic planning, resource allocation, and operational improvements. This approach fosters a data-driven culture, enabling organizations to adapt to changing market conditions, optimize performance, and achieve long-term financial sustainability.

Key Components of a Three-Year Income Statement

A comprehensive three-year income statement includes several key components, each providing crucial insights into an organization’s financial performance over time. Understanding these components is essential for effective analysis, informed decision-making, and strategic planning.

1. Revenue: Revenue represents income generated from sales of goods or services. Tracking revenue across three years reveals growth trends, seasonality, and the impact of market conditions on an organization’s top line.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold. Analyzing COGS trends helps assess production efficiency, pricing strategies, and the impact of input costs on profitability.

3. Gross Profit: Gross profit, calculated as revenue less COGS, reflects the profitability of core business operations. Analyzing gross profit trends offers insights into pricing strategies, production efficiencies, and overall product profitability.

4. Operating Expenses: Operating expenses encompass costs incurred in running the day-to-day business, including salaries, rent, marketing, and administrative expenses. Analyzing operating expense trends reveals insights into cost control, operational efficiency, and resource allocation.

5. Operating Income: Operating income, calculated as gross profit less operating expenses, measures profitability from core business operations. Analyzing operating income trends assesses the organization’s ability to manage operating costs and generate profits from its core activities.

6. Other Income/Expenses: This category includes income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time charges. Analyzing these items provides insights into non-operating activities that impact overall profitability.

7. Income Before Taxes: This represents income generated before accounting for income tax expense. Analyzing this figure helps assess an organization’s pre-tax profitability and the impact of operating and non-operating activities on its financial performance.

8. Income Tax Expense: This represents the expense incurred for income taxes. Analyzing income tax expense trends helps understand the organization’s effective tax rate and its impact on net income.

9. Net Income: Net income, often referred to as the “bottom line,” represents the organization’s profit after all expenses, including taxes, have been deducted. Analyzing net income trends provides a comprehensive view of an organization’s overall profitability and financial performance over time.

Careful examination of these components within a three-year income statement provides valuable insights for assessing financial health, identifying trends, and making informed strategic decisions. This multi-period perspective allows stakeholders to understand the drivers of past performance and project future outcomes with greater accuracy.

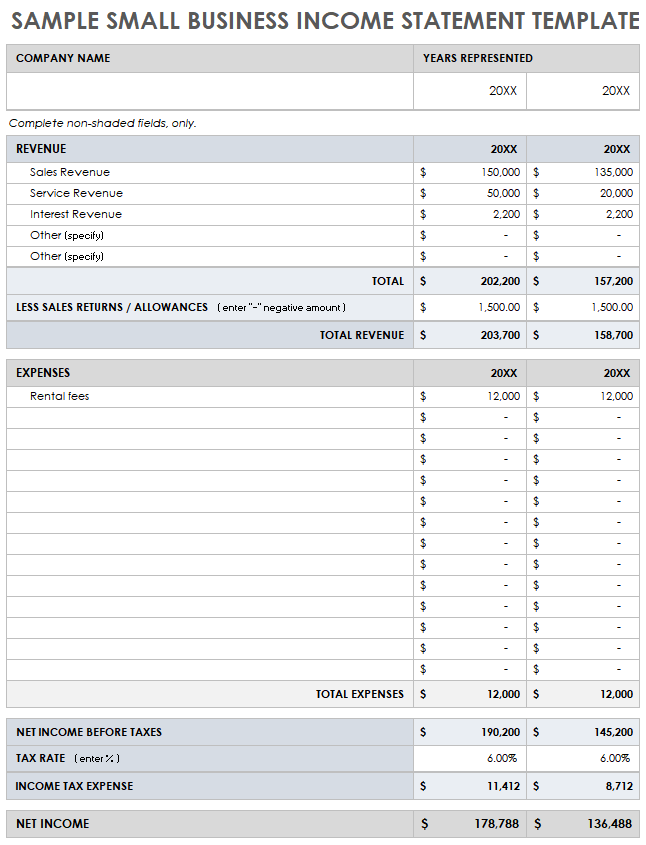

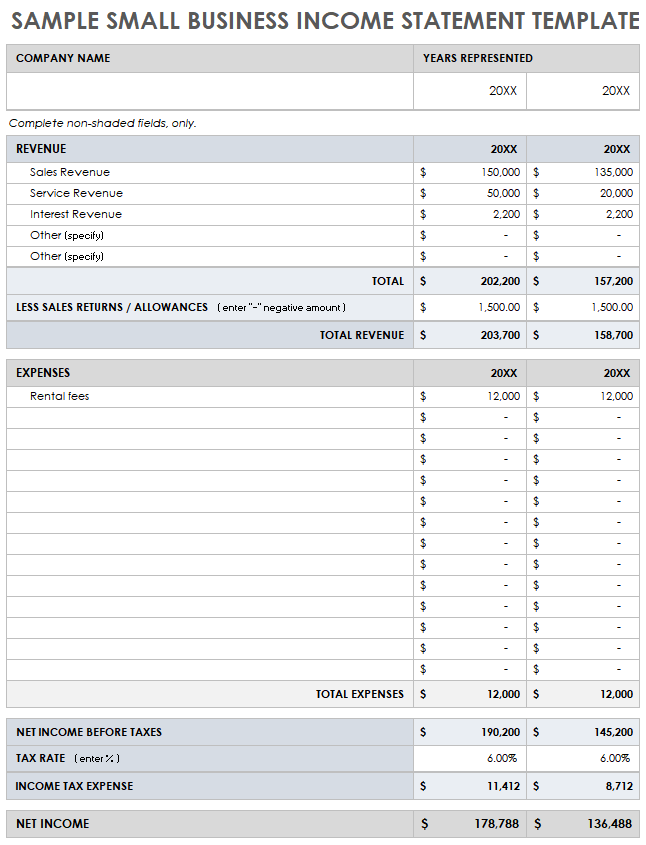

How to Create a Three-Year Income Statement

Creating a three-year income statement involves compiling financial data from three consecutive reporting periods. This process requires careful organization and a clear understanding of financial statement structure. The following steps outline the process of creating a comprehensive and informative three-year income statement.

1: Gather Financial Data: Collect income statements for the three desired periods. Ensure data consistency across all periods, using the same accounting principles and reporting formats. This consistency ensures accurate trend analysis and meaningful comparisons.

2: Create a Template: Structure the template with columns for each year and rows for each income statement component (revenue, COGS, gross profit, operating expenses, operating income, other income/expenses, income before taxes, income tax expense, and net income). This structured format facilitates clear comparisons and trend identification.

3: Populate the Template: Transfer the financial data from each individual income statement into the corresponding columns of the template. Maintain accuracy and double-check entries to ensure data integrity. Accuracy is paramount for reliable analysis and informed decision-making.

4: Calculate Key Metrics: Calculate key profitability metrics, including gross profit margin, operating profit margin, and net profit margin, for each year. These metrics provide insights into operational efficiency and profitability trends. Understanding these metrics is crucial for assessing financial performance.

5: Format for Clarity: Format the statement for readability, using clear labels, consistent formatting, and appropriate units (e.g., currency). A well-formatted statement enhances understanding and facilitates effective communication of financial information.

6: Review and Verify: Thoroughly review the completed three-year income statement for accuracy and completeness. Ensure all data is correctly entered and calculations are accurate. Data integrity is paramount for reliable analysis and informed decision-making. Any discrepancies should be investigated and corrected before utilizing the statement for analysis or reporting.

A well-constructed three-year income statement provides a powerful tool for analyzing trends, evaluating performance, and informing strategic decision-making. Accuracy, consistency, and clarity are crucial throughout the creation process to ensure the reliability and usefulness of the statement.

Analysis using a three-year income statement template provides valuable insights into an organization’s financial trajectory. Examining revenue trends, expense patterns, and profitability metrics across multiple periods reveals key insights into operational efficiency, financial health, and potential risks. Comparative analysis, benchmarking, and forecasting become significantly more robust with this longitudinal perspective, facilitating data-driven decision-making and strategic planning. Understanding the components and construction of this financial tool empowers stakeholders to assess past performance, identify areas for improvement, and project future outcomes with greater accuracy.

Leveraging the insights offered by a three-year income statement allows organizations to move beyond static financial analysis and embrace a dynamic understanding of their financial health. This proactive approach to financial management is crucial for navigating complex market conditions, optimizing resource allocation, and achieving long-term financial sustainability. The insights derived from this analysis serve as a cornerstone for informed strategic planning, driving organizational growth and resilience in the face of evolving economic landscapes.