Running a business often involves establishing strong relationships with suppliers, distributors, or other businesses. These B2B interactions frequently rely on trade accounts, which allow for credit terms, bulk discounts, and streamlined purchasing processes. But before you can enjoy the benefits of a trade account, there’s usually a bit of paperwork involved. That’s where a well-designed trade account opening form comes into play.

Creating an efficient and comprehensive form for new trade account applications is crucial for any business looking to expand its reach and improve its B2B operations. It ensures you gather all necessary information upfront, helps with credit assessments, and sets clear terms and conditions. Without a clear process, opening new accounts can become a bottleneck, leading to frustration for both your business and your potential partners. A robust trade account opening form template can be a game-changer.

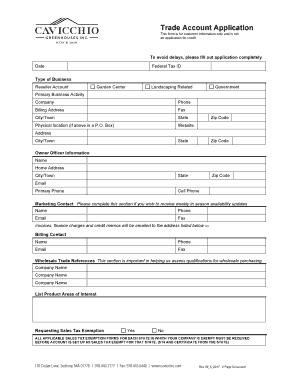

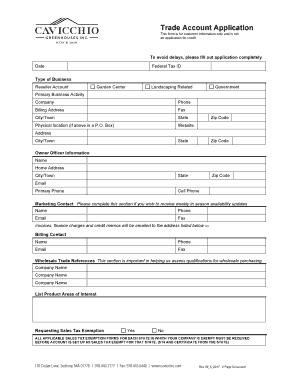

The Essentials of a Great Trade Account Opening Form Template

When you’re looking for or designing a trade account opening form template, think about what truly makes it effective. It’s not just about ticking boxes; it’s about collecting the right data to facilitate a smooth, long-lasting business relationship while mitigating risks. A great template should be intuitive for the applicant yet thorough enough for your internal review processes. It needs to balance user-friendliness with comprehensive information gathering.

Your form needs to cover several critical areas to be truly effective. This includes everything from basic contact information to financial details and legal agreements. Overlooking even one small section could lead to future complications or delays in service provision. A structured approach ensures all bases are covered without overwhelming the applicant.

Key Information to Include

- Applicant Business Details: Name, registered address, trading name, company registration number, VAT number if applicable.

- Key Contact Information: Names, phone numbers, email addresses for primary contacts, accounts payable, and purchasing.

- Financial Information: Bank details for direct debit setup or credit checks, trade references, and perhaps annual turnover.

- Terms and Conditions: A clear section for applicants to acknowledge and agree to your payment terms, return policies, and general terms of trade.

- Signatures: Spaces for authorized signatories, ensuring legal validity and commitment.

Each of these sections serves a specific purpose. Business details confirm legitimacy, contact information ensures smooth communication, and financial details are paramount for credit assessment and invoicing. Terms and conditions protect both parties, setting expectations upfront. Don’t underestimate the power of a clear and legally sound agreement section; it’s your first line of defense against misunderstandings.

Beyond the content, consider the design. A cluttered or confusing form can deter potential partners. Use clear headings, logical flow, and perhaps even some helpful hints or tooltips if it’s a digital form. The easier it is for someone to complete, the faster you can onboard them and start doing business together. Simplicity and professionalism go hand-in-hand in creating a positive first impression.

Implementing and Optimizing Your Trade Account Opening Form Template

Once you have a solid trade account opening form template, the next step is to implement it effectively. Will it be a printable PDF, an online form, or a combination of both? Each option has its advantages. Online forms can offer automation, integration with CRM systems, and easier data validation. Physical forms might be preferred by some businesses or in specific industries where wet signatures are still the norm.

For digital forms, consider using platforms that allow for e-signatures and conditional logic, where certain fields only appear based on previous answers. This can significantly streamline the applicant’s experience and ensure you only collect relevant data. If you’re using a physical form, ensure it’s easy to download, print, and that the layout allows enough space for written answers. Always provide clear instructions on how to submit the completed form.

Don’t just set it and forget it. Your trade account opening process should be regularly reviewed and optimized. Gather feedback from both your team and new applicants. Are there common questions or sticking points? Can any sections be simplified or clarified? Business needs evolve, and your forms should evolve with them. Staying agile in this process can save time and resources in the long run.

- Regularly review legal compliance for data collection.

- Integrate the form data directly into your CRM or accounting software.

- Provide clear contact information for support during the application process.

- Consider multi-language options if you deal with international clients.

Optimizing your form isn’t just about making it easier for applicants; it also makes your internal processes more efficient. Faster processing means quicker onboarding, and that directly translates to revenue generation. A well-oiled application system reduces administrative burden, allowing your team to focus on core business activities rather than chasing incomplete information or correcting errors. It’s an investment in smoother operations.

Ultimately, a carefully crafted and well-implemented application form is more than just a piece of paper or a digital page; it’s the foundation for healthy and productive business relationships. It ensures you have the necessary information to serve your clients effectively, manage credit responsibly, and comply with regulatory requirements. Think of it as the handshake that formalizes a professional partnership.

By investing time into creating or customizing an excellent template, you’re not just simplifying an administrative task; you’re actively contributing to your company’s growth and stability. A seamless onboarding experience leaves a positive first impression, setting the stage for long-term collaboration and mutual success. It’s a strategic asset that supports your operational efficiency and helps you confidently expand your network of trade partners.