Ever wondered how businesses confidently extend credit or enter into significant partnerships? A crucial piece of the puzzle often involves understanding a potential partner’s financial reliability and operational consistency. This is where a well-crafted trade reference inquiry form template becomes an invaluable tool, providing a structured way to gather essential insights into a company’s past performance with other suppliers and clients. It’s not just about credit; it’s about building trust and minimizing risk before you commit.

Think of it as doing your homework before a big test. You wouldn’t jump into a major investment without thorough research, and the same principle applies to business relationships that involve credit, large orders, or long-term contracts. A standardized form ensures you collect consistent, comparable data from all references, making the evaluation process far more efficient and objective. It’s a simple yet powerful document that protects your interests and helps foster more secure business dealings.

Why a Trade Reference Inquiry Form is Crucial for Your Business

In the fast-paced world of business, making informed decisions is paramount. A trade reference inquiry form is more than just a formality; it’s a vital part of your risk assessment strategy. When a new client requests credit terms, or you’re considering a substantial new supplier, you’re essentially putting your financial health on the line. Relying solely on self-reported information can be risky, which is why reaching out to past business partners provides an unbiased, third-party perspective. This due diligence helps you avoid potential pitfalls like delayed payments, non-compliance, or even outright fraud.

By systematically gathering feedback from references, you gain valuable insights into a company’s payment habits, their responsiveness to issues, and their overall professionalism. Does the company typically pay on time? Do they communicate effectively when there are challenges? Are they reliable in fulfilling their obligations? These are the kinds of critical questions that a comprehensive trade reference inquiry form can help answer, offering a clearer picture than just a credit score alone. A credit score tells you about their financial history, but trade references reveal their operational character.

Moreover, utilizing a standardized form streamlines your internal processes. Imagine the chaos of trying to gather information ad hoc, with different questions asked to different references. A template ensures consistency, making it easier to compare data across multiple inquiries and accelerating your decision-making process. It also projects a professional image, demonstrating to your potential partners that you take your business relationships seriously and operate with a structured approach.

Ultimately, integrating a robust trade reference inquiry process into your onboarding or vendor selection workflow can significantly mitigate financial exposure and operational disruptions. It allows you to enter new agreements with greater confidence, knowing that you’ve done your due diligence and have a clearer understanding of the entity you’re dealing with. This proactive approach saves time, money, and headaches in the long run.

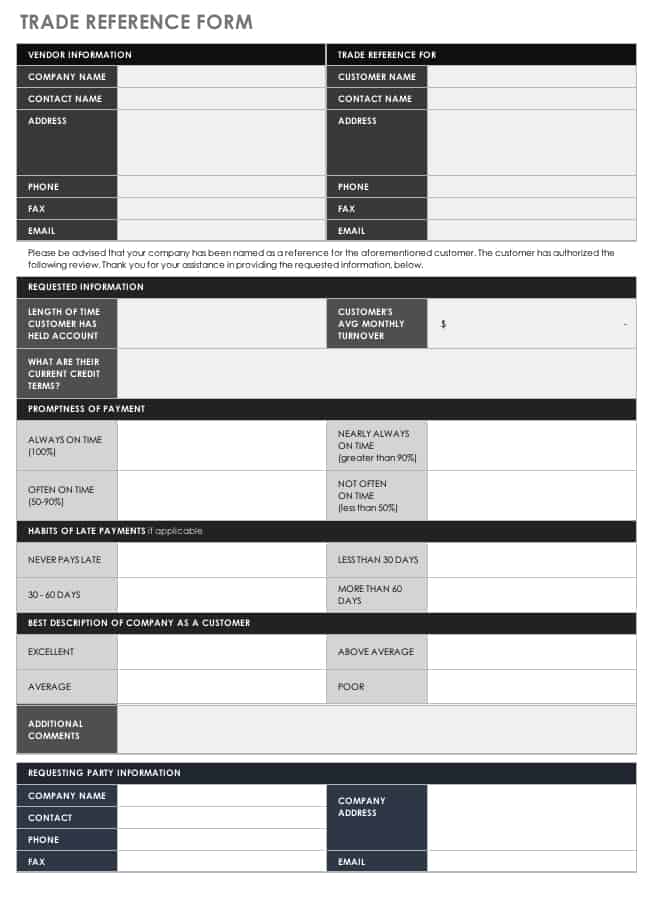

Key Sections to Include in Your Form

- Reference Company Information: Name, contact person, phone number, email, and relationship to the applicant. This ensures you’re speaking to the right party and can verify their connection.

- Credit Experience: Questions about the highest credit extended, current balance, payment terms, and typical payment timeliness. This is crucial for assessing financial reliability.

- Payment Habits: Inquiries about any overdue payments, returned checks, or disputes. Understanding their payment history helps predict future behavior.

- Service Experience: Questions regarding the quality of service, communication, and overall professionalism exhibited by the applicant. This goes beyond just financial aspects and covers operational reliability.

- General Conduct: Open-ended questions asking if the reference would do business with the applicant again and any additional comments they might have. This provides qualitative insights.

Crafting the Perfect Trade Reference Inquiry Form Template

Developing an effective trade reference inquiry form template requires careful thought to ensure you capture all necessary information without making the process overly burdensome for the reference. The goal is to make it easy for the reference to provide honest and concise feedback, which in turn gives you actionable insights. Start by clearly stating the purpose of the inquiry and assuring the reference that their responses will be kept confidential, which encourages more candid feedback. Remember, people are busy, so a well-designed, user-friendly form is key to getting a good response rate.

Consider the layout and flow of your form. Group related questions together to make it logical and intuitive. For example, all questions pertaining to payment history should be in one section, followed by questions about general business conduct. Using a mix of multiple-choice, rating scales, and open-ended questions can provide a comprehensive view. Rating scales (e.g., 1-5 for promptness) offer quantifiable data that’s easy to compare, while open-ended questions allow for richer, qualitative feedback that might reveal nuances not covered by specific questions.

Legal considerations are also important when creating your trade reference inquiry form template. Ensure you have proper authorization from the applicant to contact their references. This is typically done through a consent clause on the applicant’s credit application or agreement. Be mindful of data protection regulations and ensure that the information you collect is stored securely and used only for its stated purpose. Transparency and compliance build trust with both the applicant and their references.

Finally, think about how you will process and analyze the responses. Will you use a digital form that automatically populates a spreadsheet, or a printable PDF that requires manual data entry? Automating as much of this process as possible can save significant time and reduce errors. Regularly review and update your trade reference inquiry form template to ensure it remains relevant and effective, adapting it as your business needs or industry standards evolve.

- Clarity and Conciseness: Use clear, unambiguous language. Avoid jargon that might confuse the reference.

- Obtain Consent: Always confirm you have the applicant’s explicit permission to contact their references.

- Confidentiality Statement: Assure references that their responses will be treated with discretion.

- Balanced Questions: Include questions that cover both positive and potentially negative aspects of the applicant’s performance.

- Easy Return Method: Provide clear instructions on how the completed form should be returned (e.g., email, secure portal).

Leveraging a well-structured system for gathering trade references can truly transform how you evaluate potential partners. It moves you beyond guesswork, providing concrete, third-party validation that empowers you to make smarter, more secure decisions for your business. This proactive approach doesn’t just protect your interests; it lays the foundation for more reliable and productive future collaborations.

By consistently applying this diligent process, you’re not only mitigating risks but also cultivating a reputation as a business that values thoroughness and integrity. It reinforces your commitment to building strong, trustworthy relationships, ensuring that every new venture you embark upon is built on a foundation of confidence and informed judgment.