Navigating the world of financial forms can often feel like searching for a needle in a haystack, especially when you’re dealing with specific documents like a continued monthly residence form. You might be looking to update your records, ensure uninterrupted service, or comply with specific policy requirements from Transamerica, and finding the exact “transamerica continued monthly residence form template” can be quite the quest.

This particular document is crucial for various reasons, primarily ensuring that Transamerica has your most current and accurate residency information. Whether it’s for annuity payments, policy updates, or simply maintaining your account in good standing, keeping your details precise is paramount. We understand the challenges of locating and understanding such a form, and this article aims to guide you through what it is, why it’s important, and how you can typically go about finding and completing it.

Understanding the Transamerica Continued Monthly Residence Form

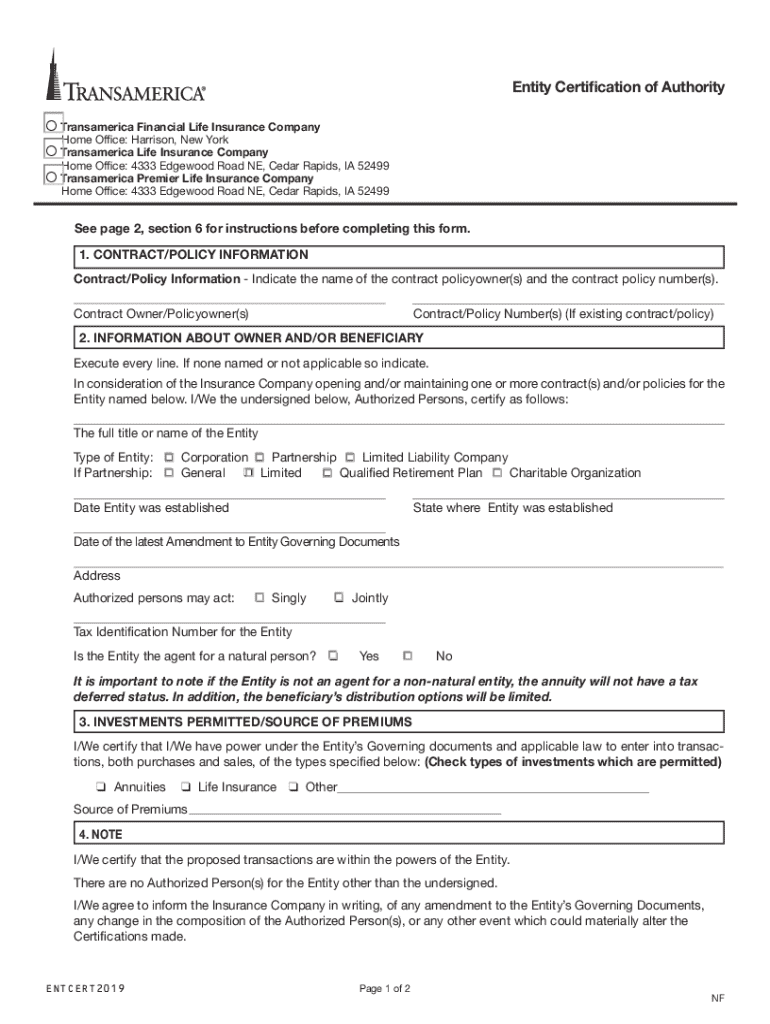

The Transamerica Continued Monthly Residence Form is not just a piece of paper; it’s a vital document that confirms your current place of residence to Transamerica. This form is often required periodically, especially for individuals receiving regular payments, like annuitants, or those whose policies might have specific residency clauses. Its primary purpose is to verify that the policyholder or beneficiary continues to reside at a particular address, which is essential for compliance, tax purposes, and ensuring the correct delivery of communications and funds. Without accurate and up-to-date residency information, there’s a risk of delays in payments, lapsed communications, or even complications with your policy’s terms.

Why would Transamerica need this specific verification? For many financial institutions, continuous residency verification is a standard procedure to prevent fraud, comply with state and federal regulations, and manage their client relationships effectively. It ensures that funds are going to the correct person and address, particularly in cases involving long-term care benefits, life insurance annuities, or other ongoing payment streams. Furthermore, your state of residence can impact tax implications related to your Transamerica products, making accurate residency data absolutely critical for both you and the company.

Think of it as Transamerica’s way of touching base and confirming everything is still in order regarding your primary living situation. This is especially true for those who might have moved, are receiving benefits tied to a particular locale, or simply need to ensure their account details are always current. It helps prevent mail from going astray and ensures that any important policy updates or financial statements reach you without delay, maintaining the integrity of your account and benefits.

Key Situations Requiring This Form

Ensuring the form is filled out accurately and submitted promptly is key. Any discrepancies or delays can lead to unnecessary complications, so it’s always best to be proactive when you receive a request for this form or anticipate needing one due to a change in your living situation.

Navigating the Process: Finding and Submitting Your Transamerica Continued Monthly Residence Form

Locating specific forms like the “transamerica continued monthly residence form template” isn’t always as straightforward as a simple search engine query. While many companies offer a library of documents online, specialized forms often require a more direct approach. The most reliable method to obtain this particular form is by directly engaging with Transamerica’s official channels. Their customer service portal, or a direct phone call to their dedicated support lines, will usually put you in touch with someone who can provide the exact document you need, tailored to your specific situation and policy.

Often, financial institutions prefer to provide these sensitive forms directly to the policyholder to ensure security and prevent the use of outdated or incorrect versions found elsewhere. You might be asked to log into your online account, where a digital version could be available, or they may opt to mail or email it to you after verifying your identity. This personalized approach guarantees you receive the correct form and any accompanying instructions relevant to your account.

Once you have the form, the completion process typically involves providing your personal identification details, your current full residential address, and potentially past addresses if you’ve recently moved. You might also need to provide the dates of your residency and, in some cases, a signature from a witness or a notary public, depending on the policy and state requirements. Always read the instructions carefully before filling anything out, as errors can cause processing delays.

After carefully completing the form, the next crucial step is submission. Transamerica usually specifies the preferred method of return, which could include mailing it to a particular department, faxing it, or uploading it through a secure online portal. Before sending it off, it’s highly recommended to make a copy of the fully completed and signed form for your personal records. This copy can be invaluable if there are any questions or issues later on regarding your submission. Keep track of the date you sent it and the method used.

When dealing with important documents like the transamerica continued monthly residence form template, it’s always wise to err on the side of caution. If you have any doubts about a specific field on the form, or the correct way to submit it, don’t hesitate to reach out to Transamerica’s customer service for clarification. Their representatives are there to assist you and ensure your information is processed accurately and efficiently, maintaining the smooth operation of your policy or benefits.