Managing finances, whether for a bustling business, a non-profit organization, or even within complex family structures, often involves the necessity of moving money from one account to another. While the act of transferring funds might seem straightforward, the process itself can quickly become chaotic without proper documentation. Errors, delays, and miscommunications are common pitfalls when ad hoc requests replace a structured approach, leading to frustration and potential financial discrepancies.

That is precisely why implementing a clear, standardized system for these requests is not just a good idea, but a vital component of sound financial management. A formal request mechanism ensures every transfer is properly authorized, clearly documented, and easily traceable. It’s about building a foundation of clarity and accountability into your financial operations, minimizing headaches and maximizing efficiency for everyone involved.

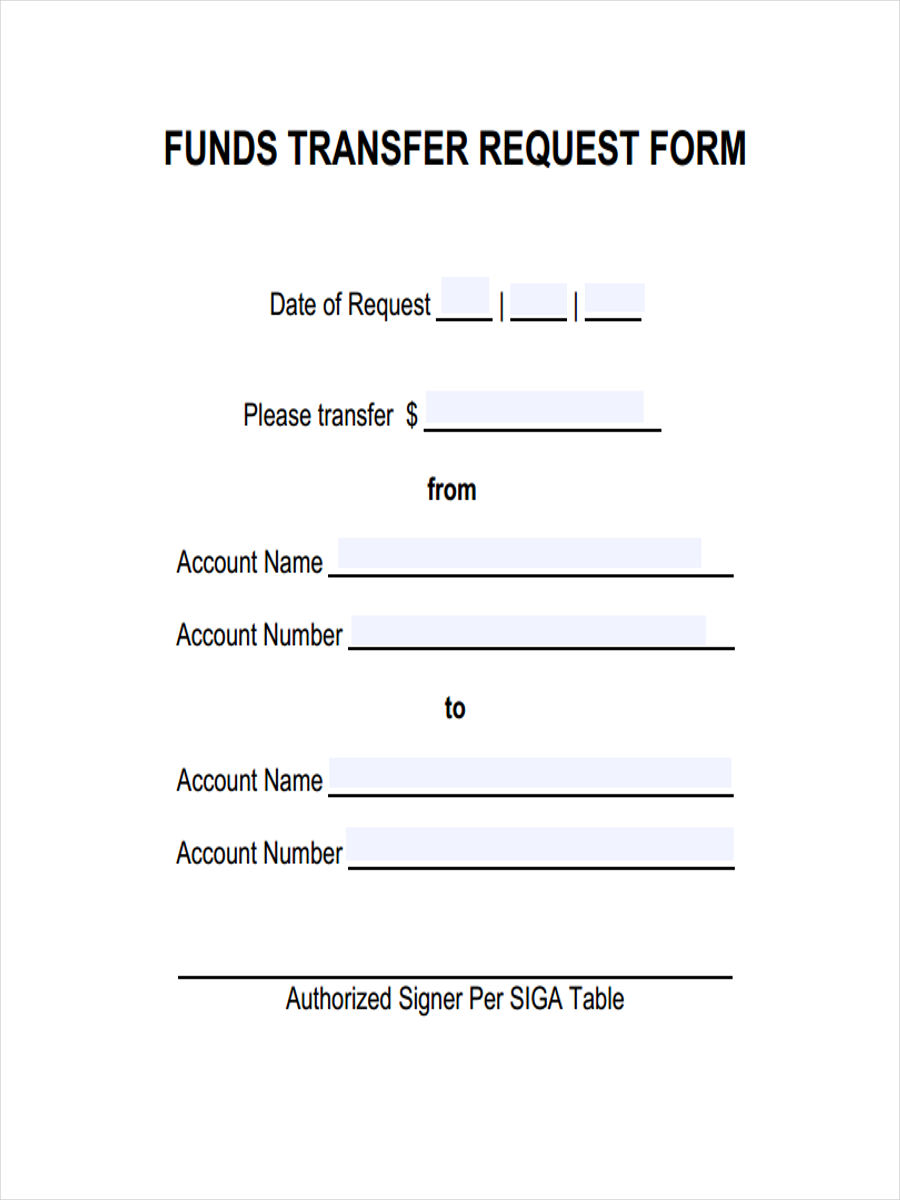

Key Elements of an Effective Transfer Funds Request Form Template

Adopting a standardized transfer funds request form template can significantly enhance your financial workflows. It serves as a universal document, ensuring that every piece of critical information is captured consistently, regardless of who is making or approving the request. This standardization dramatically reduces the chances of errors and oversights, creating a smoother and more reliable process for all fund movements.

When you design or choose a template for requesting fund transfers, think about what absolutely needs to be included to prevent confusion down the line. It is not just about moving money; it is about accountability, transparency, and a clear audit trail. A well-designed form acts as a checklist, prompting the requestor to provide all necessary details, thereby avoiding back and forth queries and delays.

An effective form should be intuitive and comprehensive. It needs to guide the user through the inputting of information, ensuring nothing is missed. Consider the journey of a transfer request from its initiation to its final approval and execution; every step should be supported by the data collected on the form. This includes not only the financial details but also the rationale behind the transfer and the necessary authorizations.

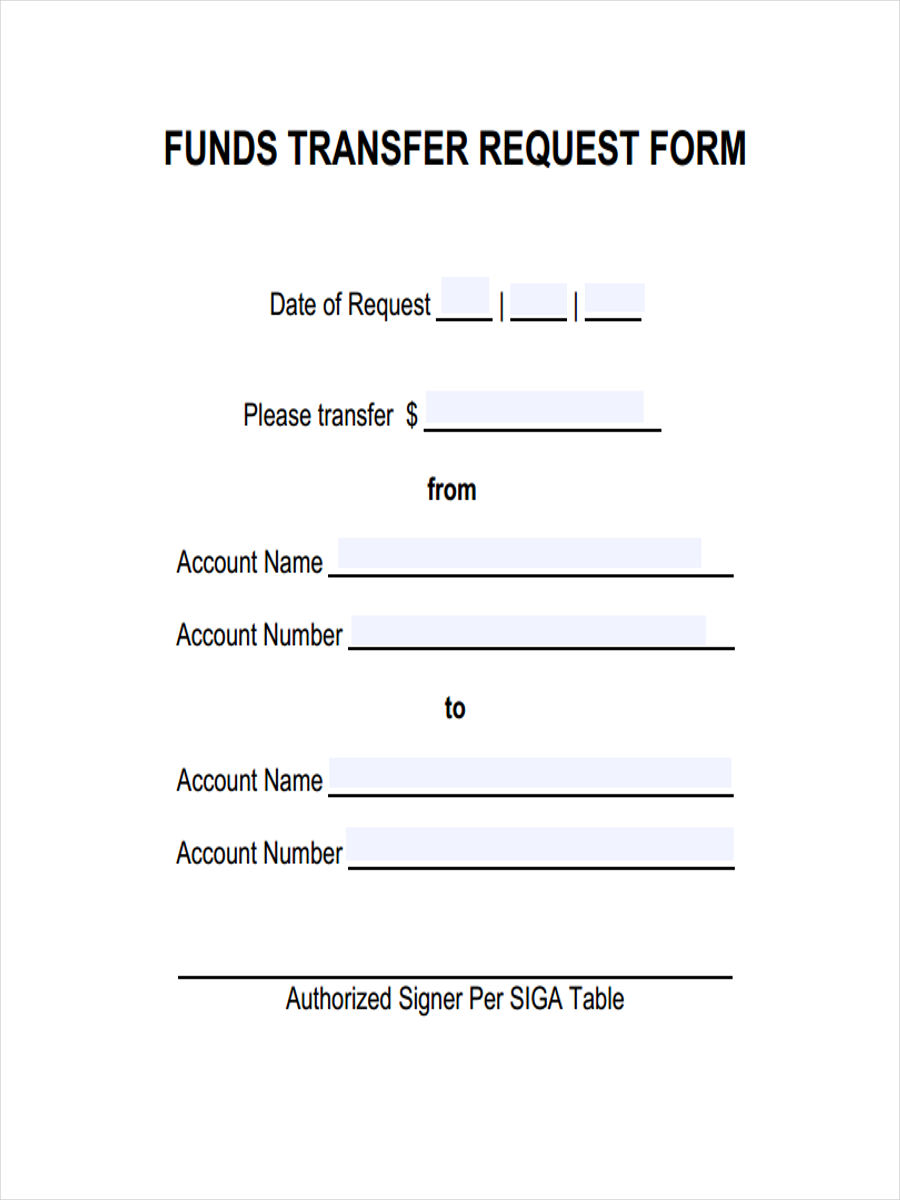

Here are the essential components that should be part of any robust transfer funds request form template, ensuring all relevant information is captured:

-

Requestor Information

This section captures who is initiating the request. It typically includes the requestor’s name, department, contact information, and the date of the request. Knowing who made the request is fundamental for any follow up or clarification.

-

Recipient Information

Details about where the funds are going are crucial. This includes the recipient’s name or company name, their bank name, account number, and routing or SWIFT code. Accuracy here is paramount to prevent misdirected funds.

-

Transfer Details

This covers the specifics of the transaction itself. Include the exact amount to be transferred, the currency, and the desired transfer date. A clear indication of the amount and currency prevents costly misunderstandings.

-

Purpose of Transfer

Why are these funds being moved? A concise explanation of the reason for the transfer is vital for record-keeping, auditing, and often for internal approvals. This could be for vendor payment, payroll adjustment, inter-departmental allocation, or reimbursement.

-

Authorization and Approvals

No fund transfer should occur without proper authorization. This section includes spaces for signatures of the person requesting the transfer, their immediate supervisor, and any other required financial approvers. Dates of approval are also important for tracking.

-

Supporting Documentation

While not a field on the form itself, the template should ideally prompt users to attach any relevant supporting documents, such as invoices, contracts, or budgets, that justify the transfer.

Streamlining Your Financial Operations with a Transfer Funds Request Form

Implementing a dedicated form for requesting fund transfers brings a multitude of benefits that extend beyond mere organization. It fundamentally transforms a potentially messy process into a streamlined operation, improving efficiency, enhancing security, and fostering greater accountability across your financial activities. Imagine a scenario where every fund transfer is not only clearly documented but also follows a predictable, consistent path from request to completion.

One of the most immediate advantages is the significant reduction in administrative burden. Instead of fielding disparate email requests, verbal instructions, or hastily scribbled notes, your finance team receives requests in a uniform format. This consistency allows for quicker processing, fewer errors requiring manual correction, and a smoother workflow. It frees up valuable time for your finance personnel to focus on more strategic tasks rather than chasing missing information.

Furthermore, a standardized form acts as a powerful deterrent against fraud and unauthorized transactions. By requiring specific fields to be completed, along with multiple levels of authorization, you build robust internal controls directly into your process. Every transfer leaves a clear, traceable paper trail, making it much easier to audit and ensuring that all fund movements are legitimate and approved according to established protocols.

Beyond efficiency and security, these forms foster a culture of transparency and accountability within an organization. Everyone understands the process, what information is required, and who is responsible at each stage. This clarity minimizes misunderstandings, encourages responsible financial behavior, and ensures that all stakeholders have access to the necessary documentation should questions arise in the future. It truly elevates your financial management practices.

Embracing a structured approach to managing your financial transactions, especially fund transfers, is a non-negotiable step for any organization aiming for operational excellence and robust financial health. By putting clear processes in place, you are not just improving efficiency; you are building a resilient system that minimizes risks and maximizes clarity. It allows for a cohesive and error-free environment where every financial movement is tracked, understood, and accountable.

The foresight to implement such a system today will undoubtedly pay dividends in the long run. It sets a precedent for precision and professionalism in all financial dealings, contributing to a more organized, secure, and ultimately more successful operational framework for handling your most valuable assets.