Managing money effectively is a cornerstone of both personal finance and business operations. Whether you’re sending funds to a family member, settling an invoice with a vendor, or moving capital between accounts, the process needs to be clear, secure, and well-documented. This is where a robust transfer of funds form template becomes an invaluable asset. It transforms what could be a vague or error-prone process into a streamlined, precise, and auditable transaction.

Having a standardized form eliminates guesswork and ensures that all necessary information is captured from the outset. Imagine the time saved by not having to chase down missing account numbers, verify spellings, or confirm transfer purposes. A well-designed template provides a consistent framework, reducing the likelihood of mistakes that could lead to delays, bounced transactions, or even financial disputes. It’s about bringing clarity and efficiency to one of the most fundamental financial activities we undertake.

Why a Transfer of Funds Form Template is Indispensable

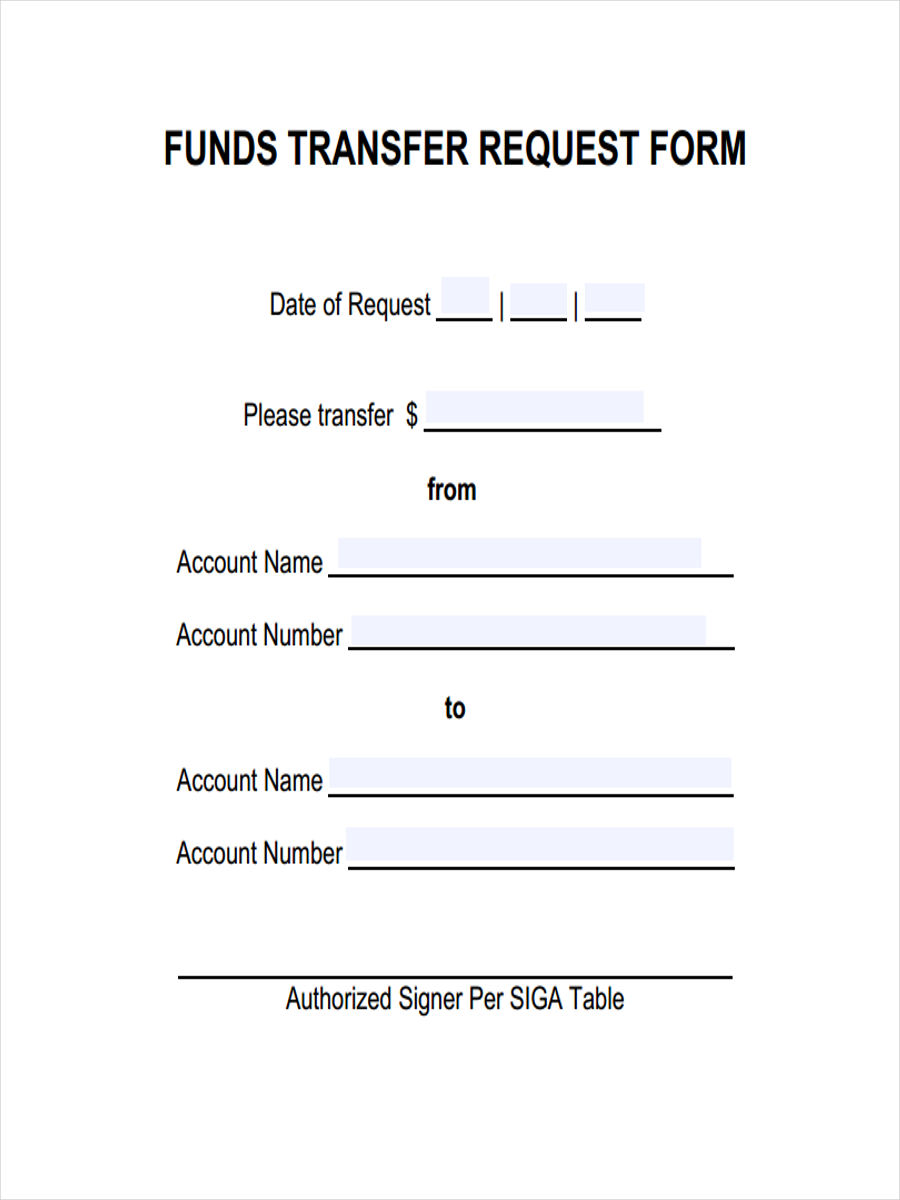

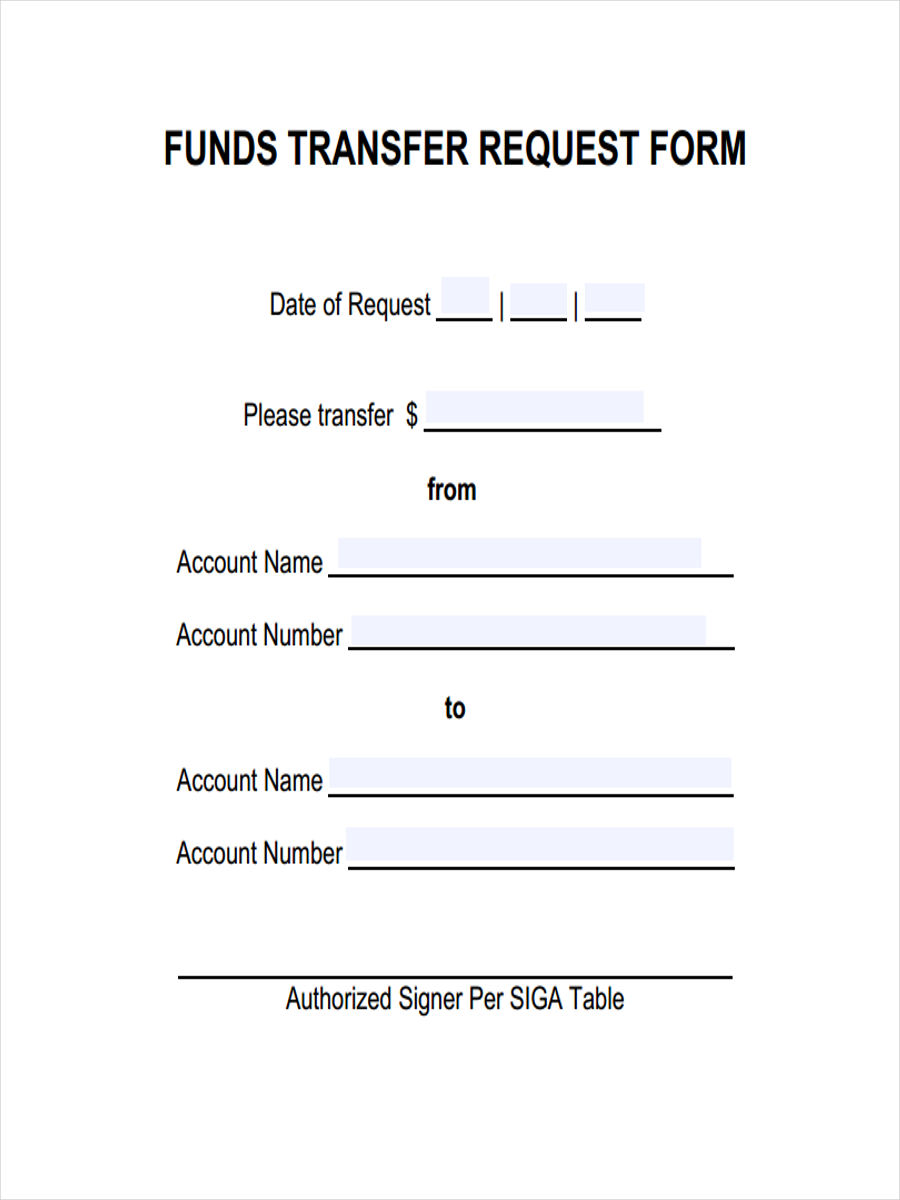

In any financial transaction, clarity and precision are paramount. A dedicated transfer of funds form template serves as a vital tool to achieve just that. It acts as a standardized checklist, ensuring that every piece of critical information related to a money transfer is captured and recorded. This includes details about the sender, the recipient, the exact amount, the currency, and perhaps most importantly, the specific purpose of the transfer. Without such a document, you risk incomplete data, which can lead to confusion, delays, or even costly errors. For businesses, this translates directly to operational efficiency and accuracy in their accounting records.

Consider the myriad of scenarios where such a form becomes essential. For personal use, it could be sending money to a child in college, contributing to a joint expense, or making a significant gift. In a business context, it’s indispensable for payroll, vendor payments, inter-company transfers, or even charitable donations. Each situation demands a clear paper trail, not just for financial reconciliation but also for legal and compliance purposes. A comprehensive template provides the necessary structure to document these transactions meticulously, offering peace of mind and a ready reference should any questions arise later.

Furthermore, a customizable transfer of funds form template offers incredible flexibility. You are not confined to a rigid, one-size-fits-all solution. Instead, you can adapt the template to suit your specific needs, whether that means adding fields for project codes, specific departmental approvals, or unique reference numbers relevant to your organization. This adaptability ensures that the form remains a practical and highly functional tool, regardless of the complexity or simplicity of the transfer in question. It empowers users to tailor the documentation process to perfectly align with their internal procedures and external requirements.

Ultimately, investing time in creating or adopting a robust template pays dividends in saved time, reduced errors, and enhanced financial integrity. It builds a foundation of transparency for all your monetary movements. When everyone involved understands exactly what information is needed and where it needs to go, the entire process becomes smoother and more reliable. It’s about building trust and efficiency into every transaction.

Key Elements to Include in Your Template

- Sender’s and Recipient’s Full Names and Contact Information

- Full Bank Account Details for Both Sender and Recipient (Account Number, Routing Number, SWIFT/IBAN if international)

- Name and Address of Financial Institutions Involved

- Exact Amount to be Transferred and the Currency

- Clear Purpose of the Transfer (e.g., invoice payment, gift, salary, loan repayment)

- Date of Request and Desired Transfer Date

- Authorization Signatures (of sender and possibly an approver) and Date of Signature

- Internal Reference Numbers or Invoice Numbers for Tracking

Streamlining Your Financial Transactions with a Digital Template

While traditional paper forms have their place, the digital age offers unparalleled opportunities to further streamline financial processes. Embracing a digital transfer of funds form template can dramatically enhance efficiency, security, and accessibility. Imagine filling out a form from anywhere, at any time, without the need for printing, scanning, or physical delivery. This convenience is a game-changer for individuals and businesses operating in our increasingly remote and interconnected world. Digital forms can be easily shared via email or cloud services, ensuring that all relevant parties receive a copy instantly, fostering real-time collaboration and approval workflows.

Beyond convenience, digital templates offer environmental benefits by reducing paper consumption, contributing to a more sustainable operation. They also inherently improve data readability, as you eliminate issues like illegible handwriting. This clarity directly translates to fewer misunderstandings and errors on the part of the financial institutions processing the transfer. Furthermore, many digital platforms allow for auto-filling of recurring information, saving even more time and reducing the potential for typos in frequently used fields, such as your own bank details.

Security is another significant advantage. Properly implemented digital forms can incorporate encryption, secure authentication methods, and audit trails that log every modification and access. This provides a robust layer of protection against unauthorized changes or fraudulent activity. Unlike a paper form that could be lost or misplaced, a digital record can be securely stored, backed up, and retrieved whenever needed, ensuring continuous access to vital transaction history. This level of traceability is invaluable for compliance, audits, and resolving any future discrepancies.

Creating or utilizing a digital transfer of funds form template doesn’t require advanced technical skills. Many online tools and software offer intuitive interfaces for designing and deploying these forms. Whether you opt for a simple fillable PDF, a document created in a word processor that can be converted, or a more sophisticated online form builder, the key is to ensure it captures all the essential information we discussed earlier. The transition to digital doesn’t just modernize your process; it fundamentally transforms the way you manage and document your financial movements, making them faster, safer, and more reliable than ever before.

- Choose a user-friendly format (PDF, Word, or an online form builder).

- Ensure all necessary fields are present and clearly labeled for clarity.

- Consider integrating digital signature capabilities for added efficiency and legal validity.

- Provide clear, concise instructions for filling out the form to prevent errors.

Implementing a clear and comprehensive form for your monetary transfers is more than just a procedural step; it’s a strategic move towards greater financial control and accountability. By providing a structured method for documenting every detail, you not only minimize the risk of errors and disputes but also establish a robust record-keeping system. This attention to detail simplifies auditing, tax preparation, and overall financial management, making your transactions consistently smooth and transparent.

Ultimately, whether for personal use or business operations, a well-designed form acts as an indispensable tool for maintaining clarity and efficiency in your financial life. It ensures that every transfer is executed with precision, properly recorded, and easily retrievable, contributing to a more organized and secure handling of your funds. It’s about building a foundation of reliability for all your monetary movements.