Utilizing such a structured financial tool empowers independent truckers to make informed business decisions. It facilitates accurate tax preparation, simplifies loan applications, and allows for effective budgeting and financial planning. By closely monitoring income and expenses, drivers can identify trends, optimize operations for maximum profitability, and ensure long-term financial stability. This detailed financial analysis is crucial for negotiating rates, understanding overall business performance, and making sound investments in equipment or business expansion.

This understanding of financial tracking and management is essential for successful independent trucking. The following sections will delve into the specific components of this important financial tool, offering practical advice and guidance on its effective utilization.

1. Revenue

Accurate revenue tracking is fundamental to a comprehensive profit and loss statement for independent truck drivers. Understanding revenue streams allows for precise profitability calculations and informed business decisions. A detailed breakdown of income sources provides insights into business performance and areas for potential growth.

- Freight ChargesThis constitutes the core income source for most truck drivers, representing payments received for hauling loads. Variations in freight rates depend on factors like distance, cargo type, and market demand. Accurately recording each trip’s revenue is crucial for assessing profitability on a per-load basis. This allows drivers to identify high-performing routes and negotiate better rates.

- Fuel SurchargesFluctuating fuel prices necessitate fuel surcharges, separate payments designed to offset fuel cost variations. These surcharges must be meticulously tracked and separated from freight charges on the profit and loss statement to provide a clear picture of actual earnings versus reimbursements for fuel expenses.

- Accessorial ChargesThese charges represent additional services beyond standard transportation, such as detention time, layovers, or special handling requirements. Including these charges offers a complete revenue picture and ensures accurate compensation for all services rendered.

- Bonuses and IncentivesSome companies offer performance-based bonuses or safety incentives. These should be included as revenue to accurately reflect total earnings. Tracking bonus payments helps motivate drivers and provides valuable data for performance evaluation.

By meticulously tracking these revenue components within the profit and loss statement, drivers gain valuable insights into their business’s financial health. This data-driven approach allows for effective cost management, informed pricing strategies, and ultimately, improved profitability and business growth.

2. Operating Expenses

Operating expenses represent the day-to-day costs directly associated with running a trucking business. Accurate tracking of these expenses is critical for understanding profitability and making informed financial decisions. Within a profit and loss statement template, operating expenses provide a granular view of where capital is being utilized, enabling drivers to identify areas for potential cost reduction and efficiency improvements.

- Fuel CostsFuel represents a significant operating expense for truck drivers. Fluctuations in fuel prices directly impact profitability. Detailed tracking of fuel consumption, including gallons purchased, price per gallon, and mileage, allows for precise cost analysis and potential identification of fuel-saving strategies. Analyzing fuel efficiency helps in evaluating route optimization and driving practices.

- Maintenance and RepairsRegular maintenance and unforeseen repairs are unavoidable operating expenses. These costs, including oil changes, tire replacements, and mechanical repairs, can vary significantly. Tracking these expenses allows for budgeting for future maintenance needs and identifying potential mechanical issues early on, preventing costly breakdowns.

- Tolls and PermitsOperating a commercial vehicle often involves tolls and permits, which vary based on routes and jurisdictions. Meticulous tracking of these expenses is crucial for accurate cost accounting. Analyzing toll costs can contribute to route planning that minimizes expenses while maintaining efficient delivery schedules.

- Meals and LodgingOver-the-road drivers incur expenses for meals and lodging. While per diem rates offer some standardization, actual costs can fluctuate. Tracking these expenses offers insights into spending patterns and can reveal opportunities for cost savings through strategic meal planning or lodging choices.

By diligently tracking these operating expenses within a profit and loss statement template, drivers gain a clear understanding of their cost structure. This detailed analysis facilitates informed decisions regarding pricing strategies, expense management, and overall business optimization, contributing directly to improved profitability and long-term financial stability.

3. Fixed Costs

Fixed costs represent recurring, predictable expenses essential to trucking operations, regardless of mileage or revenue. Accurate accounting for these costs within a profit and loss statement template is crucial for assessing true profitability and making informed financial projections. Understanding fixed costs empowers drivers to establish sustainable pricing models and ensure long-term financial stability.

- Truck PaymentsFinancing a truck often involves monthly payments. These payments remain constant regardless of usage and represent a significant fixed cost. Accurately tracking these payments helps drivers understand their financial obligations and ensures timely payments, avoiding penalties and maintaining creditworthiness.

- Insurance PremiumsCommercial truck insurance is a legal requirement and a substantial fixed cost. Premiums depend on factors like coverage type and driving history. Regularly reviewing insurance policies and comparing quotes can help optimize costs without compromising necessary coverage.

- Permits and LicensesOperating authority, heavy vehicle use tax, and other permits and licenses are recurring fixed costs. These fees vary by jurisdiction and must be tracked meticulously to ensure compliance and avoid penalties. Understanding these costs allows for accurate budgeting and efficient allocation of resources.

- Office and Administrative ExpensesEven independent truckers often incur administrative expenses, such as accounting software subscriptions, phone bills, or association fees. These costs, while often smaller than other fixed costs, contribute to the overall operational expense and should be tracked for accurate financial reporting.

By diligently tracking and analyzing fixed costs within a profit and loss statement template, drivers gain valuable insights into their baseline operating expenses. This understanding is fundamental for setting profitable rates, negotiating contracts, and making strategic financial decisions that contribute to long-term business success. Consistent monitoring of fixed costs also allows for identifying potential areas for cost optimization, such as refinancing loans or exploring alternative insurance providers.

4. Profit Margin

Profit margin represents the profitability of a trucking business after all expenses are deducted from revenue. Within a profit and loss statement template, profit margin serves as a key performance indicator, reflecting the financial health and sustainability of the operation. Understanding profit margin is crucial for making informed business decisions, setting appropriate rates, and ensuring long-term financial success.

- Gross Profit MarginGross profit margin represents the profitability after deducting the direct costs associated with providing services, primarily fuel, maintenance, and tolls. Calculating gross profit margin provides insight into the efficiency of core operations. For example, a low gross profit margin might indicate the need for better fuel management or more cost-effective maintenance practices.

- Net Profit MarginNet profit margin represents the overall profitability after all expenses, including fixed costs such as insurance, permits, and truck payments, are deducted from total revenue. This figure provides the most comprehensive view of the business’s financial health. A healthy net profit margin is essential for long-term sustainability and allows for reinvestment in the business, such as upgrading equipment or expanding operations.

- Operating Profit MarginOperating profit margin measures profitability after deducting operating expenses and excluding interest and taxes. This metric helps assess the efficiency of day-to-day operations independent of financing and tax burdens. Analyzing operating profit margin allows for benchmarking against industry averages and identifying areas for operational improvement.

- Factors Affecting Profit MarginSeveral factors influence profit margin, including fuel prices, maintenance costs, insurance premiums, and prevailing freight rates. External factors like economic downturns or regulatory changes can also significantly impact profitability. Regularly monitoring these factors and adjusting business strategies accordingly is crucial for maintaining a healthy profit margin.

Careful analysis of profit margin within the context of a profit and loss statement template empowers truck drivers to make data-driven decisions. By understanding the factors influencing profitability, drivers can implement strategies to optimize operations, negotiate better rates, and ultimately ensure the long-term financial health and success of their business. Regular review and analysis of profit margins are essential for identifying trends, adapting to market changes, and achieving sustainable growth.

5. Tax Implications

Accurate and organized financial records are crucial for meeting tax obligations. A comprehensive profit and loss statement template serves as a foundational tool for managing tax liabilities and maximizing deductions for independent truck drivers. Understanding the tax implications associated with trucking operations is essential for financial stability and legal compliance.

- Deductible ExpensesVarious operating costs are deductible, including fuel, maintenance, insurance, and tolls. Meticulous record-keeping, facilitated by a profit and loss statement template, allows drivers to accurately claim these deductions, minimizing tax burdens. For example, tracking mileage and fuel purchases enables accurate deduction calculations based on per-mile or standard deduction methods.

- Quarterly Tax PaymentsSelf-employed individuals, including independent truck drivers, are generally required to make estimated tax payments quarterly. A well-maintained profit and loss statement provides the necessary data to calculate these payments accurately, avoiding penalties and ensuring compliance. Understanding projected income and expenses allows for accurate estimation and timely payments.

- DepreciationTrucks and other business assets depreciate over time. The profit and loss statement helps track depreciation expenses, allowing drivers to claim these deductions and reduce their tax liability. Different depreciation methods exist, and understanding their implications is crucial for optimizing tax benefits.

- Record Keeping RequirementsThe IRS mandates specific record-keeping practices for businesses. A profit and loss statement template, combined with supporting documentation like receipts and invoices, helps drivers meet these requirements. Organized records simplify tax preparation and facilitate audits, ensuring compliance and minimizing potential issues with tax authorities.

By utilizing a profit and loss statement template effectively, truck drivers can not only track their financial performance but also ensure compliance with tax regulations and optimize their tax strategies. This organized approach to financial management contributes to long-term financial stability and minimizes potential legal and financial challenges associated with tax obligations. Furthermore, readily available financial data simplifies the process of working with tax professionals, enabling more effective tax planning and maximizing potential deductions.

6. Financial Planning

Sound financial planning is essential for the long-term success of any business, and independent trucking is no exception. A well-structured profit and loss statement template serves as a cornerstone of effective financial planning, providing the necessary data to make informed decisions, set realistic goals, and navigate the financial complexities of operating a trucking business. It offers a clear picture of current financial standing and allows for projecting future performance based on current trends and anticipated market conditions.

- Budgeting and ForecastingA profit and loss statement provides historical data on income and expenses, enabling the creation of realistic budgets and accurate financial forecasts. By analyzing past performance, drivers can anticipate future revenue and expenses, allowing for proactive adjustments to spending habits and operational strategies. This forward-looking approach facilitates informed decisions regarding investments, expansion, and overall financial management.

- Loan Applications and FinancingLenders require demonstrable financial stability when considering loan applications for equipment purchases or business expansion. A meticulously maintained profit and loss statement offers credible evidence of financial performance, increasing the likelihood of loan approval and potentially securing favorable interest rates. Clear financial documentation builds trust with lenders and strengthens the business’s financial credibility.

- Investment StrategiesWhether investing in new equipment, upgrading existing assets, or exploring diversification opportunities, informed investment decisions require a clear understanding of financial performance. The profit and loss statement provides the necessary data to assess the potential return on investment and make strategic decisions that align with long-term financial goals. Analyzing profitability and cash flow allows for informed assessments of investment risks and potential rewards.

- Retirement PlanningIndependent trucking often lacks the structured retirement plans offered by larger companies. A profit and loss statement is instrumental in planning for retirement by allowing drivers to track income, manage expenses, and project future earnings. This information is crucial for making informed decisions regarding retirement savings, investment strategies, and ensuring long-term financial security beyond an active trucking career.

By utilizing a profit and loss statement template as a foundation for financial planning, independent truck drivers gain control over their financial future. This data-driven approach empowers informed decision-making, strengthens financial stability, and enables the pursuit of long-term financial goals, from securing loans and making sound investments to planning for a secure retirement. The detailed insights provided by the statement facilitate proactive financial management, allowing drivers to adapt to changing market conditions and navigate the complexities of running a successful trucking business.

Key Components of a Profit and Loss Statement for Truck Drivers

A profit and loss statement, tailored for independent truck drivers, provides a crucial overview of financial performance. Understanding its key components is essential for effective business management and informed decision-making.

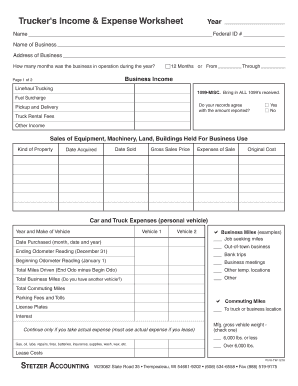

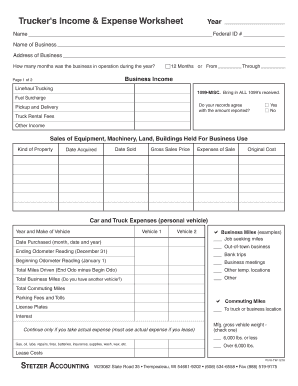

1. Revenue: This section details all income generated from trucking operations. Key elements include freight charges, fuel surcharges, accessorial charges (e.g., detention, layover), and any bonuses or incentives. Accurate revenue tracking is fundamental for understanding profitability.

2. Operating Expenses: These are the costs directly associated with daily operations. Essential components include fuel costs, maintenance and repair expenses, tolls, permits, and meals and lodging (for over-the-road drivers). Managing operating expenses is crucial for maximizing profit margins.

3. Fixed Costs: These recurring expenses remain relatively constant regardless of operational activity. Key fixed costs include truck payments, insurance premiums, license and permit fees, and administrative expenses (e.g., accounting software, communication costs). Understanding fixed costs is essential for accurate budgeting and pricing.

4. Profit Margin: This crucial metric reflects the profitability of the business after deducting expenses from revenue. Different profit margin calculations, including gross, net, and operating profit margins, offer varying perspectives on financial performance and efficiency.

5. Depreciation: This accounts for the decrease in value of assets like trucks over time. Understanding depreciation and applying appropriate methods is essential for accurate financial reporting and tax purposes. This non-cash expense impacts profitability calculations and tax liabilities.

6. Taxes: Accurate record-keeping within the profit and loss statement is essential for managing tax obligations. Understanding deductible expenses, quarterly tax payment requirements, and other tax implications is crucial for compliance and financial stability. This component ensures accurate reporting and minimizes potential tax liabilities.

Careful tracking and analysis of these components provide a comprehensive understanding of financial performance, enabling informed decision-making, strategic planning, and long-term business success in the trucking industry. This structured approach to financial management allows for proactive adjustments to operational strategies and enhances overall financial stability.

How to Create a Truck Driver Profit and Loss Statement Template

Creating a profit and loss statement template provides a structured approach to managing finances for independent truck drivers. This organized approach allows for accurate tracking of income and expenses, facilitating informed business decisions and contributing to long-term financial stability.

1. Choose a Format: Select a formatspreadsheet software, dedicated accounting software, or even a simple paper ledger. The chosen format should allow for detailed categorization of income and expenses. Spreadsheet software offers flexibility and customization, while accounting software often provides automated features and reporting capabilities.

2. Define the Reporting Period: Establish a consistent reporting period (e.g., monthly, quarterly, annually). This ensures regular monitoring of financial performance and facilitates comparisons over time. Monthly reporting provides a more granular view of financial activity, while quarterly or annual reporting offers a broader perspective on overall performance.

3. Categorize Revenue Streams: Create distinct categories for each revenue stream: freight charges, fuel surcharges, accessorial charges, and bonuses. This detailed breakdown allows for analysis of individual income sources and identification of areas for potential revenue growth.

4. Itemize Operating Expenses: Categorize operating expenses, including fuel, maintenance, repairs, tolls, permits, and meals/lodging. Detailed expense tracking is crucial for identifying areas for cost reduction and efficiency improvements.

5. Account for Fixed Costs: Include fixed costs such as truck payments, insurance premiums, license fees, and administrative expenses. Accurate tracking of fixed costs is essential for understanding the baseline operating expenses and establishing sustainable pricing models.

6. Calculate Profit Margins: Incorporate formulas to calculate gross profit, net profit, and operating profit margins. These metrics provide essential insights into the profitability and overall financial health of the business.

7. Track Depreciation: Include a section for depreciation of assets like trucks. Accurate depreciation tracking is important for financial reporting and tax purposes. Choosing an appropriate depreciation method ensures compliance and accurate reflection of asset value over time.

8. Consider Tax Implications: Ensure the template facilitates the tracking of deductible expenses and other relevant tax information. This preparation simplifies tax filing and ensures compliance with relevant regulations.

Regularly updating and analyzing this template offers valuable insights into financial performance, enabling data-driven decision-making for improved profitability and long-term financial stability. This structured approach to financial management allows for proactive adaptation to changing market conditions and ensures the long-term health and sustainability of the trucking business.

Effective financial management is paramount for success in the independent trucking industry. A dedicated profit and loss statement template provides the necessary framework for tracking revenue and expenses, calculating profit margins, and understanding the financial health of the business. By diligently utilizing such a template, drivers gain valuable insights into their operational costs, revenue streams, and overall profitability. This data-driven approach empowers informed decision-making regarding pricing strategies, expense management, and investment opportunities, ultimately contributing to long-term financial stability and growth.

Careful financial planning, facilitated by a comprehensive profit and loss statement, is not merely a recommended practice but a critical requirement for thriving in the competitive landscape of independent trucking. This proactive approach to financial management enables drivers to navigate economic fluctuations, adapt to industry changes, and build a sustainable and prosperous future. The insights derived from consistent financial analysis empower informed decisions that drive profitability, mitigate risks, and ensure long-term success in the demanding world of trucking.