Utilizing such a structured financial report allows trucking companies to identify areas of strength and weakness in their operations. This detailed overview can inform strategic decision-making regarding pricing, expense management, and investment opportunities. It also facilitates improved financial control, assists with budgeting and forecasting, and provides essential data for securing loans or attracting investors.

This foundational understanding of a specialized financial report for trucking businesses sets the stage for a deeper exploration of its key components, creation, and practical application within the industry.

1. Revenue

Revenue forms the cornerstone of a trucking profit and loss statement, representing the income generated from business operations. Accurate revenue reporting is essential for assessing financial performance and making informed decisions.

- Freight ChargesThis constitutes the primary revenue source for trucking companies, derived from transporting goods for clients. Rates can vary based on distance, cargo type, and market conditions. Accurate tracking and invoicing of freight charges are crucial for maximizing income.

- Fuel SurchargesFluctuating fuel prices significantly impact operating costs. Fuel surcharges, calculated as a percentage of the base freight rate or a per-mile basis, offset these variations. Transparency in applying fuel surcharges is essential for maintaining client relationships.

- Accessorial ChargesThese cover additional services provided beyond standard transportation, such as detention time, loading/unloading fees, and special handling requirements. Clearly defining and documenting these charges ensures proper compensation for extra services rendered.

- Other RevenueThis category encompasses any income generated outside core transportation services. Examples include storage fees, equipment rentals, or driver training programs. Accurate categorization allows for a comprehensive understanding of all income streams.

A comprehensive understanding of these revenue components provides a clear picture of a trucking company’s income generation. Accurate and detailed revenue tracking within the profit and loss statement is fundamental for evaluating profitability, identifying growth opportunities, and ensuring long-term financial stability.

2. Expenses

Accurately tracking and managing expenses is critical for trucking company profitability. A detailed breakdown of expenses within a specialized profit and loss statement provides insights into cost drivers and informs strategic decision-making. Understanding the various expense categories is essential for effective financial control.

- Driver CompensationThis significant expense encompasses wages, benefits, and payroll taxes associated with drivers. Factors influencing driver compensation include experience, driving record, and regional variations. Managing driver compensation effectively requires balancing competitive pay with cost control measures.

- Fuel CostsFuel represents a substantial and often volatile expense for trucking operations. Fuel consumption depends on factors such as truck type, route efficiency, and driver behavior. Strategies for managing fuel costs include optimizing routes, implementing fuel-efficient driving practices, and negotiating fuel contracts.

- Maintenance and RepairsRegular maintenance and repairs are crucial for ensuring vehicle safety and reliability. These expenses encompass preventative maintenance, repairs due to wear and tear, and unexpected breakdowns. Effective maintenance programs can minimize downtime and extend the life of trucking assets.

- InsuranceInsurance protects against potential risks and liabilities associated with trucking operations. Various insurance types, including liability, collision, and cargo insurance, are essential. Choosing appropriate coverage and managing insurance premiums effectively requires careful consideration of risk factors.

By carefully monitoring and analyzing these expense categories within the profit and loss statement, trucking companies can identify areas for cost optimization, improve operational efficiency, and enhance overall profitability. Effective expense management is directly linked to a company’s financial health and long-term sustainability.

3. Profit/Loss

The core purpose of a trucking profit and loss statement template is to determine the net profit or loss generated over a specific period. This bottom-line figure represents the financial outcome of the business’s operations, indicating whether revenues exceeded expenses or vice versa. Understanding the factors contributing to profit or loss is essential for informed decision-making and long-term financial sustainability.

- Net Income CalculationNet income, or profit, is calculated by subtracting total expenses from total revenues. A positive net income indicates profitability, while a negative net income signifies a loss. For example, if a trucking company generates $100,000 in revenue and incurs $80,000 in expenses, the net income is $20,000. Conversely, if expenses exceed revenues, the result is a net loss.

- Profitability AnalysisAnalyzing profit margins provides insights into the efficiency and financial health of a trucking business. Key metrics include gross profit margin (revenue minus cost of goods sold divided by revenue) and net profit margin (net income divided by revenue). These metrics allow for benchmarking against industry averages and identifying areas for improvement.

- Loss Mitigation StrategiesWhen a trucking company experiences a loss, the profit and loss statement helps pinpoint contributing factors. Analyzing expense categories reveals areas for potential cost reduction, such as optimizing fuel consumption or negotiating better insurance rates. Identifying and addressing these areas is crucial for returning to profitability.

- Profit Reinvestment OpportunitiesGenerating a profit provides opportunities for reinvestment in the business. This may include upgrading equipment, expanding the fleet, investing in driver training, or exploring new technologies to enhance efficiency and competitiveness. Strategic reinvestment fuels long-term growth and sustainability.

The profit/loss calculation within the trucking profit and loss statement template provides crucial insights into the financial performance of the business. By analyzing the factors contributing to profit or loss, trucking companies can make informed decisions to improve profitability, optimize resource allocation, and achieve long-term financial success. This understanding forms the foundation for strategic planning and sustainable growth within the competitive trucking industry.

4. Time Period

The “Time Period” component of a trucking profit and loss statement template defines the specific duration for which financial performance is being measured. This period can range from a week to a year, with monthly and quarterly periods being common choices. Selecting an appropriate time period is crucial for generating meaningful insights and facilitating effective financial management. Shorter periods, such as weekly or monthly, allow for frequent monitoring of performance and quicker identification of trends or anomalies. Longer periods, such as quarterly or annually, provide a broader overview of financial health and are useful for strategic planning and reporting to stakeholders. For example, analyzing monthly statements can reveal seasonal fluctuations in fuel costs, while annual statements offer a comprehensive view of profitability and return on investment. The chosen time period directly impacts the data captured and the insights derived.

The relationship between the chosen time period and the data presented in the profit and loss statement is essential for accurate analysis. Comparing performance across consistent time periods allows for meaningful trend analysis and informed decision-making. For instance, comparing monthly revenue figures year-over-year can reveal growth patterns and identify potential market shifts. Similarly, tracking expenses over consistent periods facilitates cost control and identifies areas where spending may be exceeding projections. Inconsistencies in time periods can distort comparisons and lead to inaccurate conclusions. For example, comparing a month’s performance to a quarter’s performance would provide a skewed perspective. Maintaining consistent time periods ensures data integrity and allows for reliable performance evaluation.

Selecting and consistently applying appropriate time periods within the trucking profit and loss statement template is fundamental for accurate financial analysis and effective decision-making. The chosen time period influences the granularity of insights obtained and allows for meaningful performance comparisons. This understanding allows trucking companies to leverage financial data for informed strategic planning, optimized resource allocation, and enhanced long-term profitability.

5. Industry Specific

A generic profit and loss statement may not adequately capture the unique financial nuances of the trucking industry. An industry-specific template, tailored to the trucking sector, is essential for accurate financial reporting, analysis, and decision-making. This specialization ensures that relevant cost categories, revenue streams, and industry-specific metrics are appropriately represented, providing a more precise and insightful view of financial performance.

- Fuel CostsFuel consumption represents a major operating expense for trucking companies, often exceeding other industries. An industry-specific template incorporates detailed fuel cost tracking, including fuel type, consumption rates, and fuel surcharge mechanisms. This detailed tracking facilitates better cost management and pricing strategies. For example, incorporating fuel price fluctuations and hedging strategies into the statement provides a more accurate picture of profitability.

- Maintenance and RepairThe demanding nature of trucking operations necessitates frequent maintenance and repairs. A specialized template includes dedicated categories for preventative maintenance, repairs, and part replacements. This detailed categorization allows for accurate tracking of maintenance expenses, facilitates budgeting for future repairs, and supports proactive maintenance planning to minimize downtime. For instance, tracking the costs associated with specific vehicle components can reveal patterns of wear and tear, informing preventative maintenance schedules.

- Driver Compensation and BenefitsDriver-related expenses, including wages, benefits, and payroll taxes, constitute a significant portion of trucking operating costs. An industry-specific template accounts for these unique costs, including per-mile compensation, overtime pay, and health insurance premiums. This granular approach enables accurate cost analysis, facilitates driver retention strategies, and supports informed decisions regarding driver compensation packages. Distinguishing between independent contractor expenses and employee payroll costs is a prime example of this specificity.

- Regulatory Compliance CostsThe trucking industry faces stringent regulations related to safety, emissions, and licensing. An industry-specific template includes provisions for tracking compliance-related expenses, such as permits, inspections, and compliance audits. This detailed tracking ensures accurate cost allocation and supports informed decision-making regarding regulatory compliance strategies. For example, accurately tracking expenses associated with electronic logging devices (ELDs) provides valuable data for evaluating the financial impact of regulatory changes.

By incorporating these industry-specific elements, a trucking profit and loss statement template offers a more accurate and insightful reflection of a company’s financial performance. This specialized approach empowers trucking businesses to make informed decisions regarding pricing, cost control, and resource allocation, ultimately contributing to enhanced profitability and long-term sustainability within the competitive trucking landscape.

6. Template Format

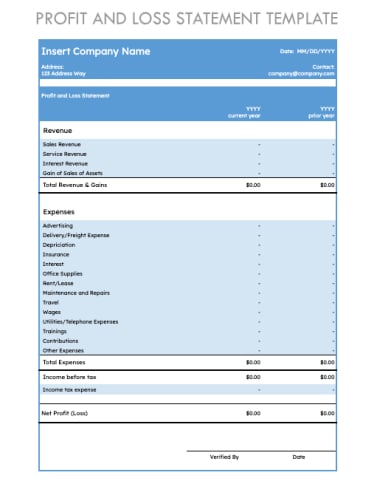

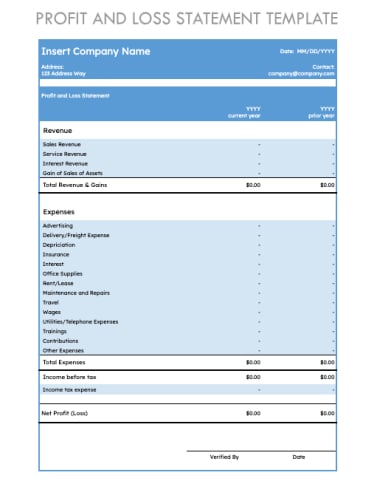

The format of a trucking profit and loss statement template significantly impacts its usability and the insights derived. A well-structured format ensures clarity, facilitates data entry and analysis, and supports informed decision-making. A logical structure, clear labeling, and appropriate categorization are crucial for maximizing the template’s effectiveness.

- Clear Structure and LayoutA clear, logical structure, often chronological, guides users through the statement’s components. Distinct sections for revenue, expenses, and calculations ensure easy navigation and data interpretation. Consistent formatting, such as the use of tables and columns, enhances readability and facilitates comparisons across periods. For example, presenting revenue streams in a tabular format with clear column headers for each revenue type clarifies the sources of income and their respective contributions. A structured layout minimizes the risk of errors and misinterpretations, leading to more accurate analysis.

- Comprehensive CategorizationCategorizing revenue and expenses provides a granular view of financial performance. Detailed categories, such as driver compensation, fuel costs, and maintenance expenses, allow for in-depth analysis of cost drivers and revenue sources. This granular approach enables targeted cost control measures and informed resource allocation decisions. For instance, categorizing maintenance expenses into preventative maintenance, repairs, and tire costs offers insights into specific areas for cost optimization.

- Formula IntegrationIntegrating formulas directly into the template automates calculations, minimizing manual data entry and reducing the risk of errors. Automated calculation of gross profit, net profit, and other key metrics streamlines the analysis process and ensures accuracy. Pre-built formulas for calculating profit margins, for example, ensure consistency and efficiency in performance evaluation. Automated calculations save time and improve the reliability of financial analysis.

- Comparative Analysis FeaturesTemplates designed for comparative analysis often include columns for previous periods or budget figures. This facilitates year-over-year or month-over-month comparisons, enabling trend identification and performance evaluation against targets. Visual aids, such as charts and graphs, enhance data visualization and simplify complex comparisons. For example, incorporating a column for budgeted expenses alongside actual expenses allows for immediate identification of variances and facilitates proactive cost management.

A well-designed template format enhances the usability and analytical power of a trucking profit and loss statement. By incorporating clear structure, comprehensive categorization, formula integration, and comparative analysis features, the template becomes a powerful tool for financial management, supporting informed decision-making and contributing to the long-term success of trucking businesses. Choosing or creating a template that aligns with the specific needs and analytical requirements of the business is crucial for maximizing its value.

Key Components of a Trucking Profit and Loss Statement Template

Effective financial management within the trucking industry requires a comprehensive understanding of the key components within a specialized profit and loss statement template. These components provide a structured framework for analyzing financial performance and making informed business decisions.

1. Revenue: This section details all income generated from trucking operations. Critical elements include freight charges, fuel surcharges, accessorial revenue for additional services, and other income streams. Accurate revenue reporting is fundamental for assessing financial health.

2. Expenses: A detailed breakdown of operating costs is crucial for profitability analysis. Key expense categories include driver compensation (wages, benefits), fuel costs, maintenance and repair expenses, insurance premiums, and administrative overhead.

3. Profit/Loss Calculation: This core component represents the difference between total revenues and total expenses. A positive result indicates net profit, while a negative result signifies a net loss. This figure is a key indicator of financial performance.

4. Time Period: The statement must specify the reporting period, whether weekly, monthly, quarterly, or annually. Consistent time periods are crucial for accurate trend analysis and performance comparisons.

5. Industry-Specific Details: A template tailored to the trucking industry incorporates specific cost categories relevant to the sector, such as per-mile driver compensation, fuel efficiency metrics, and maintenance expenses related to heavy-duty vehicles.

6. Template Format: A well-designed template employs a clear, logical structure with distinct sections for revenue, expenses, and calculations. Automated formulas and comparative analysis features enhance usability and analytical capabilities.

Accurate data capture and analysis within these key components provide trucking businesses with the insights needed to optimize operations, manage costs effectively, and achieve sustainable profitability.

How to Create a Trucking Profit and Loss Statement Template

Creating a customized profit and loss statement template for a trucking business requires careful consideration of key components and industry-specific factors. A well-structured template facilitates accurate financial reporting, analysis, and informed decision-making.

1. Define the Reporting Period: Specify the timeframe covered by the statement, such as a month, quarter, or year. Consistent reporting periods are essential for accurate trend analysis.

2. Structure the Revenue Section: Create categories for major revenue streams, including freight charges, fuel surcharges, accessorial charges (detention, loading/unloading), and other revenue sources. Ensure clear labeling and consistent formatting.

3. Detail Expense Categories: Establish specific expense categories relevant to trucking operations. Include driver compensation (wages, benefits, payroll taxes), fuel costs, maintenance and repairs, insurance premiums, vehicle depreciation, administrative expenses, and other operating costs.

4. Incorporate Calculations: Integrate formulas for calculating key metrics. Automate calculations for gross profit (revenue – cost of goods sold), net profit (gross profit – operating expenses), and relevant profit margins. This reduces manual data entry and ensures accuracy.

5. Include Industry-Specific Metrics: Incorporate metrics relevant to the trucking industry. Consider including fuel efficiency (miles per gallon), cost per mile, revenue per mile, and driver utilization rates. These metrics offer deeper insights into operational efficiency.

6. Design for Comparative Analysis: Incorporate columns for previous periods’ data or budget figures to facilitate trend analysis and performance evaluation. Consider adding visual aids, like charts and graphs, for enhanced data visualization.

7. Choose a Format: Select a format that aligns with business needs and software capabilities. Spreadsheet software offers flexibility and formula integration, while dedicated accounting software may offer more specialized features. Ensure the chosen format supports clear data presentation and analysis.

8. Test and Refine: Populate the template with sample data to ensure accuracy and functionality. Review and refine the template based on practical use and evolving business requirements. Periodic review and updates maintain the template’s relevance and effectiveness.

A well-designed trucking profit and loss statement template, tailored to the specific needs of the business, provides a powerful tool for financial analysis, informed decision-making, and long-term success within the trucking industry. Regular review and refinement ensure the template remains a valuable asset for managing financial performance and driving profitability.

Careful management of finances is critical in the competitive trucking industry. A specialized profit and loss statement template provides a structured framework for tracking revenue and expenses, calculating profitability, and making informed business decisions. Understanding key components, such as revenue streams, expense categories, industry-specific metrics, and the importance of consistent reporting periods, allows trucking companies to gain a comprehensive view of their financial health. A well-designed template facilitates accurate data analysis, supports effective cost management strategies, and provides insights for optimizing operations and enhancing profitability.

Implementing and regularly utilizing a tailored profit and loss statement template empowers trucking businesses to navigate financial complexities, identify areas for improvement, and achieve long-term sustainability. This proactive approach to financial management is essential for thriving in the dynamic and challenging trucking industry. Regular review and adaptation of the template to evolving business needs ensures its continued effectiveness as a valuable tool for financial analysis and informed decision-making, ultimately contributing to sustained growth and success.