Utilizing such a structured projection offers several advantages. It enables businesses to secure funding by demonstrating financial viability to potential investors and lenders. It serves as a roadmap for operational decision-making, allowing management to anticipate potential challenges and proactively adjust strategies. Furthermore, it provides a benchmark for performance monitoring, allowing for timely identification of variances and corrective action. The process of developing these projections also fosters a deeper understanding of the business’s financial dynamics and key value drivers.

This article will further explore the core components of each financial statement within this framework, best practices for developing accurate projections, and strategies for utilizing this powerful tool for business growth and financial success.

1. Forecasting Horizon

The two-year forecasting horizon is a critical element of a two-year, three-statement business plan template. This timeframe provides a balance between short-term tactical planning and medium-term strategic vision. A shorter horizon might not capture significant market shifts or long-term investment returns, while a longer horizon can introduce greater uncertainty and make projections less reliable. The two-year period allows businesses to anticipate near-term challenges and opportunities while also laying the groundwork for future growth. For example, a startup might project initial losses in the first year but anticipate profitability in the second year based on market penetration and scaling operations. This two-year outlook allows potential investors to assess both the initial risk and the potential for future returns.

The selection of a two-year horizon influences the level of detail required in the financial projections. While longer-term forecasts might focus on broader trends, a two-year projection requires a more granular approach. This includes detailed assumptions about revenue growth, cost structures, and capital expenditures. For instance, a retail business might need to project sales on a quarterly or even monthly basis to account for seasonality and promotional campaigns. This granular detail allows for more accurate forecasting of cash flow and profitability, which are critical for short-term financial management.

A clear understanding of the two-year forecasting horizon is essential for effectively utilizing the three-statement business plan template. It provides the timeframe within which the income statement, balance sheet, and cash flow statement are projected and interconnected. This interconnectedness allows for a dynamic and comprehensive view of the business’s financial trajectory. The two-year horizon also facilitates performance monitoring and allows for timely adjustments to the plan based on actual results. This iterative process of planning, monitoring, and adjusting is critical for achieving financial objectives and navigating the complexities of the business environment.

2. Financial Statements

The foundation of a robust two-year business plan rests upon the three core financial statements: the income statement, the balance sheet, and the statement of cash flows. These interconnected statements provide a comprehensive and dynamic view of a company’s projected financial performance. The income statement projects profitability over the two-year period, detailing anticipated revenues, costs, and resulting net income or loss. For example, a manufacturing company might project increasing sales revenue based on anticipated market growth, while also projecting rising raw material costs. The difference between these projections reveals the projected gross profit, a key indicator of operational efficiency.

The balance sheet provides a snapshot of the company’s projected financial position at the end of each year, outlining assets, liabilities, and equity. Projecting the balance sheet requires careful consideration of how operational activities and financing decisions will impact asset acquisition, debt levels, and retained earnings. For instance, a company investing in new equipment will see an increase in its assets, potentially funded by debt, impacting the liabilities side of the balance sheet. Equity projections will reflect retained earnings based on projected profitability from the income statement. This interplay between the income statement and balance sheet is crucial for understanding the financial health of the business.

The statement of cash flows completes the picture by projecting the movement of cash both into and out of the company over the two-year period. It categorizes cash flows into operating activities, investing activities, and financing activities. A company experiencing rapid sales growth might project positive cash flow from operations but negative cash flow from investing activities if it is investing heavily in new equipment or acquisitions. Accurately projecting cash flows is vital for ensuring the business maintains sufficient liquidity to meet its obligations and fund its growth plans. The interconnected nature of these three statements provides a dynamic system for financial planning. Changes in one statement necessarily impact the others, allowing for a holistic and realistic projection of financial performance.

3. Integrated Projections

Integrated projections form the cornerstone of a robust two-year, three-statement business plan template. Rather than treating the income statement, balance sheet, and cash flow statement in isolation, integrated projections link these statements, ensuring consistency and reflecting the dynamic relationships between them. This interconnectedness is essential for creating a realistic and reliable financial forecast.

- Interconnected Financial StatementsThe core principle of integrated projections lies in recognizing the interdependence of the three financial statements. For example, projected net income from the income statement flows into retained earnings on the balance sheet, impacting equity. Similarly, capital expenditures projected on the statement of cash flows affect the asset side of the balance sheet. This dynamic interplay ensures that changes in one statement automatically flow through to the others, maintaining a coherent and accurate financial picture. Without this integration, inconsistencies can arise, leading to unrealistic projections and flawed decision-making.

- Circular Relationships and Feedback LoopsIntegrated projections capture the circular relationships within financial planning. For instance, projected sales growth influences revenue on the income statement, which in turn impacts profitability. This profitability affects the cash flow from operations and subsequently the cash balance, which can then influence future investment decisions and, therefore, future profitability. These feedback loops are crucial for understanding the long-term implications of short-term decisions. A two-year horizon provides sufficient time to observe these effects, allowing for more informed strategic planning.

- Dynamic Adjustments and Scenario PlanningThe interconnected nature of integrated projections facilitates dynamic adjustments and scenario planning. If initial sales projections prove overly optimistic, adjustments can be made, and the impact of this change will ripple through all three statements. This allows businesses to assess the financial implications of various scenarios, such as changes in market conditions, pricing strategies, or cost structures. This flexibility is critical for navigating uncertainty and adapting to evolving business environments. For example, a business can model the impact of a price increase on sales volume, revenue, profitability, and ultimately, cash flow, allowing for informed pricing decisions.

- Enhanced Accuracy and ReliabilityBy ensuring consistency and capturing the dynamic relationships between financial variables, integrated projections enhance the accuracy and reliability of financial forecasts. This is particularly important for securing funding, as investors and lenders require credible financial projections to assess risk and potential returns. A well-integrated two-year, three-statement business plan template provides a comprehensive and trustworthy view of the business’s financial trajectory, increasing confidence in the projected outcomes.

In conclusion, integrated projections are essential for developing a robust and reliable two-year, three-statement business plan template. This integrated approach provides a holistic view of the business’s financial future, allowing for informed decision-making, effective scenario planning, and ultimately, greater financial success.

4. Key Assumptions

Key assumptions underpin the entire structure of a two-year, three-statement business plan template. These assumptions represent educated guesses about future trends and conditions that influence projected financial performance. They serve as the foundation upon which financial projections are built, driving the outcomes reflected in the income statement, balance sheet, and cash flow statement. The accuracy and reliability of a financial plan are directly tied to the validity of these underlying assumptions. For instance, a software company projecting revenue growth might assume a specific rate of customer acquisition. This assumption directly impacts projected sales, influencing profitability on the income statement and subsequent cash flow projections. Similarly, assumptions about inflation rates can impact cost projections, influencing profitability and potentially affecting financing needs reflected on the balance sheet.

Several factors influence the selection of key assumptions. Market research plays a crucial role in informing assumptions about market size, growth rates, and competitive pressures. Internal data, such as historical sales trends and cost structures, can provide valuable insights for projecting future performance. Macroeconomic factors, such as interest rates and inflation, must also be considered. For example, a real estate development company might base assumptions about property values on historical market trends and current economic conditions. Careful consideration of these factors is essential for developing realistic and defensible assumptions. Furthermore, sensitivity analysis, exploring the impact of varying assumptions on financial outcomes, is a critical practice. This analysis reveals which assumptions have the most significant impact on projections, allowing for greater focus on refining these critical drivers.

Understanding the role and importance of key assumptions is crucial for effectively utilizing a two-year, three-statement business plan template. Clearly defined and well-supported assumptions enhance the credibility of the financial projections. They facilitate informed decision-making by providing a framework for evaluating potential risks and opportunities. Furthermore, they serve as a benchmark for performance monitoring, allowing for timely identification of deviations from the plan. Regularly reviewing and refining key assumptions, based on actual results and evolving market conditions, is essential for maintaining the accuracy and relevance of the financial plan. This iterative process of planning, monitoring, and adjusting is critical for navigating the complexities of the business environment and achieving long-term financial success.

5. Dynamic Adjustments

The ability to make dynamic adjustments is a critical feature of an effective two-year, three-statement business plan template. The business environment is constantly evolving, and a static plan quickly becomes outdated. Dynamic adjustments allow the plan to remain relevant and useful by incorporating new information and responding to unforeseen events. This flexibility is crucial for navigating uncertainty and ensuring the plan continues to serve as a reliable guide for decision-making.

- Responding to Market ChangesMarket conditions can shift rapidly due to factors like changes in consumer demand, competitor actions, or economic downturns. A dynamic plan allows businesses to respond to these changes by adjusting projections for sales, costs, and other key variables. For example, if market research reveals slower than anticipated growth in a target market, revenue projections can be adjusted downward, impacting the income statement and subsequently the cash flow and balance sheet projections. This responsive approach ensures the plan remains aligned with market realities.

- Incorporating New InformationAs businesses operate, they gather new information about their performance, market dynamics, and operational efficiencies. A dynamic two-year plan allows for the integration of this new information into the projections. For example, if a company implements a cost-saving initiative that proves more effective than initially anticipated, the projected cost of goods sold can be adjusted, impacting profitability and cash flow projections. This continuous refinement of the plan based on real-world data enhances its accuracy and reliability.

- Evaluating Strategic OptionsA dynamic plan serves as a powerful tool for evaluating strategic options. By adjusting key assumptions and drivers, businesses can model the potential impact of various strategic decisions, such as launching a new product, entering a new market, or acquiring a competitor. This analysis provides valuable insights into the potential financial implications of each option, facilitating informed decision-making. For instance, a company considering expanding into a new market can use the plan to model the associated costs and potential revenue streams, assessing the impact on overall profitability and financial position.

- Maintaining Stakeholder ConfidenceThe ability to adapt to changing circumstances and incorporate new information demonstrates sound financial management to stakeholders. Investors and lenders value businesses that can proactively adjust their plans rather than rigidly adhering to outdated projections. A dynamic two-year plan provides a framework for communicating these adjustments and maintaining stakeholder confidence in the face of uncertainty. This transparency and responsiveness are critical for securing funding and building long-term relationships with investors and lenders.

In conclusion, dynamic adjustments are essential for maximizing the value of a two-year, three-statement business plan template. This adaptability ensures the plan remains relevant, reliable, and useful as a guide for decision-making in a dynamic business environment. The ability to respond to market changes, incorporate new information, and evaluate strategic options strengthens financial planning and enhances stakeholder confidence, contributing to long-term financial success.

6. Performance Monitoring

Performance monitoring is integral to the effective utilization of a two-year, three-statement business plan template. The template serves as a roadmap, and performance monitoring provides the navigation system, ensuring the business stays on course toward its financial objectives. Regular monitoring allows for timely identification of variances between projected and actual performance, enabling corrective action and informed decision-making. Without consistent monitoring, the plan becomes a static document, losing its relevance and value in guiding the business’s financial trajectory.

- Variance AnalysisVariance analysis involves comparing actual financial results against the projected figures within the two-year plan. This analysis identifies discrepancies, highlighting areas where performance exceeds or falls short of expectations. For example, if actual sales revenue is significantly lower than projected, variance analysis pinpoints the shortfall, prompting investigation into potential causes, such as weakened market demand or ineffective sales strategies. This process provides valuable insights into operational efficiency and market dynamics.

- Key Performance Indicators (KPIs)KPIs provide quantifiable metrics for tracking progress toward specific objectives outlined within the two-year plan. These metrics can include revenue growth, profit margins, customer acquisition costs, and inventory turnover rates. Regularly monitoring KPIs provides a focused view of critical aspects of the business’s performance, allowing for quick identification of areas requiring attention. For instance, tracking customer acquisition costs can reveal inefficiencies in marketing campaigns, prompting adjustments to improve return on investment. This data-driven approach ensures resources are allocated effectively.

- Corrective Action and AdjustmentsPerformance monitoring is not merely about identifying variances; it’s about taking action based on those insights. If KPIs indicate underperformance, corrective action must be taken. This might involve adjusting sales strategies, streamlining operations to reduce costs, or seeking additional funding. The two-year plan serves as a framework for implementing these adjustments, allowing businesses to revise projections and maintain a realistic outlook. For example, if rising material costs impact profitability, the plan can be adjusted to reflect higher prices or cost-saving measures, ensuring continued financial viability.

- Strategic Decision-MakingPerformance monitoring informs strategic decision-making by providing real-time feedback on the effectiveness of existing strategies. If the business is consistently exceeding projections in a particular product line, this data might support a decision to invest further in that area. Conversely, persistent underperformance might lead to a decision to divest or restructure. The two-year plan provides a framework for evaluating these strategic options and assessing their potential impact on the overall financial trajectory. This iterative process of planning, monitoring, and adjusting ensures the business remains adaptable and responsive to changing market conditions.

By consistently monitoring performance against the two-year, three-statement business plan template, businesses gain valuable insights into their financial health and operational efficiency. This ongoing process facilitates proactive adjustments, informed decision-making, and ultimately, greater financial success. The plan serves as a dynamic tool, guiding the business toward its objectives while adapting to the inevitable challenges and opportunities that arise in a dynamic business environment.

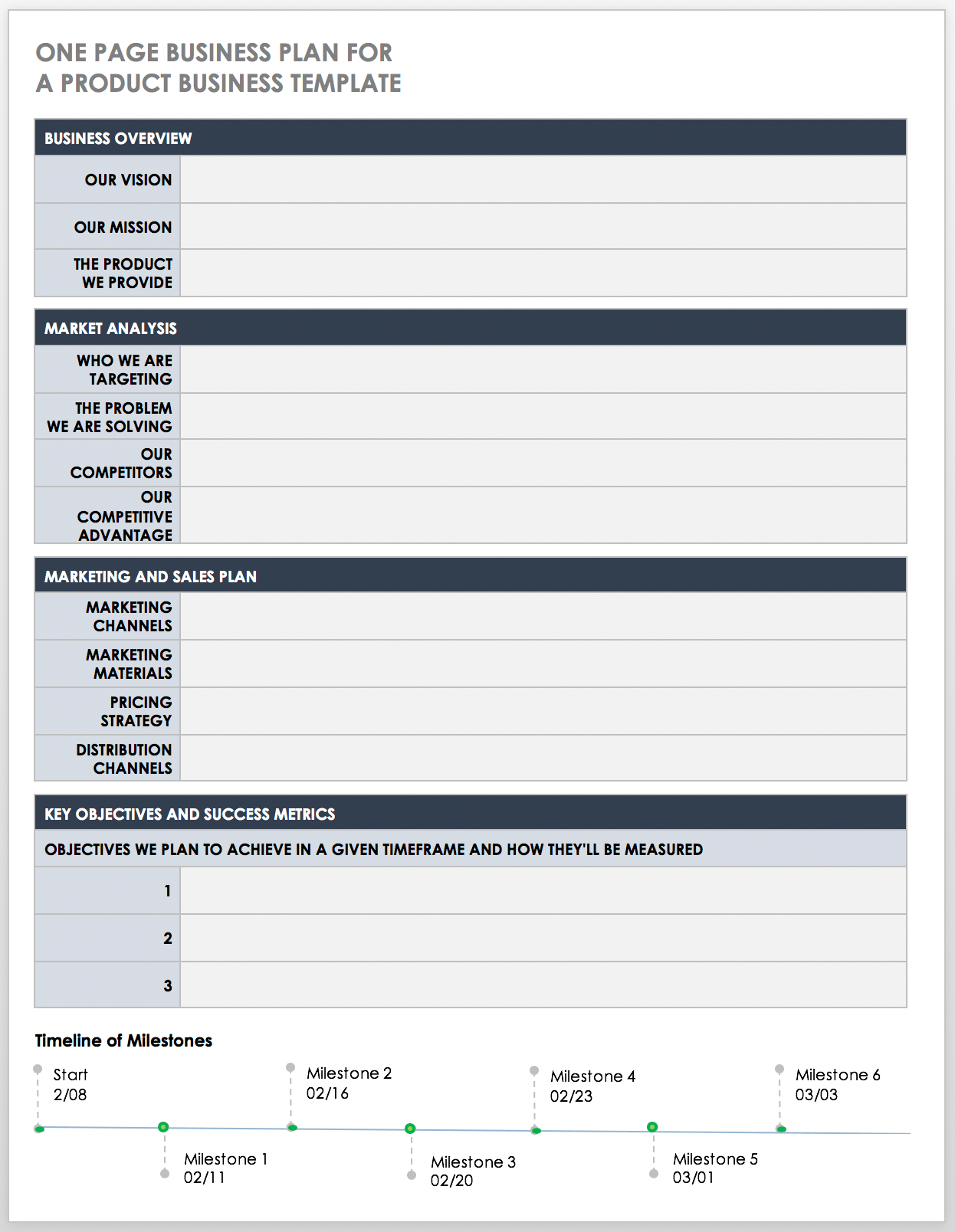

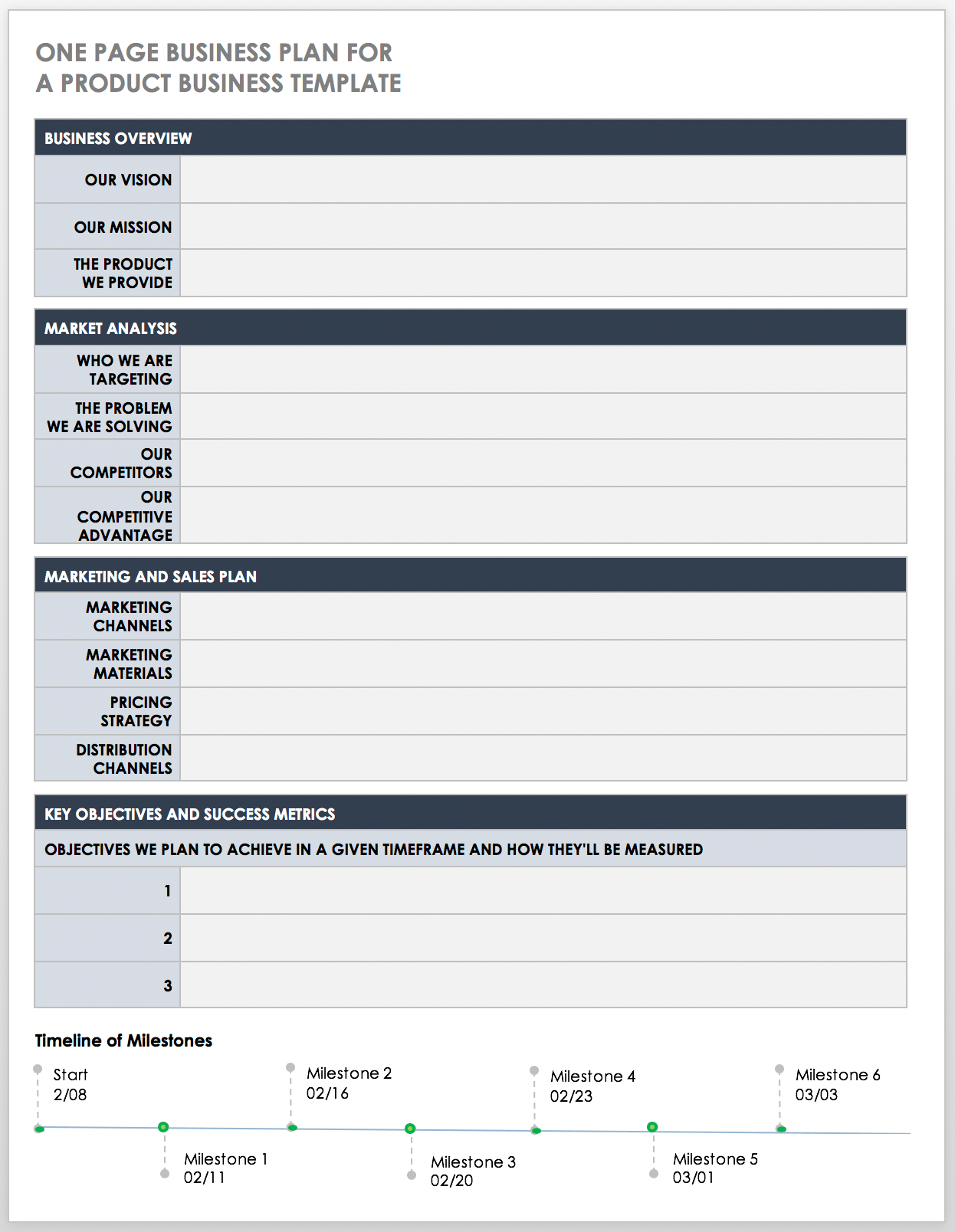

Key Components of a Two-Year, Three-Statement Business Plan Template

A robust financial plan requires a structured approach. The following components are essential for developing a comprehensive two-year, three-statement business plan template.

1. Income Statement: The income statement projects revenue, costs, and resulting profitability over the two-year period. This includes forecasting sales, cost of goods sold, operating expenses, and net income. Accuracy in these projections is crucial for assessing the financial viability of the business model.

2. Balance Sheet: The balance sheet provides a snapshot of the company’s projected financial position at the end of each year. It outlines assets, liabilities, and equity, reflecting the impact of operational activities and financing decisions. This statement offers insights into the company’s financial health and stability.

3. Cash Flow Statement: The cash flow statement projects the movement of cash into and out of the company. It categorizes cash flows into operating activities, investing activities, and financing activities, providing a clear picture of the company’s liquidity and ability to meet its financial obligations.

4. Key Assumptions: Underlying the financial projections are key assumptions about market conditions, industry trends, and internal performance drivers. These assumptions must be clearly defined and justified to ensure the credibility and reliability of the financial plan.

5. Financial Metrics and Ratios: Beyond the raw financial data, calculating key metrics and ratios provides deeper insights into profitability, liquidity, and solvency. Metrics like gross profit margin, current ratio, and debt-to-equity ratio offer a more nuanced understanding of financial performance.

6. Sensitivity Analysis: Given the inherent uncertainty in forecasting, sensitivity analysis explores the potential impact of varying key assumptions on the financial projections. This analysis helps assess the robustness of the plan and identify critical areas of vulnerability.

Developing a comprehensive two-year plan requires careful consideration of these interconnected components. This structured approach provides a holistic view of the company’s projected financial performance, facilitating informed decision-making and enhancing the ability to navigate the complexities of the business environment.

How to Create a Two-Year, Three-Statement Business Plan Template

Developing a robust two-year, three-statement business plan requires a structured approach and careful consideration of key financial drivers. The following steps outline the process for creating a comprehensive and effective template.

1: Define the Business Model and Objectives: Clearly articulate the business model, target market, and core value proposition. Establish specific, measurable, achievable, relevant, and time-bound (SMART) financial objectives for the two-year period. This provides a clear direction for the financial projections.

2: Develop the Income Statement: Project revenue based on market analysis, pricing strategies, and sales forecasts. Estimate cost of goods sold and operating expenses, considering factors like raw materials, labor, marketing, and administrative overhead. Calculate projected net income by subtracting total costs from total revenue.

3: Construct the Balance Sheet: Project assets, including current assets like cash, accounts receivable, and inventory, and long-term assets like property, plant, and equipment. Project liabilities, including current liabilities like accounts payable and short-term debt, and long-term liabilities like long-term debt. Calculate projected equity based on retained earnings and any additional capital contributions.

4: Prepare the Cash Flow Statement: Project cash flow from operating activities based on projected net income, adjusted for non-cash items like depreciation and changes in working capital. Project cash flow from investing activities, including capital expenditures and asset acquisitions. Project cash flow from financing activities, including debt issuance, equity financing, and dividend payments.

5: Establish Key Assumptions: Document all key assumptions underlying the financial projections, including market growth rates, inflation rates, customer acquisition costs, and production capacity. Justify these assumptions with market research, industry data, and internal historical performance.

6: Calculate Financial Metrics and Ratios: Calculate key financial metrics and ratios, such as gross profit margin, operating profit margin, current ratio, quick ratio, and debt-to-equity ratio. These metrics provide valuable insights into profitability, liquidity, and solvency, enabling deeper analysis of financial performance.

7: Conduct Sensitivity Analysis: Explore the potential impact of variations in key assumptions on the projected financial outcomes. Identify critical assumptions that have the most significant impact on the plan. This analysis reveals potential vulnerabilities and informs risk management strategies.

8: Review and Iterate: Regularly review and update the two-year plan based on actual performance, changing market conditions, and new information. This iterative process ensures the plan remains relevant and continues to serve as a valuable tool for guiding decision-making and achieving financial objectives.

A well-constructed template requires a thorough understanding of the business model, realistic assumptions, and consistent integration between the three financial statements. This structured approach provides a roadmap for financial success, facilitating informed decision-making, resource allocation, and performance monitoring.

A structured approach to financial forecasting, embodied in a two-year, three-statement business plan template, provides a comprehensive view of projected financial performance. Integrating the income statement, balance sheet, and cash flow statement offers a dynamic and interconnected understanding of profitability, financial position, and liquidity. Well-defined key assumptions, coupled with dynamic adjustments and regular performance monitoring, ensure the plan remains relevant and reliable amidst evolving market conditions. This structured approach enables informed decision-making, effective resource allocation, and proactive risk management.

Strategic financial planning is not a one-time event but a continuous process. Regularly reviewing, updating, and adapting the two-year plan is essential for navigating the complexities of the business environment and achieving sustained financial success. This proactive approach enables organizations to anticipate challenges, capitalize on opportunities, and maintain a clear path toward their long-term financial objectives. A well-constructed and diligently maintained financial plan serves as a cornerstone of organizational resilience and growth.