Utilizing such a statement empowers drivers to understand their true earnings, identify areas for cost optimization, and make informed financial decisions. Accurate income and expense tracking simplifies tax preparation, facilitates access to financial products like loans, and enables better budgeting and financial planning. Ultimately, it allows drivers to maximize their earnings and operate their ride-sharing activities as a sustainable business.

The following sections will delve deeper into the specific components of a well-structured financial statement for ride-sharing drivers, offer practical tips for its effective utilization, and explore resources available to assist in its creation and management.

1. Revenue Tracking

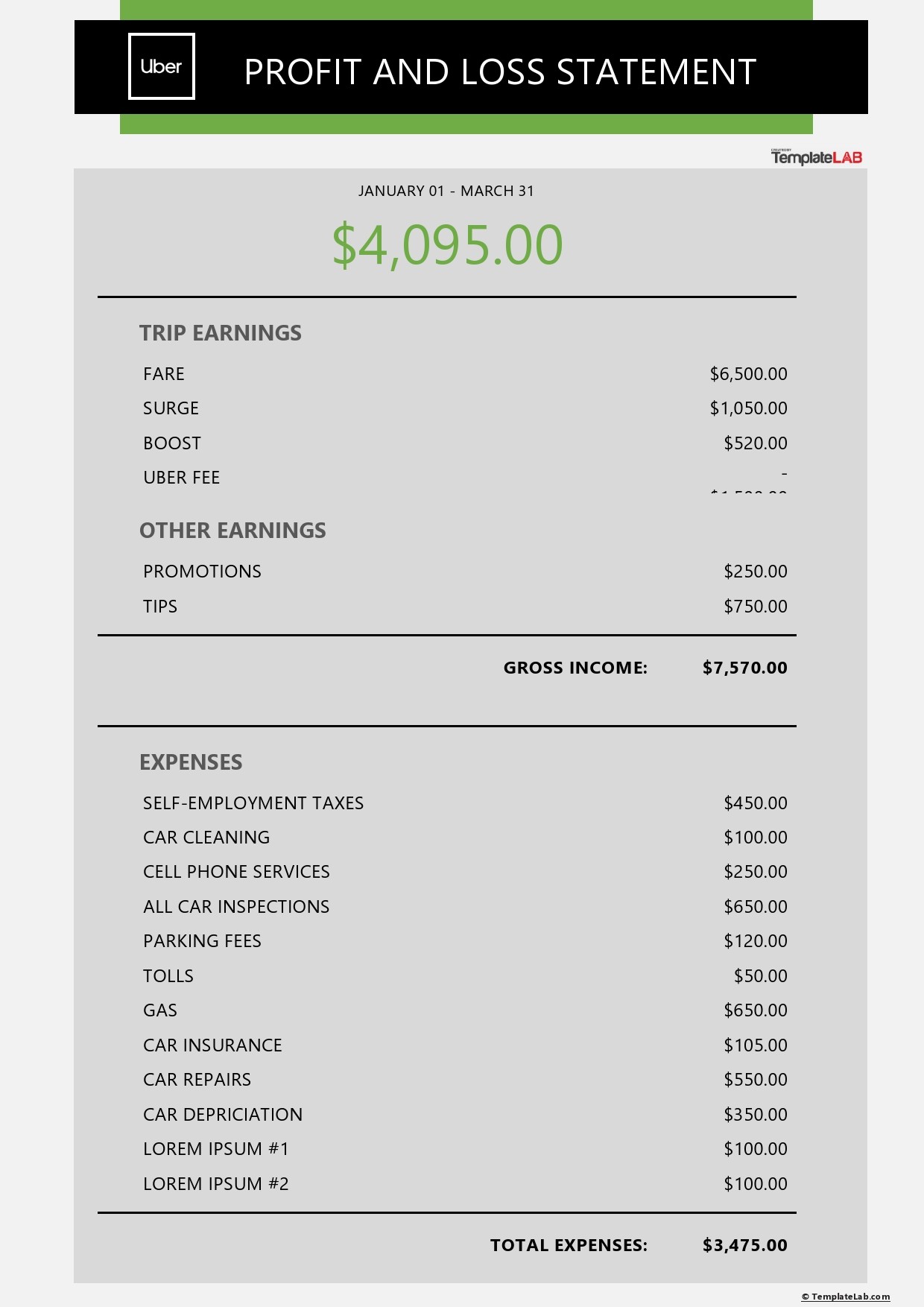

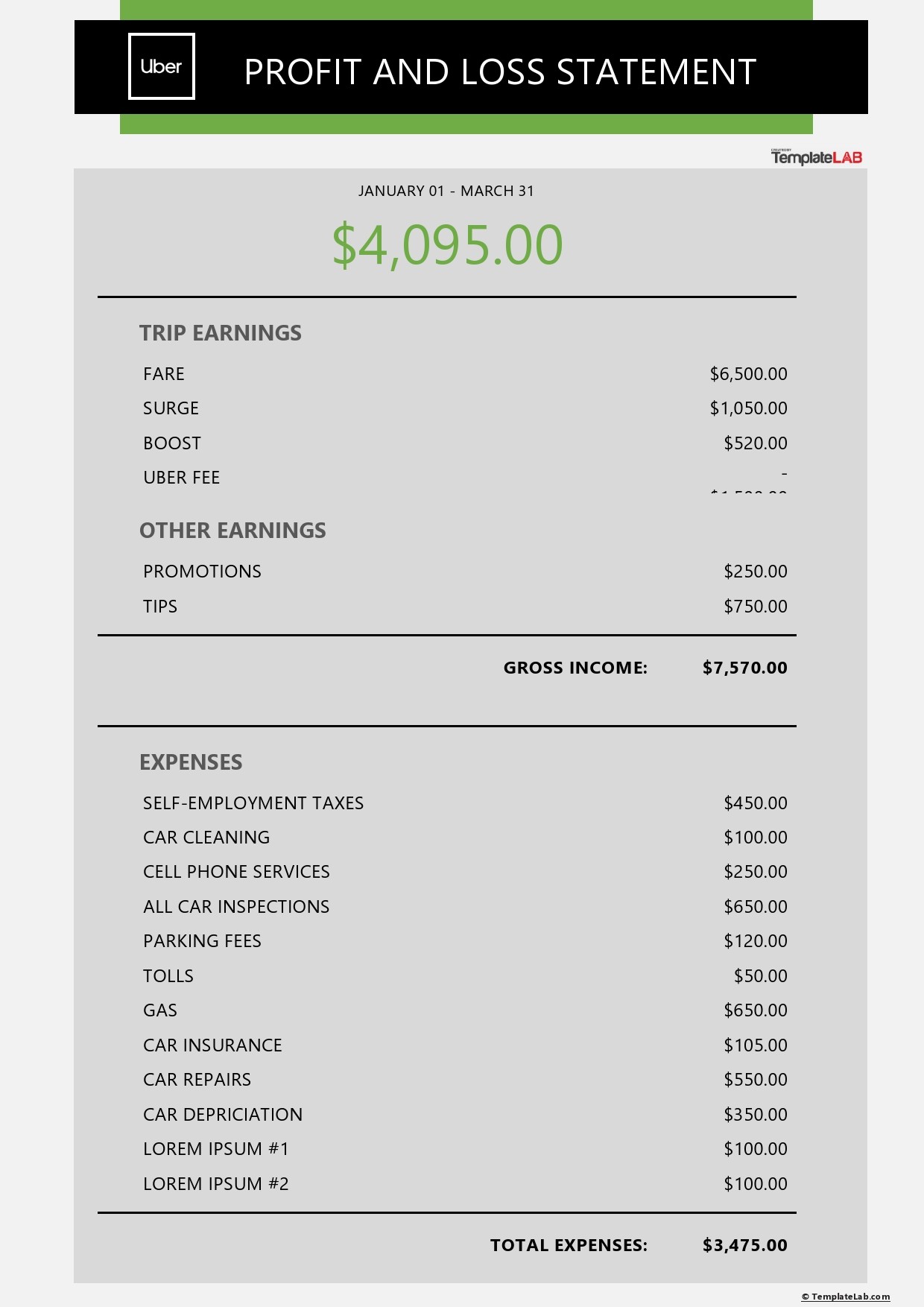

Accurate revenue tracking forms the cornerstone of a comprehensive profit and loss statement for rideshare drivers. Meticulous recording of all income sources, including fares, surge pricing bonuses, tips, and any other incentives, provides the foundation for calculating profitability. Without precise revenue data, the resulting profit calculation will be inaccurate, hindering effective financial management. For example, failing to track a weekly bonus could lead to an underestimation of earnings and potentially misinformed financial decisions.

A well-designed statement template facilitates systematic revenue entry, often categorized by trip, date, and payment type. This granular approach enables drivers to identify trends in earnings, peak earning periods, and the impact of various promotions or incentives on overall income. Analyzing this data can inform strategic decisions, such as optimizing driving hours to coincide with high-demand periods. This data-driven approach empowers drivers to maximize earning potential and operate their rideshare business with greater financial awareness. Consider a driver who, through diligent revenue tracking, discovers that weekend evenings consistently yield higher fares due to surge pricing. This insight could motivate a shift in work schedule to capitalize on these more profitable periods.

In summary, precise revenue tracking is not merely a bookkeeping exercise; it provides crucial insights into business performance and informs strategic decision-making. Challenges such as accurately recording cash tips or reconciling payments from multiple platforms underscore the need for a robust tracking system within the profit and loss statement template. Overcoming these challenges empowers drivers to gain a clear understanding of their financial position and optimize their earning strategies.

2. Expense Categorization

Effective expense categorization is fundamental to a meaningful profit and loss statement for rideshare drivers. Categorizing expenses provides a granular view of where money is spent, facilitating analysis and informed decision-making. Common categories include fuel, vehicle maintenance (repairs, oil changes, tires), insurance, licensing and registration fees, commissions paid to the rideshare platform, cleaning supplies, and depreciation of the vehicle. A well-structured template facilitates this categorization, allowing drivers to accurately allocate each expense.

The benefits of detailed expense categorization extend beyond simply knowing where money goes. By analyzing spending patterns, drivers can identify areas for potential cost savings. For instance, tracking mileage and fuel costs can reveal the true cost per mile driven, potentially highlighting the need for a more fuel-efficient vehicle or adjustments to driving habits. Similarly, regular maintenance tracking can prevent costly major repairs by addressing minor issues proactively. Suppose a driver notices consistently high maintenance costs due to frequent tire replacements. This observation might prompt investigation into tire quality, driving conditions, or wheel alignment, potentially leading to significant long-term savings.

Accurate expense categorization within the profit and loss statement is crucial for tax purposes. Clearly categorized expenses allow for accurate deductions, minimizing tax liability and ensuring compliance. Moreover, this level of financial clarity allows for better financial planning, budgeting, and informed decision-making regarding vehicle upgrades, insurance options, and overall business strategy. Failure to categorize expenses effectively can lead to an incomplete understanding of operational costs and potentially inaccurate profit calculations, hindering sound financial management and potentially jeopardizing long-term profitability.

3. Profit Calculation

Accurate profit calculation is the core objective of an Uber profit and loss statement template. It provides the critical insight into the financial viability and success of a driver’s rideshare operation. This calculation hinges on the precise tracking of both revenue and expenses, offering a clear picture of net earnings over a specific period.

- Gross Profit vs. Net ProfitA profit and loss statement distinguishes between gross profit and net profit. Gross profit represents revenue minus the direct costs of providing services (e.g., commissions and mileage-based expenses). Net profit further deducts operating expenses like insurance, maintenance, and vehicle depreciation, providing a more accurate measure of overall profitability. Understanding this distinction is crucial for assessing the true financial performance of a rideshare business. For example, a driver might have high gross profit but a lower net profit due to substantial vehicle maintenance costs.

- Impact of Expense Tracking on Profit AccuracyAccurate expense tracking directly impacts the reliability of profit calculations. Omitting or underestimating expenses leads to an inflated profit figure, providing a misleadingly optimistic view of financial performance. Conversely, overestimating expenses can create an unnecessarily pessimistic picture. Meticulous expense recording within the template ensures a realistic profit assessment, facilitating informed financial planning and decision-making. A driver who diligently tracks expenses, including tolls and parking fees, gains a more precise understanding of their actual profit margin.

- Analyzing Profitability TrendsProfit calculations over multiple periods allow for trend analysis. Observing consistent profit growth indicates a healthy business trajectory, while declining profits signal a need for operational adjustments or strategic changes. Analyzing profitability patterns helps drivers identify seasonal fluctuations, the impact of pricing changes, and the effectiveness of cost-saving measures. For example, a consistent drop in profit during certain months might indicate higher fuel consumption due to increased use of air conditioning, prompting a reassessment of pricing strategies for those periods.

- Profit Margin Calculation and InterpretationCalculating profit margin, typically expressed as a percentage of revenue, offers a standardized measure of profitability. This metric allows for comparisons across different periods and against industry benchmarks, providing valuable insights into business performance. A healthy profit margin indicates efficient cost management and effective pricing strategies. Tracking profit margin over time can highlight the effectiveness of implemented changes. For instance, a driver might implement a strategy to minimize idle time and observe a subsequent increase in profit margin, demonstrating the strategy’s positive impact on profitability.

In conclusion, accurate profit calculation is the central function of an Uber profit and loss statement template. Understanding the nuances of profit calculation, including the difference between gross and net profit, and the impact of expense tracking, empowers drivers to make informed decisions, optimize their operations, and ultimately maximize their earnings potential. By analyzing profitability trends and profit margins, drivers can gain valuable insights into the financial health and long-term sustainability of their rideshare business.

4. Time Period Specification

Defining a specific time period is crucial for a rideshare driver’s profit and loss statement. This specification provides the temporal boundaries for financial analysis, enabling meaningful comparisons and trend identification. Without a defined timeframe, financial data lacks context and actionable insights.

- Weekly AnalysisWeekly analysis offers a short-term view of financial performance, allowing for rapid identification of fluctuations in earnings and expenses. This frequency facilitates prompt adjustments to driving strategies based on recent activity. For example, a driver might notice lower-than-expected earnings during a particular week and adjust their schedule or driving area accordingly in the following week.

- Monthly TrackingMonthly tracking provides a broader perspective on financial trends. It allows drivers to observe patterns related to expenses like car payments, insurance premiums, and routine maintenance, facilitating better budgeting and resource allocation. Analyzing monthly data can reveal seasonal variations in demand and profitability, enabling proactive adjustments to pricing or operational strategies. A driver might observe consistently higher earnings during holiday months and adjust their availability to maximize income during these periods.

- Quarterly ReviewQuarterly review facilitates medium-term financial assessment. It enables drivers to evaluate the effectiveness of strategies implemented over several months and make informed decisions regarding vehicle upgrades, investments, or business expansion. This timeframe allows for a more comprehensive understanding of the impact of market changes or seasonal fluctuations on overall profitability. For instance, a driver might analyze quarterly data to assess the return on investment of a recent vehicle upgrade in terms of fuel efficiency and maintenance costs.

- Annual AnalysisAnnual analysis provides a comprehensive overview of financial performance over an entire year. This long-term perspective is crucial for tax planning, investment decisions, and assessing the overall health and growth of the rideshare business. Analyzing annual data enables drivers to identify long-term trends, assess the effectiveness of annual goals, and plan for future financial objectives. A driver might use annual data to compare performance year-over-year and identify areas for improvement or growth in the coming year.

Selecting an appropriate time period depends on the specific analytical goals. While weekly analysis allows for rapid adjustments, annual analysis provides a broader strategic overview. Utilizing multiple timeframes within the profit and loss statement template offers a comprehensive understanding of financial performance, enabling data-driven decisions that optimize profitability and support the long-term sustainability of the rideshare business.

5. Template Accessibility

Template accessibility is a critical factor in the effective utilization of an Uber profit and loss statement template. Accessibility encompasses several key aspects: ease of use, availability across various platforms (desktop, mobile), format compatibility (spreadsheet software, online tools), and understandability. A readily accessible template promotes consistent and accurate financial tracking, enabling informed decision-making based on reliable data. A driver constantly on the go, for example, benefits significantly from a mobile-compatible template, facilitating real-time expense entry and income tracking regardless of location. Conversely, a complex or inaccessible template discourages regular use, hindering accurate financial analysis and potentially leading to poor financial decisions due to incomplete data.

Several factors contribute to template accessibility. A user-friendly design with clear instructions and intuitive data entry fields promotes consistent usage. Compatibility with commonly used spreadsheet software or the availability of user-friendly online tools eliminates technical barriers to access. Pre-populated categories and formulas further simplify the tracking process. Consider a driver who struggles with complex spreadsheets. A simple, pre-formatted template with clear income and expense categories significantly reduces the barrier to entry for maintaining accurate records. Furthermore, availability in multiple languages caters to a diverse driver population, ensuring inclusivity and promoting wider adoption. Offering the template in both English and Spanish, for instance, expands its reach and usability within diverse linguistic communities.

The practical significance of template accessibility directly impacts a driver’s ability to manage their finances effectively. A readily accessible template facilitates regular tracking of income and expenses, leading to a clearer understanding of profitability. This, in turn, informs strategic decisions related to driving hours, expense management, and overall business operations. Challenges related to accessibility, such as a lack of mobile compatibility or complex formatting, can hinder consistent usage, undermining the template’s value and potentially leading to financial mismanagement. Ultimately, ensuring template accessibility empowers drivers to take control of their financial well-being and operate their rideshare businesses with greater clarity and informed decision-making.

Key Components of an Uber Profit and Loss Statement Template

Effective financial management for rideshare drivers necessitates a structured approach to income and expense tracking. Key components within a specialized profit and loss statement template provide the framework for this analysis.

1. Revenue Streams: Comprehensive revenue tracking encompasses all income sources. This includes fares collected, surge pricing bonuses, tips, and any other incentives or promotional rewards received through the platform.

2. Operating Expenses: Accurate categorization of operating expenses is crucial. Common categories include fuel costs, vehicle maintenance and repairs, insurance premiums, licensing and registration fees, and commissions or fees paid to the rideshare platform.

3. Vehicle-Related Expenses: These expenses specifically relate to the vehicle used for rideshare operations. This includes depreciation of the vehicle’s value, lease payments (if applicable), and interest on any auto loans.

4. Miscellaneous Expenses: This category captures additional expenses necessary for rideshare operations, such as cleaning supplies, phone data usage, and parking fees.

5. Time Period Specification: A defined timeframe for analysis, whether weekly, monthly, quarterly, or annually, provides the necessary context for interpreting financial data and identifying trends.

6. Profit Calculation: The core function of the template lies in calculating both gross and net profit. Gross profit represents revenue minus direct operational costs. Net profit further deducts all other expenses, revealing the true profitability of the rideshare operation.

7. Profit Margin: Calculating profit margin, typically expressed as a percentage, provides a standardized measure of profitability, allowing for performance comparison over different periods.

A well-structured template facilitates accurate data entry, automates calculations, and presents information in a clear, concise manner. This allows for informed financial decisions related to operational efficiency, cost optimization, and overall business strategy. Regular review and analysis of these components empowers drivers to maximize earnings and achieve financial sustainability.

How to Create an Uber Profit and Loss Statement Template

Creating a tailored profit and loss statement empowers rideshare drivers to gain a comprehensive understanding of their financial performance. The following steps outline the process of developing a practical and effective template.

1: Choose a Format: Select a format suitable for individual needs and technical proficiency. Options include spreadsheet software (e.g., Google Sheets, Microsoft Excel), dedicated accounting software, or readily available online templates. Spreadsheet software offers flexibility and customization, while online templates often provide pre-built formulas and categories.

2: Define the Time Period: Specify the timeframe for analysis (weekly, monthly, quarterly, annually). This timeframe determines the scope of data included in the statement and influences the frequency of updates. Consistent time periods facilitate accurate trend analysis.

3: Establish Revenue Categories: Create distinct categories for all income streams. Typical categories include fares, surge pricing bonuses, tips, and any other incentives received from the platform. Clear categorization enables accurate revenue tracking and analysis.

4: Categorize Expenses: Establish comprehensive expense categories relevant to rideshare operations. Common categories include fuel, vehicle maintenance, insurance, platform commissions, licensing fees, vehicle depreciation, and miscellaneous expenses (e.g., cleaning supplies, tolls).

5: Implement Formulas for Calculations: Utilize formulas within the chosen software to automate calculations. Key calculations include total revenue, total expenses, gross profit (revenue minus direct costs), net profit (gross profit minus all other expenses), and profit margin (net profit divided by revenue, expressed as a percentage).

6: Data Input and Tracking: Regularly input income and expense data into the designated categories. Maintain consistent record-keeping practices to ensure data accuracy and reliability. Leverage features like automated data import or mobile apps to streamline the process.

7: Review and Analysis: Regularly review the completed statement to identify trends, areas for potential cost savings, and opportunities for income maximization. Analyze profit margins, expense ratios, and revenue fluctuations to inform strategic business decisions.

8: Adapt and Refine: Periodically review and adjust the template as needed. Refine categories, add new expense types, or modify reporting periods based on evolving business needs and analytical requirements. This ensures the template remains a relevant and effective tool for financial management.

A well-structured profit and loss statement, tailored to the specific requirements of rideshare operations, provides essential insights into financial performance. Regular tracking, accurate categorization, and consistent analysis empower drivers to optimize profitability and achieve long-term financial success. Utilizing available resources and adapting the template to individual needs ensures its ongoing effectiveness as a financial management tool.

An Uber profit and loss statement template provides a crucial framework for financial analysis within the rideshare context. Through meticulous tracking of revenue streams, encompassing fares, bonuses, and incentives, alongside comprehensive categorization of operating expenses, including fuel, maintenance, and platform commissions, drivers gain a clear understanding of their profitability. Precise calculation of both gross and net profit, coupled with analysis of profit margins over specific time periods, allows for informed decision-making regarding operational efficiency and cost optimization. Accessibility of the template, through user-friendly design and compatibility across various platforms, ensures consistent usage and data accuracy, further enhancing its value as a financial management tool.

Effective utilization of such a template empowers rideshare drivers to move beyond simple income tracking and engage in proactive financial management. By leveraging the insights derived from detailed profit and loss analysis, drivers can optimize their earning potential, identify areas for cost reduction, and ultimately build a more sustainable and profitable rideshare business. This data-driven approach to financial management is essential for navigating the dynamic landscape of the rideshare industry and achieving long-term financial success. Regular review and adaptation of the template ensures its continued relevance and efficacy as a cornerstone of sound financial practice.