Embarking on the journey to homeownership is an exciting time, but it often comes with a significant amount of paperwork. One of the most crucial documents you’ll encounter is the loan application. It’s the cornerstone of your mortgage request, providing lenders with a comprehensive snapshot of your financial health and ability to repay a loan.

While the prospect of filling out forms might seem daunting, understanding the purpose and structure of this vital document can make the process much smoother. This is where the uniform residential loan application form template comes into play, offering a standardized approach that benefits both borrowers and financial institutions alike, simplifying what could otherwise be a complex maze of information gathering.

Understanding the Uniform Residential Loan Application Form

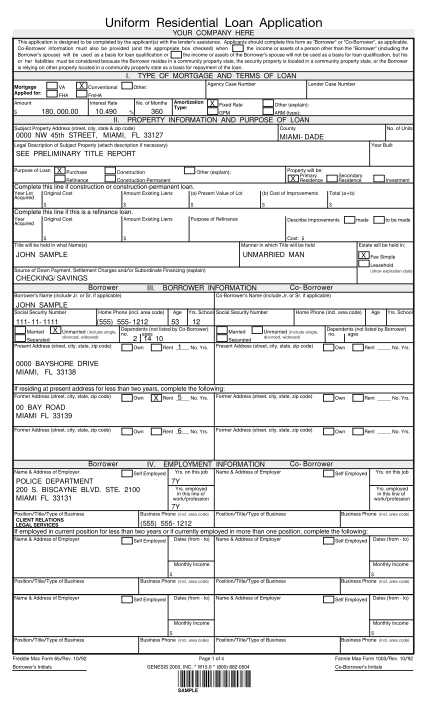

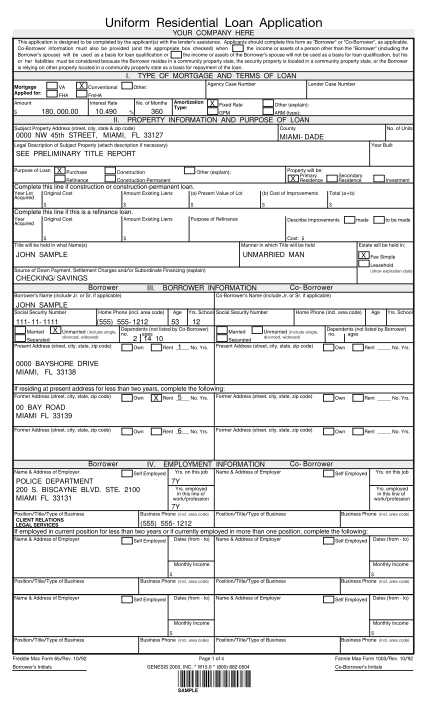

The uniform residential loan application form, often referred to by its Fannie Mae Form 1003 or Freddie Mac Form 65 equivalent, is the industry standard for mortgage applications in the United States. Its primary purpose is to collect all necessary financial and personal information from a borrower in a consistent format, allowing lenders to efficiently assess creditworthiness, calculate risk, and determine eligibility for a mortgage. This standardization helps streamline the underwriting process, making it easier for lenders to compare applications and for borrowers to understand what information is required regardless of the financial institution they choose.

Completing this form accurately and completely is paramount. Any discrepancies or omissions can lead to delays in your loan approval or even a denial. It requires you to be meticulous, providing precise details about your income, assets, liabilities, and employment history. Think of it as painting a detailed financial portrait of yourself for the lender, showcasing your ability to responsibly manage a significant financial commitment like a home loan.

Key Sections You’ll Encounter

The uniform residential loan application form is divided into several sections, each designed to gather specific information about the borrower and the property they wish to finance. While the exact numbering and layout might vary slightly between versions, the core content remains consistent. You will typically start with personal details, moving into more intricate financial data. Understanding these sections beforehand can help you gather the necessary documentation.

You’ll find sections dedicated to your employment history and income, requiring details of your current and past employers, your gross monthly income, and any other sources of income you wish to be considered. Following this, the form delves into your assets and liabilities. This part necessitates a clear accounting of your bank accounts, investments, retirement funds, and any other significant assets, balanced against all your debts, including credit cards, auto loans, student loans, and other mortgage obligations. Furthermore, there are sections to declare any real estate you currently own, details about the proposed property, and various declarations about your financial history and intentions. These declarations are crucial, as they cover aspects like bankruptcies, foreclosures, or outstanding judgments, which directly impact your eligibility. Being prepared with all this information will undoubtedly make the process much smoother.

Tips for Navigating Your Loan Application

Approaching the loan application process with preparation and a clear understanding of what’s needed can significantly reduce stress and expedite your journey to homeownership. Before you even sit down with the uniform residential loan application form template, it’s wise to gather all your relevant financial documents. This includes pay stubs, W-2 forms, tax returns for the past two years, bank statements, investment account statements, and details of any outstanding debts. Having these readily accessible will allow you to fill out the form accurately and efficiently, minimizing the need to pause and search for information.

Honesty and transparency are non-negotiable when completing your application. Lenders will verify all the information you provide, and any misrepresentations, whether intentional or not, can lead to serious consequences, including loan denial or even legal repercussions. If you are unsure about how to answer a specific question or where to include certain financial details, it’s always best to ask your loan officer or a financial advisor for clarification rather than making an educated guess. They are there to guide you through the complexities of the process and ensure your application accurately reflects your financial situation.

Remember that the uniform residential loan application form is designed to provide a comprehensive picture, so every detail, no matter how small it may seem, contributes to the overall assessment of your eligibility. Take your time, review your answers carefully, and double-check for any errors before submission. A well-prepared and accurate application demonstrates your readiness for homeownership and helps the lender process your request more smoothly. Don’t hesitate to use the opportunity to ask questions if any section seems unclear.

Finally, understanding that this standardized form benefits both parties can help alleviate any apprehension. It ensures that all applicants are evaluated on the same criteria, promoting fairness and consistency across the lending industry. By familiarizing yourself with its structure and requirements, you’re not just filling out a document; you’re actively participating in a well-established process designed to help you achieve your homeownership dreams. Being thorough now will save you time and potential headaches down the line, setting you on a solid path.

Navigating the path to securing a home loan might seem complex, but with a clear understanding of the uniform residential loan application form template, you’re well-equipped for success. This essential document serves as the foundation for your mortgage journey, providing a structured framework that benefits both you and your potential lender. By taking the time to prepare thoroughly and accurately complete each section, you streamline the entire process, bringing your homeownership dreams closer to reality.

Ultimately, your diligence in preparing and submitting a complete and precise application reflects your readiness for the responsibilities of a mortgage. It’s a significant step toward achieving one of life’s major milestones, and with the right approach to this key document, you can feel confident and prepared for what lies ahead in the exciting world of real estate.