Navigating the complexities of tax rebates can often feel like solving a puzzle with missing pieces. For many professionals who are required to wear specific uniforms for their jobs, the possibility of reclaiming some of the costs is a welcome relief. However, the process of documenting these expenses and applying for the rebate can be daunting, leading many to simply forgo what they are rightfully owed. This is where a structured approach, aided by a reliable tool, can make all the difference.

Imagine having a clear, organized document that guides you through every step, ensuring you don’t miss any crucial information. Such a tool not only simplifies the task but also instills confidence that your claim is accurate and complete. Whether you’re a nurse, a police officer, a construction worker, or any other professional with a required uniform, understanding how to effectively manage your uniform expenses for tax purposes is a valuable skill.

Why a Uniform Tax Rebate Form Template is a Game-Changer

Using a dedicated template for your uniform tax rebate can dramatically streamline a process that might otherwise be confusing and time-consuming. It provides a standardized framework, ensuring consistency in how you record your expenses and present your claim to the tax authorities. This level of organization minimizes the chances of errors or omissions, which could delay or even invalidate your rebate application. Think of it as your personal assistant, making sure all your ducks are in a row before you hit send.

Many professions incur significant costs related to uniforms. Nurses often need specific scrubs and footwear, police officers have extensive uniform requirements including protective gear, and tradespeople like plumbers or electricians might need branded workwear and safety equipment. These aren’t just minor expenses; they can add up over a tax year. A well-designed uniform tax rebate form template helps you track these expenditures precisely, allowing you to clearly demonstrate your entitlement to a rebate.

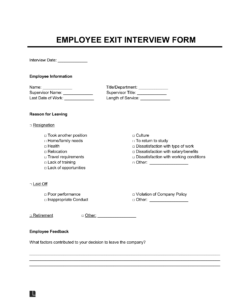

The template typically prompts you for all the necessary details an assessor would require. This includes information about your employer, the type of uniform purchased or maintained, the dates of purchase, the precise costs involved, and sometimes even the justification for why the uniform is essential to your role. By filling out these sections methodically, you build a robust case for your claim, leaving little room for ambiguity.

Ultimately, adopting a uniform tax rebate form template isn’t just about convenience; it’s about efficiency and accuracy. It empowers you to take control of your financial claims, ensuring you recover every penny you’re entitled to without the usual stress and guesswork. It transforms a potentially complex task into a manageable series of steps.

Key Elements to Include in Your Template

- Personal Information: Your full name, address, tax identification number, and contact details.

- Employer Details: The name and address of your employer, and your job title.

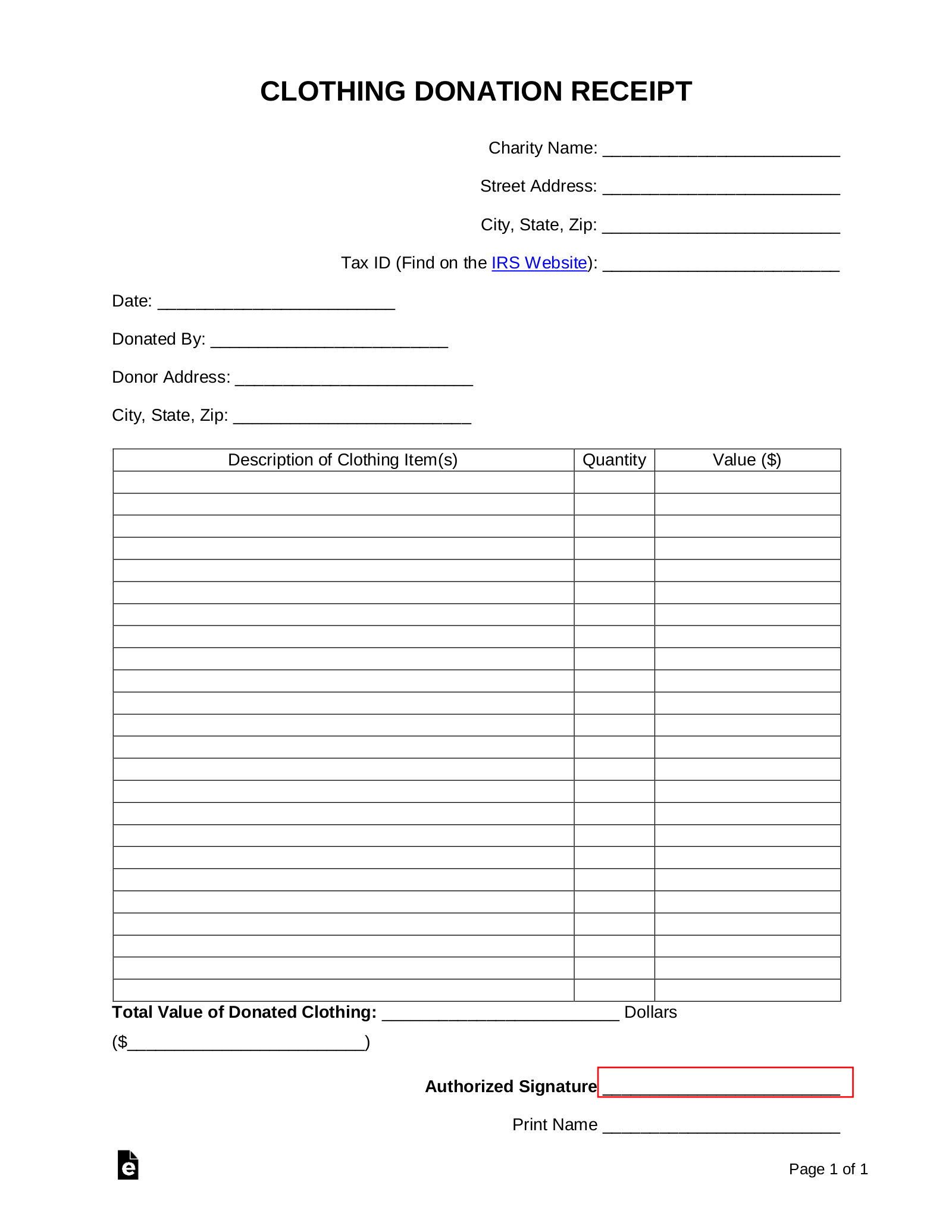

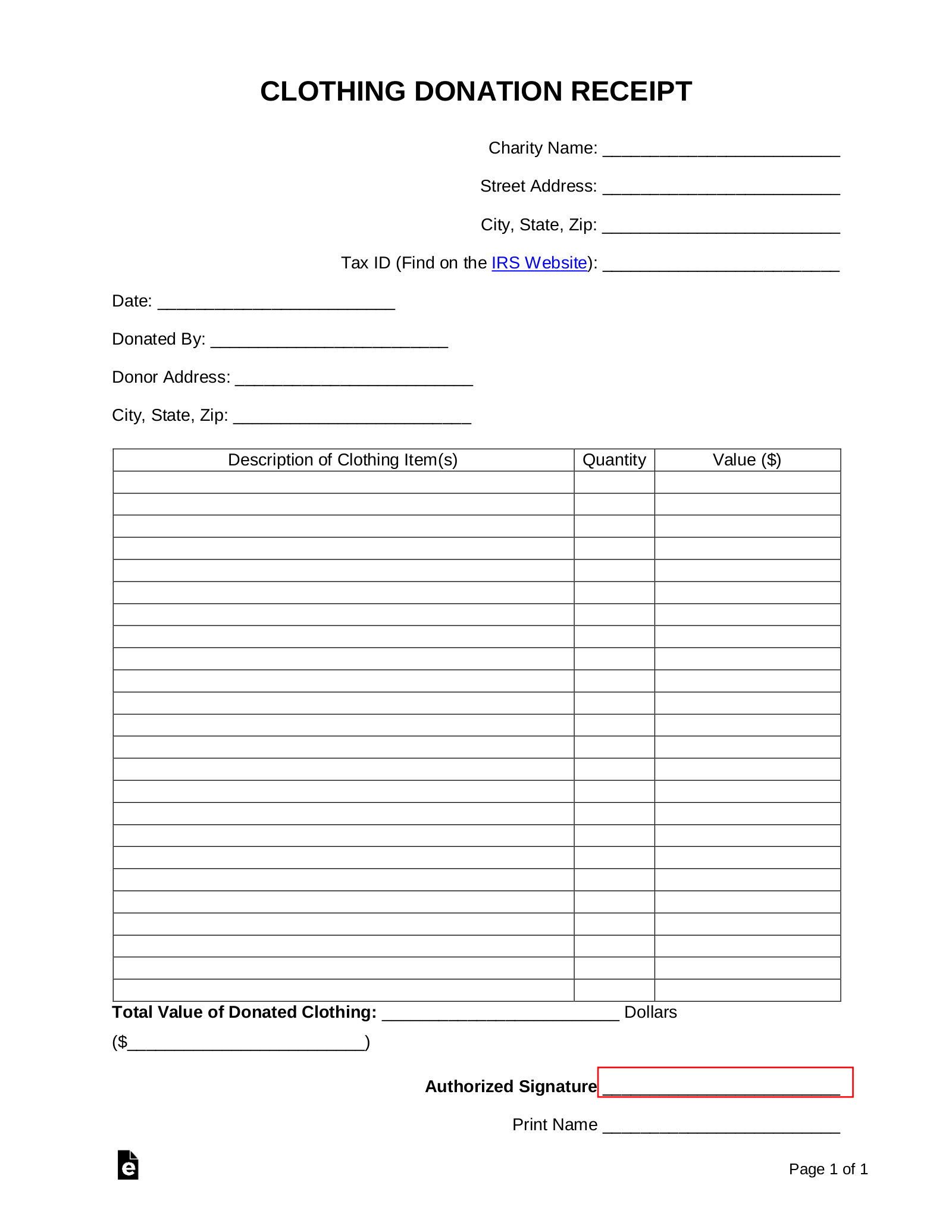

- Uniform Description and Cost: A detailed breakdown of each uniform item, its cost, and the date of purchase.

- Dates of Purchase/Wear: Specific periods for which the expenses are being claimed.

- Declaration/Signature: A section for you to sign, affirming the accuracy of the information provided.

How to Effectively Use and Customize Your Template

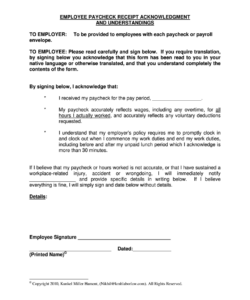

Once you have a suitable uniform tax rebate form template, the next step is to use it effectively. The beauty of a template lies in its adaptability. While it provides a solid foundation, you can, and should, customize it to perfectly fit your specific circumstances and the requirements of your local tax authority. Start by gathering all your relevant financial documents, such as receipts for uniform purchases, laundry services, or dry cleaning bills, as these will be your primary evidence.

When filling out the template, meticulous attention to detail is paramount. Don’t rush through the sections. Double-check all figures, dates, and descriptions. For instance, if you’re claiming for the cost of professional uniform cleaning, ensure you have a clear record of these expenses and that they align with the periods you’re claiming for. Accuracy not only speeds up the processing of your claim but also prevents potential queries from the tax office.

It is also incredibly important to maintain a comprehensive record-keeping system alongside your template. The template itself serves as a summary document, but the supporting evidence, like original receipts or bank statements, is crucial. These documents should be organized in a way that allows you to easily retrieve them if requested. A good practice is to create a digital folder for each tax year, containing scanned copies of all relevant uniform expense documents, cross-referenced with your filled-out template.

Finally, consider the submission process. While a uniform tax rebate form template makes the internal preparation straightforward, you’ll still need to follow the official submission guidelines provided by your tax authority. This might involve submitting the form digitally, mailing a physical copy, or including it as part of a larger tax return. Always keep a copy of your completed template and all supporting documents for your own records, just in case you need to refer back to them in the future.

Successfully navigating the landscape of tax rebates, especially for uniform expenses, boils down to organization and attention to detail. By consistently using a structured template, you empower yourself to manage your claims with confidence and clarity. This proactive approach not only helps you reclaim what you are owed but also simplifies your financial life each tax season.

Embrace the power of good record-keeping and a well-utilized template. It’s a small investment in time that yields significant returns, transforming a potentially stressful annual task into a straightforward exercise in financial management. Ultimately, being organized ensures you maximize your entitlements and maintain peace of mind.