Dealing with unexpected property damage or loss can be incredibly stressful, and navigating the insurance claims process often adds to that burden. When you’re a USAA member, you trust them to be there for you, but even with their excellent service, preparing your claim thoroughly is key to a smooth resolution. It’s not just about reporting what happened; it’s about presenting a clear, detailed account of your loss, and that’s where having a structured approach, perhaps even a usaa personal property claim form template, can make a world of difference.

Many members wonder how to best document their personal property losses to ensure everything is accounted for. While USAA provides clear instructions and online tools, having your own organized framework for gathering information before you even begin the official claim can save you a lot of time and potential headaches. Think of it as your personal preparation sheet, designed to help you capture every necessary detail efficiently, making your communication with USAA as precise as possible.

Navigating the USAA Personal Property Claim Process with Confidence

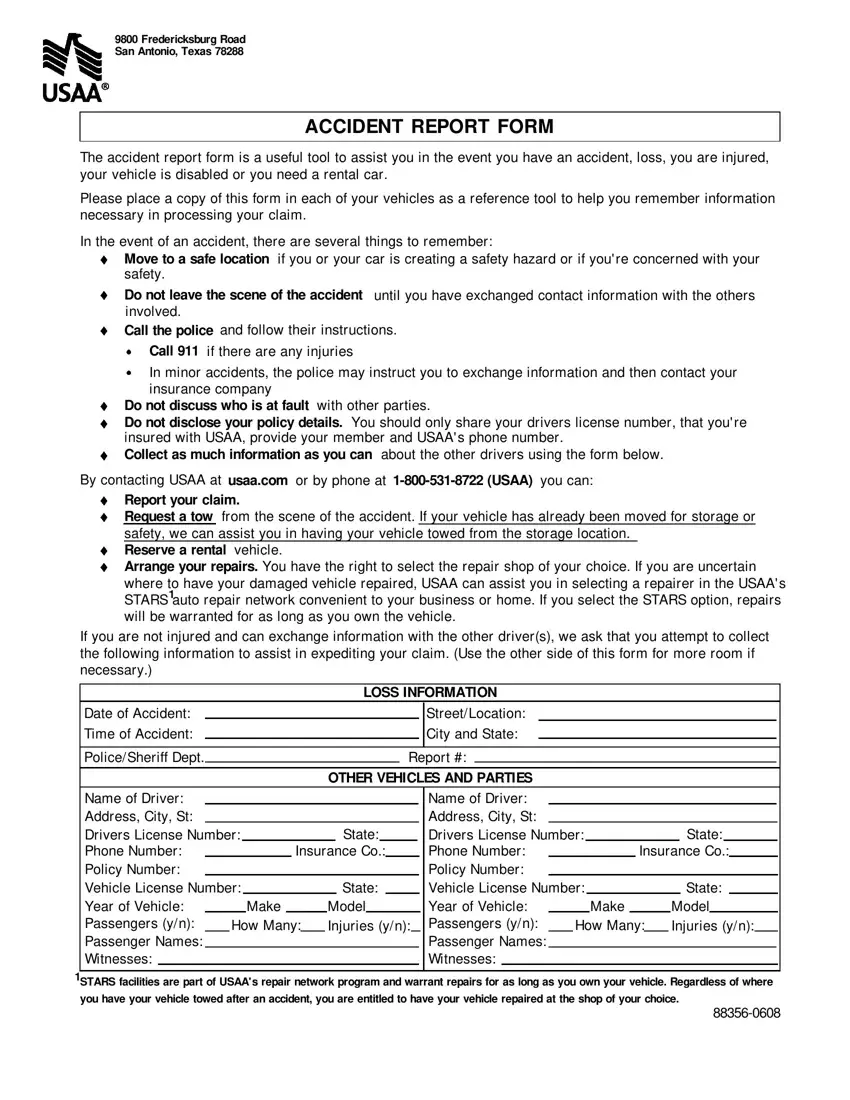

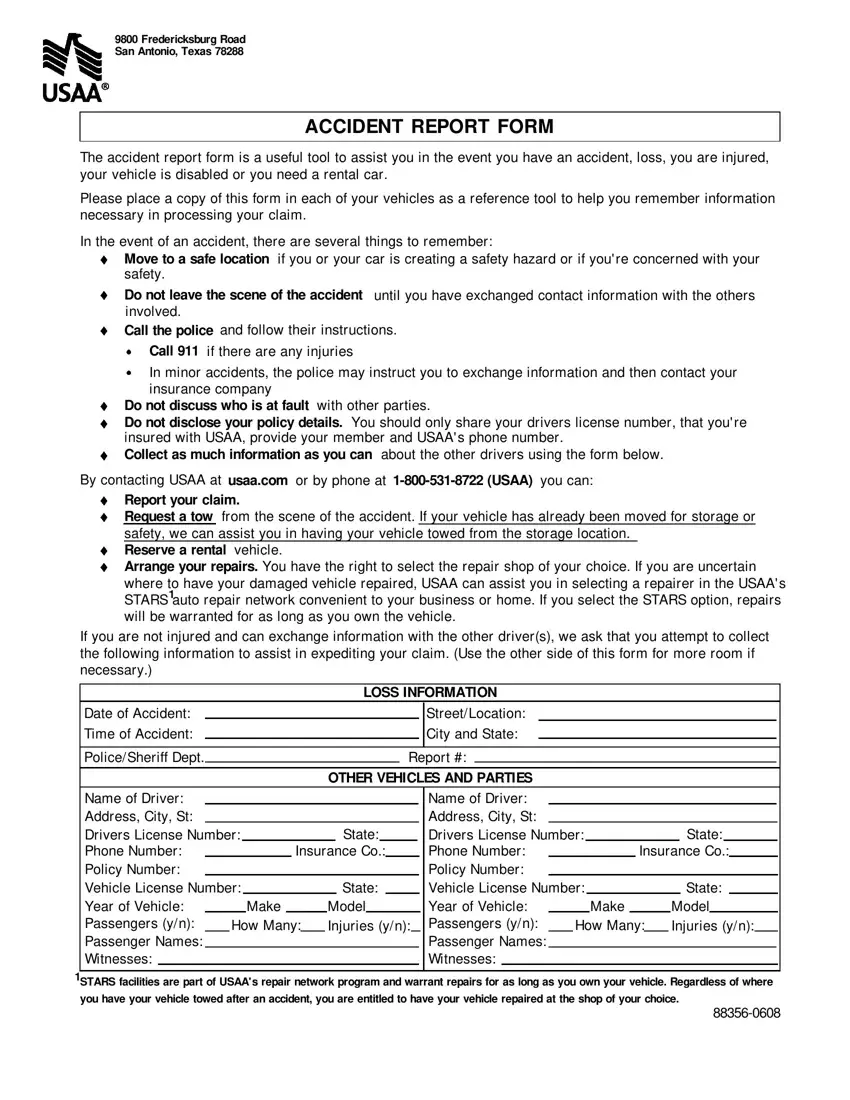

When an incident occurs that impacts your personal property, whether it’s a burst pipe, a fire, or even theft, your first instinct might be to call USAA immediately. While reporting the incident promptly is crucial, taking a few moments to organize your thoughts and gather preliminary information can significantly streamline the entire process. USAA representatives will guide you, but the more prepared you are with specifics, the faster they can assess your situation and move your claim forward. This preparation isn’t about filling out a specific USAA form template that doesn’t exist publicly in a standardized format, but rather about pre-populating the kind of information they will undoubtedly ask for.

Every claim, big or small, requires a certain level of documentation. This includes details about the incident itself, the specific items affected, and any steps you’ve taken to mitigate further damage. The goal is to provide a comprehensive picture of your loss, enabling USAA to understand the full scope and value of your damaged or lost belongings. Being thorough from the outset helps prevent delays and ensures you receive the appropriate compensation.

Key Information to Gather Before Starting Your Claim

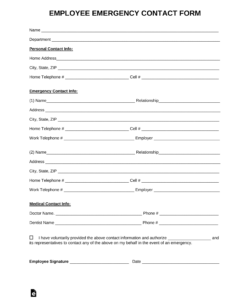

- Your USAA policy number and contact information.

- The exact date, time, and location of the incident.

- A detailed description of how the damage or loss occurred.

- A comprehensive list of each item of personal property that was damaged, lost, or stolen.

- For each item, include its approximate age, original purchase price, and a brief description.

- Photographs or videos of the damage, if applicable, taken before any cleanup or repairs.

- Any receipts or appraisals for high-value items to substantiate their worth.

- Contact information for any third parties involved (e.g., police report number for theft, fire department report).

- Details of any temporary repairs made to prevent further damage.

Having this information neatly organized, perhaps in a format that resembles a personal property inventory or a usaa personal property claim form template you’ve created yourself, ensures you don’t miss anything important when you communicate with USAA. It acts as your personal checklist, reducing the chance of forgetting crucial details that could impact your claim’s progress.

Providing USAA with these details upfront isn’t just about efficiency; it empowers their claims adjusters to make accurate assessments. It reduces back-and-forth inquiries and demonstrates your diligence in documenting the loss, which can foster a smoother and more confident claims experience for both parties involved.

Crafting Your Own Personal Property Loss Inventory Template

Since an official, publicly downloadable usaa personal property claim form template in a universal format isn’t something USAA typically provides for the initial claim submission (as they use their own internal systems and online portals), creating your own detailed inventory template before an incident occurs can be incredibly beneficial. This proactive step ensures you have a structured document ready to capture all the necessary information when you need it most. Imagine a spreadsheet or a simple document divided into sections that mirror the information USAA will request. It’s not about submitting this specific document to them, but using it as your personal data collection tool.

Such a template would help you systematically list every item, its description, value, and the nature of its damage or loss. This isn’t just for large, obvious items; remember to account for smaller electronics, clothing, kitchenware, and even personal keepsakes that hold significant value, either monetary or sentimental. A good template will prompt you to think about categories of items you might otherwise overlook in the stress of the moment.

Your template should include dedicated sections for incident details, policy information, and most importantly, an itemized list for all affected property. Each entry on this list should have columns for the item’s name, description, quantity, approximate age, estimated replacement cost, and a space for notes (e.g., serial numbers, links to purchase, photos). Consider adding a column to check if you have a receipt or photo for that item. This meticulous approach pays dividends when it comes time to submit your claim, as it demonstrates a clear and organized presentation of your loss.

By investing a little time now to develop your own comprehensive personal property inventory template, you’ll be well-prepared for any future unforeseen events. This self-made tool becomes an invaluable asset, ensuring that when you do need to file a claim with USAA, you have all your ducks in a row. It transforms a potentially chaotic situation into a manageable task, allowing you to focus on recovery rather than scrambling for information.

In conclusion, while the thought of a personal property claim can be daunting, being thoroughly prepared significantly eases the burden. Organizing your documentation and understanding the types of information USAA will need beforehand empowers you to navigate the process with greater confidence and efficiency. A structured approach, perhaps by creating your own detailed inventory system, ensures that every aspect of your loss is meticulously recorded.

Taking the initiative to document your belongings and incident details proactively means you’ll be in a stronger position when communicating with USAA. This level of preparation not only helps your claim proceed more smoothly but also provides you with peace of mind during what can undoubtedly be a challenging time. Your preparedness is your best asset in securing a fair and timely resolution.