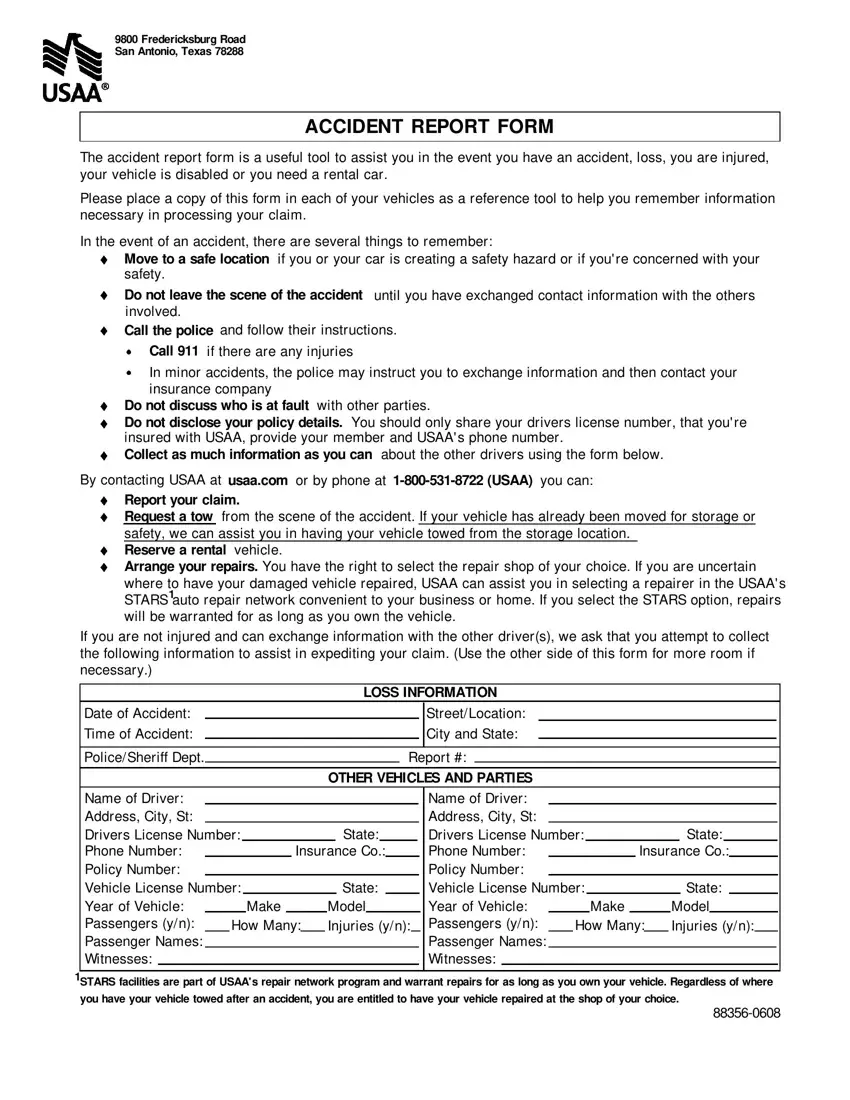

Dealing with personal property damage can be a stressful experience. Whether it’s the aftermath of a storm, an unfortunate accident, or another unexpected event, the immediate concern often turns to how to recover and replace what’s been lost or damaged. For USAA members, navigating the claims process efficiently is key to getting back on track. Understanding what information you’ll need and how to present it can significantly smooth out this often-daunting process.

While USAA provides specific channels for submitting claims, having a robust framework for organizing your information before you even touch their official forms can be incredibly beneficial. This isn’t just about speed; it’s about accuracy and ensuring you haven’t overlooked any crucial details that could impact your claim’s outcome. Think of it as your personal preparatory toolkit, designed to make the formal submission as straightforward as possible.

Understanding the Claim Process for Personal Property Damage with USAA

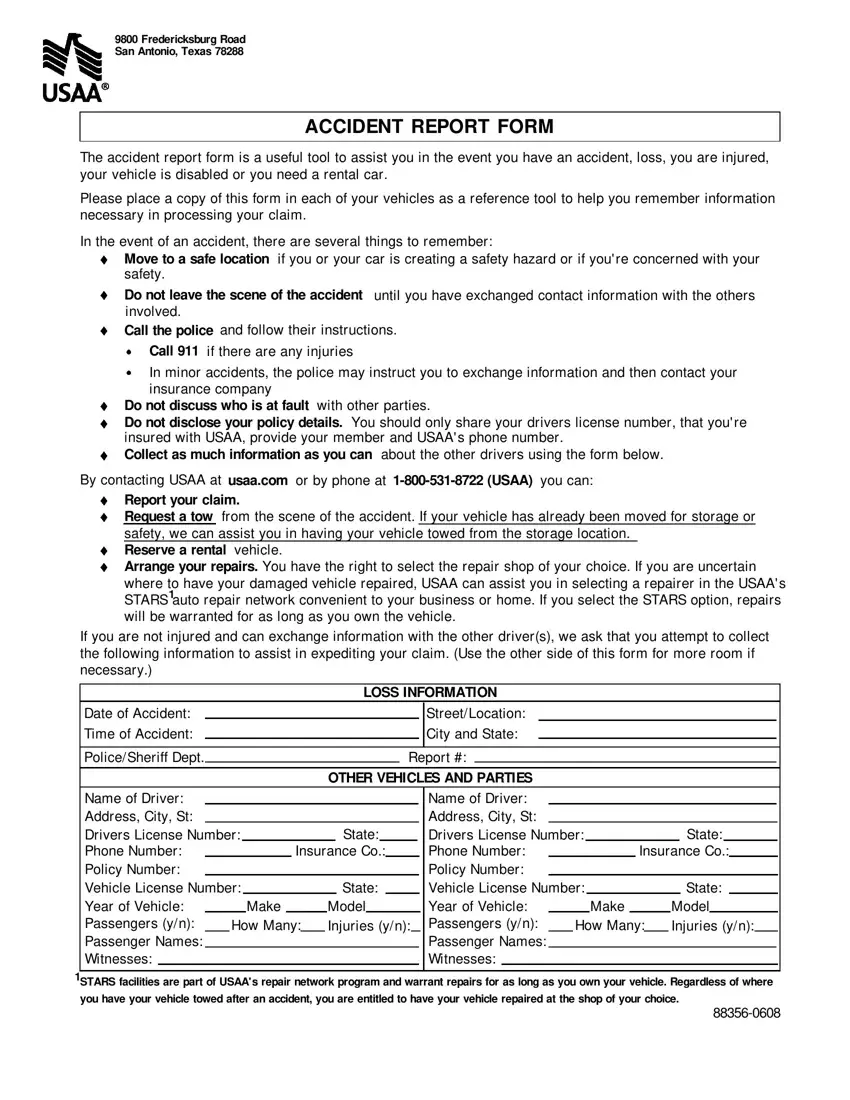

When personal property damage occurs, your first thought might be about how quickly you can get things repaired or replaced. However, before you dive into the specifics of a claim form, it’s essential to grasp the broader context of the USAA personal property damage claim process. This isn’t just about filling out a document; it’s about building a comprehensive case for your loss. Personal property damage typically refers to damage to your belongings, like furniture, electronics, clothing, and other items within your home, rather than the structure itself.

The initial steps are always crucial. As soon as it’s safe to do so, you should take immediate action to prevent further damage to your property. For instance, if a window is broken, cover it; if there’s a leak, try to contain the water. Documenting the scene before any clean-up or repairs begin is paramount. This means taking clear photos and videos from various angles, capturing the full extent of the damage to individual items and the overall affected area. These visual records serve as irrefutable evidence when you eventually communicate with USAA.

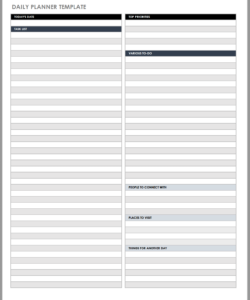

Beyond visual documentation, gathering detailed written information is equally important. This is where an organized approach truly shines. Being able to provide specific details about each damaged item will not only help your claim adjuster but also ensure you receive fair compensation for your loss. It saves a lot of back-and-forth later on if you have everything ready from the start.

Key Information to Gather Before Filing

- Date and approximate time the damage occurred.

- A precise description of the cause of the damage (e.g., burst pipe, fire, theft, storm).

- A comprehensive inventory of all damaged or lost items, including make, model, and serial numbers where applicable.

- Estimated purchase dates and original costs for each item.

- Photographs or video footage of the damage, clearly showing the items and the extent of their harm.

- Any relevant external reports, such as police reports for theft or vandalism, or fire department reports for fire damage.

- Receipts, appraisals, or credit card statements that can prove ownership and value of high-value items.

- Details of any temporary repairs made to prevent further damage.

Having this information meticulously organized before you even look for a usaa personal property damage claim form template will make your claim process significantly smoother. It transforms a potentially chaotic situation into a systematic one, allowing you to focus on recovery rather than scrambling for details.

Crafting Your Own USAA Personal Property Damage Claim Template

While USAA offers straightforward methods for filing a claim, often through their website or mobile app, creating your own preliminary template for information gathering can be incredibly empowering. This isn’t about replacing their official forms, but rather about pre-populating your mind and your files with all the necessary details, ensuring nothing is missed when you sit down to formally report your loss. Think of it as your personal data capture sheet, designed for maximum efficiency and completeness.

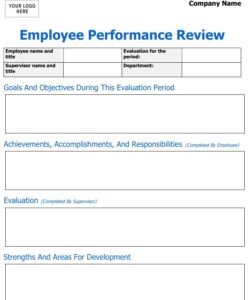

A well-structured personal property damage claim template should act as a comprehensive checklist, guiding you through every piece of information an adjuster might ask for. It should cover not just the damaged items but also the circumstances surrounding the incident and your contact details. This proactive approach helps you consolidate all pertinent facts in one accessible place, which is invaluable during a stressful time.

Here are the essential sections that a robust template for your personal property damage claim information should include:

- Claimant Information: Your full name, USAA policy number, contact phone number, email address, and current mailing address.

- Incident Details: Date, time, and exact location of the incident. A clear and concise description of how the damage occurred, including any contributing factors or eyewitness accounts.

- Damaged Property Inventory: This is arguably the most critical section. For each item, list its description (e.g., “Samsung 55-inch Smart TV”), estimated purchase date, original purchase price, current condition (e.g., “cracked screen,” “water damaged”), and estimated replacement cost. Provide space to note if you have photos or receipts for the item.

- Supporting Documents Checklist: A list of all documents you have or plan to obtain, such as photos, videos, purchase receipts, appraisals, police reports, or repair estimates. This ensures you remember to attach or reference them later.

- Declaration and Signature Line: A simple statement affirming the accuracy of the information provided, with space for your signature and the date. While this won’t be legally binding until you sign USAA’s official documents, it reinforces the thoroughness of your preparation.

Using such a template provides numerous benefits. It reduces the likelihood of forgetting crucial details, which can lead to delays in your claim. It also helps you present a clear, organized narrative to USAA, demonstrating your diligence and making the adjuster’s job easier. Ultimately, a well-prepared claim often leads to a quicker and smoother resolution, allowing you to focus on rebuilding and recovery rather than administrative headaches.

Preparing thoroughly for a personal property damage claim is one of the best ways to ensure a streamlined experience with USAA. By meticulously documenting your losses and organizing all relevant information beforehand, you’re not just filling out a form; you’re building a solid foundation for a successful claim. This proactive approach alleviates much of the stress associated with property damage and empowers you to navigate the process with confidence.

Remember, your goal is to provide USAA with a clear and comprehensive picture of what happened and what was lost. With your information well-ordered and readily available, you put yourself in the best position to receive the support you need, allowing you to focus on restoring your peace of mind and your belongings.