Utilizing a pre-established structure for these declarations streamlines the import process, reducing delays and potential complications at the border. This efficiency benefits both exporters and importers by minimizing administrative burdens and ensuring compliance with international trade regulations. Standardized documentation promotes transparency and helps prevent costly rejections of shipments due to inadequate or inaccurate information.

The following sections will explore the specific requirements and procedures associated with preparing and submitting these crucial agricultural export documents, including details on relevant regulations and best practices for seamless international trade.

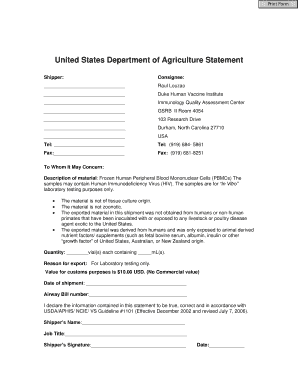

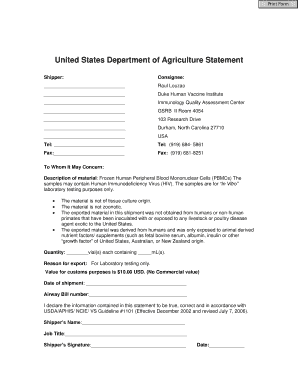

1. Standardized Format

Standardized formats are fundamental to the efficacy of USDA statements for customs templates. A consistent structure ensures customs officials worldwide can readily locate and interpret critical information regarding agricultural imports. This interoperability reduces the likelihood of misunderstandings or delays due to varying document structures. Uniformity facilitates automated data processing, streamlining customs procedures and enabling efficient risk assessment. For example, a standardized declaration of the product’s scientific name prevents ambiguity arising from varying common names used in different regions. Similarly, a consistent format for declaring quantities and weights eliminates potential confusion caused by differing units of measurement.

Consistent presentation of information, such as origin, sanitary certifications, and treatment details, enables rapid verification of compliance with import regulations. This predictability allows customs agencies to allocate resources effectively and focus on potential risks rather than deciphering inconsistently formatted documents. The use of standardized templates also reduces the burden on exporters, providing clear guidelines for information disclosure and minimizing the risk of errors or omissions. This, in turn, contributes to a more predictable and reliable trading environment.

Standardized formats represent a crucial element in facilitating efficient and secure global agricultural trade. They offer significant benefits for both exporters and customs authorities, promoting compliance, transparency, and the seamless flow of goods across international borders. Challenges remain in achieving universal adoption and adapting to evolving regulatory landscapes. However, the inherent advantages of standardized formats underscore their critical role in optimizing international trade processes.

2. Product Identification

Accurate product identification is paramount within a USDA statement for customs templates, ensuring regulatory compliance and facilitating efficient trade. Incorrect or ambiguous identification can lead to delays, penalties, or even rejection of shipments. Clear, standardized product descriptions are essential for customs officials to verify adherence to import regulations, assess potential risks, and apply appropriate tariffs.

- Harmonized System (HS) CodesThe HS code is a globally standardized system of names and numbers for classifying traded products. Proper HS code assignment is crucial for determining tariffs, quotas, and other trade restrictions. For example, fresh apples might fall under a different HS code than dried apples, impacting applicable tariffs. Accurate HS codes are vital for a compliant USDA statement.

- Product DescriptionBeyond the HS code, a detailed product description provides further clarity. This might include variety, processing method, and intended use. For example, specifying “organic Granny Smith apples for fresh consumption” provides more information than “apples.” This detailed description assists customs officials in verifying compliance with specific import requirements for organic produce or products intended for direct consumption.

- Scientific Name (where applicable)For certain agricultural products, particularly plants and plant products, the scientific name provides unambiguous identification. This prevents confusion arising from regional variations in common names. For example, including the scientific name Malus domestica alongside “apple” ensures accurate identification regardless of linguistic variations.

- Packaging and Labeling InformationDetails about product packaging and labeling, including weight, quantity, and any special handling instructions, are also crucial. This information helps verify declared quantities and ensures proper handling during transit and storage. Consistent reporting of these details contributes to the overall accuracy and integrity of the customs declaration.

Precise product identification, incorporating HS codes, detailed descriptions, scientific names, and packaging details, forms the cornerstone of a compliant and efficient customs process. These elements ensure clarity and transparency, facilitating the smooth passage of agricultural goods across international borders and minimizing the risk of delays or rejection due to inadequate or inaccurate product information. The information contained within the USDA statement serves to verify compliance with destination country import regulations, enhancing the overall efficiency and reliability of international trade.

3. Origin Certification

Origin certification forms a critical component of the USDA statement for customs templates, directly impacting the admissibility and tariff treatment of agricultural imports. It establishes the product’s country of origin, enabling customs authorities to verify compliance with trade agreements, apply preferential tariffs, enforce quotas, and implement sanitary and phytosanitary (SPS) measures specific to certain regions. A clear and verifiable origin declaration is essential for accurate assessment and lawful entry of agricultural goods.

The origin certification within the USDA statement must adhere to specific rules of origin as defined in relevant trade agreements. These rules determine the criteria for conferring origin status, considering factors such as substantial transformation, value-added content, and processing operations. For instance, a product made with imported ingredients may still qualify for origin status in the processing country if it undergoes sufficient transformation, changing its HS code or meeting specific value-added thresholds. Failure to provide valid origin certification can result in delays, increased tariffs, or even rejection of the shipment. A shipment of processed fruit from Country A, even if utilizing imported raw materials from Country B, might qualify for origin status in Country A if the processing significantly alters the product’s classification. This accurate origin declaration ensures proper tariff application and compliance with trade regulations.

The practical significance of origin certification extends beyond tariff implications. It plays a crucial role in trade statistics, market access, and consumer preferences. Accurate data on product origins supports informed trade policy decisions and market analysis. Origin certification also allows consumers to make purchasing choices based on product origin, supporting fair trade practices and local economies. Furthermore, it strengthens traceability, enabling efficient product recalls and responses to biosecurity threats, safeguarding public health and agricultural integrity. The robust origin declaration facilitates accurate product tracking, contributing to consumer confidence and enhanced food safety protocols.

4. Sanitary Compliance

Sanitary compliance constitutes a critical aspect of the USDA statement for customs templates, ensuring imported agricultural products meet the destination country’s health and safety standards. This protects public health, safeguards domestic agriculture from pests and diseases, and maintains consumer confidence in food safety. The USDA statement serves as a verifiable record of compliance with these crucial sanitary regulations.

- Pest and Disease FreedomDeclarations regarding pest and disease freedom are essential for preventing the introduction of harmful organisms. The USDA statement may require certification that the product is free from specific pests or diseases, or that it has undergone approved treatments to mitigate risks. For example, a shipment of citrus fruit might require certification demonstrating freedom from citrus greening disease, safeguarding the importing country’s citrus industry.

- Veterinary Inspections (for Animal Products)Animal products require veterinary inspections to verify compliance with animal health regulations. The USDA statement might include details of veterinary certifications, confirming the animals’ health status and freedom from specific diseases. A shipment of beef, for instance, might require certification of origin from a bovine spongiform encephalopathy (BSE)-free region, protecting consumer health in the importing country.

- Maximum Residue Limits (MRLs)MRLs specify the permissible levels of pesticide residues in food products. The USDA statement may require declarations confirming adherence to MRLs established by the importing country. This ensures consumer safety by limiting exposure to potentially harmful chemical residues. A shipment of grapes might require testing and certification that pesticide residues are within acceptable limits, ensuring food safety.

- Processing and Handling StandardsCompliance with processing and handling standards ensures product safety and quality. The USDA statement may require details of processing methods, storage conditions, and packaging materials used. This guarantees adherence to hygiene standards and prevents contamination. A shipment of processed vegetables, for example, may require certification that the processing facility adheres to Good Manufacturing Practices (GMP), ensuring product integrity and safety.

These sanitary compliance aspects, documented within the USDA statement, are essential for facilitating safe and lawful trade in agricultural products. They provide assurance to importing countries that products meet their health and safety requirements, protecting consumers and preserving agricultural integrity. The USDA statement serves as a critical link between exporting and importing nations, establishing a transparent and accountable system for verifying sanitary compliance and promoting confidence in international agricultural trade. Thorough and accurate documentation promotes efficient customs clearance while minimizing potential biosecurity risks.

5. Import Regulations

Import regulations are the legal and administrative rules governing the entry of goods into a country. These regulations, specific to each country and often varying by product type, are crucial for maintaining border security, protecting domestic industries, and safeguarding public health. The USDA statement for customs templates plays a vital role in demonstrating compliance with these regulations, facilitating smooth and lawful importation of agricultural products.

- Tariffs and QuotasTariffs are taxes imposed on imported goods, while quotas restrict the quantity of specific goods that can be imported. Import regulations stipulate the applicable tariffs and quotas for different products. The USDA statement, by accurately identifying the product and its origin, enables customs officials to determine the correct tariff and verify compliance with quota restrictions. For example, a shipment of wheat might be subject to a specific tariff rate and quota, both of which are checked against information provided in the USDA statement.

- Sanitary and Phytosanitary (SPS) MeasuresSPS measures aim to protect human, animal, and plant health from risks associated with imported agricultural products. These measures might include requirements for pest and disease freedom, veterinary inspections, and maximum residue limits for pesticides. The USDA statement provides evidence of compliance with SPS measures, such as certifications of pest-free status or veterinary inspection reports. A shipment of mangoes, for instance, might require certification of treatment against fruit flies to comply with SPS measures.

- Labeling and Packaging RequirementsImport regulations often stipulate specific labeling and packaging requirements for certain products. These requirements might include language specifications, nutritional information, and country of origin labeling. The USDA statement, by detailing the product and its packaging, aids customs officials in verifying compliance with these regulations. For example, a shipment of packaged food might require labels in the importing country’s official language, as stipulated in import regulations.

- Licensing and PermittingCertain agricultural products may require import licenses or permits. Import regulations outline the procedures for obtaining these authorizations. The USDA statement may include information related to licenses or permits, facilitating verification of compliance. A shipment of live animals, for instance, might require an import permit, the details of which are cross-referenced with information provided in the USDA statement.

Adherence to import regulations is essential for successful importation of agricultural goods. The USDA statement for customs templates serves as a crucial tool for demonstrating this adherence, providing customs officials with the necessary information to verify compliance efficiently and effectively. By aligning with these regulations, the USDA statement contributes to a transparent, predictable, and secure international trade environment, fostering trust between trading partners and promoting the smooth flow of agricultural goods across borders.

6. Digital Templates

Digital templates represent a significant advancement in streamlining the preparation and submission of USDA statements for customs. These templates offer a structured, pre-formatted framework for entering required information, reducing the risk of errors and omissions associated with manual document creation. This standardization ensures consistency and facilitates automated data processing by customs authorities, leading to more efficient clearance procedures. Digital templates often incorporate built-in validation checks, ensuring data accuracy and completeness before submission, further minimizing potential delays due to incorrect or incomplete information.

The shift towards digital templates aligns with the broader trend of digitization in international trade. Electronic submission of customs declarations, enabled by these templates, reduces reliance on paper documents, minimizing processing time and administrative overhead. For example, a digital template can automatically populate fields with product information based on the entered HS code, eliminating manual data entry and minimizing the risk of errors. Furthermore, digital signatures and secure transmission protocols enhance the security and integrity of these declarations, reducing the risk of fraud and counterfeiting. This digitization enhances transparency and traceability, enabling efficient monitoring and audit trails for regulatory compliance. A digital USDA statement, linked to a specific shipment’s electronic tracking data, provides a comprehensive and accessible record for customs authorities, simplifying verification and reducing the need for physical document handling.

Adoption of digital templates signifies a crucial step towards modernizing agricultural trade processes. While challenges remain in achieving universal adoption and ensuring interoperability across different systems, the benefits of enhanced efficiency, accuracy, and security are undeniable. Digital templates empower both exporters and customs authorities to navigate complex regulatory landscapes more effectively, contributing to a more seamless and reliable international trade environment. The transition towards digital templates offers significant long-term advantages in facilitating global trade, promoting data harmonization, and streamlining customs processes worldwide, although continued adaptation to evolving technological and regulatory standards will remain essential.

Key Components of a USDA Statement for Customs

A compliant USDA statement for customs requires specific information presented in a standardized format. These key components ensure accurate product identification, verification of origin, and demonstration of adherence to relevant regulations. Omitting or misrepresenting information can lead to delays, penalties, or rejection of shipments.

1. Product Description: A precise product description, including the Harmonized System (HS) code, is essential. This code facilitates accurate tariff classification and determines applicable trade restrictions. Supplemental details, such as variety, processing method, and intended use, provide further clarity and aid in regulatory compliance.

2. Origin Certification: This declaration verifies the product’s country of origin, enabling the application of preferential tariffs, enforcement of quotas, and implementation of specific sanitary and phytosanitary measures. Accurate origin certification is crucial for compliance with trade agreements and accurate trade statistics.

3. Sanitary and Phytosanitary (SPS) Compliance: Declarations of pest and disease freedom, veterinary inspection results (for animal products), and adherence to maximum residue limits (MRLs) for pesticides are crucial for protecting public and agricultural health. These declarations demonstrate adherence to the importing country’s health and safety standards.

4. Packaging and Labeling Information: Details about product packaging, including weight, quantity, and labeling information, ensure accurate declaration of goods and facilitate proper handling during transit and storage. This information also aids in verifying compliance with labeling regulations in the destination country.

5. Supporting Documentation: Additional documentation, such as phytosanitary certificates, certificates of origin, and veterinary health certificates, may be required depending on the product and destination country. These documents provide further verification of compliance with specific import regulations.

6. Digital Submission (Where Applicable): Electronic submission, facilitated by digital templates, offers increased efficiency and accuracy. These templates often incorporate data validation checks, reducing errors and streamlining customs procedures. Digital signatures enhance security and support the growing trend of digitization in international trade.

Accurate and comprehensive information within the USDA statement facilitates efficient customs clearance, promotes compliance with international trade regulations, and contributes to a secure and predictable global trading environment. This documentation safeguards public and agricultural health while minimizing potential disruptions to the flow of agricultural goods across borders.

How to Create a USDA Statement for Customs

Creating a compliant USDA statement for customs requires careful attention to detail and adherence to specific guidelines. Accurate and complete information is crucial for efficient customs clearance and avoidance of potential delays or penalties.

1: Obtain Necessary Templates and Guidelines: Begin by acquiring the appropriate USDA export document templates and relevant guidelines from official sources such as the USDA website or other authorized platforms. Ensure the templates align with the specific product and destination country requirements.

2: Accurately Identify the Product: Provide a precise product description, including the correct Harmonized System (HS) code. Include details like variety, processing method, and intended use to avoid ambiguity. Consulting the HS code database ensures proper classification.

3: Certify the Product’s Origin: Complete the required origin certification section, adhering to the rules of origin stipulated in relevant trade agreements. This declaration establishes the product’s country of origin, impacting tariff treatment and trade compliance.

4: Demonstrate Sanitary and Phytosanitary Compliance: Provide documentation demonstrating adherence to sanitary and phytosanitary (SPS) measures. This includes declarations of pest and disease freedom, veterinary inspection results (for animal products), and adherence to maximum residue limits (MRLs) for pesticides.

5: Provide Packaging and Labeling Details: Include details on product packaging, including weight, quantity, and labeling information. Ensure labeling complies with the destination country’s requirements regarding language, nutritional information, and country of origin markings.

6: Include Supporting Documentation: Attach supporting documentation, such as phytosanitary certificates, certificates of origin, and veterinary health certificates, as required by the destination country’s import regulations. These documents provide additional verification of compliance.

7: Complete Information Electronically (if applicable): Utilize digital templates for electronic submission whenever possible. Digital submission offers increased efficiency and reduced errors. Ensure all information is accurate and complete before submitting the electronic declaration.

8: Review and Validate Information: Before submission, thoroughly review the completed statement to ensure accuracy and completeness of all information. Errors or omissions can lead to customs delays and potential penalties. Validation checks within digital templates assist in identifying potential issues.

Careful preparation of the USDA statement, including accurate product identification, origin certification, and demonstration of sanitary compliance, facilitates lawful and efficient trade. Complete and accurate information minimizes potential delays and ensures smooth passage through customs processes, contributing to a more predictable and reliable international trade environment.

Accurate and complete documentation, often facilitated by standardized templates aligned with USDA regulations, is essential for the efficient import of agricultural products. These declarations provide customs officials with the necessary information to verify product identification, origin, sanitary compliance, and adherence to import regulations. Standardized formats, coupled with digital submission where available, streamline customs processes, reduce delays, and promote transparency in international trade.

Successful navigation of international trade complexities requires meticulous attention to these documentation requirements. As global trade continues to evolve, embracing standardized procedures and digital solutions will become increasingly critical for ensuring the seamless and compliant flow of agricultural goods across borders. This diligence protects public and agricultural health while fostering a more predictable and secure international trade environment.