Such a document offers numerous advantages. For investors, it provides assurance that their capital will be deployed effectively and according to a well-defined plan. It fosters trust and confidence in the management team’s ability to execute their strategy. Internally, it serves as a budgeting tool, guiding spending decisions and ensuring alignment with strategic priorities. This structured approach to resource allocation promotes fiscal discipline and maximizes the impact of the acquired funds.

This article will delve deeper into the core components typically included within these documents, offering practical guidance on crafting a compelling and informative outline for potential investors. Further sections will explore best practices for creating, using, and updating these documents, as well as common pitfalls to avoid.

1. Clarity

Clarity within a use of proceeds statement is paramount for effective communication and stakeholder understanding. A clear articulation of how funds will be utilized allows investors to readily assess the strategic rationale behind resource allocation. This transparency fosters trust and allows for informed investment decisions. Ambiguity or vagueness, conversely, can raise concerns about financial management and strategic direction. For example, a statement indicating funds will be used for “general corporate purposes” lacks the specificity necessary for investors to gauge the efficacy of the proposed spending. A clearer approach would delineate specific allocations, such as “40% for research and development, 30% for marketing and sales expansion, and 30% for working capital.” This detailed breakdown provides a concrete picture of how capital will be deployed and its intended impact on the organization’s growth trajectory.

Furthermore, clarity facilitates internal accountability. A well-defined allocation framework guides spending decisions and ensures alignment with stated objectives. This promotes fiscal discipline and helps prevent deviations from the approved plan. For instance, if a significant portion of funding is earmarked for new equipment acquisition, a clear statement would specify the types of equipment, their purpose, and anticipated return on investment. This level of detail enables effective monitoring of expenditures and evaluation of whether funds are being used as intended. Lack of clarity can lead to misinterpretation, misallocation of resources, and ultimately, jeopardize the success of the venture.

In conclusion, clarity serves as a cornerstone of a robust use of proceeds statement. It fosters trust with investors, promotes internal accountability, and ultimately contributes to the overall success of the fundraising initiative. Achieving clarity requires careful consideration of language, specificity in describing planned expenditures, and a logical framework that connects resource allocation to strategic goals. Addressing these aspects strengthens the statement’s effectiveness and maximizes its value for all stakeholders.

2. Accuracy

Accuracy in a use of proceeds statement is paramount for maintaining credibility with investors and ensuring responsible financial management. Inaccurate projections can erode trust and raise concerns about the viability of the project or venture. A rigorous approach to financial forecasting and due diligence is essential to ensure the reliability of the information presented.

- Realistic Financial Projections:Realistic financial projections, grounded in market research and operational data, form the foundation of an accurate statement. Overly optimistic or unsubstantiated projections can mislead investors and create unrealistic expectations. For example, a startup projecting exponential revenue growth without a clear market penetration strategy lacks credibility. Instead, a well-researched market analysis, coupled with achievable sales targets and expense forecasts, demonstrates a more grounded and trustworthy approach. This detailed and realistic approach provides a stronger basis for investment decisions and fosters confidence in the management team’s ability to execute the plan.

- Due Diligence and Validation:Thorough due diligence is crucial for verifying the accuracy of underlying assumptions and data used in financial projections. Independent validation by external experts, such as financial advisors or industry analysts, can add further credibility to the statement. For instance, a company seeking funding for a new manufacturing facility should conduct a comprehensive cost analysis, including land acquisition, construction, equipment, and operating expenses. Validating these cost estimates with independent appraisals and industry benchmarks strengthens the accuracy and reliability of the projections.

- Contingency Planning:While accurate forecasting is essential, acknowledging potential deviations and incorporating contingency plans demonstrates prudent financial management. A realistic assessment of potential risks and their financial implications enhances the credibility of the statement and prepares stakeholders for unforeseen challenges. For example, including a contingency buffer for potential cost overruns or delays in project timelines demonstrates a proactive approach to risk management and instills greater confidence in the overall plan.

- Regular Updates and Monitoring:Maintaining accuracy requires ongoing monitoring of actual expenditures against projected allocations. Regular updates and revisions to the statement, based on actual performance and market conditions, ensure that the document remains a relevant and reliable tool for tracking progress and managing resources. This dynamic approach allows for adjustments to the allocation strategy as needed, ensuring that funds are utilized effectively and efficiently in response to evolving circumstances.

Accurate financial projections, validated by due diligence, contingency planning, and regular monitoring, underpin a credible use of proceeds statement. This meticulous approach reinforces trust with investors, enhances internal financial discipline, and increases the likelihood of achieving the stated objectives. Ultimately, accuracy in this crucial document contributes significantly to the overall success of the fundraising endeavor and the long-term health of the organization or project.

3. Comprehensiveness

A comprehensive use of proceeds statement is crucial for providing stakeholders with a complete and transparent view of how raised funds will be deployed. This comprehensiveness fosters trust with investors and ensures internal alignment on resource allocation. Omitting key expenditure categories or providing insufficient detail can raise concerns about financial planning and strategic direction. A thorough approach, encompassing all planned uses of funds, demonstrates a commitment to responsible financial management and increases stakeholder confidence.

- Detailed Expenditure Categories:A comprehensive statement includes a detailed breakdown of all planned expenditure categories, avoiding vague or generic descriptions. Instead of simply listing “operating expenses,” a thorough approach would itemize specific areas such as salaries, rent, utilities, marketing, and research and development. For a real estate development project, this might involve separate line items for land acquisition, construction materials, permits, and professional fees. This level of detail enables stakeholders to understand precisely how funds will be utilized and assess the feasibility of the proposed budget.

- Timeline of Expenditures:Providing a clear timeline for anticipated expenditures adds another layer of comprehensiveness. This allows stakeholders to understand not only how much will be spent in each category but also when those expenditures are expected to occur. For example, a startup launching a new product might outline a timeline for marketing campaigns, hiring key personnel, and securing inventory. This temporal perspective enhances understanding of the project’s phasing and allows for better monitoring of progress against planned milestones.

- Contingency Planning:A truly comprehensive statement addresses potential contingencies and outlines plans for managing unforeseen circumstances. This demonstrates proactive risk management and provides reassurance to investors that potential challenges have been considered. For instance, a company expanding into a new market might allocate a portion of funds as a contingency for unexpected regulatory hurdles or competitive pressures. This forward-thinking approach strengthens the overall financial plan and enhances credibility.

- Metrics and Milestones:Linking expenditures to specific metrics and milestones adds a further dimension of comprehensiveness. This demonstrates how the allocated funds will contribute to achieving measurable outcomes and allows for ongoing evaluation of progress. For example, a non-profit organization might tie funding for a new program to specific metrics such as the number of people served or the impact on a target community. This performance-based approach enhances accountability and demonstrates the effectiveness of the investment.

By incorporating these elements, a use of proceeds statement provides a holistic view of how funds will be deployed, fostering transparency and building confidence among stakeholders. This comprehensive approach strengthens the financial plan, enhances accountability, and ultimately increases the likelihood of achieving the stated objectives.

4. Strategic Alignment

Strategic alignment is a critical aspect of a use of proceeds statement. It demonstrates how the intended use of funds directly supports the overarching strategic goals of the organization or project. This connection provides a clear rationale for resource allocation and assures investors that their capital will be deployed in a manner consistent with achieving long-term objectives. A misalignment between funding allocation and strategic priorities can raise concerns about the effectiveness and focus of the management team.

For instance, a company focused on expanding its market share might allocate a significant portion of raised funds towards sales and marketing initiatives, new product development, or strategic acquisitions. This direct link between funding and strategic objectives demonstrates a focused approach to growth and provides investors with a clear understanding of how their capital will contribute to achieving this goal. Conversely, if the same company were to allocate a substantial portion of funds to unrelated ventures or non-core activities, it would signal a lack of strategic focus and potentially raise concerns about the management’s ability to execute effectively.

A technology company seeking to establish market leadership might allocate funds towards research and development, talent acquisition, and infrastructure development. These investments directly support the company’s innovation strategy and its goal of developing cutting-edge products and services. This alignment reinforces the company’s commitment to its core mission and provides a compelling narrative for investors. Alternatively, diverting funds towards unrelated investments, such as real estate or unrelated business ventures, would weaken the strategic alignment and potentially jeopardize the company’s ability to achieve its primary objective. In the non-profit sector, an organization focused on improving educational outcomes might allocate funds towards teacher training programs, curriculum development, and community outreach initiatives. These allocations directly support the organization’s mission and provide a clear pathway to achieving its desired impact.

Demonstrating clear strategic alignment within a use of proceeds statement is essential for building investor confidence and ensuring that resources are deployed effectively. It provides a framework for accountability and allows stakeholders to assess the potential impact of the investment. A well-defined connection between funding allocation and strategic priorities enhances the credibility of the statement and increases the likelihood of achieving the stated objectives.

5. Investor Confidence

Investor confidence is intrinsically linked to the quality and transparency of a use of proceeds statement. This document serves as a crucial tool for building trust and assuring investors that their capital will be deployed effectively and in alignment with stated objectives. A well-structured and detailed statement fosters confidence, while ambiguity or lack of clarity can raise concerns and deter potential investors.

- Transparency and Accountability:A clear and detailed use of proceeds statement demonstrates transparency and accountability in financial planning. Specifically outlining how funds will be used, including specific expenditure categories and timelines, allows investors to assess the viability and potential return on their investment. For example, a detailed breakdown of research and development spending, including milestones and anticipated outcomes, provides greater transparency than a generic allocation to “product development.” This level of detail fosters trust and allows investors to make informed decisions.

- Alignment with Strategic Objectives:Demonstrating a clear link between the use of proceeds and the organization’s overall strategic objectives is crucial for building investor confidence. Investors seek assurance that their capital will contribute to the long-term success of the venture. A software company allocating funds to enhance its cloud infrastructure demonstrates a clear alignment with a growth strategy focused on scalability and accessibility, thereby boosting investor confidence. Conversely, allocating funds to unrelated ventures or non-core activities may raise concerns about strategic focus.

- Risk Mitigation and Contingency Planning:Addressing potential risks and outlining contingency plans within the use of proceeds statement demonstrates prudent financial management and strengthens investor confidence. Acknowledging potential challenges and outlining mitigation strategies, such as allocating a portion of funds for unforeseen market fluctuations or regulatory changes, reassures investors that the management team has considered potential downsides and is prepared to navigate them effectively. This proactive approach to risk management enhances credibility and fosters trust.

- Realistic Financial Projections:Credible financial projections, grounded in market research and operational data, are essential for building investor confidence. Overly optimistic or unsubstantiated projections can erode trust and raise concerns about the viability of the project. For instance, a startup projecting rapid market penetration without a clear marketing strategy or competitive analysis may appear unrealistic. Conversely, presenting well-researched market data, achievable sales targets, and detailed expense forecasts fosters confidence in the management team’s ability to execute the plan and generate returns.

These facets of a use of proceeds statement collectively contribute to building investor confidence. A comprehensive, transparent, and strategically aligned statement, supported by realistic financial projections and a clear risk mitigation plan, provides investors with the necessary information to make informed decisions and fosters trust in the management team’s ability to execute effectively. This, in turn, increases the likelihood of securing funding and achieving the organization’s strategic objectives.

Key Components of a Use of Proceeds Statement

A well-structured statement outlining the intended use of raised funds requires several key components to ensure clarity, transparency, and investor confidence. These components provide a comprehensive roadmap for how capital will be deployed and contribute to achieving strategic objectives.

1. Executive Summary: A concise overview of the funding request and its purpose, summarizing key objectives and intended use of proceeds. This section provides a high-level snapshot of the entire document and sets the context for the detailed breakdown that follows.

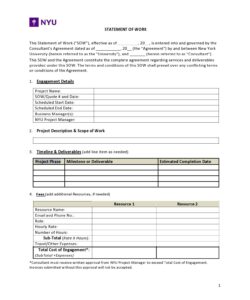

2. Sources and Uses of Funds: A clear and detailed table outlining the total amount of funding being raised, the sources of this funding (e.g., equity, debt, grants), and a breakdown of how these funds will be allocated across different expenditure categories. This section provides a concise overview of the financial structure of the fundraising initiative.

3. Project Description and Milestones: A detailed description of the project or venture for which funding is being sought, including key milestones and anticipated timelines. This section provides context for the use of proceeds and demonstrates how the allocated funds will contribute to achieving specific objectives.

4. Expenditure Breakdown: A comprehensive breakdown of planned expenditures, categorized by specific areas such as research and development, marketing and sales, capital expenditures, working capital, and debt repayment. This section provides a granular view of how funds will be deployed and allows investors to assess the allocation strategy.

5. Financial Projections: Realistic financial projections, including revenue forecasts, expense budgets, and cash flow projections, demonstrating the anticipated financial impact of the investment. This section provides investors with a basis for assessing the potential return on investment and the financial viability of the project.

6. Risk Assessment and Mitigation: An assessment of potential risks and challenges, along with corresponding mitigation strategies, demonstrating a proactive approach to risk management. This section provides investors with assurance that potential downsides have been considered and addressed.

7. Management Team and Use of Funds Justification: A brief overview of the management team’s experience and expertise, along with a justification for the proposed use of funds, demonstrating the team’s ability to execute the plan effectively. This section reinforces investor confidence in the management team’s capabilities.

These components, when presented clearly and comprehensively, provide a robust framework for communicating the intended use of proceeds, fostering transparency, and building investor confidence. This structured approach to resource allocation strengthens the overall financial plan and increases the likelihood of achieving the stated objectives.

How to Create a Use of Proceeds Statement

Creating a clear and comprehensive use of proceeds statement is crucial for securing funding and demonstrating responsible financial management. The following steps outline a structured approach to developing this essential document.

1. Define Objectives: Clearly articulate the core objectives of the fundraising initiative. Specificity is essential. Whether the goal is expanding operations, launching a new product, or retiring debt, a precise definition of objectives provides the foundation for allocating resources effectively.

2. Quantify Funding Requirements: Determine the total amount of funding required to achieve the stated objectives. This requires detailed financial modeling and careful consideration of all associated costs. A well-defined budget demonstrates a thorough understanding of financial needs.

3. Categorize Expenditures: Create distinct categories for planned expenditures. Common categories include research and development, marketing and sales, capital expenditures, working capital, and debt repayment. Specific subcategories within these broader areas provide greater granularity and transparency.

4. Allocate Funds: Allocate the required funding across the defined expenditure categories. This allocation should directly reflect the strategic priorities and objectives outlined in the first step. A clear rationale for each allocation strengthens the overall financial plan.

5. Develop Financial Projections: Create realistic financial projections that demonstrate the anticipated impact of the investment. These projections should include revenue forecasts, expense budgets, and cash flow statements. Accuracy and credibility are paramount.

6. Assess and Mitigate Risks: Identify potential risks and challenges associated with the project or venture. Develop corresponding mitigation strategies to address these risks and demonstrate a proactive approach to risk management.

7. Justify Expenditures: Provide a clear justification for each expenditure category, linking it directly to the stated objectives and strategic priorities. This rationale demonstrates a thoughtful and strategic approach to resource allocation.

8. Review and Refine: Thoroughly review and refine the statement to ensure clarity, accuracy, and completeness. Seek input from relevant stakeholders, including financial advisors and legal counsel. Regular updates and revisions maintain the document’s relevance.

A well-crafted use of proceeds statement demonstrates a clear understanding of financial needs, a strategic approach to resource allocation, and a commitment to transparency and accountability. This strengthens the overall investment proposition and fosters confidence among stakeholders.

Careful consideration of a document outlining planned use of raised capital is essential for securing funding and ensuring successful execution of projects and ventures. A well-structured approach, incorporating detailed expenditure breakdowns, realistic financial projections, and clear alignment with strategic objectives, fosters transparency, builds investor confidence, and promotes responsible financial management. Accuracy, clarity, and comprehensiveness in this document are paramount for demonstrating a commitment to achieving stated goals and maximizing the impact of invested capital.

Ultimately, a robust and transparent plan for utilizing acquired funds serves as a cornerstone of successful fundraising and sustainable growth. Organizations prioritizing meticulous planning and clear communication of resource allocation position themselves for greater success in achieving their objectives and building long-term value for stakeholders. This proactive approach to financial stewardship fosters trust, enhances accountability, and contributes significantly to the overall health and viability of any venture.