This structured approach offers several advantages. It facilitates cost-volume-profit analysis, enabling businesses to understand how changes in sales volume affect profitability. It also simplifies budgeting and forecasting by allowing for easier cost projections based on anticipated production levels. Furthermore, it can aid in managerial decision-making, particularly in pricing strategies and production planning. By highlighting the contribution margin (revenue minus variable costs), management can make informed choices about product pricing, optimal production volumes, and product mix.

This foundational understanding paves the way for a deeper exploration of cost accounting principles, inventory valuation methods, and performance evaluation techniques.

1. Format

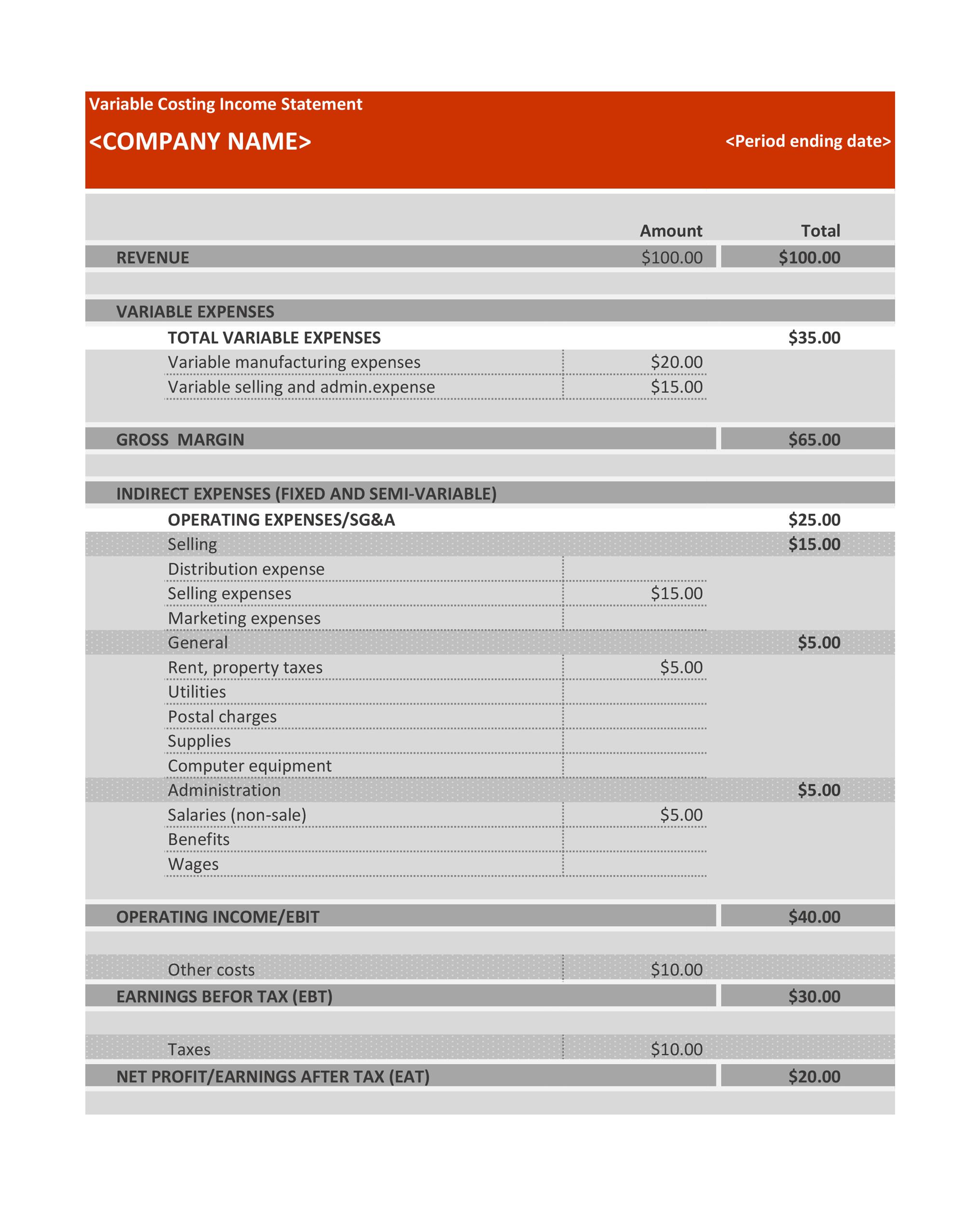

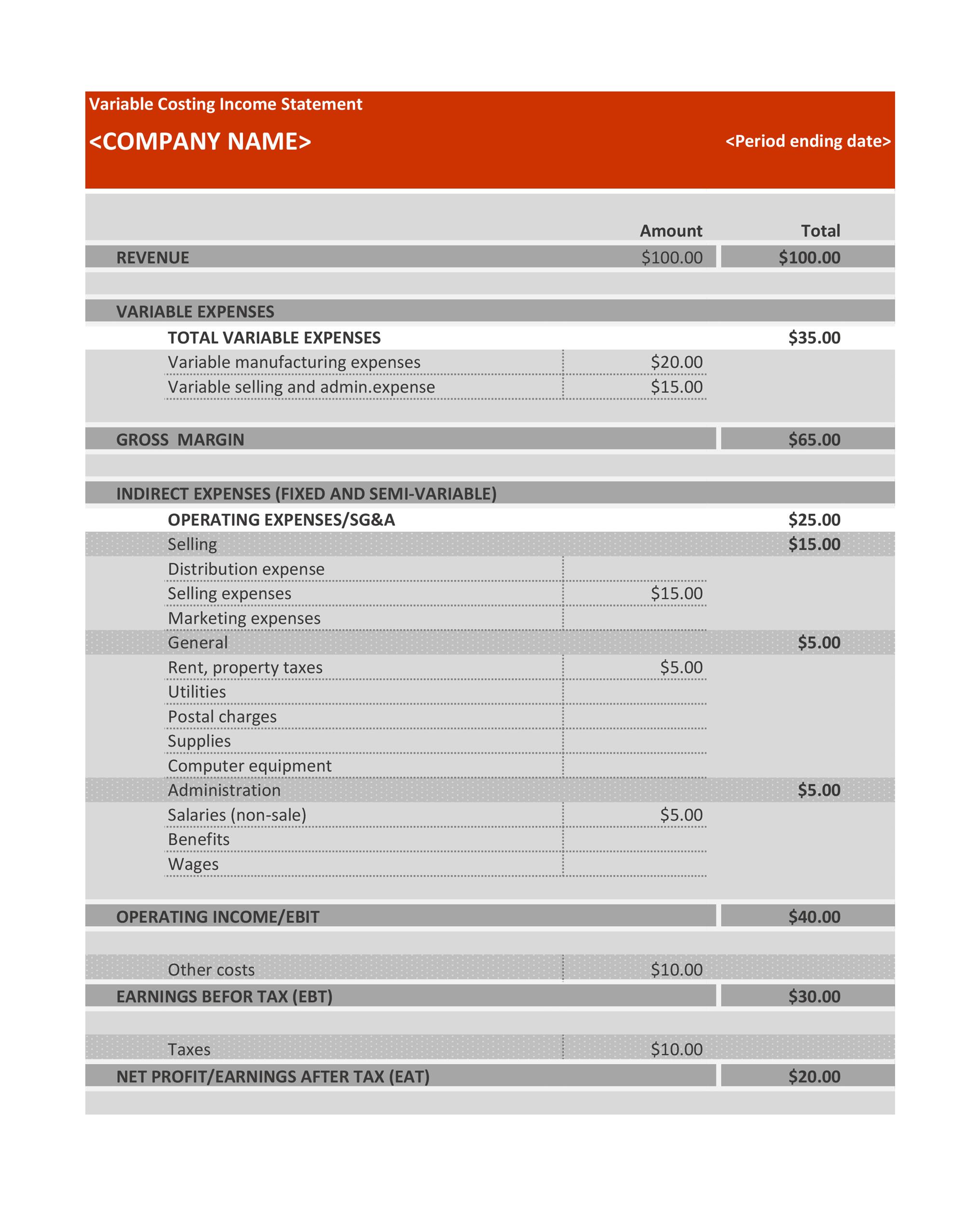

The format of a variable costing income statement is crucial for its analytical power. Distinct from the traditional absorption costing method, it emphasizes the separation of variable and fixed costs, providing a clearer picture of cost behavior and profitability drivers.

- RevenueRevenue represents the total sales generated from goods sold or services rendered. It forms the starting point of the income statement and is essential for calculating subsequent metrics. For instance, a company selling 1,000 units at $20 per unit would report $20,000 as revenue.

- Variable CostsVariable costs are expenses directly tied to production volume. These include direct materials, direct labor, and variable overhead. If each unit requires $5 of direct materials and $2 of direct labor, the variable cost for 1,000 units would be $7,000. This direct link to production highlights the cost implications of volume changes.

- Contribution MarginThe contribution margin, calculated by subtracting variable costs from revenue, represents the portion of sales that contributes to covering fixed costs and generating profit. Using the previous example, a $20,000 revenue less $7,000 variable costs results in a $13,000 contribution margin. This metric is key for break-even analysis and pricing decisions.

- Fixed CostsFixed costs, like rent, salaries, and depreciation, remain constant regardless of production volume. These costs are subtracted from the contribution margin to determine operating income. For instance, if fixed costs total $5,000, subtracting this from the $13,000 contribution margin yields an $8,000 operating income. Understanding the impact of fixed costs on profitability is vital for long-term planning.

This structured presentation allows for more accurate cost-volume-profit analysis and supports informed decision-making regarding pricing, production volume, and product mix. By isolating the contribution margin, businesses can evaluate the profitability of individual products and make strategic choices about resource allocation. The clear distinction between variable and fixed costs also facilitates budgeting and forecasting by enabling more precise cost projections based on anticipated production levels.

2. Variable Costs

Variable costs are central to the variable costing income statement template. Their direct relationship with production volume makes them a critical factor in understanding profitability and making informed operational decisions. Examining the different facets of variable costs provides deeper insight into their impact on this specific income statement format.

- Direct MaterialsDirect materials are the raw materials directly incorporated into the finished product. Examples include the wood used in furniture manufacturing or the steel in automobile production. Within the variable costing income statement template, direct material costs are subtracted from revenue as part of the total variable costs, directly impacting the contribution margin. Fluctuations in raw material prices or usage directly affect profitability as reflected in this statement.

- Direct LaborDirect labor represents the wages and benefits paid to employees directly involved in producing goods. This includes assembly line workers, machine operators, and other personnel whose work can be directly traced to specific products. Similar to direct materials, direct labor costs are a key component of total variable costs within the template. Changes in wage rates or labor efficiency have a direct impact on the contribution margin and, consequently, operating income.

- Variable OverheadVariable overhead encompasses all other costs that vary directly with production but are not direct materials or labor. Examples include utilities for production equipment, packaging supplies, and quality control inspections. These costs are included in the total variable costs within the income statement. Accurately classifying and tracking variable overhead is essential for precise cost analysis and effective decision-making regarding pricing and production levels.

- Sales CommissionsSales commissions, calculated as a percentage of sales revenue, represent a variable cost directly linked to sales volume. As sales increase, so do commission expenses. In the context of the variable costing income statement, sales commissions contribute to the total variable cost deduction from revenue, impacting the contribution margin. Understanding this relationship allows for more accurate profit projections and informs sales compensation strategies.

The accurate categorization and analysis of these variable costs are crucial for the effective utilization of the variable costing income statement template. Understanding how these costs change with production volume allows businesses to perform cost-volume-profit analysis, make informed pricing decisions, and optimize production for maximum profitability. The clear segregation of variable costs from fixed costs in this template provides management with a powerful tool for strategic planning and operational control.

3. Fixed Costs

Fixed costs represent a critical element within the variable costing income statement template. Unlike variable costs, which fluctuate with production volume, fixed costs remain constant regardless of output. This distinction is fundamental to the template’s structure and its analytical power. Fixed costs are subtracted from the contribution margin (revenue minus variable costs) to arrive at the operating income. This separation allows for a clearer understanding of how changes in sales volume affect profitability. For example, a manufacturing company with fixed costs of $10,000 per month will incur this expense regardless of whether it produces 100 or 1,000 units. This understanding is crucial for break-even analysis, as the company must generate sufficient contribution margin to cover these fixed expenses before realizing a profit.

Examples of fixed costs include rent for factory space, salaries of administrative staff, depreciation of machinery, and insurance premiums. These expenses are incurred regardless of production activity. Consider a software company with a fixed monthly cost of $50,000 for office space and salaries. If the company sells 1,000 software licenses with a contribution margin of $75 per license, the resulting contribution margin of $75,000 exceeds the fixed costs, resulting in a $25,000 operating profit. However, if sales drop to 500 licenses, the contribution margin falls to $37,500, leading to a $12,500 operating loss, despite selling a positive number of units. This illustrates the leverage effect of fixed costs and the importance of maintaining sufficient sales volume to cover them.

Understanding the relationship between fixed costs and the variable costing income statement template offers significant practical applications. It enables businesses to determine their break-even pointthe sales volume at which total revenue equals total costs. This information informs pricing strategies, production planning, and sales targets. Furthermore, it facilitates cost-volume-profit analysis, allowing managers to model the impact of different sales volumes and cost structures on profitability. By analyzing fixed costs, businesses can identify opportunities for cost optimization and improve overall financial performance. However, it is crucial to remember that fixed costs are not static indefinitely; they can change over time due to factors such as expansion, new equipment purchases, or changes in lease agreements. Regular review and adjustment of fixed cost projections are therefore essential for accurate financial planning and analysis.

4. Contribution Margin

The contribution margin stands as a pivotal element within the variable costing income statement template. It represents the portion of revenue remaining after deducting variable costs, signifying the amount available to cover fixed costs and subsequently contribute to profit. A thorough understanding of the contribution margin is essential for interpreting this specific income statement format and leveraging its analytical capabilities.

- CalculationCalculated as Revenue – Variable Costs, the contribution margin provides a clear picture of profitability at different sales volumes. For instance, if a product sells for $100 with variable costs of $60, the contribution margin is $40 per unit. This metric is fundamental to break-even analysis and pricing decisions.

- Relationship to Fixed Costs and ProfitThe contribution margin must first cover fixed costs before contributing to net profit. If fixed costs exceed the contribution margin, an operating loss occurs. Conversely, when the contribution margin surpasses fixed costs, the difference represents the profit generated. This relationship highlights the importance of managing both variable and fixed costs to maximize profitability.

- Use in Decision-MakingContribution margin analysis is crucial for various managerial decisions. It informs pricing strategies by indicating the potential impact of price changes on profitability. It also aids in product mix decisions by highlighting the relative profitability of different products. Furthermore, it supports cost control efforts by emphasizing the importance of minimizing variable costs.

- Impact on Variable Costing Income StatementWithin the variable costing income statement, the contribution margin is prominently displayed, emphasizing its role in determining profitability. This focus distinguishes it from absorption costing, which does not explicitly present this metric. The clear presentation of the contribution margin facilitates a deeper understanding of cost behavior and its effect on operating income at different sales volumes. This allows for more informed decisions regarding production levels, sales targets, and overall business strategy.

In summary, the contribution margin serves as a critical link between sales, variable costs, fixed costs, and ultimately, profitability. Its prominent position within the variable costing income statement template underscores its importance in analyzing cost behavior and supporting informed managerial decisions. By understanding how the contribution margin is calculated, its relationship to other financial metrics, and its implications for profitability, businesses can leverage the variable costing income statement to gain valuable insights into their operations and enhance financial performance.

5. Profit Calculation

Profit calculation within a variable costing income statement template diverges from the traditional absorption costing method. This distinction stems from the fundamental difference in how fixed manufacturing overhead is treated. Understanding this nuanced approach to profit calculation is crucial for accurate financial analysis and informed decision-making.

- Contribution MarginThe contribution margin, calculated as sales revenue less variable costs, forms the foundation of profit calculation under variable costing. It represents the portion of revenue available to cover fixed costs and contribute to profit. For example, if a product sells for $100 with variable costs of $60, the contribution margin is $40. This $40 contributes towards covering fixed costs and generating profit. This differs from absorption costing, where fixed manufacturing overhead is allocated to individual units, impacting gross profit.

- Fixed Cost TreatmentVariable costing treats all fixed manufacturing overhead as a period expense, deducted in its entirety from the contribution margin to arrive at operating income. This contrasts with absorption costing, which allocates fixed manufacturing overhead to units produced, impacting inventory valuation and cost of goods sold. This difference can lead to varying profit figures under the two methods, particularly when production and sales volumes differ.

- Period vs. Product CostsThe distinction between period and product costs is central to variable costing. Variable manufacturing costs (direct materials, direct labor, and variable overhead) are treated as product costs, while fixed manufacturing overhead is considered a period cost. This separation allows for a clearer understanding of cost behavior and its impact on profitability at different production levels. Absorption costing, however, treats both variable and fixed manufacturing overhead as product costs.

- Impact on Profitability AnalysisVariable costing provides a clearer picture of the relationship between sales volume, costs, and profit. Because fixed costs are treated separately, changes in sales volume directly impact operating income. This facilitates cost-volume-profit analysis and aids in decision-making regarding pricing, production levels, and product mix. Absorption costing, due to its treatment of fixed manufacturing overhead, can obscure this relationship, potentially leading to less accurate profit projections.

In summary, profit calculation under variable costing emphasizes the contribution margin and the separate treatment of fixed manufacturing overhead as a period cost. This approach provides valuable insights into cost behavior and its impact on profitability, facilitating more informed managerial decisions. The differences between variable and absorption costing can significantly impact reported profit figures, especially when inventory levels fluctuate. Understanding these nuances is crucial for accurate financial analysis and effective business management.

Key Components of a Variable Costing Income Statement

A variable costing income statement relies on a specific structure to present financial data effectively. Understanding these key components is crucial for interpreting the statement and leveraging its analytical capabilities.

1. Revenue: Revenue represents the total sales generated from goods or services, forming the basis for all subsequent calculations within the statement. It reflects the top-line financial performance of a company over a given period.

2. Variable Costs: These costs are directly proportional to production or sales volume. They encompass direct materials, direct labor, and variable overhead expenses. Accurate categorization of variable costs is critical for determining the contribution margin.

3. Contribution Margin: Calculated as Revenue minus Variable Costs, this metric reveals the portion of sales revenue available to cover fixed costs and contribute to profit. It provides a key insight into the profitability of each unit sold.

4. Fixed Costs: Fixed costs remain constant regardless of production volume. They include expenses such as rent, salaries, depreciation, and insurance. These costs are subtracted from the contribution margin to determine the operating income.

5. Operating Income: This figure represents the profit generated after deducting both variable and fixed costs from revenue. It reflects the profitability of core business operations. Operating income under variable costing provides a clear view of how changes in sales volume directly impact profit, unlike absorption costing, which can obscure this relationship due to its treatment of fixed manufacturing overhead.

The structure of the variable costing income statement provides a powerful tool for analyzing cost behavior, conducting break-even analysis, and making informed decisions related to pricing, production levels, and product mix. Its emphasis on separating variable and fixed costs allows for a clearer understanding of profitability drivers than traditional absorption costing.

How to Create a Variable Costing Income Statement

Creating a variable costing income statement requires a structured approach and accurate cost classification. The following steps outline the process:

1. Define the Reporting Period: Specify the timeframe for the income statement, such as a month, quarter, or year. This ensures consistency and allows for meaningful comparisons across periods.

2. Calculate Revenue: Determine the total sales revenue generated during the reporting period. This figure represents the starting point for the income statement.

3. Identify and Quantify Variable Costs: Categorize and calculate all variable costs, including direct materials, direct labor, and variable overhead. Accurate cost allocation is crucial for determining the contribution margin.

4. Calculate the Contribution Margin: Subtract the total variable costs from the revenue. This metric represents the portion of sales revenue available to cover fixed costs and contribute to profit.

5. Identify and Quantify Fixed Costs: Categorize and calculate all fixed costs, including rent, salaries, depreciation, and insurance. These costs remain constant regardless of production volume.

6. Calculate Operating Income: Subtract the total fixed costs from the contribution margin. The resulting figure represents the profit generated from core business operations.

7. Present the Data: Organize the calculated figures into the standard variable costing income statement format. Clearly label each line item (Revenue, Variable Costs, Contribution Margin, Fixed Costs, Operating Income) to ensure clarity and facilitate interpretation. This structured presentation allows for straightforward analysis of cost behavior and its impact on profitability.

Accurate cost classification and a clear understanding of the relationship between sales volume, costs, and profit are essential for constructing a meaningful variable costing income statement. This statement provides valuable insights for managerial decision-making regarding pricing, production levels, and overall business strategy.

This exploration of the variable costing income statement template has highlighted its significance in managerial accounting. The clear delineation between variable and fixed costs provides a more nuanced understanding of cost behavior and its impact on profitability. This structure facilitates crucial analyses, such as cost-volume-profit relationships, break-even points, and pricing strategies. The template’s focus on the contribution margin empowers informed decision-making regarding production levels, product mix, and operational efficiency. Its utility lies in its ability to provide a clearer picture of how changes in sales volume directly affect a company’s bottom line, unlike traditional absorption costing.

Mastery of this template equips businesses with a powerful tool for strategic planning and performance evaluation. Its analytical capabilities offer valuable insights for navigating complex market dynamics and optimizing resource allocation. Further exploration of advanced cost accounting principles can enhance comprehension and application of this valuable financial instrument, ultimately contributing to stronger financial performance and a more informed approach to strategic management.