Navigating the world of vehicle finance can sometimes feel like a maze, whether you are a dealership, a lender, or an individual looking to purchase a new car. The foundation of a smooth transaction often lies in a well-organized and comprehensive application process. This is where a robust vehicle finance application form template becomes an invaluable tool, simplifying the initial steps for all parties involved.

Using a standardized template ensures that all necessary information is collected efficiently and consistently, reducing back-and-forth communication and potential delays. It helps applicants understand what data is required upfront, making their submission process clearer, while enabling financial institutions to quickly assess eligibility and manage their workflow. Ultimately, a good template streamlines the journey from initial interest to driving off the lot.

What Essential Information Should Your Vehicle Finance Application Form Template Include?

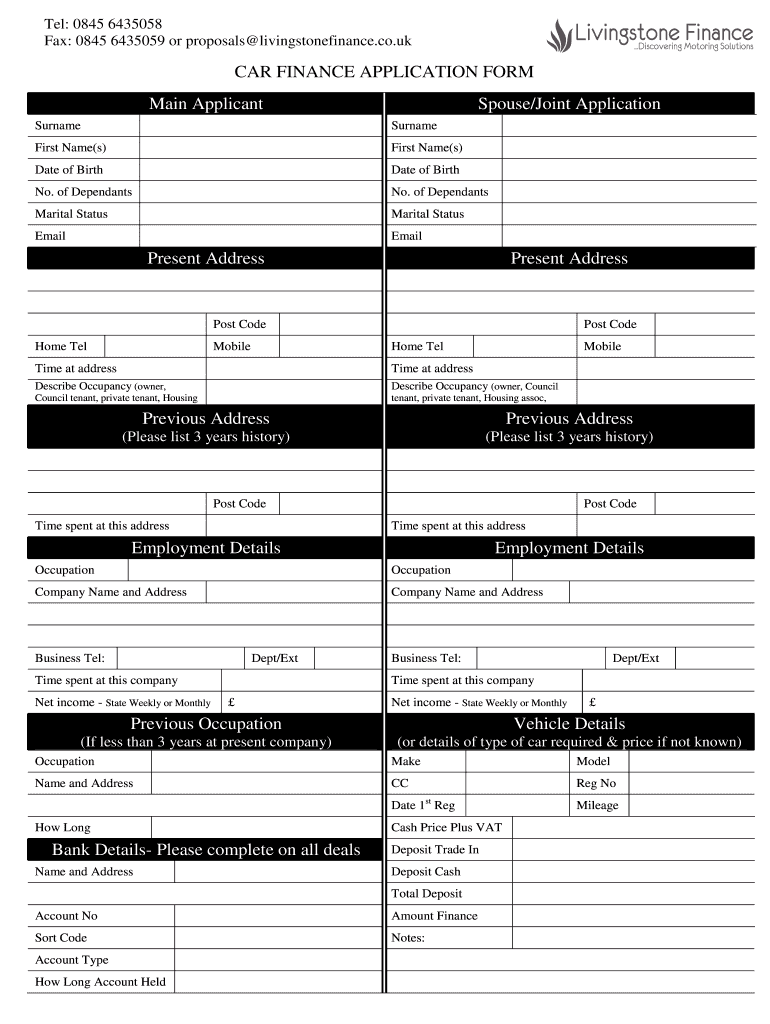

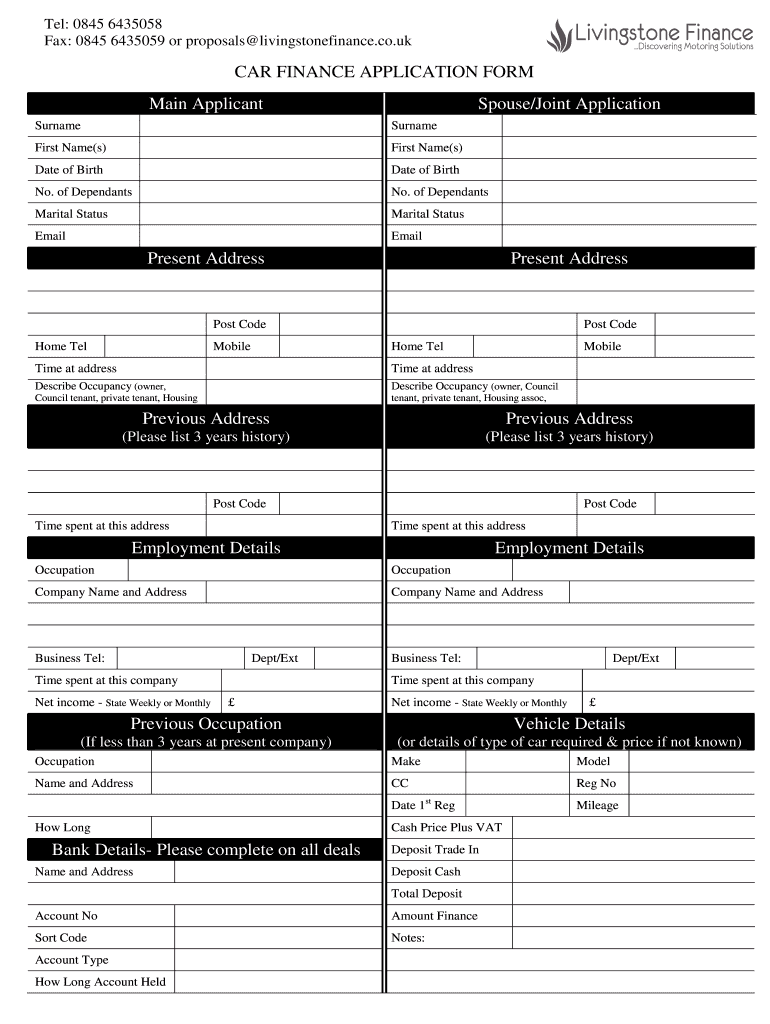

Creating an effective vehicle finance application form template means thinking about all the critical data points required for a comprehensive financial assessment. It is not just about collecting names and addresses; it is about gathering a full picture of an applicant’s financial health, their identity, and their intentions regarding the vehicle purchase. A thorough form helps both the applicant provide all necessary details and the lender make an informed decision.

First and foremost, the template needs to capture detailed personal and contact information. This is foundational for identification and communication. Think beyond just the basics; consider fields for previous addresses if the current residency is short-term, or additional contact methods. This section ensures the lender can verify identity and reach out with questions or updates throughout the application process.

Key Personal and Contact Details:

- Full Legal Name (First, Middle, Last)

- Date of Birth

- Social Security Number (or equivalent national ID)

- Current Residential Address and Length of Residence

- Previous Residential Addresses (if current is less than a specified period, e.g., 2 years)

- Phone Numbers (Home, Mobile)

- Email Address

- Marital Status

- Number of Dependents

Secondly, comprehensive employment and income details are paramount. Lenders need to assess an applicant’s ability to repay the loan. This means not only current employment information but also a history of employment to demonstrate stability. Details about gross income, other sources of income, and existing financial obligations paint a clear picture of an applicant’s financial capacity.

Crucial Employment and Financial Information:

- Current Employer’s Name and Address

- Job Title/Position

- Length of Employment

- Gross Monthly/Annual Income

- Other Sources of Income (e.g., freelance, rental income, benefits)

- Previous Employment History (e.g., for the past 2-3 years)

- Bank Account Information (for direct debit purposes)

- Details of Existing Debts (e.g., mortgages, other loans, credit cards)

Finally, information about the desired vehicle and the specifics of the finance requested are crucial. This includes details about the make, model, year, and price of the car, as well as the desired loan amount, down payment, and trade-in value if applicable. A well-structured vehicle finance application form template anticipates these needs, ensuring a smooth transition from application to approval and ultimately, to vehicle acquisition.

The Undeniable Advantages of a Well-Designed Vehicle Finance Application Form Template

Adopting a standardized vehicle finance application form template brings a multitude of benefits, extending far beyond simple data collection. For dealerships and lenders, it creates a streamlined, professional process that reflects positively on their operations. For applicants, it transforms a potentially daunting task into a clear, manageable set of steps, enhancing their overall experience.

One of the most significant advantages is the efficiency it brings to the application process. With a template, all required fields are clearly laid out, minimizing omissions and errors. This reduces the back-and-forth communication often needed to gather missing information, accelerating the approval timeline. Time saved for both the applicant and the finance provider means a faster path to a vehicle purchase, improving customer satisfaction and operational throughput.

Furthermore, a well-designed template ensures consistency in data collection. Every application received will follow the same format, making it easier for finance teams to review, compare, and process submissions. This consistency not only aids in compliance with regulatory requirements but also helps in building robust data sets for internal analysis, allowing institutions to identify trends and optimize their lending criteria over time. It creates a unified approach that is both professional and reliable.

Beyond efficiency and consistency, using a professional template significantly enhances the applicant’s experience. A clear, intuitive form signals professionalism and transparency. Applicants feel more confident and less overwhelmed when they know exactly what information is needed and why. This can lead to higher completion rates and fewer abandoned applications, as the process feels less intimidating and more straightforward.

Ultimately, a robust application form serves as the backbone of a successful vehicle finance operation. It not only simplifies the initial collection of data but also sets the stage for a smooth, efficient, and pleasant experience for everyone involved in the vehicle acquisition journey. Investing in a comprehensive and user-friendly template pays dividends in operational excellence and customer satisfaction.