In today’s fast-paced business world, efficiency and security are paramount, especially when it comes to managing finances and paying your valued vendors. Gone are the days when mailing checks was the standard practice, often leading to delays, lost mail, and reconciliation headaches. Businesses are increasingly shifting towards more streamlined methods, and direct deposit has emerged as the clear winner, offering a host of benefits that traditional payment methods simply can’t match.

This modern approach not only accelerates the payment cycle but also significantly reduces administrative burden and enhances security. However, to fully leverage the advantages of direct deposit, you need a clear, concise, and easy-to-use system for collecting vendor banking information. This is where a well-designed vendor direct deposit form template becomes an indispensable tool for any organization looking to optimize its financial operations and build stronger, more reliable relationships with its suppliers.

Why Your Business Needs a Solid Vendor Direct Deposit Process

Think about the time and resources currently spent on preparing, printing, signing, and mailing physical checks. Each step in that process carries a cost, from the paper and envelopes to postage and the labor involved. Beyond the immediate expenses, there’s the inherent risk of checks being lost, stolen, or misplaced, leading to frustrating delays and the need for reissuance. This old-fashioned method creates unnecessary friction, not just for your accounting team but also for your vendors who are waiting to receive their funds.

Embracing direct deposit transforms this cumbersome process into a smooth, almost instantaneous transfer of funds. Payments are delivered directly into your vendor’s bank account, often within a day or two, eliminating the delays associated with mail delivery and bank processing. This not only significantly cuts down on operational costs for your business but also enhances security by minimizing the handling of sensitive paper checks and reducing the risk of fraud. The clear audit trail provided by electronic transactions also simplifies reconciliation and financial reporting.

Streamlining Vendor Relationships

The benefits extend far beyond your internal operations; they profoundly impact your relationships with vendors. Imagine your vendors receiving their payments consistently and predictably, without having to wait for a check to arrive in the mail or making a special trip to the bank to deposit it. This reliability fosters trust and strengthens partnerships, making your business an even more appealing entity to work with. Happy vendors are often more reliable, more flexible, and more willing to collaborate, which can ultimately benefit your supply chain and overall business performance.

Furthermore, direct deposit helps improve cash flow for your vendors, allowing them to better manage their own finances and potentially offer you better terms or services in return. It’s a win-win scenario that elevates the entire B2B payment experience. By adopting a robust direct deposit system, you are demonstrating a commitment to efficiency and professionalism that resonates throughout your business ecosystem.

The cornerstone of this efficient system is a reliable vendor direct deposit form template. Without a standardized way to collect banking details, even the best direct deposit setup will falter. This form is the essential bridge between your accounting system and your vendor’s bank account, ensuring that funds reach the correct destination every single time. It’s not just about filling out numbers; it’s about establishing a clear, secure channel for financial transactions.

What to Include in Your Vendor Direct Deposit Form Template

Crafting an effective vendor direct deposit form template is crucial for ensuring smooth and accurate payment processing. A well-designed form should be comprehensive enough to collect all necessary information while remaining straightforward and easy for your vendors to complete. It acts as the official record of their banking details, so precision is key to avoiding payment errors and subsequent headaches for both parties.

At the very least, your template must clearly request the vendor’s full legal name or business name, their mailing address, and their tax identification number (TIN) or Employer Identification Number (EIN). This foundational information ensures you can correctly identify the vendor for tax purposes and accurate record-keeping. It’s also wise to include a space for a contact person and their email address, facilitating communication regarding payment notifications or any issues that might arise.

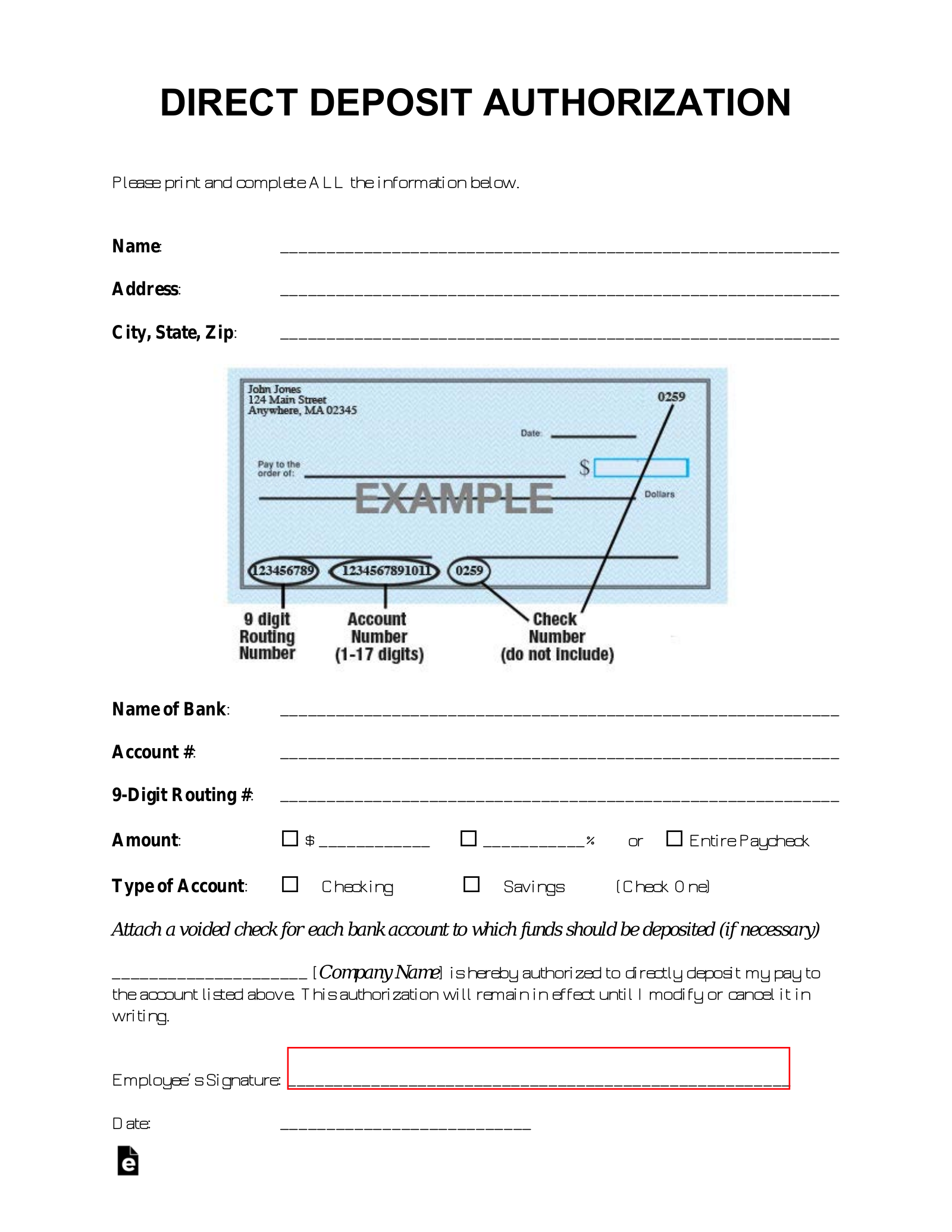

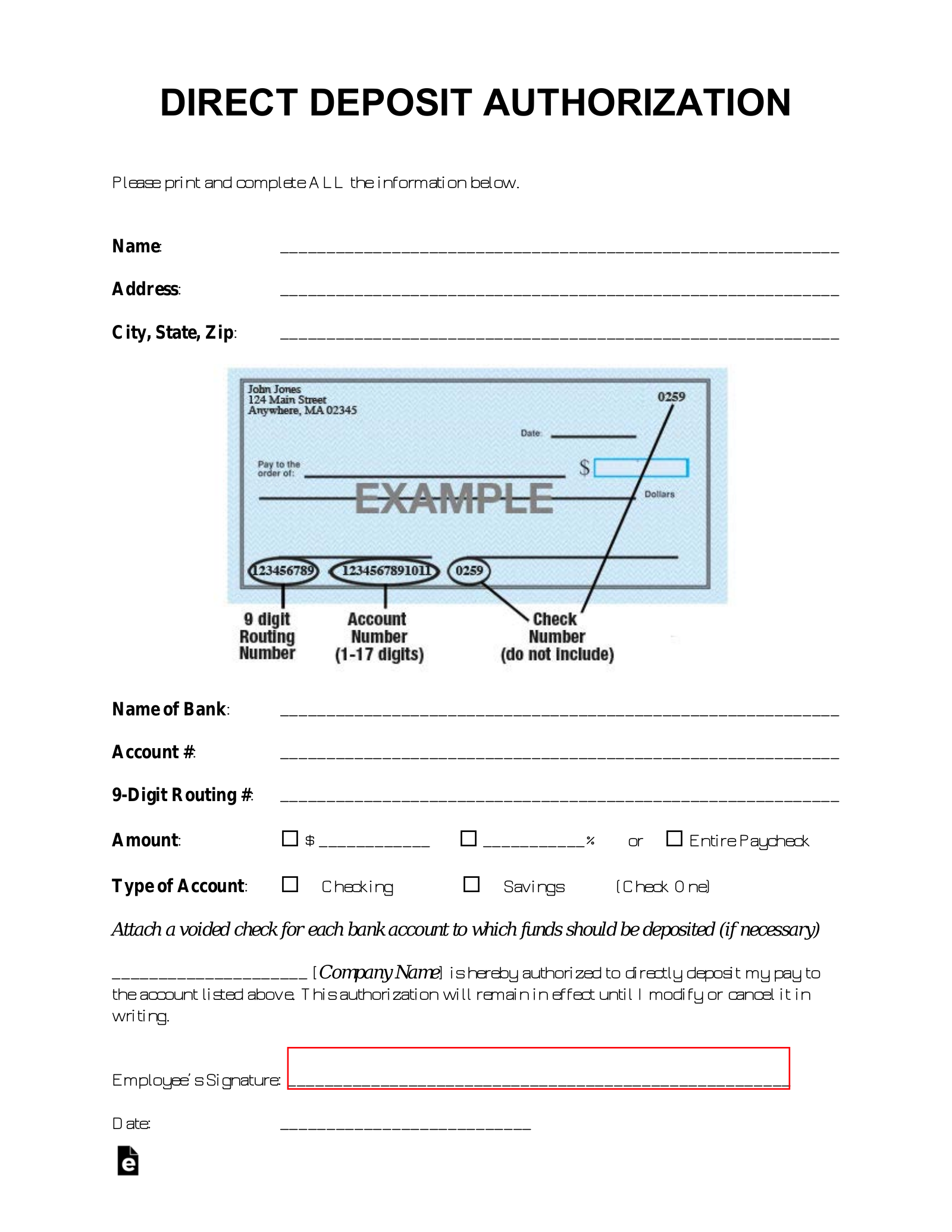

The core of the form, of course, revolves around banking information. You’ll need fields for the bank’s name, its routing number, the vendor’s account number, and the type of account (e.g., checking or savings). It is absolutely vital to clearly instruct vendors to double-check these sensitive numbers, as even a single digit error can cause payments to be misdirected or returned. Providing an example of where to find these numbers on a check or bank statement can be incredibly helpful.

Beyond the essential data, consider adding sections for an effective date for the direct deposit setup, which can be useful if a vendor wants to delay the start of electronic payments for a specific reason. A clear authorization statement, where the vendor explicitly grants permission for your business to initiate direct deposit payments to their specified account, is also non-negotiable. This statement should also include language indemnifying your company against errors caused by incorrect information provided by the vendor.

Finally, always include a date field and a signature line for the authorized representative of the vendor. This signature signifies their agreement to the terms and confirms the accuracy of the information provided. Making the vendor direct deposit form template accessible, perhaps as a downloadable PDF on your website or sent via email, encourages quick completion and integration into your payment system, further enhancing the efficiency of your accounts payable process.

Implementing direct deposit for your vendor payments marks a significant step towards modernizing your business operations, making them more secure, efficient, and cost-effective. By embracing this approach, you are not just optimizing internal processes but also cultivating stronger, more reliable relationships with your supply chain partners. The convenience, speed, and accuracy offered by electronic fund transfers are unmatched, providing a clear advantage in today’s competitive landscape.

A robust and user-friendly vendor direct deposit form template is the cornerstone of this transformation, ensuring that you gather all the necessary information accurately and securely. Investing time in developing or sourcing a comprehensive template will pay dividends by minimizing errors, reducing administrative burdens, and ensuring your vendors receive their payments seamlessly. Embrace the future of payments to build a more agile and interconnected business.