Navigating the world of health insurance can often feel like deciphering a complex code, especially when it comes to understanding what your plan actually covers before you receive medical services. This uncertainty can lead to unexpected bills and financial stress, making the pre-service verification of benefits an absolutely crucial step for both healthcare providers and patients alike. It is a proactive measure that brings clarity and prevents those unwelcome surprises down the line.

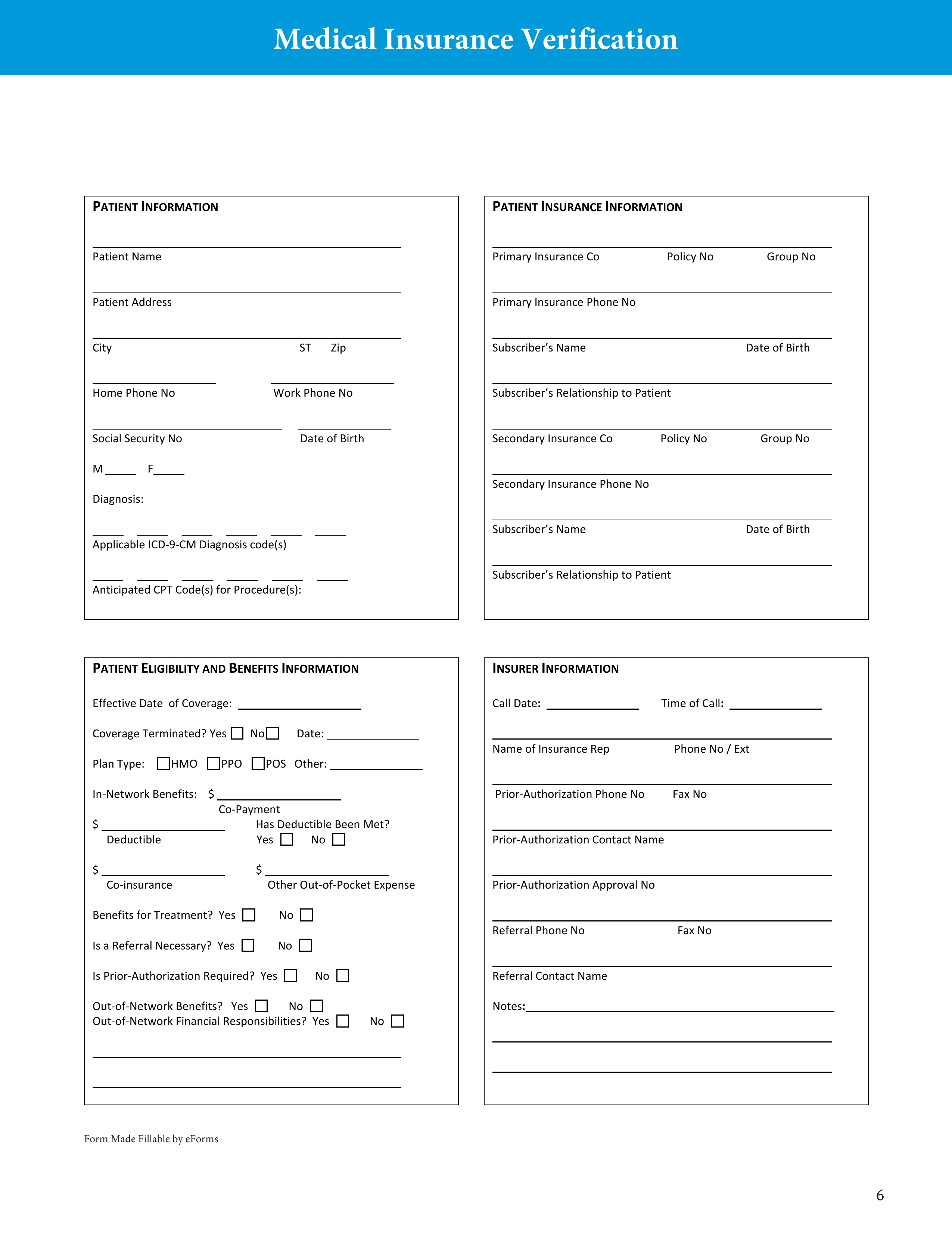

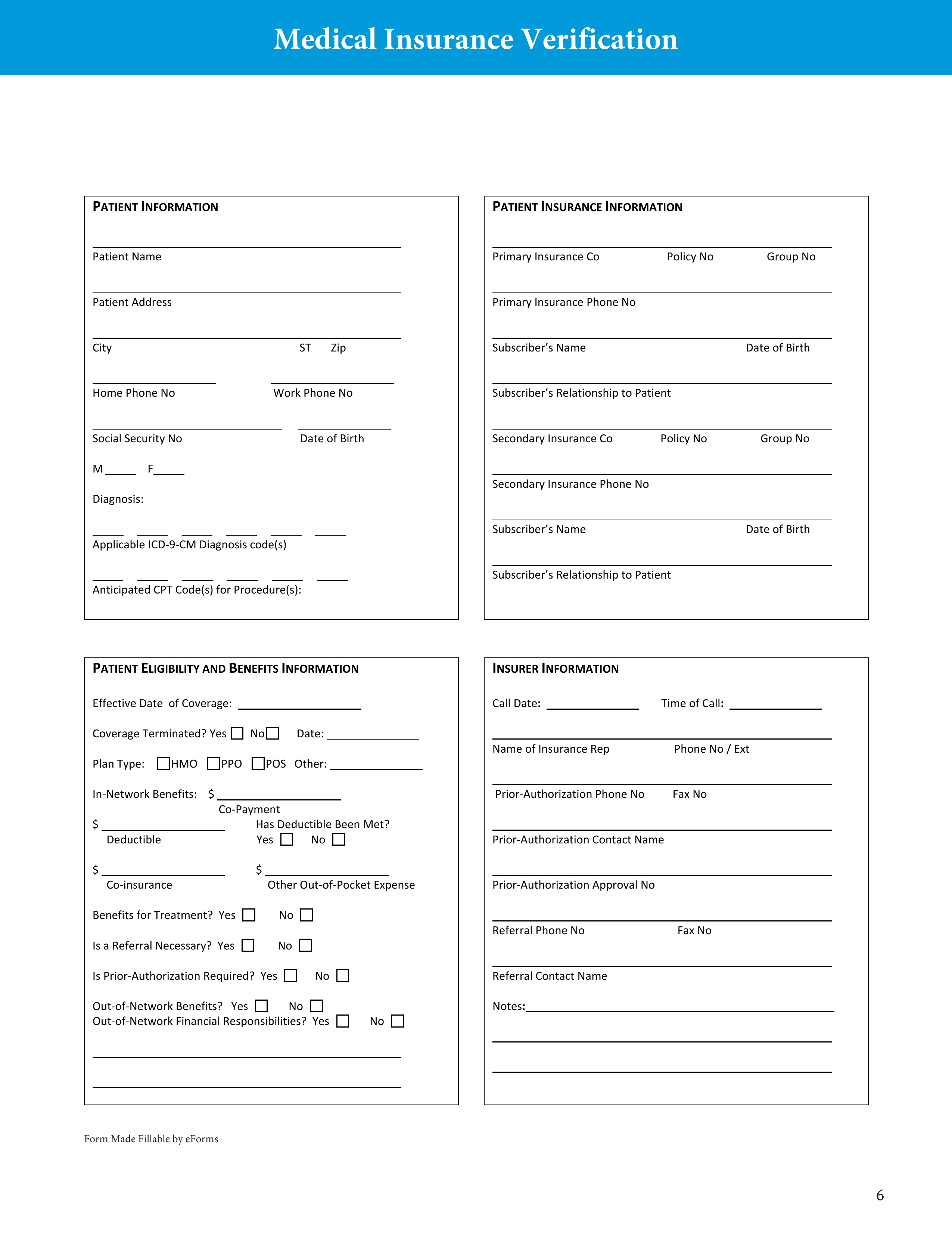

Fortunately, there are tools designed to streamline this process and bring much-needed transparency. A well-designed verification of benefits health insurance form template acts as a structured guide, ensuring that all the necessary questions are asked and all critical information is recorded accurately. This not only empowers patients with knowledge but also equips providers with the details they need for efficient billing and service delivery.

Understanding the Verification of Benefits (VOB) Process

A Verification of Benefits, often shortened to VOB, is essentially a detailed inquiry into a patient’s health insurance coverage. It involves contacting the insurance carrier to confirm the specifics of a policy, including what services are covered, what the patient’s financial responsibilities will be, and any limitations or exclusions that might apply. This step is particularly vital for healthcare providers who need to ensure they will be reimbursed for services rendered, and for patients who want to avoid unexpected out-of-pocket costs.

For providers, performing a VOB helps them understand a patient’s financial obligation upfront, allowing them to collect co-pays, deductibles, or co-insurance at the time of service, which greatly improves their revenue cycle. For patients, knowing their benefits beforehand means they can make informed decisions about their care, understand their financial liability, and budget accordingly, rather than being surprised by a large bill weeks or months later. It removes a significant layer of anxiety associated with medical treatments.

The information gathered during a VOB can be extensive, covering everything from basic policy details to very specific coverage for particular procedures or therapies. It’s not just about confirming active coverage; it’s about delving into the nuances of the plan that could significantly impact the cost of care. Without this detailed understanding, both parties are operating with incomplete information, which often leads to costly errors and disputes.

Key Information Typically Found in a VOB

- Patient’s full name and date of birth

- Subscriber’s full name and date of birth (if different from patient)

- Insurance company name and contact information

- Policy number and group number

- Effective date of coverage

- Deductible amount (individual and family, met/remaining)

- Co-pay amounts (for different types of visits, e.g., primary care, specialist, urgent care)

- Co-insurance percentage

- Out-of-pocket maximum (individual and family, met/remaining)

- In-network and out-of-network benefits

- Coverage for specific services or procedures (e.g., therapy, diagnostics, surgery)

- Referral or authorization requirements

- Benefit limitations or exclusions

- Claims mailing address

Having a clear record of these details on a standardized form helps in preventing billing errors and provides a solid reference point should any discrepancies arise later. It transforms a potentially confusing phone call into a structured, verifiable data set.

Crafting and Utilizing an Effective Verification of Benefits Health Insurance Form Template

Using a standardized verification of benefits health insurance form template can significantly enhance the efficiency and accuracy of this crucial administrative task. Instead of ad-hoc calls and scribbled notes, a template ensures consistency in the information collected, reduces the chance of overlooking important details, and provides a clear, organized record for future reference. For busy medical practices, it means faster processing and fewer errors, while for individuals, it offers a tangible document of their coverage.

When developing or selecting a template, consider including fields for all the key information discussed above, plus areas for the date of inquiry, the name of the insurance representative contacted, and a reference number for the call. This documentation proves invaluable if there’s ever a dispute about what was verified. The template should also be easy to read and fill out, whether it’s a digital form or a printable document.

Effective utilization of the template involves more than just filling it out. It requires a systematic approach, often starting with the patient’s initial intake to gather basic insurance information, followed by a dedicated process to contact the insurer. For complex cases, multiple calls or follow-ups might be necessary, and the template provides a clear framework to track these interactions and progressively build a comprehensive picture of the benefits.

To ensure the highest level of accuracy and avoid misunderstandings, always double-check the information received from the insurance company. It is good practice to ask open-ended questions and confirm specific details. For instance, rather than just noting “therapy is covered,” ask “Is X type of therapy covered for Y condition, and are there any visit limits or pre-authorization requirements?” Recording these specific answers on your verification of benefits health insurance form template will prevent future headaches.

Ultimately, a robust system for verifying benefits, supported by a comprehensive template, empowers both patients and providers. It transforms a potentially stressful and opaque process into a clear, predictable, and manageable step in healthcare delivery. This foresight leads to greater financial transparency, fewer billing surprises, and a more positive healthcare experience for everyone involved.