Understanding someone’s income is a crucial step in countless situations, whether you’re a landlord trying to secure a reliable tenant, a lender assessing a loan application, or even an employer verifying a candidate’s previous salary claims. It’s all about ensuring trust and making informed decisions. Income verification provides that essential layer of assurance, helping to mitigate risks and establish financial stability for all parties involved.

However, the process of verifying income can often feel cumbersome and time-consuming if you don’t have a standardized approach. This is where a well-designed verification of income form template comes into play. It streamlines the information gathering, ensures consistency, and makes the entire procedure far more efficient for both the verifier and the individual whose income is being checked.

Why Verifying Income Is So Important

Income verification isn’t just a bureaucratic hurdle; it’s a fundamental safeguard across various sectors. For instance, when you’re looking to rent out a property, you want to be confident that your prospective tenant can consistently meet their monthly rent obligations. Without proper verification, you’re essentially taking a leap of faith, which can lead to significant financial headaches down the line if the tenant’s actual income doesn’t match their claims.

Similarly, financial institutions rely heavily on income verification before approving loans, mortgages, or lines of credit. Their ability to assess a borrower’s capacity to repay directly depends on accurate income information. This process helps them determine appropriate loan amounts, interest rates, and overall risk levels, protecting both the lender from potential defaults and the borrower from taking on unmanageable debt.

Beyond finance and housing, employers often verify income or salary history during the hiring process, especially for roles where compensation is tied to previous earnings or where a certain financial background is relevant. Government agencies also frequently require income verification for eligibility into various social assistance programs, ensuring that benefits are directed to those who truly meet the specific criteria based on their financial need.

Having a clear, standardized process for this verification ensures fairness and transparency. It also helps prevent fraud and misrepresentation, ensuring that decisions are based on solid, verifiable facts rather than assumptions. This is where the right tools become invaluable, allowing for a smooth and defensible process.

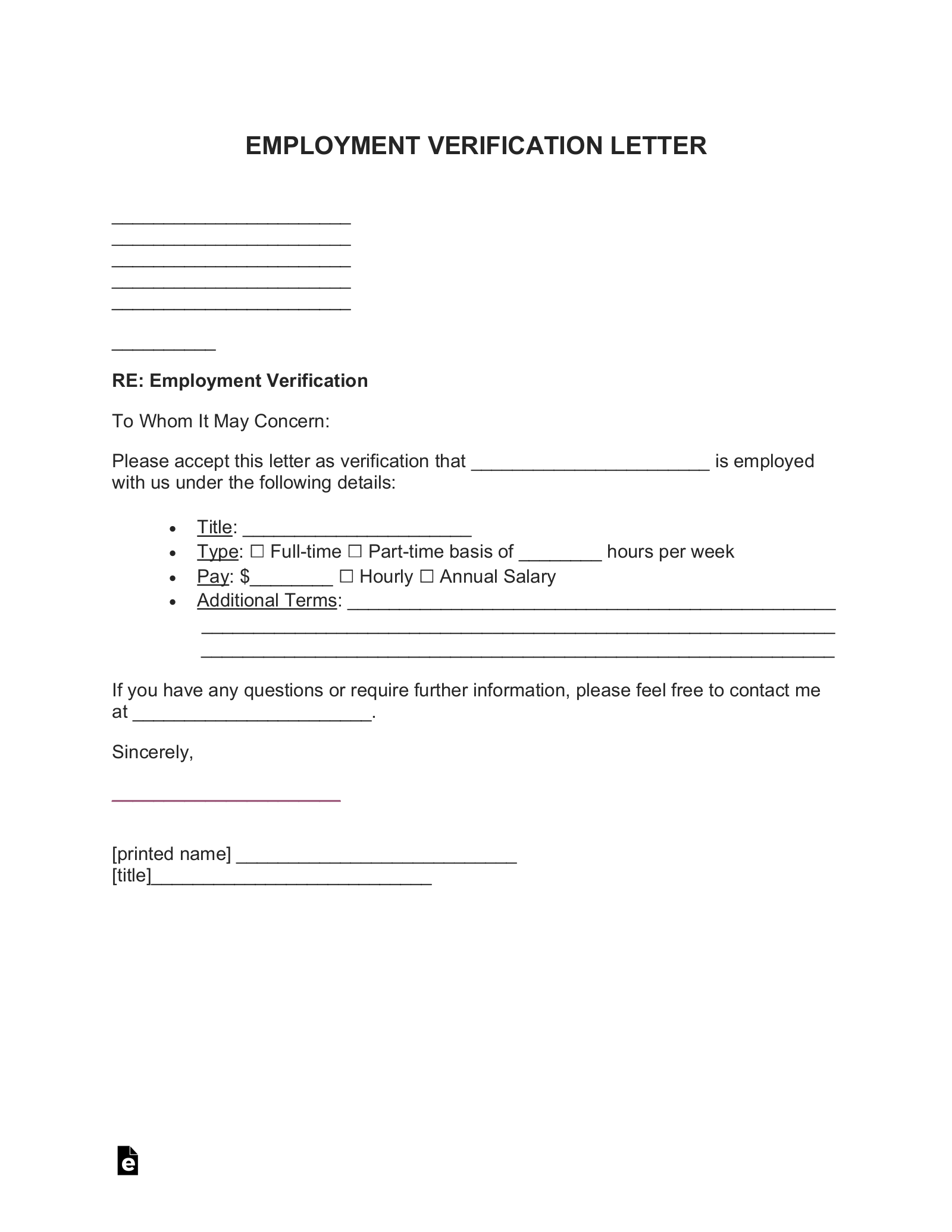

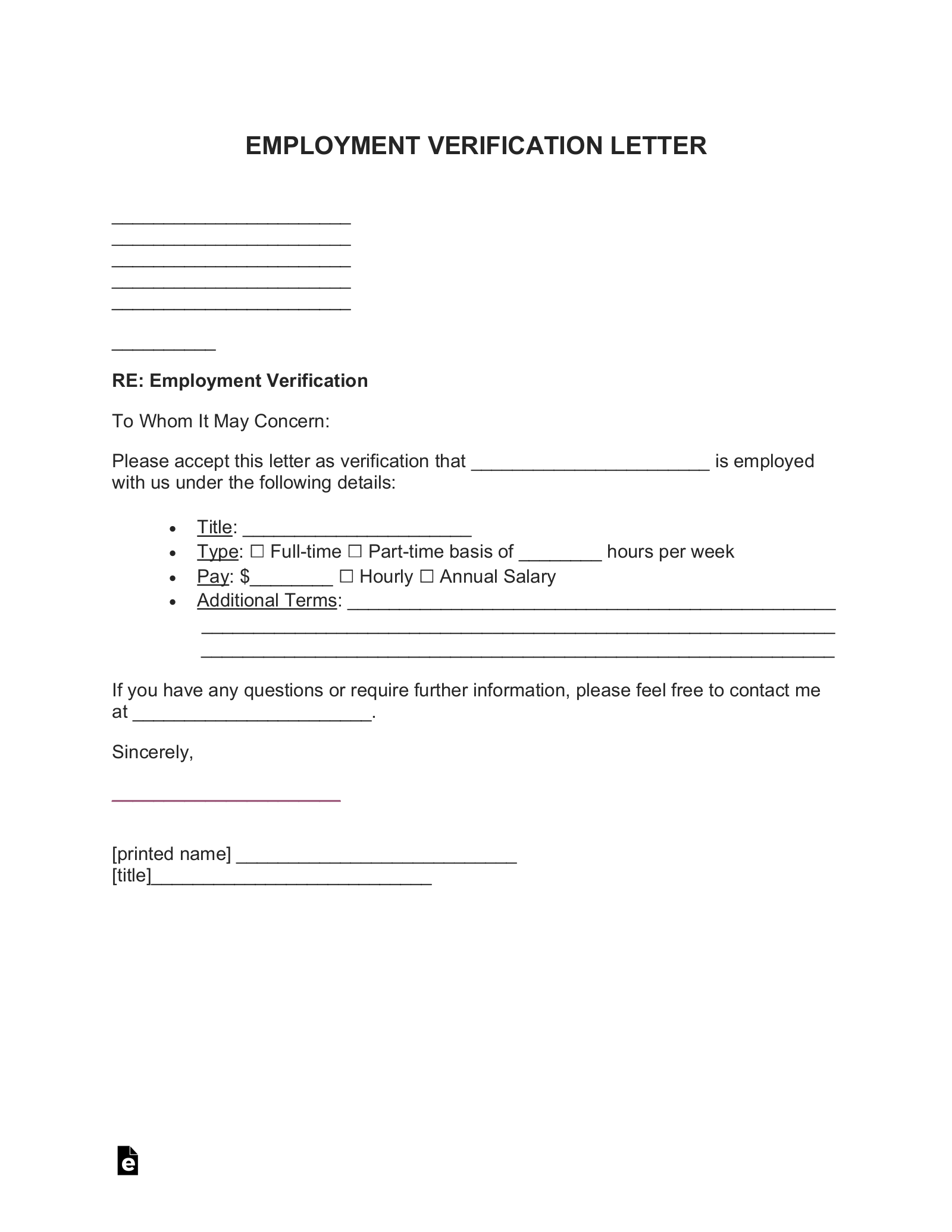

Key Elements of an Effective Income Verification Form

- Applicant’s personal details: Full name, contact information, and perhaps a social security number or ID for clear identification.

- Employer or income source details: Company name, address, contact person, and phone number, allowing for direct verification.

- Consent for verification: A clear statement signed by the applicant, authorizing the verifier to contact their employer or financial institution.

- Declaration of accuracy: A space for the applicant to attest that the information provided is true and accurate to the best of their knowledge.

How a Well-Designed Template Can Simplify the Process

Imagine having to draft a new income verification request from scratch every single time you needed one. It would be incredibly time-consuming, prone to errors, and lack consistency. This is precisely why a pre-made, thoughtfully designed verification of income form template is such a powerful tool. It provides a consistent framework, ensuring all necessary information is requested and captured every single time, without fail.

Using a template drastically cuts down on administrative time. Instead of spending precious minutes or hours formulating questions, you simply fill in the blanks or provide the template to the relevant parties. This efficiency benefit extends to the party providing the income information as well, as they know exactly what data points are required, leading to fewer back-and-forth communications and faster turnaround times.

Furthermore, a template lends a professional air to your process. It demonstrates that you have a structured and serious approach to due diligence, which can instill greater confidence in applicants and third parties alike. When a clear, consistent form is used, it reduces confusion and ensures that all parties understand their role in providing or verifying the necessary financial data.

The beauty of a robust verification of income form template is its adaptability. While a basic template serves most general purposes, it can often be customized to fit specific needs, whether you’re a small business, a large property management company, or a non-profit organization. You can add specific fields relevant to your unique situation, ensuring that the template evolves with your requirements while maintaining its core efficiency.

- Clarity and simplicity: Easy-to-understand language and a straightforward layout prevent confusion.

- Comprehensive fields: Ensures all essential data points are included for thorough verification.

- Legal compliance: Designed to meet common legal and privacy standards, minimizing risks.

- User-friendly format: Allows for easy completion by the applicant and efficient processing by the verifier.

Ultimately, a streamlined approach to income verification is beneficial for everyone involved. It builds a foundation of trust and transparency, ensuring that critical decisions—be they about housing, loans, or employment—are made on solid, verifiable financial ground. This not only protects the interests of those requiring the verification but also provides clarity and a fair process for those being asked to share their financial details.

Embracing efficient tools and standardized procedures for tasks like income verification means less time spent on administrative overhead and more time focusing on core objectives. It’s about creating a smooth, reliable system that supports sound decision-making and fosters positive relationships built on clarity and mutual understanding.