Navigating the world of rental applications, mortgage approvals, or even housing assistance programs often brings you face-to-face with a crucial document: the verification of rents form. This seemingly simple piece of paper plays a monumental role, acting as a bridge of trust and transparency between various parties. Whether you’re a prospective tenant trying to prove your reliability, a landlord vetting a new applicant, or a lender assessing a loan, having accurate and verifiable rental history is absolutely essential.

Without a clear and official record of someone’s past rent payments, it becomes incredibly difficult to make informed decisions. This is where a well-designed verification of rents form template steps in, simplifying the process for everyone involved. It ensures that all necessary information is collected systematically, reducing potential misunderstandings and speeding up what can often be a time-consuming administrative task.

Why Is a Verification of Rents Form So Important?

A verification of rents form serves as a cornerstone for due diligence in countless situations. For new landlords, it’s an invaluable tool for tenant screening, providing concrete evidence of an applicant’s financial responsibility and reliability. Instead of just taking an applicant’s word, this form allows you to directly confirm their payment habits with a previous landlord, giving you peace of mind that your future rent checks will arrive on time. It helps paint a picture of their tenancy, including how they maintained the property and their overall relationship with their landlord.

Beyond individual landlord-tenant relationships, these forms are critical in the financial sector. When someone applies for a mortgage, whether it’s for their first home or a refinancing, lenders often require proof of consistent rental payments. This history serves as an indicator of their ability to manage monthly housing costs, which is a significant factor in determining loan eligibility and terms. It’s a way for lenders to assess risk and ensure that borrowers have a proven track record of meeting their financial obligations.

Furthermore, governmental housing assistance programs, such as Section 8, or other community-based support initiatives frequently rely on these forms. They need to verify current and past rental expenses to accurately determine eligibility and the level of assistance an individual or family might qualify for. This ensures fairness and proper allocation of resources, making sure that aid goes to those who genuinely need it and have a verifiable housing situation.

Key Benefits of Using a Rent Verification Form

- Ensures accurate financial assessment for applicants and tenants.

- Reduces risk for landlords and lenders by providing documented history.

- Streamlines application processes, making them quicker and more efficient.

- Provides concrete, third-party proof of an individual’s rental history and payment habits.

- Helps prevent fraudulent claims and misrepresentations.

What Should Your Verification of Rents Form Template Include?

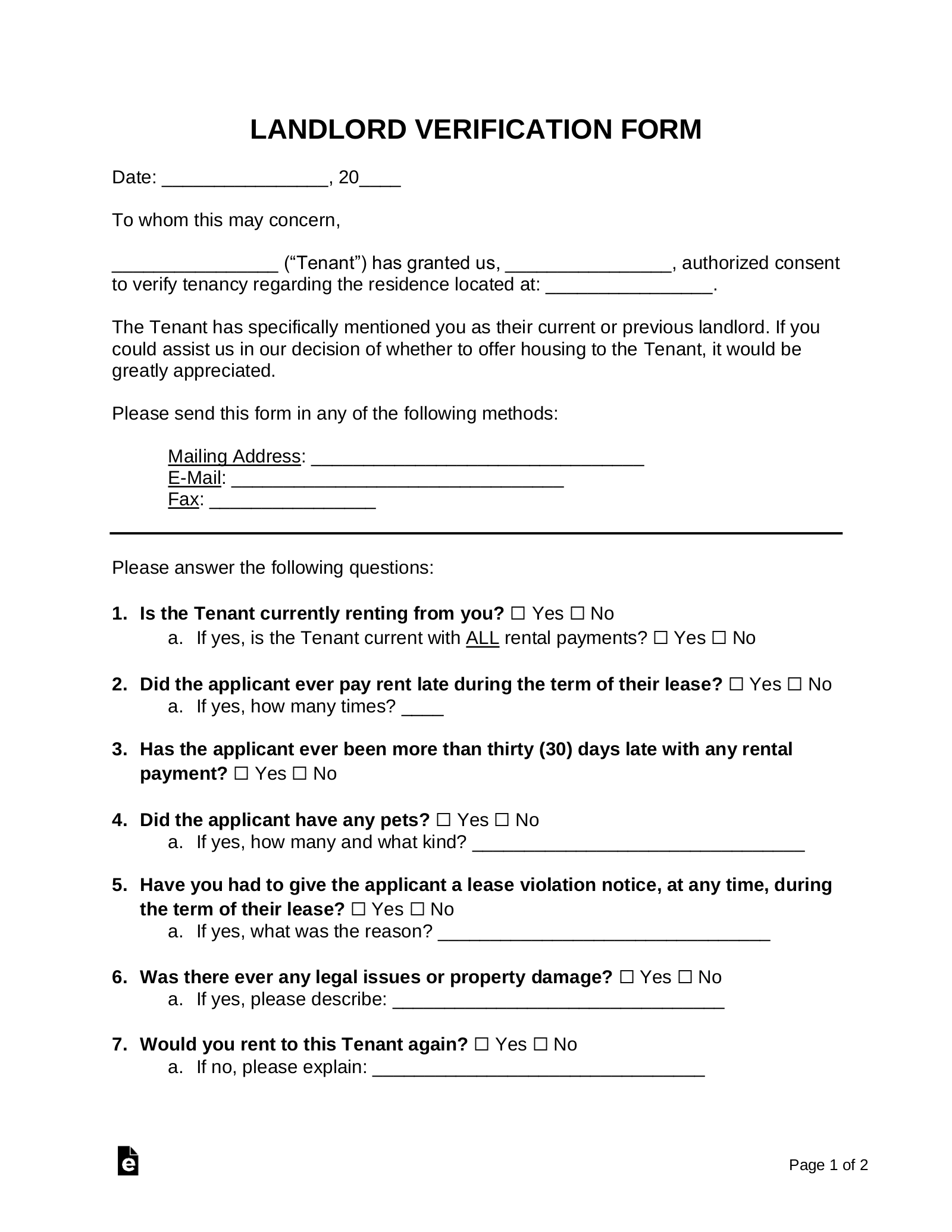

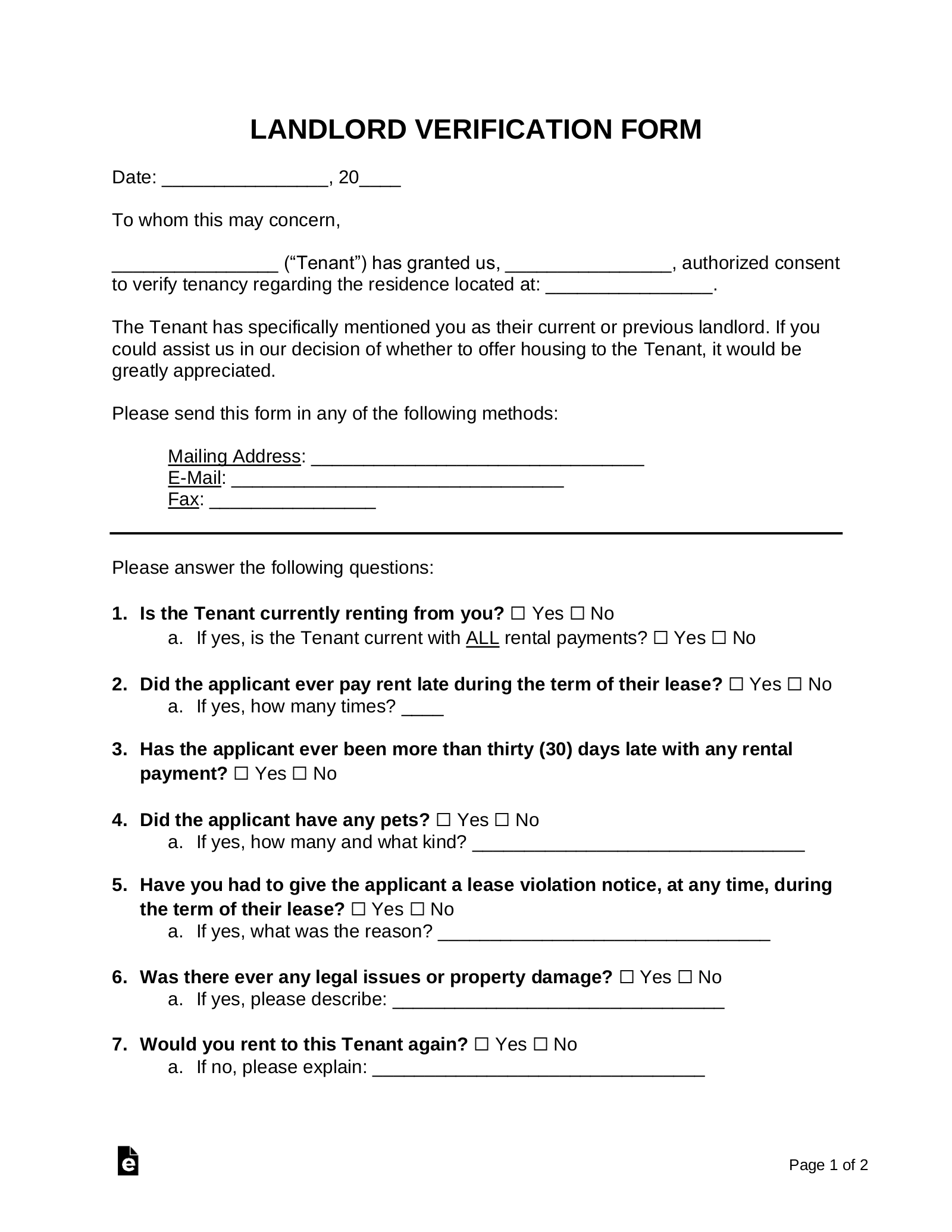

When creating or choosing a verification of rents form template, it’s vital to ensure it captures all the necessary information to make an informed decision. A comprehensive template typically begins with identifying information for the tenant whose history is being verified. This includes their full legal name, current and previous addresses they’ve rented, and contact details to ensure there’s no confusion about who the form pertains to.

Equally important are the details of the previous landlord or property management company. The form should clearly ask for their name, the name of the property or company, and their contact information, including phone number and email address. This allows the requesting party to easily follow up if any further clarification is needed, ensuring the verification process is smooth and efficient. Consent from the tenant to release this information is also a crucial legal component.

The core of the form, of course, revolves around the rental details themselves. This means specifying the exact period of tenancy, the monthly rent amount, and how frequently payments were due. It’s also crucial to include sections for the landlord to report on payment history – whether payments were consistently on time, if there were any late payments, and if so, how many. Any outstanding balances or past due amounts should also be clearly noted to provide a complete financial picture.

Finally, a robust verification of rents form template should include questions about the tenant’s overall conduct during their tenancy. This can cover aspects like property maintenance, adherence to lease terms, any complaints received, and whether they left the property in good condition. Signature lines for the previous landlord, the tenant, and the requesting party are essential to confirm the authenticity and agreement of the information provided, adding a layer of security and official recognition to the document.

- Tenant’s Full Name and Contact Information

- Property Address Being Verified

- Landlord’s Full Name and Contact Information (Previous and Current)

- Lease Start and End Dates

- Monthly Rent Amount and Payment Frequency

- Payment History (on-time, late payments, outstanding balances, evictions)

- Any Damages or Issues Reported During Tenancy

- Reason for Vacating (if applicable)

- Landlord’s Overall Recommendation for Future Landlords

- Signature Lines for All Parties (Tenant’s Consent, Previous Landlord, Requesting Party)

Utilizing a standardized verification of rents form template significantly simplifies and strengthens the process of assessing an individual’s rental history. It provides a clear, structured way to gather essential information, which is invaluable whether you’re a landlord, a lender, or part of a housing authority. This consistency helps to ensure fairness, accuracy, and efficiency in all housing-related transactions.

Having a reliable template at your disposal means you can make decisions with greater confidence, knowing you have a verified account of past rental performance. It’s a foundational document for fostering trust and ensuring smooth transitions in the dynamic world of property management and personal finance.