Utilizing a standardized structure for organizing financial data related to a prepaid card offers several advantages. It promotes clarity and consistency, simplifying the process of reviewing transactions and identifying spending patterns. This structured approach can also be beneficial for tax purposes, providing an organized record of income and expenses. Furthermore, it can facilitate the early detection of potential errors or unauthorized transactions.

The subsequent sections will delve deeper into the practical application of such structured record-keeping, exploring how it can contribute to improved financial management and provide a clear overview of transaction history for prepaid card users.

1. Structure and Format

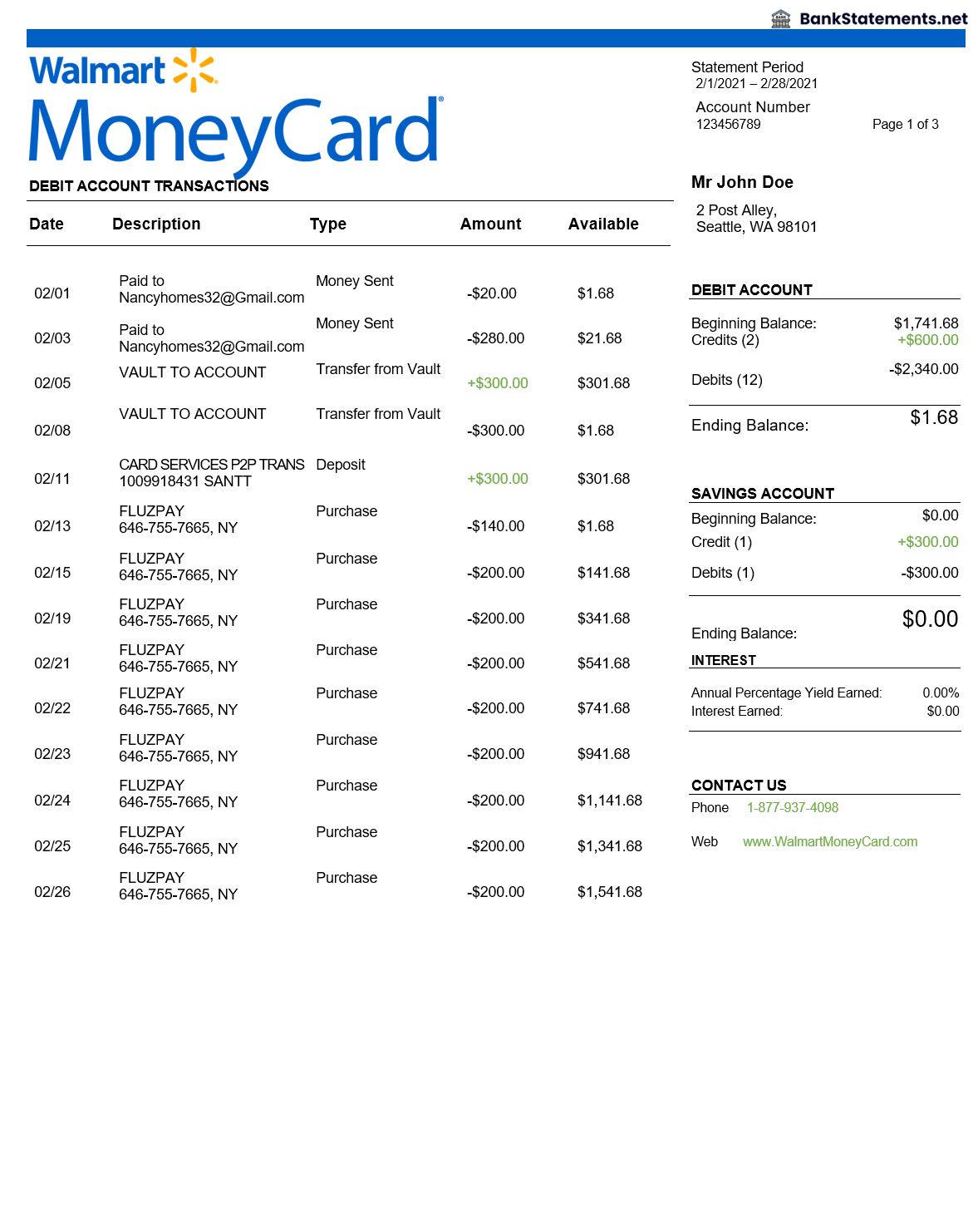

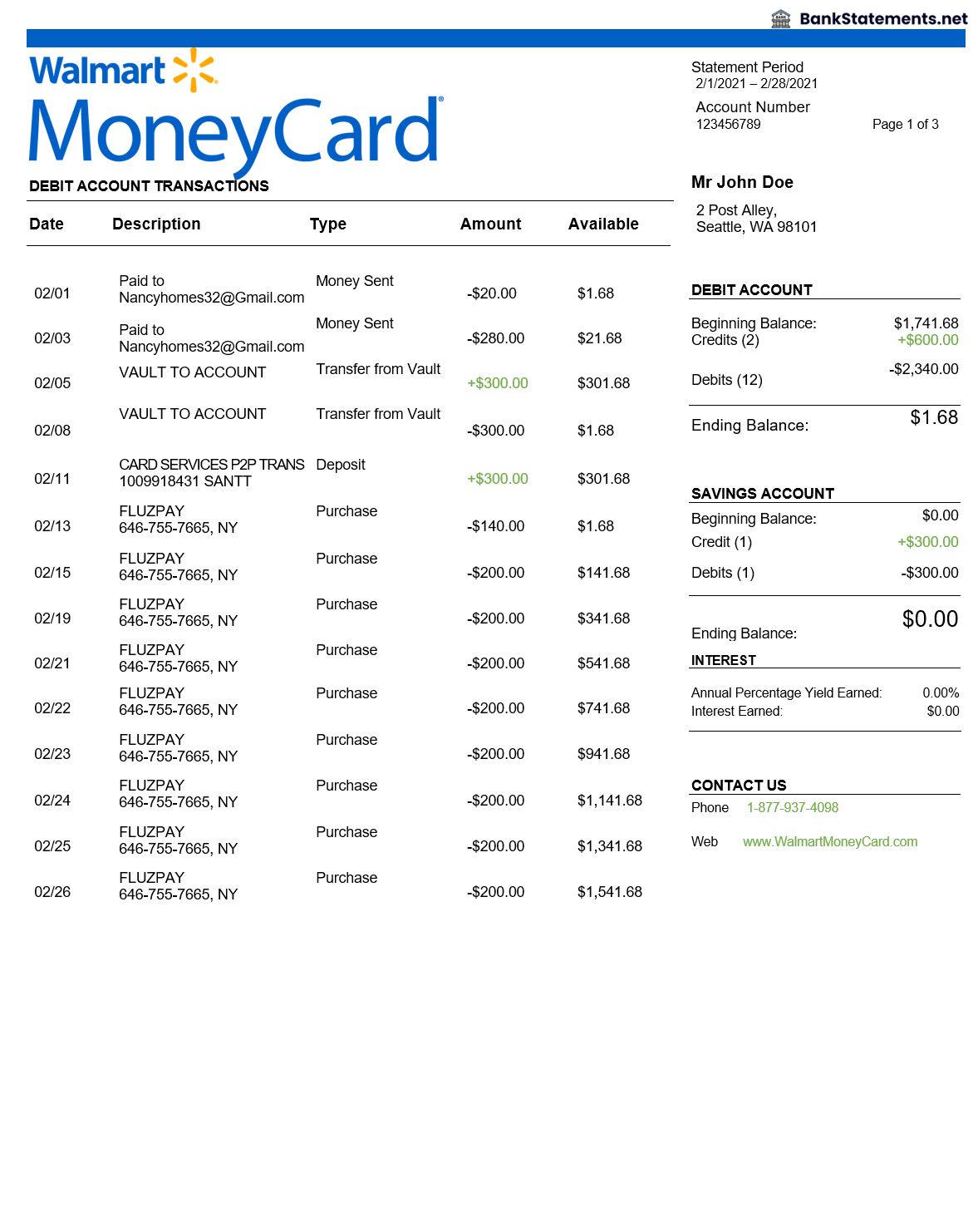

The structure and format of a document designed to mirror a bank statement for a prepaid debit card are critical for clarity and usability. A well-designed template typically employs a tabular format, organizing information into columns for date, description, transaction type (debit or credit), and amount. This standardized structure ensures consistency, making it easy to review transactions and track spending over time. A clear format also facilitates the identification of specific transactions, such as purchases, deposits, or fees. For example, a consistent date format (e.g., MM/DD/YYYY) eliminates ambiguity and supports accurate record-keeping. Clear labeling of columns and the use of consistent terminology for transaction descriptions further enhance readability and comprehension.

The logical flow of information within the template is also crucial. Typically, transactions are presented chronologically, starting with the oldest and progressing to the most recent. This chronological order provides a clear timeline of account activity, simplifying the process of reconciling transactions and identifying trends. Furthermore, a well-designed template often includes sections for beginning and ending balances, as well as a summary of total debits and credits for the statement period. This summarized information allows for a quick overview of account activity and facilitates the reconciliation process with personal records. Consider a scenario where an individual needs to track expenditures related to a specific project. A well-structured template allows for easy identification and summation of relevant transactions, providing a clear picture of project-related spending.

A consistent and logical structure and format are essential for effective financial management. These elements facilitate accurate record-keeping, simplify analysis, and contribute to a better understanding of spending habits. Challenges can arise when information is presented inconsistently or without a clear structure. This can lead to difficulties in tracking expenses, identifying errors, and managing budgets effectively. Therefore, a well-designed template serves as a valuable tool for maintaining accurate financial records and promoting sound financial practices.

2. Transaction Details

Transaction details within a document designed to resemble a bank statement for a prepaid debit card are crucial for comprehensive financial oversight. These details typically include the date and time of the transaction, a description of the purchase or transaction type, and the amount involved. The specificity of these details allows users to understand where their funds are being spent. For example, a transaction description might indicate a purchase at a specific retailer, an online payment, or an ATM withdrawal. This granular information facilitates accurate budgeting and expense tracking. The date and time stamp provide context and allow users to reconstruct their spending activity chronologically. For instance, identifying recurring transactions on specific days can reveal subscription services or regular expenses. This information empowers users to make informed decisions about their spending habits.

The availability of comprehensive transaction details is directly related to the efficacy of a structured financial record-keeping system. Without specific details, it becomes challenging to analyze spending patterns and identify areas for potential savings. Consider a scenario where a user notices a significant decrease in their available balance. Detailed transaction information allows them to pinpoint the source of the expenditure, whether it’s a series of small purchases or a single large transaction. This understanding is crucial for effective budget management and financial planning. Furthermore, detailed transaction records can be invaluable for dispute resolution. In the event of an unauthorized transaction or an incorrect charge, having specific details readily available simplifies the process of contacting customer service and resolving the issue. This level of detail provides the necessary evidence to support claims and rectify errors.

In summary, detailed transaction information forms the cornerstone of effective financial management when using prepaid debit cards. The ability to review specific dates, times, descriptions, and amounts for each transaction empowers users to understand their spending habits, identify potential issues, and maintain accurate financial records. Challenges arise when transaction details are incomplete or unavailable. This lack of information can hinder accurate budgeting, complicate dispute resolution, and obscure spending patterns. Therefore, access to comprehensive transaction details is essential for informed financial decision-making and responsible money management.

3. Balance Information

Balance information is a critical component of a document designed to emulate a bank statement for a prepaid debit card. This information typically includes the starting balance at the beginning of the statement period, the ending balance at the close of the period, and a running balance that updates after each transaction. The starting balance provides a reference point for tracking spending and income. The ending balance reflects the remaining available funds. The running balance offers a dynamic view of how funds fluctuate throughout the statement period, reflecting the impact of each individual transaction. This allows users to monitor spending in real-time and avoid overdraft situations. For instance, if a user has a starting balance of $500, makes a purchase of $50, and then receives a deposit of $100, the running balance will reflect these changes sequentially: $500, $450, and $550. This granular tracking facilitates better budget management.

The relationship between balance information and a structured record of transactions is essential for accurate financial management. The running balance links each transaction to the overall available funds, creating a clear picture of how individual expenditures affect the overall balance. This facilitates analysis of spending habits and allows users to identify trends. For example, consistently low ending balances might indicate a need for budget adjustments. Conversely, consistently increasing balances could suggest opportunities for saving or investing. Consider a scenario where a user budgets $200 for groceries each month. By monitoring the running balance after grocery purchases, they can readily assess whether they are staying within their budget. This immediate feedback is crucial for maintaining financial control.

Accurate and readily accessible balance information is paramount for effective financial planning. Challenges arise when balance information is inaccurate, outdated, or difficult to access. This can lead to overspending, missed bill payments, and difficulty in managing finances effectively. A well-designed template ensures that balance information is clearly presented, easily understood, and readily available, empowering users to make informed financial decisions and maintain healthy financial habits. Without clear balance information, it becomes difficult to reconcile transactions, track spending, and maintain control over one’s finances. Therefore, clear and accurate balance information is a fundamental component of effective personal financial management using prepaid debit cards.

4. Period Covered

The “Period Covered” designates the specific timeframe represented within a document structured like a bank statement for a prepaid debit card. This defined period, often a month or a custom date range, provides boundaries for the financial activity documented within the statement. Understanding the period covered is essential for accurate financial analysis and reconciliation. It allows users to isolate transactions within a specific timeframe, facilitating budgeting, expense tracking, and the identification of spending patterns. For example, analyzing the period covering the holiday season might reveal increased spending on gifts or travel, while reviewing a statement covering a typical month provides insights into regular recurring expenses. This defined timeframe ensures that financial analysis remains focused and relevant to the specific period under review.

The period covered forms an integral component of a structured financial record. It provides the temporal context for all transactions listed within the statement. This context is crucial for identifying trends, analyzing spending habits, and comparing financial activity across different time periods. For instance, comparing the total expenditures within one month to the next allows users to identify fluctuations in spending and adjust budgets accordingly. Furthermore, the period covered is essential for tax purposes, as it allows users to easily locate and summarize transactions relevant to a specific tax year or reporting period. Consider a freelancer who needs to track business expenses. By reviewing statements covering the relevant fiscal periods, they can readily compile the necessary information for tax reporting. This clear delineation of time periods simplifies financial organization and ensures accurate record-keeping.

Accurate specification of the period covered is crucial for maintaining organized financial records. Challenges can arise when the period covered is unclear or inconsistent. This ambiguity can complicate financial analysis, hinder accurate budgeting, and create difficulties in reconciling transactions. Therefore, a clearly defined period covered is a fundamental element of a well-structured financial record, providing the necessary temporal context for effective financial management. Without a clear understanding of the period covered, it becomes difficult to draw meaningful conclusions about spending habits, identify trends, or manage finances effectively. Therefore, accurate and consistent use of the period covered is essential for responsible financial record-keeping and informed financial decision-making.

5. Personal Record Keeping

Personal record keeping, facilitated by a structured document resembling a bank statement for a prepaid debit card, forms a cornerstone of sound financial management. This practice involves diligently maintaining a comprehensive record of all transactions, including purchases, deposits, fees, and any other activity affecting the card’s balance. A template provides a standardized framework for organizing this information, ensuring consistency and accuracy. This organized approach allows individuals to track spending habits, identify potential budgeting issues, and maintain a clear overview of their financial activity. For example, if an individual uses their prepaid card for both personal and business expenses, meticulous record keeping using a template allows for easy separation and categorization of these transactions, simplifying tax reporting and financial analysis. This practice empowers individuals to understand where their money is going, make informed financial decisions, and avoid potential overspending.

The symbiotic relationship between personal record keeping and a structured financial template enhances financial control. The template provides the structure, while personal diligence in recording transactions provides the substance. This synergy enables individuals to identify recurring expenses, anticipate upcoming bills, and monitor spending against a budget. For instance, tracking grocery expenses within a template can reveal spending patterns and highlight potential areas for savings. This level of detail allows for proactive budget adjustments and facilitates more informed financial planning. Furthermore, maintaining comprehensive records simplifies the process of identifying and resolving discrepancies or errors. Should a transaction appear inaccurate or unauthorized, readily available records provide the necessary documentation to initiate a dispute resolution process.

In summary, meticulous personal record keeping, supported by a well-designed template, is essential for effective financial management. Challenges arise when record keeping is inconsistent or incomplete. This can lead to difficulty in tracking expenses, an inaccurate understanding of spending habits, and potential financial mismanagement. Consistent and accurate record keeping empowers individuals to take control of their finances, make informed decisions, and achieve financial stability. The structured approach offered by a template simplifies this process, providing a framework for organized record keeping and facilitating informed financial decision-making.

Key Components of a Walmart MoneyCard Bank Statement Template

Understanding the core components of a document designed to resemble a Walmart MoneyCard bank statement provides a foundation for effective financial management. These elements work together to present a comprehensive overview of account activity.

1. Transaction Date: This indicates when a specific transaction occurred, providing a chronological record of activity.

2. Transaction Description: This describes the nature of the transaction, such as a purchase, deposit, or fee. Specificity in descriptions, like merchant names, enhances clarity.

3. Transaction Amount: This specifies the monetary value of each transaction, clearly indicating debits and credits.

4. Running Balance: This displays the account balance after each transaction, providing a dynamic view of available funds.

5. Beginning and Ending Balance: These figures represent the account balance at the start and end of the statement period, providing a clear overview of net changes.

6. Statement Period: This specifies the date range encompassed by the statement, defining the timeframe for the recorded transactions.

7. Account Information: This typically includes the account holder’s name and the last four digits of the card number, ensuring clear identification of the account.

These components, when presented clearly and accurately, empower individuals to understand their spending habits, track available funds, and maintain organized financial records, facilitating effective budget management and financial planning.

How to Create a Walmart MoneyCard Bank Statement Template

Creating a document that mirrors the structure of a bank statement for a Walmart MoneyCard allows for organized tracking of transactions and balances. This process involves replicating key elements found in official bank statements, providing a clear and consistent framework for managing financial information related to the card.

1. Software Selection: Choose spreadsheet software (e.g., Microsoft Excel, Google Sheets) or a word processor with table functionality. Spreadsheet software offers greater flexibility for calculations and data manipulation.

2. Column Definition: Establish columns for “Date,” “Description,” “Debit,” “Credit,” and “Balance.” This structure mirrors standard bank statement formats, ensuring clarity and consistency.

3. Data Entry: Populate the template with transaction data obtained from the Walmart MoneyCard website or app. Ensure accurate entry of dates, descriptions, and amounts for each transaction. Precision in data entry is crucial for maintaining accurate records.

4. Balance Calculation: Starting with the initial balance, calculate the running balance after each transaction. For debits, subtract the transaction amount from the previous balance. For credits, add the transaction amount. This provides a dynamic view of available funds.

5. Period Specification: Clearly define the date range covered by the statement (e.g., “Statement Period: 2024-01-01 to 2024-01-31”). This provides context for the recorded transactions.

6. Account Identification: Include account holder name and the last four digits of the card number for clear identification. This helps link the template to the specific Walmart MoneyCard.

7. Format Consistency: Maintain consistent date and number formats throughout the document. Consistent formatting enhances readability and professionalism. For example, use a consistent date format (YYYY-MM-DD) and currency format.

8. Regular Updates: Regularly update the template with new transactions to maintain an accurate and current view of account activity. Regular updates prevent discrepancies and ensure the template remains a useful financial management tool.

A well-maintained template, consistently updated and accurately populated, empowers users to track spending, manage budgets, and maintain a clear overview of their Walmart MoneyCard activity. This structured approach provides valuable insights into financial habits and facilitates informed financial decision-making.

A structured approach to managing financial information, facilitated by a document mirroring the format of a bank statement for a Walmart MoneyCard, offers significant advantages for informed financial management. Key benefits include a clear overview of transactions, accurate balance tracking, and simplified budgeting. Consistent use of such a template enables detailed analysis of spending habits, identification of potential areas for savings, and proactive management of available funds. The structured format also simplifies tax reporting and facilitates efficient dispute resolution. Accurate data entry and regular updates are essential for maximizing the template’s effectiveness.

Effective financial management requires a proactive and organized approach. Leveraging structured tools, such as a well-maintained bank statement template, empowers individuals to take control of their finances and make informed decisions. This practice fosters financial awareness, promotes responsible spending habits, and contributes to long-term financial well-being. The consistent application of organized financial management principles, supported by appropriate tools and resources, is crucial for navigating the complexities of personal finance and achieving financial goals.