Utilizing such a structure promotes consistency, accuracy, and efficiency in the reporting process. It simplifies complex data into a digestible format for stakeholders, including investors, lenders, and management, facilitating informed decision-making. Standardized reporting also allows for year-over-year comparisons, enabling trend analysis and performance evaluation.

Understanding the components and benefits of structured financial reporting is crucial for effective financial management. The following sections will explore specific aspects of the reporting process in greater detail, including best practices, common challenges, and available resources.

1. Standardized Structure

A standardized structure is fundamental to the efficacy of year-end financial statement templates. Consistency in presentation allows for efficient analysis and comparison, both within a single reporting period and across multiple years. This structure facilitates understanding for stakeholders and streamlines the auditing process.

- Balance Sheet ConsistencyThe balance sheet consistently presents assets, liabilities, and equity in a specific order. This allows for rapid assessment of an organization’s financial position. For example, current assets are always listed before non-current assets, providing a clear view of short-term liquidity. This standardized presentation is crucial for comparing balance sheets across different reporting periods.

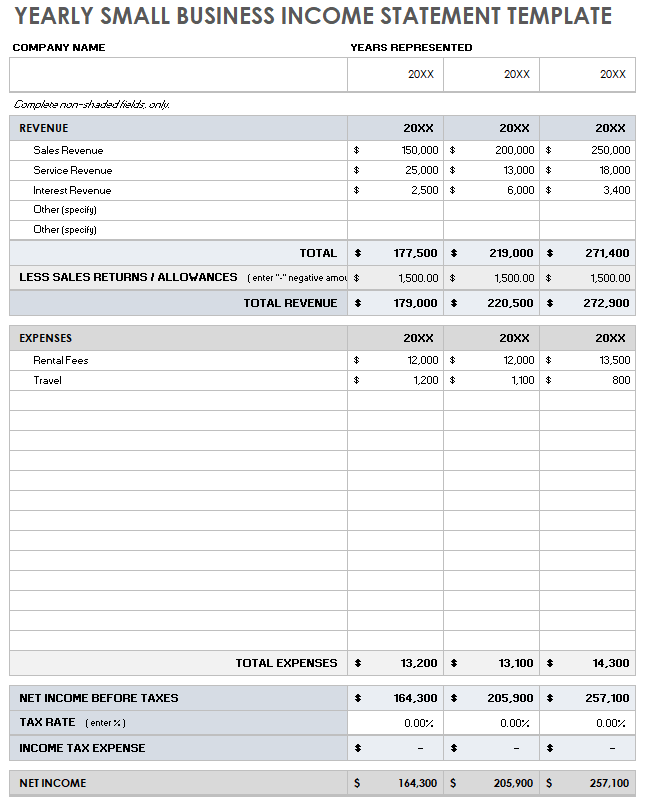

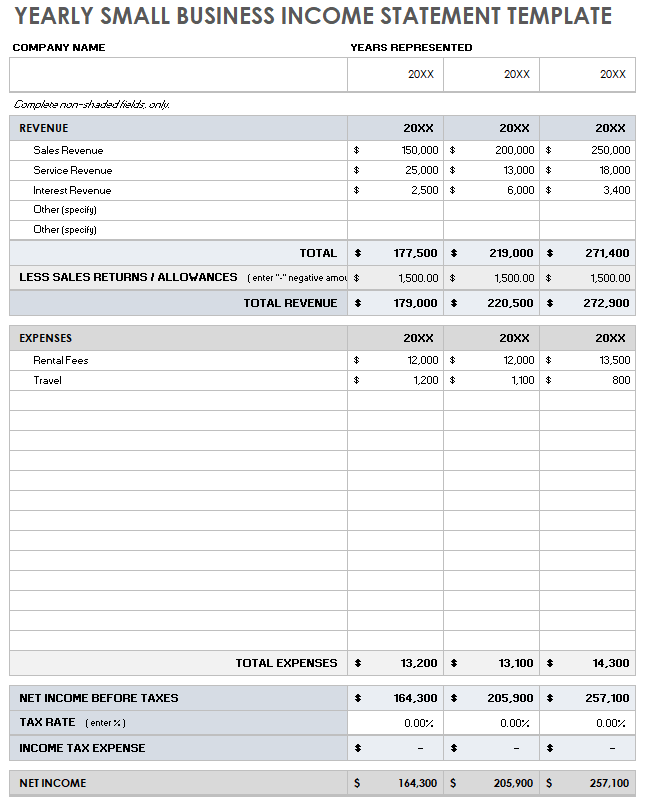

- Income Statement UniformityThe income statement adheres to a standardized format, presenting revenues, expenses, and net income (or loss) in a consistent manner. This facilitates the calculation of key profitability metrics, such as gross profit margin and net profit margin. Uniformity allows analysts to readily compare performance across different periods and against industry benchmarks.

- Statement of Cash Flows StructureThe statement of cash flows consistently categorizes cash flows into operating, investing, and financing activities. This structured approach provides insights into the sources and uses of cash within an organization. The standardized format enables analysis of cash flow trends and identification of potential liquidity issues.

- Notes to the Financial Statements FormatThe notes accompanying the financial statements follow a standardized format, providing detailed explanations and disclosures related to the information presented in the main statements. This consistent approach ensures transparency and facilitates a comprehensive understanding of the financial reporting package.

The standardized structure inherent in these templates ensures comparability and transparency, contributing significantly to the overall effectiveness of financial reporting. This consistency is crucial for stakeholders to make informed decisions based on a clear and reliable presentation of financial data.

2. Pre-built Formulas

Pre-built formulas are integral to year-end financial statement templates, automating calculations and ensuring accuracy. These formulas, embedded within the template, streamline the reporting process, reducing manual data entry and minimizing the risk of human error. This automation is crucial for efficient and reliable financial reporting.

- Automated Calculation of Key Financial MetricsTemplates often include formulas for calculating key metrics like gross profit, net income, and earnings per share. For instance, a gross profit formula automatically calculates the difference between revenue and the cost of goods sold. This automation eliminates manual calculations, saving time and ensuring accuracy in reported figures.

- Simplified Ratio AnalysisPre-built formulas can automate the calculation of financial ratios, such as current ratio, debt-to-equity ratio, and return on assets. These ratios provide valuable insights into an organization’s financial health and performance. Automated calculation ensures consistency and accuracy in ratio analysis, enabling informed decision-making.

- Interconnected Formulas for Dynamic UpdatesFormulas within the template are often interconnected, allowing for dynamic updates. Changes to one value automatically trigger recalculations in related formulas. For example, adjusting the cost of goods sold automatically updates the gross profit and net income figures. This interconnectedness ensures data integrity and reduces the risk of inconsistencies.

- Error Reduction and Improved AccuracyBy automating calculations, pre-built formulas significantly reduce the potential for human error. Manual data entry and calculations are prone to mistakes, which can have significant implications for financial reporting. Automated formulas minimize this risk, improving the overall accuracy and reliability of the financial statements.

The incorporation of pre-built formulas within year-end financial statement templates is essential for efficient and accurate reporting. This automation streamlines the process, reduces errors, and provides valuable insights into financial performance. By leveraging these pre-built calculations, organizations can ensure the reliability and integrity of their financial reporting, facilitating informed decision-making by stakeholders.

3. Automated Calculations

Automated calculations are a cornerstone of efficient and accurate year-end financial statement preparation. Leveraging pre-built formulas within a template environment streamlines the reporting process, minimizes manual intervention, and reduces the risk of errors. This automation significantly enhances the reliability and integrity of financial data, facilitating informed decision-making based on accurate insights.

- Formula-Driven CalculationsTemplates incorporate formulas for key financial metrics, such as net income, gross profit margin, and return on equity. These formulas automatically calculate values based on inputted financial data, eliminating manual calculations and reducing the likelihood of errors. For example, the cost of goods sold is automatically subtracted from revenue to calculate gross profit.

- Real-Time Updates and InterconnectivityChanges to data points within the template trigger automatic recalculations in interconnected formulas, ensuring data consistency across the entire financial statement. Modifying the value of inventory, for example, automatically updates related figures like current assets and the cost of goods sold. This real-time interconnectivity ensures accuracy and eliminates the need for manual adjustments.

- Summations and AggregationsTemplates automate the summation and aggregation of data across multiple accounts or periods. This simplifies the process of consolidating financial information from various sources, ensuring accuracy and saving significant time. For instance, total operating expenses are automatically calculated by summing individual expense accounts.

- Financial Ratio CalculationsKey financial ratios, such as current ratio, debt-to-equity ratio, and profitability ratios, are often calculated automatically within the template. This facilitates rapid analysis of financial performance and trends without requiring manual calculation. These automated ratio calculations enable quick identification of potential financial strengths and weaknesses.

The automation of calculations within year-end financial statement templates is crucial for ensuring accuracy, efficiency, and data integrity. This automation not only streamlines the reporting process but also provides valuable insights into financial performance, enabling informed decision-making by stakeholders based on reliable and accurate financial data. By reducing manual intervention and potential for errors, automated calculations contribute significantly to the overall effectiveness and reliability of year-end financial reporting.

4. Error Reduction

Error reduction is paramount in year-end financial statement preparation. Templates offer a structured approach, mitigating risks associated with manual data entry and calculations. Pre-defined formulas and automated functions within templates minimize transposition errors, incorrect formulas, and omissions, ensuring data accuracy and integrity. For instance, a template automatically calculates totals and subtotals, preventing common arithmetic errors that can occur with manual summation. This inherent accuracy is crucial for reliable financial reporting, enabling informed decision-making by stakeholders.

Consider a scenario where a company manually prepares its income statement. A misplaced decimal or an incorrect formula in calculating operating expenses can significantly misrepresent the company’s profitability. Utilizing a template with pre-built formulas and automated calculations prevents such errors, ensuring accurate representation of financial performance. Furthermore, templates often include validation rules, flagging inconsistencies or unusual entries, providing an additional layer of error prevention. This contributes to greater confidence in the reported figures and facilitates more reliable analysis.

Accurate financial reporting is essential for building trust with investors, creditors, and regulatory bodies. Templates significantly enhance the reliability of financial statements by minimizing the potential for human error. The resulting accuracy strengthens stakeholder confidence, facilitates compliance, and supports sound financial decision-making. By reducing errors, templates promote transparency and accountability, ultimately contributing to the overall integrity of the financial reporting process.

5. Comparative Analysis

Comparative analysis is integral to the value derived from year-end financial statement templates. Templates facilitate this analysis by providing a consistent structure for presenting financial data across multiple periods. This consistent formatting allows stakeholders to readily identify trends, assess performance changes, and make informed decisions based on historical data. For example, comparing the current year’s revenue figures against the previous year’s reveals revenue growth or decline, offering insights into business performance and potential future trajectories. Without a standardized template, comparing data across different periods becomes significantly more challenging and prone to errors due to inconsistencies in presentation.

The practical significance of comparative analysis using templates extends to various stakeholders. Investors use comparative data to assess the long-term viability and growth potential of a company. Creditors utilize historical trends to evaluate creditworthiness and risk. Management leverages comparative analysis to identify areas for improvement, track progress towards strategic goals, and make informed operational decisions. For instance, consistent declines in gross profit margin over several years, easily observed through comparative analysis within a template, might signal pricing inefficiencies or increasing production costs, prompting management to investigate and implement corrective measures.

Comparative analysis enabled by standardized templates is essential for understanding financial performance over time. While single-period statements offer a snapshot of financial position, comparative analysis provides the context necessary for identifying trends, evaluating performance against benchmarks, and making informed projections. Challenges can arise when data from different accounting systems or reporting periods needs to be integrated into the template. Ensuring data consistency and accuracy across periods is critical for reliable comparative analysis. Addressing these challenges through robust data management practices enhances the value and insights derived from comparative analysis using year-end financial statement templates.

Key Components of Year-End Financial Statement Templates

Effective financial reporting hinges on well-structured and comprehensive year-end statements. Several key components ensure these statements provide a clear and accurate representation of an organization’s financial performance and position.

1. Balance Sheet: This statement presents a snapshot of an organization’s assets, liabilities, and equity at a specific point in time, typically the end of the fiscal year. It provides insights into the organization’s financial health and solvency.

2. Income Statement: This statement, also known as the profit and loss statement, summarizes revenues, expenses, and resulting net income or loss over a specific period. It reflects the organization’s profitability during the reporting period.

3. Statement of Cash Flows: This statement tracks the movement of cash both into and out of an organization during the reporting period. It categorizes cash flows into operating, investing, and financing activities, providing a comprehensive view of cash management.

4. Statement of Changes in Equity: This statement details changes in an organization’s equity over the reporting period. It outlines contributions from owners, net income or loss, dividends, and other changes affecting equity.

5. Notes to the Financial Statements: These notes provide additional context and details regarding the information presented in the core financial statements. They include accounting policies, significant events, and other disclosures necessary for a complete understanding of the financial picture.

6. Comparative Figures: Prior-period data is often included alongside the current period’s figures, facilitating trend analysis and performance evaluation over time. These comparative figures are crucial for identifying patterns and assessing progress.

These components work in concert to provide a comprehensive and detailed view of an organization’s financial performance, position, and cash flows. Careful preparation and analysis of these statements are crucial for informed decision-making by management, investors, creditors, and other stakeholders.

How to Create a Year-End Financial Statement Template

Creating a robust year-end financial statement template requires careful planning and consideration of key financial reporting elements. A well-structured template ensures consistency, accuracy, and efficiency in the reporting process. The following steps outline a practical approach to template development.

1. Determine Reporting Requirements: Clarify specific reporting requirements based on accounting standards (e.g., GAAP, IFRS) and legal or regulatory obligations. Consider the needs of various stakeholders, including investors, creditors, and management.

2. Select Software or Platform: Choose appropriate software, such as spreadsheet software or dedicated accounting software, based on the complexity of reporting needs and available resources. Consider factors like data capacity, formula functionality, and collaboration features.

3. Structure the Template: Design the template layout to include essential financial statements: Balance Sheet, Income Statement, Statement of Cash Flows, and Statement of Changes in Equity. Organize each statement logically with clear headings and subheadings.

4. Incorporate Formulas and Automated Calculations: Integrate formulas and automated calculations for key financial metrics and ratios. This automation minimizes manual data entry and reduces the risk of errors. Ensure formulas are interconnected for dynamic updates.

5. Include Comparative Figures: Incorporate columns for prior-period data to facilitate trend analysis and performance comparisons. This historical context enhances understanding of financial performance over time.

6. Add Notes and Disclosures: Designate sections for notes to the financial statements, providing additional context and explanations for reported figures. Include relevant accounting policies and significant events affecting financial performance.

7. Implement Data Validation and Error Checks: Incorporate data validation rules and error checks to ensure data accuracy and consistency. This step mitigates the risk of inaccuracies and enhances the reliability of reported data.

8. Test and Refine: Thoroughly test the template with sample data to identify and correct any errors or inconsistencies. Seek feedback from relevant stakeholders to refine the template and ensure it meets reporting needs effectively.

A well-designed template facilitates accurate and efficient financial reporting. Consistent structure, automated calculations, and comparative data enhance transparency and support informed decision-making by stakeholders. Regular review and updates ensure the template remains relevant and aligned with evolving reporting requirements.

Precise and well-organized year-end financial reporting is crucial for evaluating performance, making informed decisions, and maintaining transparency with stakeholders. Standardized templates offer a structured approach, ensuring consistency, accuracy, and efficiency in the reporting process. Leveraging pre-built formulas, automated calculations, and comparative data analysis within these templates provides valuable insights into financial trends, strengths, and weaknesses. Attention to key components, such as the balance sheet, income statement, and statement of cash flows, ensures a comprehensive overview of financial health and performance.

Effective utilization of year-end financial statement templates contributes significantly to robust financial management and informed decision-making. Regular review and adaptation of templates to evolving reporting requirements and organizational needs are essential for maintaining accuracy, relevance, and compliance. Adherence to established accounting principles and regulatory guidelines ensures the integrity and reliability of reported financial information, fostering trust and accountability among stakeholders.