Utilizing such a report allows for timely monitoring of financial progress, facilitating proactive adjustments and strategic planning. This regular review can reveal potential issues early on, enabling corrective measures before they escalate into significant problems. Furthermore, it assists in accurate forecasting, budgeting, and performance evaluation, ultimately contributing to better financial management and improved outcomes.

The following sections will delve deeper into the specific components, creation methods, and practical applications of this essential financial tool, exploring its role in diverse business contexts and its significance in driving informed decision-making.

1. Current Financial Period

A “year to date” income statement fundamentally relies on the “current financial period.” This period, representing the timeframe from the start of the fiscal year to the present date, provides the temporal scope for the financial data presented. Understanding this concept is crucial for accurately interpreting the statement and its implications for business performance.

- Fiscal Year Start DateThe starting point of the current financial period is determined by the organization’s fiscal year. This may align with the calendar year (January 1st to December 31st) or follow a different schedule, such as April 1st to March 31st. Accurately identifying this date is essential for defining the period covered by the statement.

- Reporting DateThe “current date” signifies the endpoint of the reporting period within the fiscal year. This could be the end of a month, a quarter, or any specific date up to which financial performance is being measured. The reporting date provides a snapshot of financial activity up to that specific point in time.

- Period Length and Data RelevanceThe length of the current financial period directly impacts the data presented in the year-to-date statement. Shorter periods offer more granular insights into recent performance, while longer periods provide a broader view of cumulative results. The chosen reporting frequency influences the analysis and decision-making processes.

- Comparative AnalysisYear-to-date data allows for comparisons against corresponding periods in previous fiscal years. This comparison reveals trends in revenue, expenses, and profitability, facilitating performance evaluation and strategic planning. Analyzing period-over-period changes provides valuable insights for informed decision-making.

Accurate delineation of the current financial period is paramount for the effective use of a year-to-date income statement. Precisely defined start and end dates ensure the reliability and relevance of the financial data presented, enabling meaningful analysis, performance evaluation, and strategic planning based on current financial results.

2. Revenue Streams

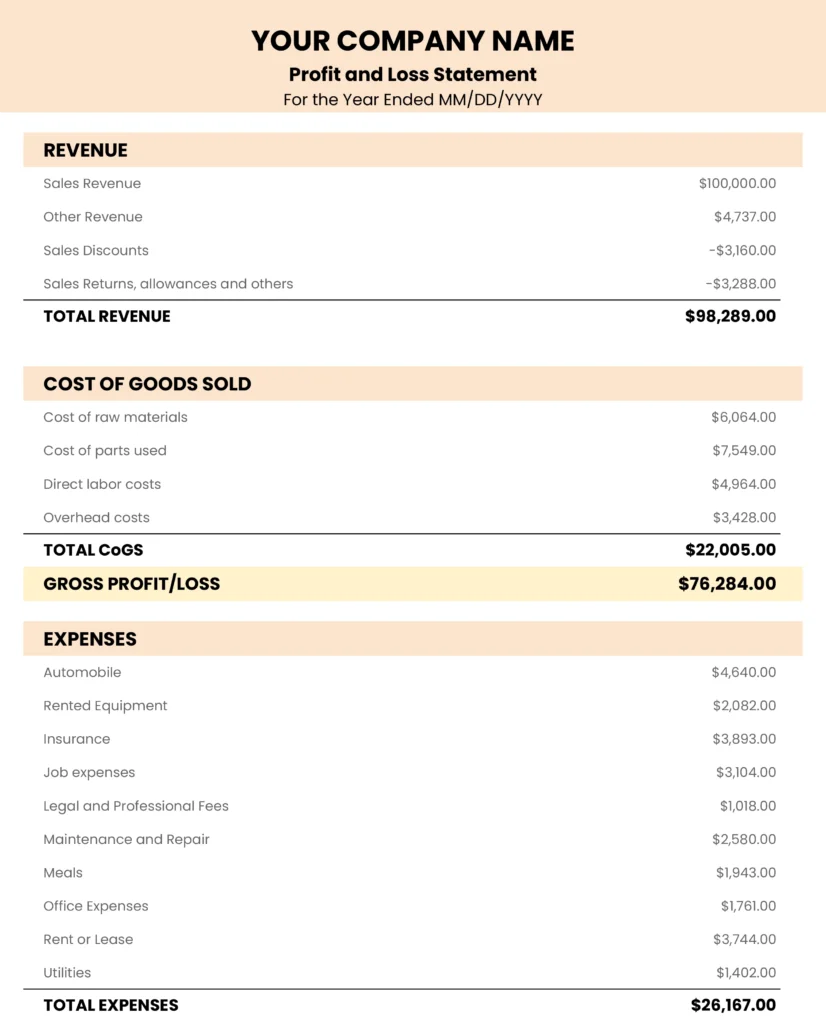

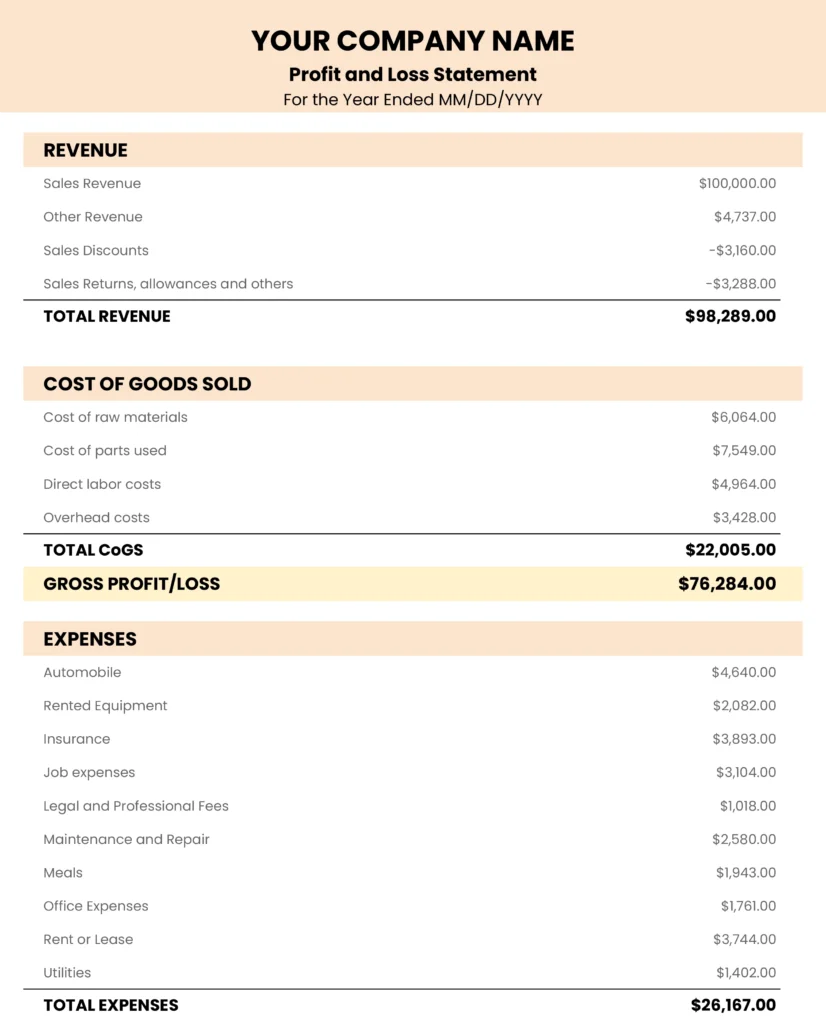

Revenue streams represent the various sources of income generated by a business within a given period. Within the context of a year-to-date income statement template, detailing these streams is crucial for understanding the overall financial performance. This detailed breakdown offers insights into the health of individual revenue channels and their collective contribution to profitability. For example, a software company might have separate revenue streams for software licenses, maintenance contracts, and consulting services. Each stream’s performance, tracked within the year-to-date statement, provides granular data for strategic decision-making.

Accurately categorizing and reporting individual revenue streams facilitates informed resource allocation and strategic planning. Consider a retail business with both online and brick-and-mortar stores. By separating these revenue streams within the year-to-date statement, management can assess the performance of each channel and identify areas for improvement or investment. Perhaps online sales are growing rapidly while in-store sales are declining. This insight, derived from the detailed revenue breakdown, allows for data-driven decisions regarding marketing spend, inventory management, and overall business strategy.

A comprehensive understanding of revenue streams within a year-to-date context is essential for effective financial management. Analyzing trends within individual streams, identifying potential weaknesses, and capitalizing on growth opportunities are all facilitated by this detailed reporting. The ability to track revenue performance against historical data and industry benchmarks provides valuable context for strategic decision-making and enhances the ability to navigate a dynamic business landscape.

3. Expense Categorization

Expense categorization is a critical component of a year-to-date income statement template. Organizing expenses into distinct categories provides a structured view of where funds are being allocated, enabling comprehensive analysis of cost structures and their impact on profitability. This systematic approach facilitates informed decision-making regarding resource allocation and cost optimization strategies.

- Cost of Goods Sold (COGS)COGS represents the direct costs associated with producing goods sold by a business. This category typically includes raw materials, direct labor, and manufacturing overhead. For a manufacturer, accurately tracking COGS within a year-to-date income statement is essential for determining gross profit margins and identifying potential production efficiencies. For example, rising raw material costs, reflected in the year-to-date COGS, might necessitate adjustments in pricing or sourcing strategies.

- Operating ExpensesOperating expenses encompass the costs incurred in running the day-to-day operations of a business. These expenses can include rent, utilities, salaries, marketing, and administrative costs. Analyzing operating expenses within a year-to-date framework allows businesses to monitor trends in spending, identify areas for potential cost reduction, and assess the efficiency of operational processes. For example, a significant increase in marketing spend without a corresponding rise in sales revenue, as revealed by the year-to-date statement, might prompt a reevaluation of marketing strategies.

- Interest ExpenseInterest expense reflects the cost of borrowing money. Tracking interest payments within the year-to-date income statement allows businesses to assess the impact of debt financing on profitability. This is particularly important for companies with significant debt burdens. Analyzing interest expense trends can inform decisions regarding debt management and refinancing strategies.

- TaxesIncome tax expense represents the amount owed in taxes based on a company’s profits. This figure, tracked within the year-to-date statement, allows businesses to monitor tax liabilities and ensure compliance with tax regulations. Analyzing year-to-date tax expenses also assists in financial planning and budgeting for future tax obligations.

By meticulously categorizing expenses, a year-to-date income statement provides a granular view of cost structures, enabling businesses to identify areas for potential savings, optimize resource allocation, and ultimately enhance profitability. The detailed breakdown of expenses facilitates data-driven decision-making, contributing to improved financial performance and long-term sustainability.

4. Profitability Calculation

Profitability calculation forms the core purpose of a year-to-date income statement template. This calculation provides insights into a company’s financial performance by analyzing revenues and expenses over a specific period. Understanding profitability is crucial for assessing the financial health of a business, making informed decisions, and evaluating the effectiveness of operational strategies.

- Gross ProfitGross profit represents the revenue remaining after deducting the direct costs associated with producing goods or services (COGS). Calculating gross profit within a year-to-date income statement reveals the profitability of core business operations. For instance, a retailer’s year-to-date gross profit indicates the effectiveness of pricing strategies and inventory management. Monitoring trends in gross profit can signal shifts in market dynamics or production efficiencies.

- Operating IncomeOperating income, derived by subtracting operating expenses from gross profit, reflects the profitability of a company’s core business operations, excluding interest and taxes. Analyzing year-to-date operating income provides insights into the efficiency of management in controlling operating costs. A consistent increase in operating income over corresponding periods suggests effective cost management and operational efficiency.

- Net IncomeNet income, often referred to as the “bottom line,” represents the ultimate profitability of a company after all expenses, including interest and taxes, have been deducted. Year-to-date net income offers a comprehensive view of a company’s financial performance, reflecting the cumulative impact of all revenue and expense activities. Tracking net income trends provides crucial insights for investors, creditors, and management in assessing the overall financial health and growth trajectory of the business.

- Profit MarginsProfit margins, expressed as percentages, provide a standardized way to assess profitability relative to revenue. Different profit margins, such as gross profit margin, operating profit margin, and net profit margin, offer varying perspectives on a company’s ability to generate profit at different stages of its operations. Analyzing these margins within a year-to-date income statement helps identify trends in profitability and facilitates comparisons against industry benchmarks. For example, a declining net profit margin over several reporting periods could indicate increased competition or rising costs, prompting further investigation and strategic adjustments.

The various profitability metrics calculated within a year-to-date income statement offer a comprehensive understanding of a company’s financial performance. These calculations provide crucial insights for internal management in evaluating operational efficiency, for investors in assessing investment opportunities, and for creditors in determining creditworthiness. The ability to track profitability trends over time empowers stakeholders to make informed decisions and contribute to the long-term financial health of the organization.

5. Comparative Analysis

Comparative analysis forms an integral part of utilizing a year-to-date income statement template effectively. The true value of this financial statement lies not just in presenting current figures, but in providing a framework for understanding performance trends and making informed decisions based on historical context. Comparing current year-to-date figures with those from previous periods, or against industry benchmarks, unlocks deeper insights into financial health and operational efficiency. This comparative approach allows businesses to identify areas of strength, pinpoint potential weaknesses, and anticipate future challenges.

Consider a company analyzing its year-to-date operating expenses. While the current figures provide a snapshot of spending, comparing them to the same period in the previous year reveals whether costs are increasing or decreasing. This comparison can highlight areas where cost control measures have been successful or where spending has become excessive. Furthermore, comparing year-to-date performance against industry averages provides context for evaluating competitive positioning and identifying areas for potential improvement. Perhaps a company’s year-to-date gross profit margin is significantly lower than the industry average. This discrepancy could indicate inefficiencies in production or pricing strategies, prompting further investigation and corrective action.

The power of comparative analysis lies in its ability to transform static financial data into actionable insights. By comparing year-to-date performance against historical data and industry benchmarks, businesses can identify trends, assess the effectiveness of strategies, and make informed decisions to improve financial performance. This ongoing process of evaluation and adjustment is essential for navigating a dynamic business environment and achieving long-term financial sustainability. Challenges in data consistency and the need for accurate benchmarks must be addressed to ensure the reliability and effectiveness of comparative analysis within the context of year-to-date income statements. However, when implemented effectively, this analytical approach provides a crucial tool for driving growth and maintaining a competitive edge.

Key Components of a Year-to-Date Income Statement Template

A well-structured template ensures consistency and facilitates informed financial decisions. Understanding the key components provides a framework for interpreting the data and extracting meaningful insights.

1. Reporting Period: This clearly defines the timeframe covered by the statement, specifying the start and end dates. Precision in defining the reporting period is crucial for accurate analysis and comparisons. Without specific dates, the data loses its context and comparative value.

2. Revenue Streams: A detailed breakdown of revenue sources offers granular insights into the performance of different business activities. Categorizing revenue streams allows for targeted analysis and strategic decision-making regarding resource allocation and growth opportunities.

3. Expense Categorization: Organizing expenses into distinct categories provides a structured view of cost drivers. This categorization allows for analysis of spending trends, identification of potential cost savings, and improved resource allocation.

4. Cost of Goods Sold (COGS): For businesses selling physical products, COGS represents the direct costs associated with production. Tracking COGS is essential for determining gross profit margins and understanding the profitability of core operations.

5. Gross Profit: This metric, calculated by subtracting COGS from revenue, represents the profitability of core business activities before considering operating expenses. Analyzing gross profit reveals the effectiveness of pricing and production strategies.

6. Operating Expenses: These expenses encompass the costs of running the business, including salaries, rent, marketing, and administrative costs. Monitoring operating expenses helps assess operational efficiency and identify areas for potential cost reduction.

7. Operating Income: Calculated by subtracting operating expenses from gross profit, operating income reflects the profitability of core business operations. Analyzing operating income trends provides insights into the effectiveness of management in controlling costs and driving revenue growth.

8. Net Income: Often referred to as the “bottom line,” net income represents the overall profitability after all expenses, including interest and taxes, have been deducted. This key metric provides a comprehensive assessment of financial performance.

These components work together to provide a comprehensive financial overview, enabling effective performance evaluation, strategic planning, and informed decision-making. Accurate data within a structured template empowers stakeholders to understand financial health, identify trends, and drive sustainable growth.

How to Create a Year-to-Date Income Statement Template

Creating a robust template ensures data consistency and facilitates insightful financial analysis. The following steps outline the process of developing a template for effective tracking of year-to-date financial performance.

1. Define the Reporting Period: Clearly specify the start and end dates for the income statement. Accurate date delineation is fundamental for meaningful comparisons and trend analysis. This establishes the timeframe for the financial data being presented.

2. Structure Revenue Sections: Create distinct sections for each revenue stream. This detailed breakdown enables granular analysis of revenue performance and informs strategic decision-making regarding resource allocation and growth opportunities. Categorization provides clarity and facilitates comparisons across different revenue channels.

3. Establish Expense Categories: Develop a comprehensive system for categorizing expenses. This structured approach enables analysis of spending patterns, identification of areas for potential cost savings, and optimization of resource allocation. Accurate expense categorization is crucial for understanding cost drivers and their impact on profitability.

4. Incorporate COGS (if applicable): For businesses selling physical products, include a section for Cost of Goods Sold (COGS). Tracking COGS is essential for calculating gross profit margins and understanding the profitability of core operations. This component is specific to businesses involved in production or manufacturing activities.

5. Calculate Key Profitability Metrics: Include formulas for calculating key profitability metrics, such as gross profit, operating income, and net income. These calculations provide insights into the financial health of the business and facilitate performance evaluation. Clear formulas ensure consistency and accuracy in profitability assessments.

6. Design for Comparative Analysis: Structure the template to facilitate comparisons with previous periods or industry benchmarks. This comparative approach enables identification of performance trends, assessment of strategy effectiveness, and informed decision-making. Columns for previous year-to-date figures or industry averages enhance the analytical value of the template.

7. Ensure Data Accuracy and Consistency: Implement validation rules and data checks to maintain data integrity. Accurate and consistent data is fundamental for reliable analysis and informed decision-making. Regular review and validation processes contribute to data quality.

8. Choose a Suitable Format: Select a formatspreadsheet software, dedicated accounting software, or a custom-built solutionthat aligns with specific business needs. The chosen format should support efficient data entry, automated calculations, and flexible reporting capabilities.

A well-designed year-to-date income statement template provides a powerful tool for monitoring financial performance, identifying trends, and making informed decisions. By following these steps, organizations can create a template that supports effective financial management and contributes to long-term success.

Effective financial management hinges on timely and accurate insights into performance. A properly constructed and utilized financial reporting mechanism provides a structured view of revenue generation, expense allocation, and ultimately, profitability. Understanding the key components, from revenue streams and expense categorization to profitability calculations and comparative analysis, empowers stakeholders to make informed decisions based on current financial data. This structured approach to financial reporting facilitates proactive adjustments, optimized resource allocation, and strategic planning, all of which contribute to enhanced financial health and long-term sustainability.

In an evolving business landscape, consistent monitoring and analysis of financial performance are paramount. Leveraging a robust and well-understood financial reporting mechanism enables organizations to navigate challenges, capitalize on opportunities, and achieve sustained growth. Accurate and insightful data provides a solid foundation for informed decision-making, driving operational efficiency and long-term financial success.