Utilizing a standardized structure offers several advantages. It simplifies the process of creating consistent financial reports, allowing for easy comparison across multiple periods. This consistency enables better trend identification and informed decision-making regarding resource allocation and future planning. Furthermore, a well-organized annual summary of cash movements can be invaluable for securing financing, attracting investors, and fulfilling regulatory requirements.

This foundation of financial understanding allows for deeper exploration of specific topics related to managing annual finances. Considerations such as budgeting, forecasting, and variance analysis become more manageable with accurate and readily available financial data.

1. Standardized Format

A standardized format is crucial for a yearly cash flow statement template. Consistency ensures comparability across different periods, facilitating trend analysis and informed decision-making. A standardized structure typically includes sections for operating activities, investing activities, and financing activities. This allows for a clear segregation of cash flows related to core business operations, capital expenditures, and debt or equity financing. Without a standardized format, comparing performance year-over-year or against industry benchmarks becomes significantly more challenging. For example, an organization might classify interest payments under operating activities one year and financing activities the next, distorting the true picture of financial performance in both areas.

The benefits of standardization extend beyond internal analysis. When seeking external financing, investors and lenders rely on standardized financial statements to assess risk and potential returns. A consistent format makes it easier for external stakeholders to understand the financial health of an organization. Consider two companies with identical underlying cash flows but different reporting formats. The company with a clear, standardized statement will likely be viewed more favorably due to the transparency and ease of analysis it offers. This can lead to better loan terms and increased investor confidence.

Standardized reporting also simplifies compliance with accounting regulations and reporting requirements. Regulatory bodies often prescribe specific formats for financial statements, and adhering to these standards is essential for maintaining legal compliance. Failure to present information in a standardized manner can lead to penalties and reputational damage. Ultimately, a standardized format for yearly cash flow statement templates underpins accurate analysis, effective communication with stakeholders, and compliance with regulatory requirements.

2. Annual Overview

An annual overview provides a comprehensive summary of an entity’s financial performance over a fiscal year. Within the context of a yearly cash flow statement template, this overview encapsulates the net result of all cash inflows and outflows. It provides a high-level understanding of how cash was generated and utilized throughout the year, encompassing operating activities, investing activities, and financing activities. This aggregated view allows stakeholders to quickly grasp the overall financial health and trajectory of the organization. For instance, a consistent positive cash flow from operating activities over several years suggests a sustainable business model, while a reliance on financing activities to cover operating shortfalls may signal potential challenges.

The annual overview serves as a crucial component of a yearly cash flow statement template, enabling effective analysis and informed decision-making. By summarizing the yearly cash flow data, it facilitates the identification of trends, the evaluation of performance against benchmarks, and the development of future strategies. Consider a company experiencing declining cash flows from operating activities. The annual overview highlights this trend, prompting further investigation into potential causes, such as declining sales, increasing costs, or ineffective working capital management. This analysis can then inform corrective actions, such as cost reduction initiatives or improvements in inventory management.

Understanding the annual overview within a yearly cash flow statement template is essential for effective financial management. It provides a concise yet comprehensive picture of an organization’s financial performance, allowing stakeholders to assess its sustainability, identify potential risks and opportunities, and make informed decisions regarding resource allocation and future growth. While the detailed breakdown within the statement offers granular insights, the annual overview synthesizes this information into a readily digestible format, offering a crucial high-level perspective on financial health and performance.

3. Track Key Activities

Tracking key activities is fundamental to the utility of a yearly cash flow statement template. The template provides the structure for organizing cash flows into three core categories: operating activities, investing activities, and financing activities. This categorization allows for a granular understanding of how cash is generated and used within an organization. Operating activities reflect the day-to-day business functions, such as sales and inventory management. Investing activities encompass capital expenditures, like purchasing equipment or acquiring other businesses. Financing activities involve transactions with lenders and investors, such as borrowing funds or issuing equity. Accurately tracking these distinct activities provides insights into the drivers of financial performance.

Consider a manufacturing company analyzing its yearly cash flow statement. A decrease in cash flow from operating activities might be attributed to increased raw material costs, identified through detailed tracking within that category. Conversely, an increase in cash flow from investing activities could indicate the sale of a subsidiary, revealed through tracking investments. This detailed tracking within the template allows management to pinpoint specific areas of strength and weakness, facilitating targeted interventions and informed strategic decisions. Without this granular tracking, identifying the underlying causes of changes in overall cash flow becomes significantly more challenging. For instance, simply observing a net decrease in cash flow without understanding its source offers limited actionable information.

Effective tracking of key activities within a yearly cash flow statement template is essential for financial analysis and decision-making. It allows for the dissection of overall cash flow into its constituent parts, providing a deeper understanding of the factors driving financial performance. This granular view enables proactive management of cash resources, identification of potential risks and opportunities, and the development of strategies to optimize financial outcomes. The ability to isolate and analyze specific cash flow drivers within the template offers a critical advantage in navigating the complexities of business finance and achieving sustainable growth. This detailed analysis is a cornerstone of effective financial planning and performance evaluation.

4. Inform Financial Decisions

A yearly cash flow statement template plays a critical role in informing financial decisions. By providing a structured overview of cash inflows and outflows over a fiscal year, the template equips stakeholders with the necessary information to make sound judgments regarding resource allocation, investment strategies, and overall financial management. The ability to analyze trends in operating, investing, and financing activities allows for data-driven decisions rather than relying on assumptions or gut feelings. For example, consistent negative cash flow from operating activities might necessitate cost-cutting measures or a reassessment of pricing strategies. Conversely, strong positive cash flow could support expansion plans or increased investment in research and development. The template facilitates these decisions by providing a clear and concise picture of financial performance.

The insights derived from a yearly cash flow statement template extend beyond short-term operational decisions. Understanding long-term trends in cash flow is crucial for strategic planning and capital budgeting. For instance, if a company consistently generates substantial cash flow from its core operations, it may consider acquisitions or investments in new product lines. Alternatively, declining cash flow might signal the need for restructuring or divestiture of underperforming assets. These strategic decisions, with long-term implications, are informed by the historical data provided within the yearly cash flow statement template. A comprehensive understanding of past performance provides a foundation for informed projections and strategic planning.

Effective financial management hinges on access to accurate and reliable data. The yearly cash flow statement template provides this foundation, enabling informed decisions across all levels of an organization. From short-term operational adjustments to long-term strategic planning, the template empowers stakeholders with the insights necessary to navigate the complexities of business finance. Challenges such as declining profitability, inadequate liquidity, or excessive debt can be addressed proactively by leveraging the information presented within the template. Ultimately, the yearly cash flow statement template serves as a critical tool for informed financial decision-making, contributing to the overall financial health and sustainability of an organization.

5. Facilitate Analysis

A primary benefit of a yearly cash flow statement template lies in its capacity to facilitate analysis. The structured format, categorizing cash flows into operations, investing, and financing activities, enables a methodical examination of financial performance. This structure allows for the identification of trends, the comparison of performance against benchmarks, and the pinpointing of areas requiring attention. For example, consistently increasing cash flow from operating activities often indicates a healthy and growing business, while a persistent reliance on financing activities to cover operational shortfalls could signal underlying financial weaknesses. The template facilitates this analysis by providing a consistent framework for evaluating performance over time and against industry peers. Without a standardized format, extracting meaningful insights and making informed decisions becomes significantly more challenging. Consider attempting to compare the performance of two companies with drastically different reporting methods the lack of comparability hinders effective analysis and obscures potential insights.

The ability to analyze historical cash flow data is crucial for forecasting future performance and making strategic decisions. A yearly cash flow statement template provides the historical context necessary for developing realistic financial projections. By understanding past trends, organizations can better anticipate future challenges and opportunities. For example, a company experiencing seasonal fluctuations in sales can use historical cash flow data from the template to predict cash flow needs during peak and off-peak seasons, ensuring adequate liquidity and avoiding potential shortfalls. This forecasting capability, facilitated by the template, empowers organizations to proactively manage their finances and optimize resource allocation. Without access to structured historical data, developing accurate forecasts and making informed financial decisions becomes significantly more speculative and risky.

Effective financial management hinges on the ability to analyze performance and make data-driven decisions. The yearly cash flow statement template provides the structure and historical context necessary for this analysis. It empowers organizations to identify trends, compare performance, develop forecasts, and ultimately make informed decisions that contribute to financial health and long-term sustainability. The challenges of financial analysis, such as deciphering complex data and making accurate predictions, are significantly mitigated by the standardized format and historical insights offered by the template. Its consistent structure and focus on key cash flow drivers make the yearly cash flow statement template an invaluable tool for effective financial analysis and informed decision-making.

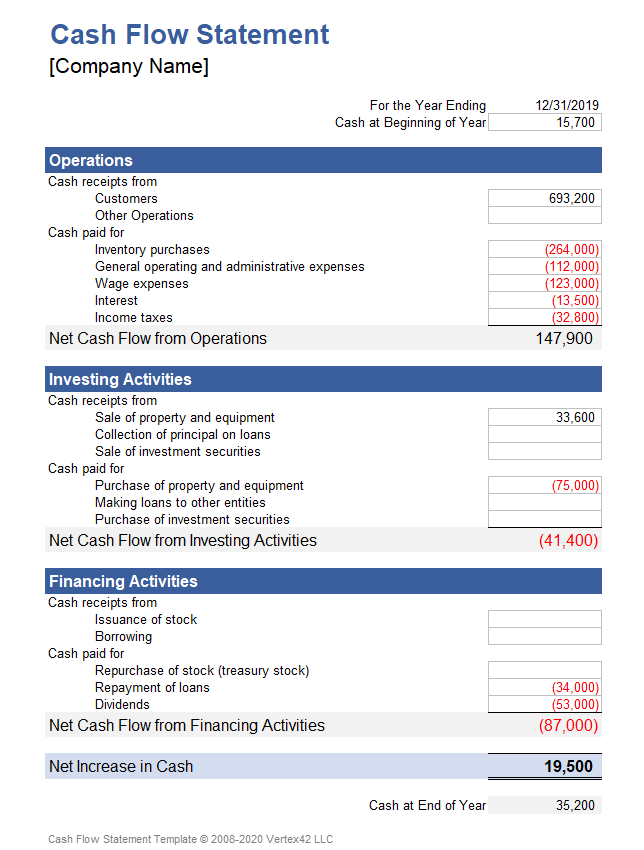

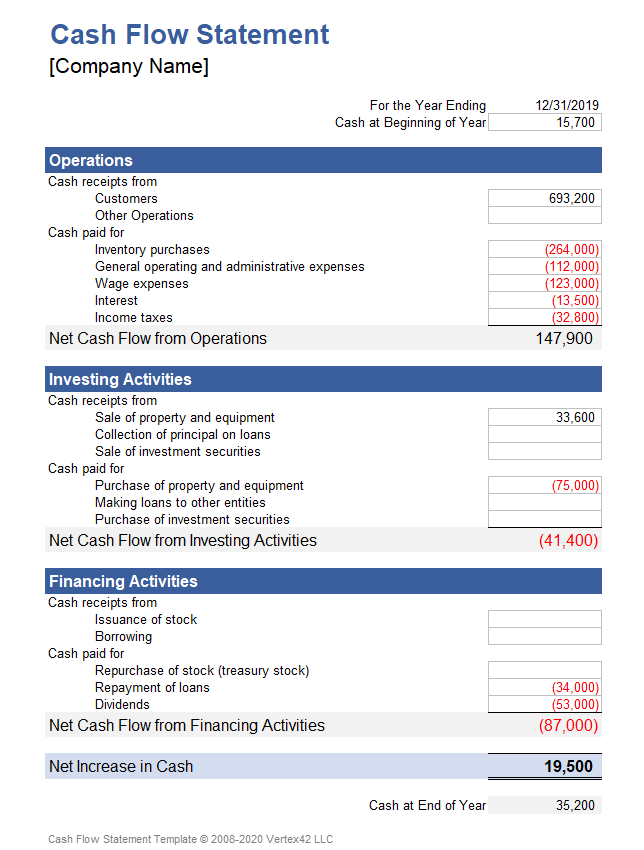

Key Components of a Yearly Cash Flow Statement Template

A well-structured yearly cash flow statement template provides a comprehensive overview of an organization’s financial performance. Several key components contribute to this comprehensive view, enabling informed decision-making and effective financial management.

1. Operating Activities: This section details cash flows generated from the core business operations. It includes cash received from customers, payments to suppliers, and other operating expenses. Analyzing this section reveals the profitability and efficiency of day-to-day business functions.

2. Investing Activities: This component tracks cash flows related to capital expenditures and investments. Purchases of property, plant, and equipment (PP&E), acquisitions of other businesses, and proceeds from the sale of assets are recorded here. This section provides insights into long-term investment strategies and their impact on cash flow.

3. Financing Activities: Cash flows related to debt, equity, and dividends are documented in this section. It includes proceeds from issuing debt or equity, repayment of loans, and dividend payments to shareholders. Analyzing this section reveals the organization’s capital structure and its reliance on external financing.

4. Beginning Cash Balance: This crucial starting point represents the cash available at the beginning of the fiscal year. It sets the context for all subsequent cash inflows and outflows.

5. Ending Cash Balance: This figure represents the net result of all cash flows during the year. It reflects the organization’s cash position at the end of the fiscal year and serves as the beginning balance for the subsequent period.

6. Non-Cash Transactions: While not directly impacting cash flow, significant non-cash transactions, such as depreciation, amortization, and stock-based compensation, are often disclosed in a separate note. These transactions provide context for understanding the overall financial picture.

Careful consideration of each component within the yearly cash flow statement template provides a robust understanding of an organization’s financial health, allowing for effective analysis, strategic planning, and informed decision-making.

How to Create a Yearly Cash Flow Statement Template

Developing a yearly cash flow statement template requires a structured approach. The following steps outline the process of creating a template suitable for tracking and analyzing annual cash flow data.

1. Define Reporting Periods: Establish a clear timeframe for the cash flow statement. This is typically a fiscal year, but it can also be a calendar year or any other consistent 12-month period. Consistent reporting periods are essential for comparability.

2. Categorize Cash Flows: Structure the template to categorize cash flows into three core sections: operating activities, investing activities, and financing activities. This categorization provides a standardized framework for analysis.

3. Detail Operating Activities: Include line items for key components of operating cash flow, such as cash receipts from customers, cash payments to suppliers, and cash payments for operating expenses (e.g., salaries, rent, utilities).

4. Specify Investing Activities: Incorporate line items to track cash flows related to capital expenditures (e.g., purchase of equipment, investments in other companies) and proceeds from the sale of assets.

5. Outline Financing Activities: Include line items for cash flows related to debt, equity, and dividends. This includes proceeds from borrowing, repayment of loans, issuance of stock, and dividend payments.

6. Include Beginning and Ending Cash Balances: Incorporate lines for the beginning and ending cash balances. The beginning balance represents the cash on hand at the start of the reporting period, while the ending balance reflects the cash position at the end of the period.

7. Account for Non-Cash Transactions: While not directly impacting cash flow, consider including a section or footnote to disclose significant non-cash transactions, such as depreciation, amortization, and stock-based compensation, to provide a more comprehensive financial picture.

8. Ensure Flexibility and Scalability: Design the template to accommodate potential changes in business operations or reporting requirements. A flexible template allows for adaptation to evolving business needs without requiring a complete overhaul.

A well-designed template provides a clear, concise, and standardized format for tracking and analyzing yearly cash flow, enabling informed financial decisions and contributing to long-term financial health. Regular review and refinement of the template ensure its continued relevance and effectiveness in meeting evolving business needs.

Effective financial management requires a clear understanding of cash flow dynamics. A yearly cash flow statement template provides the necessary structure for tracking, analyzing, and interpreting the movement of cash within an organization over a fiscal year. From the granular details of operating activities to the strategic implications of investing and financing activities, the template offers a comprehensive view of financial performance. Standardization, facilitated by the template, ensures comparability across periods, enabling trend analysis and informed decision-making. Furthermore, the insights derived from a well-structured template inform both short-term operational adjustments and long-term strategic planning, contributing to financial stability and sustainable growth.

The ability to analyze historical cash flow data, identify key drivers of performance, and project future trends positions organizations for financial success. Leveraging the insights provided by a yearly cash flow statement template empowers stakeholders to navigate the complexities of business finance, mitigate risks, and capitalize on opportunities for growth. A commitment to consistent and rigorous cash flow analysis, facilitated by a robust template, is essential for achieving long-term financial health and achieving strategic objectives. The insights gleaned from this analysis provide a crucial foundation for informed decision-making and sustainable value creation.