Utilizing such a projection allows businesses to anticipate potential shortfalls, identify opportunities for investment, and secure necessary funding. This forward-looking approach enables proactive management of financial resources, facilitating informed decisions about budgeting, resource allocation, and overall financial stability. It also serves as a valuable communication tool for stakeholders, demonstrating financial viability and potential for growth.

The following sections will delve deeper into the specific components of a typical three-year projection, offering practical guidance on creating and interpreting this essential financial document. Topics covered will include detailed explanations of cash flow from operations, investing, and financing activities, as well as best practices for developing realistic projections and using them effectively for strategic decision-making.

1. Projected Future Cash Inflows

Accurate projection of future cash inflows forms the cornerstone of a reliable three-year cash flow statement template. These projections provide the foundation for assessing financial performance, planning for future investments, and securing financing. Understanding the various components contributing to projected inflows is essential for developing a realistic and comprehensive financial forecast.

- Sales Revenue:This represents the primary source of cash inflow for most businesses. Accurately forecasting sales revenue requires analyzing historical sales data, market trends, pricing strategies, and anticipated market share. For example, a seasonal business might anticipate higher sales during specific periods, while a company launching a new product might project increasing sales over time. Realistic sales projections are crucial for determining overall financial viability within the three-year timeframe.

- Investment Income:Income generated from investments, such as interest on savings accounts or returns on equity investments, contributes to overall cash inflows. Projecting investment income depends on factors like interest rates, market conditions, and the specific investment portfolio. This component, while potentially smaller than sales revenue, can play a significant role in overall financial stability, particularly for businesses with substantial investment holdings.

- Asset Sales:The sale of assets, such as equipment or property, generates non-recurring cash inflows. While not part of core operations, including potential asset sales in the projection provides a more complete picture of anticipated cash resources. For instance, a company planning to upgrade equipment might include the sale of existing assets to offset the cost of new acquisitions. This facet is crucial for accurately reflecting the impact of strategic asset management decisions.

- Receivables Collection:Converting accounts receivable into cash is a vital aspect of cash flow management. Projecting the timing and amount of receivables collection impacts the overall cash inflow forecast. Factors influencing collection rates include customer payment terms, credit policies, and overall economic conditions. Accurate projections of receivables collection ensure a realistic representation of available cash resources within each projected year.

By meticulously projecting each of these components, a three-year cash flow statement template provides a comprehensive view of anticipated cash resources. This, in turn, allows for more informed decision-making regarding growth strategies, investment opportunities, and overall financial management. Furthermore, a detailed understanding of projected cash inflows strengthens the foundation for securing financing and demonstrating financial viability to stakeholders.

2. Anticipated Cash Outflows

A comprehensive understanding of anticipated cash outflows is critical for developing a robust three-year cash flow statement template. Accurate outflow projections enable businesses to anticipate funding needs, optimize resource allocation, and maintain financial stability. This component of the template details how a company expects to use its cash resources over the projected period, encompassing operational expenses, investments, and financing activities. A clear picture of anticipated outflows facilitates proactive financial management and informed decision-making.

Several key categories typically comprise anticipated cash outflows within a three-year projection. Operating expenses, such as salaries, rent, and utilities, represent recurring costs essential for day-to-day business operations. Capital expenditures, including investments in new equipment or property, reflect strategic decisions aimed at long-term growth and efficiency. Debt service payments, encompassing principal and interest payments on outstanding loans, demonstrate a company’s financial obligations. Accurately projecting these outflows allows for effective budgeting, resource allocation, and assessment of long-term financial sustainability. For instance, a manufacturing company anticipating increased production might project higher raw material costs and labor expenses, while a software company might project significant investment in research and development. Understanding the drivers behind each outflow category enhances the accuracy and reliability of the overall financial projection.

The relationship between anticipated cash outflows and the three-year cash flow statement template is fundamental to sound financial planning. By carefully analyzing and projecting outflows, businesses can proactively identify potential funding gaps, optimize spending, and maintain adequate cash reserves. This forward-looking approach allows for informed decisions regarding pricing strategies, cost control measures, and investment priorities. Furthermore, a clear understanding of anticipated cash outflows strengthens a company’s ability to secure financing, negotiate favorable terms with suppliers, and demonstrate financial viability to stakeholders. Effectively managing anticipated cash outflows contributes significantly to overall financial health and long-term success.

3. Operational Cash Flow

Operational cash flow represents the lifeblood of any business, reflecting its ability to generate cash from core activities. Within a three-year cash flow statement template, it provides crucial insights into a company’s financial health and sustainability. Accurately projecting operational cash flow is essential for informed decision-making regarding investments, growth strategies, and overall financial planning. This section explores the key facets of operational cash flow within the context of a multi-year projection.

- Revenue GenerationRevenue forms the foundation of operational cash flow. Projecting revenue accurately requires careful consideration of market conditions, pricing strategies, and sales forecasts. For example, a subscription-based business might project recurring revenue streams, while a retail business might anticipate seasonal fluctuations. Realistic revenue projections are fundamental to a reliable three-year cash flow statement, impacting all subsequent calculations and analyses.

- Operating ExpensesOperating expenses represent the costs incurred in running the business, such as salaries, rent, and utilities. Accurately projecting these expenses is crucial for determining profitability and overall cash flow. For instance, a growing company might anticipate increased hiring costs and office space expansion. Effective management and projection of operating expenses are essential for maintaining financial stability and achieving profitability targets within the projected timeframe.

- Working Capital ManagementWorking capital management, encompassing accounts receivable, inventory, and accounts payable, significantly influences operational cash flow. Efficient management of these components is vital for maintaining liquidity and ensuring sufficient cash resources. For example, extending payment terms to customers might increase sales but could also negatively impact short-term cash flow. Balancing these considerations within the three-year projection is critical for accurate cash flow forecasting.

- Depreciation and AmortizationWhile not a direct cash outflow, depreciation and amortization impact operational cash flow calculations within a three-year projection. These non-cash expenses represent the reduction in value of assets over time. Understanding their impact on profitability and tax liabilities is important for accurate cash flow forecasting and informed financial decision-making within the projected period.

By meticulously projecting each of these facets, the operational cash flow section of a three-year cash flow statement provides critical insights into a company’s financial performance and sustainability. These projections inform decisions regarding resource allocation, investment strategies, and overall financial planning. A robust understanding of operational cash flow enhances the reliability of the three-year projection, enabling businesses to anticipate potential challenges and capitalize on opportunities for growth and profitability. This detailed analysis ultimately contributes to a more accurate and insightful long-term financial roadmap.

4. Investment Activities

Investment activities within a three-year cash flow statement template provide crucial insights into a company’s strategic capital allocation and its potential for future growth. Analyzing these activities allows stakeholders to understand how a company plans to utilize its resources to expand operations, develop new products, or acquire other businesses. This section explores key facets of investment activities and their implications for long-term financial planning.

- Capital ExpendituresCapital expenditures represent investments in long-term assets, such as property, plant, and equipment (PP&E). These investments are crucial for expanding operational capacity, enhancing efficiency, and supporting future growth. For example, a manufacturing company might invest in new machinery to increase production output, while a technology company might invest in data centers to enhance its service capabilities. Within a three-year cash flow statement, capital expenditures demonstrate a company’s commitment to long-term growth and its willingness to invest in future opportunities. These outflows can significantly impact cash flow and require careful planning to ensure sufficient funding.

- AcquisitionsAcquisitions of other businesses represent significant investment activities that can reshape a company’s strategic direction and market position. These transactions often involve substantial cash outflows and require careful due diligence to assess their potential impact on the acquiring company’s financial performance. Within the three-year cash flow statement, acquisitions are typically reflected as large, one-time cash outflows. Analyzing the rationale behind acquisitions and their projected impact on future cash flows is essential for evaluating the long-term financial implications of these strategic decisions.

- Investments in SecuritiesInvestments in securities, such as stocks and bonds, can generate returns and diversify a company’s investment portfolio. These investments can represent both short-term and long-term strategies, depending on the specific investment objectives. Within a three-year cash flow statement, investments in securities are reflected as cash outflows for purchases and cash inflows for sales or dividend income. Tracking these investments provides insights into a company’s investment strategy and its potential impact on overall financial performance.

- Sale of AssetsThe sale of long-term assets, such as property or equipment, generates cash inflows and can be considered an investment activity. These divestitures might reflect strategic decisions to streamline operations, dispose of underperforming assets, or generate cash for other investment opportunities. Within the three-year cash flow statement, the sale of assets is reflected as a cash inflow, which can offset other investment outflows. Analyzing the reasons for asset sales and their impact on future cash flows provides valuable context for understanding a company’s overall investment strategy.

By carefully analyzing investment activities within a three-year cash flow statement template, stakeholders gain valuable insights into a company’s strategic direction, growth prospects, and financial health. Understanding how a company plans to deploy its capital resources over the projected period provides a crucial foundation for assessing its long-term financial viability and potential for future success. These insights are essential for investors, lenders, and other stakeholders in evaluating a company’s financial health and making informed decisions.

5. Financing Strategy

A company’s financing strategy plays a critical role in shaping its financial health and long-term sustainability. Within a three-year cash flow statement template, the financing strategy section details how a company plans to source and manage its funding over the projected period. This encompasses activities related to debt, equity, and dividend payments. A well-defined financing strategy is crucial for ensuring access to necessary capital, managing financial risk, and maximizing shareholder value. Understanding the various components of a financing strategy and their implications within a multi-year projection is essential for informed financial decision-making.

- Debt FinancingDebt financing, encompassing loans and bonds, represents a primary source of external funding for many businesses. Raising debt allows companies to invest in growth opportunities, manage working capital, and fund other strategic initiatives. Within a three-year cash flow statement, debt financing is reflected as cash inflows from loan proceeds and cash outflows for principal and interest payments. Analyzing a company’s debt levels and repayment schedules provides insights into its financial leverage and its ability to meet its debt obligations.

- Equity FinancingEquity financing involves issuing shares of stock to investors in exchange for capital. This can provide significant funding for growth and expansion without incurring debt obligations. Equity financing affects a company’s ownership structure and can dilute existing shareholders’ ownership stake. Within the three-year cash flow statement, equity financing appears as cash inflows from stock issuances. Analyzing equity financing activities within the context of a multi-year projection offers insights into a company’s growth strategy and its approach to balancing debt and equity financing.

- Dividend PaymentsDividend payments represent distributions of profits to shareholders. These payments can signal financial strength and provide a return on investment for shareholders. However, dividend payments also reduce a company’s retained earnings and its available cash for reinvestment. Within the three-year cash flow statement, dividend payments are reflected as cash outflows. Analyzing dividend payout ratios and their projected trajectory within the multi-year projection offers insights into a company’s approach to balancing shareholder returns and reinvestment opportunities.

- Capital Structure ManagementCapital structure management refers to the mix of debt and equity financing a company utilizes. Optimizing the capital structure is crucial for minimizing the cost of capital and maximizing shareholder value. Within the three-year cash flow statement, analyzing the interplay between debt and equity financing provides insights into a company’s capital structure and its potential impact on financial performance. For example, a company relying heavily on debt financing might face higher interest expenses and increased financial risk, while a company relying primarily on equity financing might experience dilution of ownership. Understanding the dynamics of capital structure management is essential for interpreting a company’s financing strategy and its implications for long-term financial health.

Analyzing the financing strategy section within a three-year cash flow statement template provides crucial insights into a company’s financial health, growth prospects, and risk profile. Understanding how a company plans to source and manage its funding over the projected period allows stakeholders to assess its financial stability, its ability to meet its financial obligations, and its potential for long-term success. This analysis, combined with an understanding of operational and investment activities, provides a comprehensive view of a company’s financial trajectory and its prospects for future growth. A well-defined financing strategy is fundamental to achieving sustainable financial performance and maximizing long-term value.

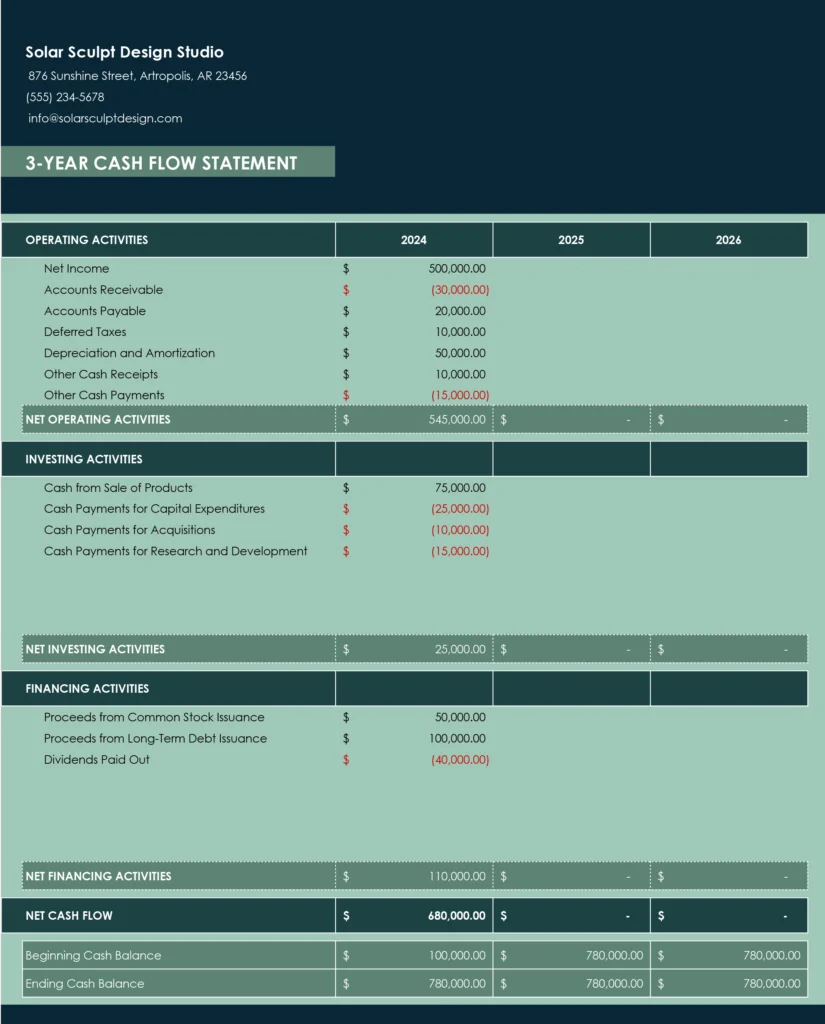

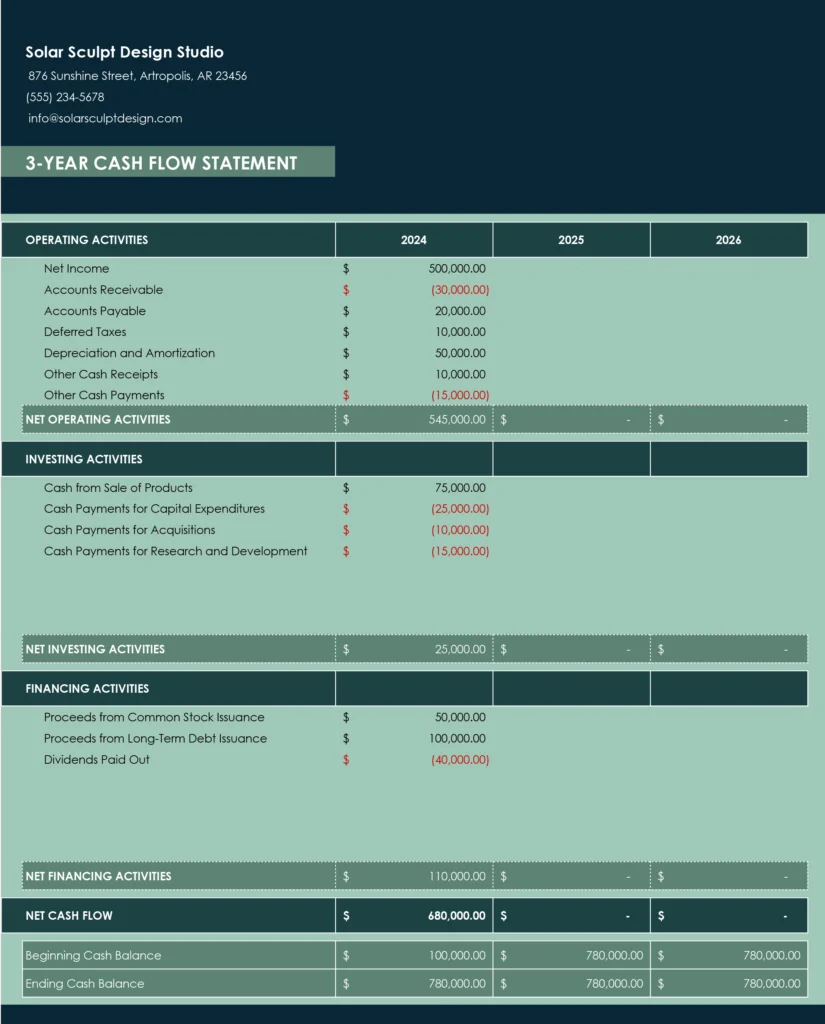

Key Components of a Three-Year Cash Flow Projection

A robust three-year cash flow projection relies on several key components, each contributing to a comprehensive understanding of a company’s anticipated financial performance. These components provide a structured framework for analyzing cash inflows and outflows, enabling informed decision-making and proactive financial management.

1. Operating Activities: This section details cash flows generated from core business operations. Key elements include revenue from sales, payments to suppliers, salaries, and other operating expenses. Analyzing operational cash flow reveals a company’s ability to generate cash from its primary business activities.

2. Investing Activities: This section captures cash flows related to investments in long-term assets and securities. Key elements include capital expenditures for property, plant, and equipment, acquisitions of other businesses, and investments in securities. Analyzing investing activities provides insights into a company’s growth strategy and its allocation of capital resources.

3. Financing Activities: This section details cash flows related to debt, equity, and dividend payments. Key elements include proceeds from debt or equity financing, repayment of debt principal, interest payments, and dividend distributions. Analyzing financing activities reveals how a company sources and manages its funding.

4. Beginning and Ending Cash Balances: These figures provide context for the overall cash flow changes over each period. The beginning cash balance of one period is the ending cash balance of the previous period. Tracking these balances helps assess a company’s liquidity and its ability to meet short-term obligations.

5. Net Cash Flow: This represents the overall change in cash during each period, calculated as the sum of cash flows from operating, investing, and financing activities. Net cash flow provides a concise summary of a company’s cash generation and usage.

Careful consideration of these interconnected components provides a comprehensive understanding of a company’s projected financial performance, enabling informed decision-making regarding resource allocation, investment strategies, and overall financial management. This structured approach facilitates proactive identification of potential challenges and opportunities, contributing to long-term financial stability and sustainable growth.

How to Create a Three-Year Cash Flow Statement Template

Developing a robust three-year cash flow statement template requires a systematic approach and careful consideration of various factors influencing future cash flows. This structured process enables businesses to project financial performance, anticipate potential challenges, and make informed decisions regarding resource allocation and investment strategies.

1. Historical Data Analysis: Begin by analyzing historical financial statements, including income statements, balance sheets, and cash flow statements. This provides a baseline for projecting future performance and identifying trends in revenue, expenses, and cash flow patterns.

2. Sales Revenue Projections: Project future sales revenue based on historical data, market analysis, industry trends, and anticipated growth rates. Consider factors such as pricing strategies, market share, and economic conditions. Realistic sales projections form the foundation of the entire cash flow statement.

3. Operating Expense Projections: Project operating expenses, including salaries, rent, utilities, and other costs associated with running the business. Consider factors such as inflation, anticipated headcount changes, and potential cost-saving initiatives.

4. Investment Activity Projections: Project capital expenditures for property, plant, and equipment, acquisitions of other businesses, and investments in securities. Align investment projections with long-term strategic goals and growth plans.

5. Financing Activity Projections: Project financing activities, including debt or equity financing, loan repayments, interest payments, and dividend distributions. Consider the company’s capital structure and its target debt-to-equity ratio.

6. Working Capital Management: Project changes in working capital, including accounts receivable, inventory, and accounts payable. Efficient working capital management is crucial for maintaining adequate liquidity and ensuring smooth operations.

7. Calculate Net Cash Flow: Calculate the net cash flow for each period by summing the cash flows from operating, investing, and financing activities. This provides a concise overview of a company’s cash generation and usage.

8. Review and Refine: Regularly review and refine the three-year cash flow statement template based on actual performance, changing market conditions, and updated business strategies. This iterative process ensures the projection remains relevant and reliable for informed decision-making.

A meticulously constructed three-year cash flow statement template offers invaluable insights into a company’s projected financial performance, enabling proactive management of financial resources, identification of potential risks and opportunities, and informed decision-making regarding investments, growth strategies, and overall financial planning. This dynamic tool empowers businesses to navigate the financial landscape with greater confidence and achieve long-term sustainability.

A three-year cash flow statement template provides a crucial framework for understanding a company’s projected financial health. Through careful analysis of anticipated cash inflows and outflows across operational, investing, and financing activities, businesses gain valuable insights into future liquidity, profitability, and financial stability. This structured approach enables proactive identification of potential challenges, informed resource allocation, and strategic investment decisions essential for long-term success. Accurate projections, coupled with ongoing review and refinement, empower businesses to navigate the complexities of the financial landscape and achieve sustainable growth.

Effective utilization of a three-year cash flow statement template represents a cornerstone of sound financial management. This forward-looking approach empowers organizations to not only anticipate but also shape their financial future. By embracing the insights provided by this essential tool, businesses can make informed decisions that drive growth, enhance profitability, and ensure long-term financial viability in an ever-evolving economic environment.