Utilizing a pre-designed structure for this type of report offers several advantages. It ensures consistency in reporting, simplifies the process of data entry and analysis, and facilitates comparisons across different periods. This standardized approach reduces the risk of errors, saves time, and allows for efficient tracking of financial progress. Furthermore, it provides a clear framework for understanding the financial position of a business, enabling stakeholders to identify trends and make informed strategic choices.

The following sections will delve deeper into the specific components of these reports, exploring best practices for their creation and utilization, and highlighting their role in effective financial management.

1. Standardized Format

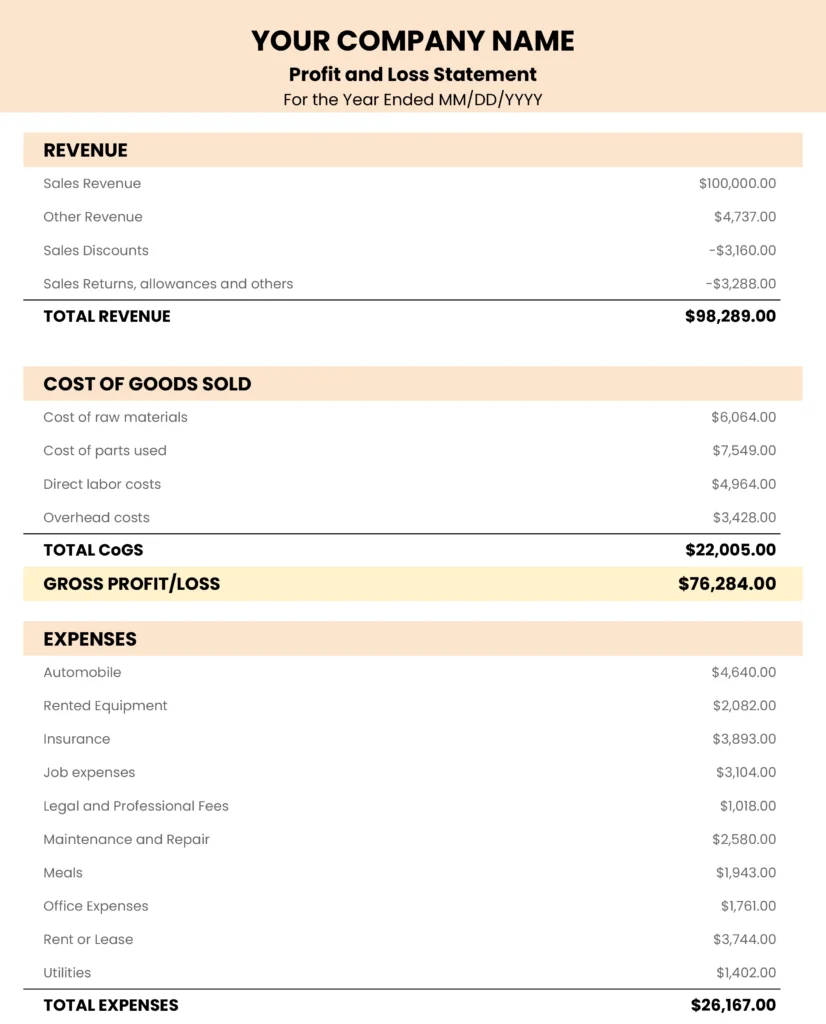

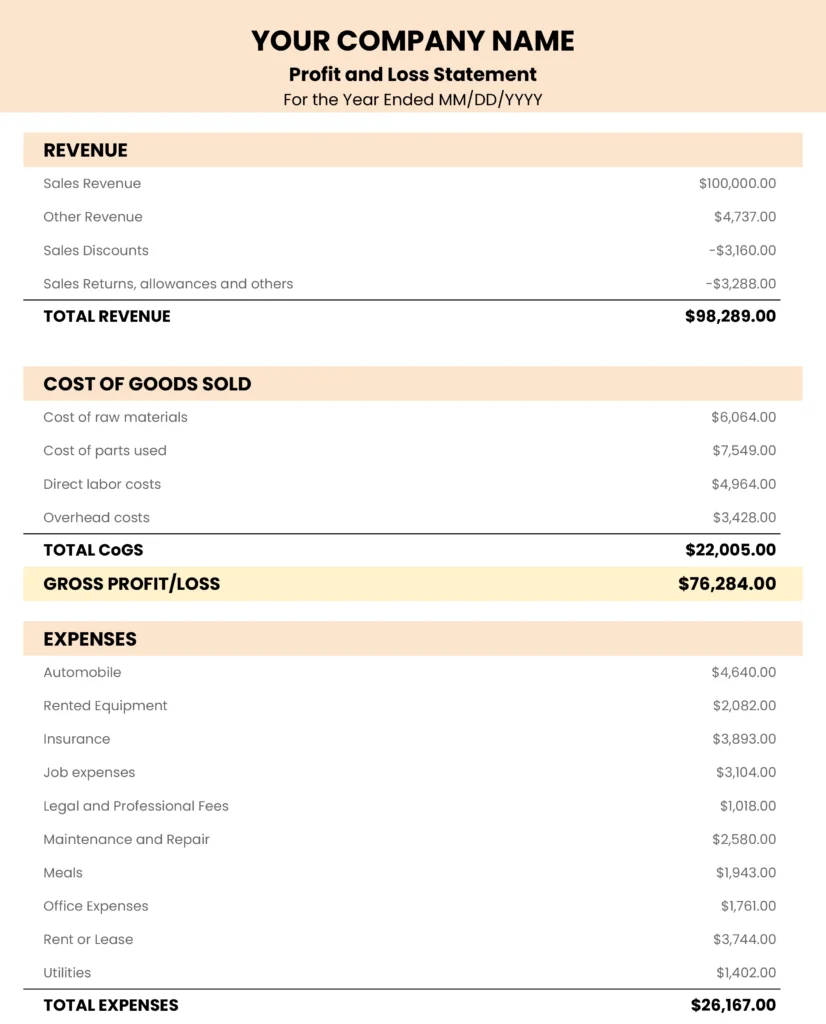

A standardized format is fundamental to the efficacy of a year-to-date profit and loss statement template. Consistency in structure, labeling, and calculations ensures data clarity, simplifies analysis, and promotes comparability. A standardized template provides a framework for organizing financial data in a predictable manner, allowing stakeholders to quickly locate and interpret key figures. Without standardization, comparing performance across different periods or against industry benchmarks becomes challenging, hindering informed decision-making. For example, consistent placement of revenue streams, such as “Sales Revenue” and “Service Revenue,” allows for easy tracking of these streams over time and comparison across different business units.

Standardization also reduces the likelihood of errors in data entry and reporting. When a consistent structure is followed, individuals preparing the statement are less prone to omissions or misclassifications. This improves the reliability of the financial data and strengthens the foundation for strategic planning. Consider a scenario where “Cost of Goods Sold” is categorized differently across various reports. This inconsistency can lead to skewed profit margins and misrepresent the actual cost structure of the business. A standardized template mitigates such risks.

In conclusion, the standardized format inherent in a robust year-to-date profit and loss statement template is crucial for accurate, reliable, and comparable financial reporting. This structure fosters efficient analysis, reduces errors, and supports sound financial decision-making. Challenges may arise in adapting a standardized template to unique business needs, requiring careful consideration of industry-specific reporting requirements and internal operational structures. However, the benefits of standardization significantly outweigh the challenges, making it an indispensable element of effective financial management.

2. Year-to-date Data

Year-to-date (YTD) data forms the core of a YTD profit and loss statement. This data represents the cumulative financial performance of a business from the beginning of the current fiscal year up to a specific date. The relationship is intrinsic; without YTD data, such a statement cannot exist. This data provides a dynamic view of financial health, enabling stakeholders to monitor progress toward annual goals and identify emerging trends. For example, a retailer might track YTD sales data to assess performance against projected targets and adjust inventory or marketing strategies accordingly.

The importance of YTD data lies in its ability to reveal patterns and inform strategic decision-making. Analyzing YTD revenue can indicate growth or decline compared to the previous year, signaling potential market shifts or internal operational issues. Similarly, tracking YTD expenses can highlight areas of overspending or identify cost-saving opportunities. For a manufacturing company, rising YTD raw material costs might prompt exploration of alternative suppliers or process optimizations. This continuous monitoring allows for proactive adjustments rather than reactive responses at the end of the fiscal year.

Understanding the significance of YTD data within the context of a profit and loss statement is crucial for effective financial management. This data provides a timely and relevant snapshot of performance, empowering businesses to make informed decisions, adapt to changing market conditions, and optimize resource allocation. Challenges can arise in ensuring data accuracy and consistency, especially in organizations with complex accounting systems. However, robust data management practices can mitigate these challenges and maximize the value derived from YTD analysis.

3. Revenue and Expenses

Revenue and expenses are the fundamental components of a year-to-date (YTD) profit and loss statement template. Their accurate categorization and reporting are essential for determining a company’s financial performance over a given period. A clear understanding of these elements is crucial for interpreting the statement and making informed business decisions.

- Revenue StreamsRevenue represents income generated from a company’s primary business activities. In a YTD profit and loss statement, this section details all revenue streams accumulated from the start of the fiscal year to the reporting date. Examples include sales revenue from products sold, service revenue from services rendered, and interest income. Accurate revenue reporting is critical for assessing sales performance, forecasting future earnings, and evaluating the overall financial health of the business.

- Cost of Goods Sold (COGS)COGS represents the direct costs associated with producing goods sold by a company. This includes raw materials, direct labor, and manufacturing overhead. Accurately tracking COGS is essential for calculating gross profit and understanding the profitability of individual products or services. Within a YTD context, COGS provides insights into production efficiency and cost trends over time.

- Operating ExpensesOperating expenses are the costs incurred in running a business’s day-to-day operations. These expenses are not directly tied to production but are necessary for maintaining business functions. Examples include rent, salaries for administrative staff, marketing, and utilities. Monitoring YTD operating expenses can help identify areas for cost optimization and improve operational efficiency. Increases in operating expenses, without corresponding revenue growth, can signal potential financial challenges.

- Non-Operating ExpensesNon-operating expenses are costs unrelated to a company’s core business operations. These can include interest expense on debt, losses from asset sales, or lawsuit settlements. While not directly reflecting operational efficiency, these expenses impact net income and provide a more complete picture of a companys overall financial situation. Tracking these expenses in a YTD format helps monitor their impact on profitability over time.

The interplay between revenue and expenses within a YTD profit and loss statement ultimately determines a companys profitability. By carefully tracking and analyzing these figures, stakeholders gain valuable insights into business performance, enabling informed decision-making related to pricing strategies, cost management, resource allocation, and future growth plans. The YTD perspective provides a dynamic view of these financial drivers, allowing for timely adjustments and proactive management throughout the fiscal year.

4. Profit or Loss Calculation

The core purpose of a year-to-date (YTD) profit and loss statement template is to facilitate the calculation of net profit or loss. This calculation represents the culmination of all financial activity within a given period, from the start of the fiscal year to the present date. It provides a clear indication of a company’s financial health and sustainability. The template’s structured format, categorizing revenues and expenses, enables a systematic and accurate determination of this crucial figure. Without a clear profit or loss calculation, assessing financial performance and making informed decisions would be significantly hampered. Consider a retail business: calculating YTD profit reveals the effectiveness of sales strategies, pricing models, and inventory management. A negative YTD profit signals the need for adjustments to improve profitability.

The profit or loss calculation within a YTD context provides more than just a snapshot in time; it offers a dynamic view of financial performance throughout the fiscal year. By tracking this figure regularly, businesses can identify trends, anticipate potential challenges, and adapt strategies proactively. For example, a manufacturing firm experiencing declining YTD profit might investigate rising production costs or explore new markets to boost sales. This ongoing analysis enables course correction throughout the year, rather than relying solely on year-end results. Furthermore, comparing YTD profit against previous periods or industry benchmarks provides valuable context and insights into competitive positioning and overall financial trajectory.

In summary, the profit or loss calculation is intrinsically linked to the YTD profit and loss statement template. It serves as the central output, providing a concise measure of financial performance and enabling informed decision-making. Challenges can arise in accurately capturing and categorizing all revenue and expense data, particularly in complex organizations. However, maintaining rigorous accounting practices and utilizing a robust template can mitigate these challenges and ensure the reliability of the profit or loss calculation, supporting sound financial management.

5. Comparability

Comparability is a critical aspect of year-to-date (YTD) profit and loss statement templates. The ability to compare financial performance across different periods or against industry benchmarks provides valuable context for evaluating business health and making strategic decisions. A well-structured template facilitates such comparisons by ensuring data consistency and providing a standardized framework for analysis. Without comparability, financial data loses much of its value, hindering effective decision-making and strategic planning.

- Trend AnalysisAnalyzing YTD performance against previous periods reveals trends in revenue growth, cost management, and overall profitability. For example, comparing current YTD sales figures with those from the same period last year can highlight market shifts, the effectiveness of sales strategies, or the impact of external factors. This trend analysis provides insights into the company’s trajectory and informs future projections.

- BenchmarkingComparing YTD performance against industry averages or competitors’ results offers a valuable external perspective. This benchmarking process can reveal areas where a company excels or lags, highlighting opportunities for improvement or competitive advantages. Understanding industry benchmarks helps organizations set realistic performance targets and develop strategies to enhance market positioning. For example, a company with a lower YTD gross profit margin than its competitors might need to review its pricing strategies or cost structure.

- Internal Performance EvaluationWithin larger organizations, comparability allows for performance evaluation across different departments or business units. Analyzing YTD results for individual teams or product lines provides insights into their relative contributions to overall profitability. This internal comparison can highlight areas of strength and weakness, supporting resource allocation decisions and promoting operational efficiency. For instance, comparing YTD sales growth across different product lines can inform marketing and product development strategies.

- Investment DecisionsConsistent YTD reporting provides crucial data for investors and lenders evaluating a company’s financial health. Comparability across different reporting periods allows stakeholders to assess the company’s progress, stability, and potential for future growth. This consistent data stream supports informed investment decisions and facilitates access to capital. A consistent upward trend in YTD profit enhances investor confidence and strengthens a company’s financial standing.

The comparability enabled by a well-designed YTD profit and loss statement template is essential for informed financial management. By facilitating trend analysis, benchmarking, internal performance evaluation, and investment decisions, comparability transforms raw financial data into actionable insights, empowering businesses to make strategic choices, optimize operations, and achieve sustainable growth. While specific metrics and benchmarks may vary across industries, the underlying principle of comparability remains a cornerstone of effective financial analysis and reporting.

6. Decision-Making Support

A year-to-date (YTD) profit and loss statement template plays a crucial role in supporting informed decision-making within an organization. By providing a clear and concise overview of financial performance from the start of the fiscal year to the present date, the template equips stakeholders with the data necessary for strategic planning, resource allocation, and performance evaluation. This connection between financial data and actionable insights is essential for navigating the complexities of business operations and achieving sustainable growth. The following facets highlight how the template empowers data-driven decisions:

- Strategic PlanningYTD financial data allows organizations to assess progress toward annual goals and adjust strategies as needed. For example, if YTD revenue falls short of projections, the template allows for prompt identification of the shortfall, enabling leadership to revise sales targets, marketing campaigns, or product development plans. This real-time insight prevents costly delays in addressing performance gaps and enhances the likelihood of achieving long-term objectives.

- Resource AllocationUnderstanding YTD expenses and profitability across different departments or product lines allows for strategic resource allocation. For instance, if one product line consistently demonstrates stronger YTD profitability than others, resources can be shifted to capitalize on this strength, potentially through increased marketing investment or expanded production. This data-driven approach optimizes resource utilization and maximizes return on investment.

- Performance EvaluationYTD performance data facilitates objective evaluation of both individual departments and overall organizational effectiveness. Comparing YTD results against previous periods or industry benchmarks provides a clear measure of progress and identifies areas for improvement. This data-driven evaluation fosters accountability and promotes a culture of continuous improvement, enhancing operational efficiency and overall performance.

- Risk ManagementMonitoring YTD financial performance enables proactive risk management. By identifying emerging trends, such as declining sales or increasing costs, organizations can anticipate potential challenges and implement mitigation strategies. For example, consistently increasing YTD operating expenses, without corresponding revenue growth, could signal the need for cost-cutting measures or process optimization. This proactive approach minimizes potential financial losses and safeguards long-term sustainability.

In conclusion, the YTD profit and loss statement template empowers organizations to base decisions on concrete financial data rather than speculation. This informed approach is crucial for effective strategic planning, resource allocation, performance evaluation, and risk management, ultimately contributing to increased profitability, enhanced competitiveness, and sustainable growth. The accessibility and clarity of the data presented within the template facilitate a shared understanding of financial performance across all levels of the organization, fostering alignment and driving collective efforts toward common goals.

Key Components of a Year-to-Date Profit and Loss Statement Template

A comprehensive understanding of the key components within a year-to-date (YTD) profit and loss statement template is essential for accurate financial analysis and informed decision-making. These components provide a structured view of a company’s financial performance throughout the fiscal year.

1. Reporting Period: The YTD statement explicitly defines the reporting period, typically starting from the beginning of the fiscal year up to the present date. This clearly delineated timeframe is crucial for accurate performance tracking and comparison.

2. Revenue: This section details all income generated from the company’s primary business activities during the YTD period. It includes various revenue streams, such as sales revenue, service revenue, and any other income relevant to the business.

3. Cost of Goods Sold (COGS): For companies selling physical products, the COGS section outlines the direct costs associated with producing those goods. This includes raw materials, direct labor, and manufacturing overhead.

4. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profitability of a company’s core business operations before accounting for operating expenses.

5. Operating Expenses: This section encompasses all costs incurred in running the business’s day-to-day operations, including salaries, rent, utilities, marketing, and administrative expenses.

6. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reflects the profitability of a company’s core business operations after accounting for all operating costs.

7. Other Income/Expenses: This section captures income or expenses not directly related to core business operations, such as interest income, investment gains, or interest expenses.

8. Net Income: Representing the bottom line, net income is calculated by adding other income and subtracting other expenses from operating income. It provides a comprehensive measure of a company’s profitability after considering all revenue and expense items within the YTD period.

These components work together to provide a holistic view of a company’s financial performance during the year. The structured format ensures clarity, facilitates analysis, and supports effective decision-making based on accurate and up-to-date financial data.

How to Create a Year-to-Date Profit and Loss Statement Template

Creating a robust year-to-date (YTD) profit and loss statement template requires careful consideration of key financial elements and a structured approach. A well-designed template ensures data accuracy, facilitates analysis, and supports informed decision-making.

1. Define the Reporting Period: Clearly specify the start and end dates for the YTD period. This typically encompasses the period from the beginning of the fiscal year to the present date. Accurate date specification is crucial for data integrity and comparability.

2. Establish Revenue Categories: Create distinct categories for all revenue streams relevant to the business. Examples include sales revenue, service revenue, and interest income. Clear categorization ensures accurate tracking of income sources.

3. Outline Cost of Goods Sold (COGS): For businesses selling physical products, define categories for all direct costs associated with production, including raw materials, direct labor, and manufacturing overhead. Accurate COGS categorization is essential for calculating gross profit.

4. Incorporate Operating Expenses: Categorize all expenses related to daily business operations, such as salaries, rent, utilities, marketing, and administrative costs. Comprehensive expense tracking is critical for understanding overall profitability.

5. Include Other Income and Expenses: Account for income and expenses not directly tied to core business operations, including interest income, investment gains, and interest expenses. This provides a complete financial picture.

6. Calculate Key Metrics: Incorporate formulas to automatically calculate key metrics such as gross profit (Revenue – COGS), operating income (Gross Profit – Operating Expenses), and net income (Operating Income + Other Income – Other Expenses). Automated calculations ensure accuracy and efficiency.

7. Ensure Formatting Consistency: Maintain a consistent format throughout the template, using clear labels, standardized units (e.g., currency), and a logical structure. Consistent formatting enhances readability and simplifies analysis.

8. Implement Data Validation: Incorporate data validation rules where possible to minimize errors in data entry. This might include restricting input to numerical values or setting limits for specific fields. Data validation improves accuracy and reliability.

A well-structured template, incorporating these elements, provides a robust framework for tracking YTD financial performance, facilitating informed decision-making, and promoting sustainable business growth. Regular review and refinement of the template, based on evolving business needs and accounting practices, ensures its continued effectiveness as a management tool.

Effective financial management hinges on timely and accurate insights into performance. A year-to-date profit and loss statement template provides a crucial tool for achieving this objective. By offering a structured framework for recording and analyzing revenue, expenses, and resulting profit or loss, the template empowers stakeholders to monitor progress, identify trends, and make informed decisions throughout the fiscal year. Standardization, comparability, and a focus on year-to-date data are key features that enhance the template’s utility, enabling businesses to evaluate performance against benchmarks, adapt to changing market conditions, and optimize resource allocation. Understanding the components within the template, including revenue streams, cost of goods sold, operating expenses, and the calculation of net income, is essential for extracting meaningful insights and driving strategic action. Furthermore, the ability to compare YTD performance against prior periods and industry averages provides valuable context, enabling informed decision-making related to strategic planning, resource allocation, risk management, and investment evaluation.

The insights derived from a well-utilized year-to-date profit and loss statement template contribute significantly to a company’s ability to achieve financial objectives and navigate the complexities of the modern business landscape. Regular review and analysis of this data are essential for proactive financial management, enabling businesses to anticipate challenges, capitalize on opportunities, and chart a course towards sustainable growth and long-term success. Rigorous data management and adherence to sound accounting principles remain fundamental prerequisites for maximizing the value derived from this essential financial tool.